[SUMMARIES]

Employment Pass (EP) holders are legally allowed to own 100% of a Singapore company’s shares as a passive investment.

You cannot act as the local resident director for your new company without a specific Letter of Consent (LOC) from MOM, as this counts as “working.”

Operating a business without authorization can lead to EP cancellation and future bans.

You can use a Nominee Director service to satisfy ACRA requirements while remaining the owner.

For full-time entrepreneurship, consider transitioning to an EntrePass or ONE Pass.

[/SUMMARIES]

Can an employment pass holder start a business in Singapore? The answer is yes, but strictly limited to ownership, not management. Navigating Ministry of Manpower (MOM) regulations is crucial, as you must distinguish between being a Shareholder (allowed) and a Director (restricted). Koobiz helps you navigate these critical Shareholder vs. Director distinctions, ensuring you can legally register your company and capitalize on Singapore’s market without jeopardizing your current Employment Pass.

Can an Employment Pass Holder Start a Business in Singapore?

Yes, an Employment Pass holder can start a business in Singapore, provided they limit their role to passive shareholding and do not engage in the daily operations or executive management of the new company.

There are three critical legal pillars supporting this answer:

- Ownership Rights: Singapore law allows foreigners (including EP holders) to own shares in local companies.

- Employment Restrictions: The EP is sponsored by a specific employer, meaning you cannot “work” for another company (including your own) without MOM approval.

- Directorship Requirements: Every Singapore company must have at least one locally resident director, a role an EP holder generally cannot fill for their own startup initially.

As a result, while EP holders are allowed to start a business through incorporation and share ownership, they are restricted from running it as a director or employee. This distinction is crucial, as misinterpreting it is one of the most common causes of work pass compliance breaches. To manage this safely, it is essential to clearly understand the legal and functional differences between ownership and active management within a company structure.

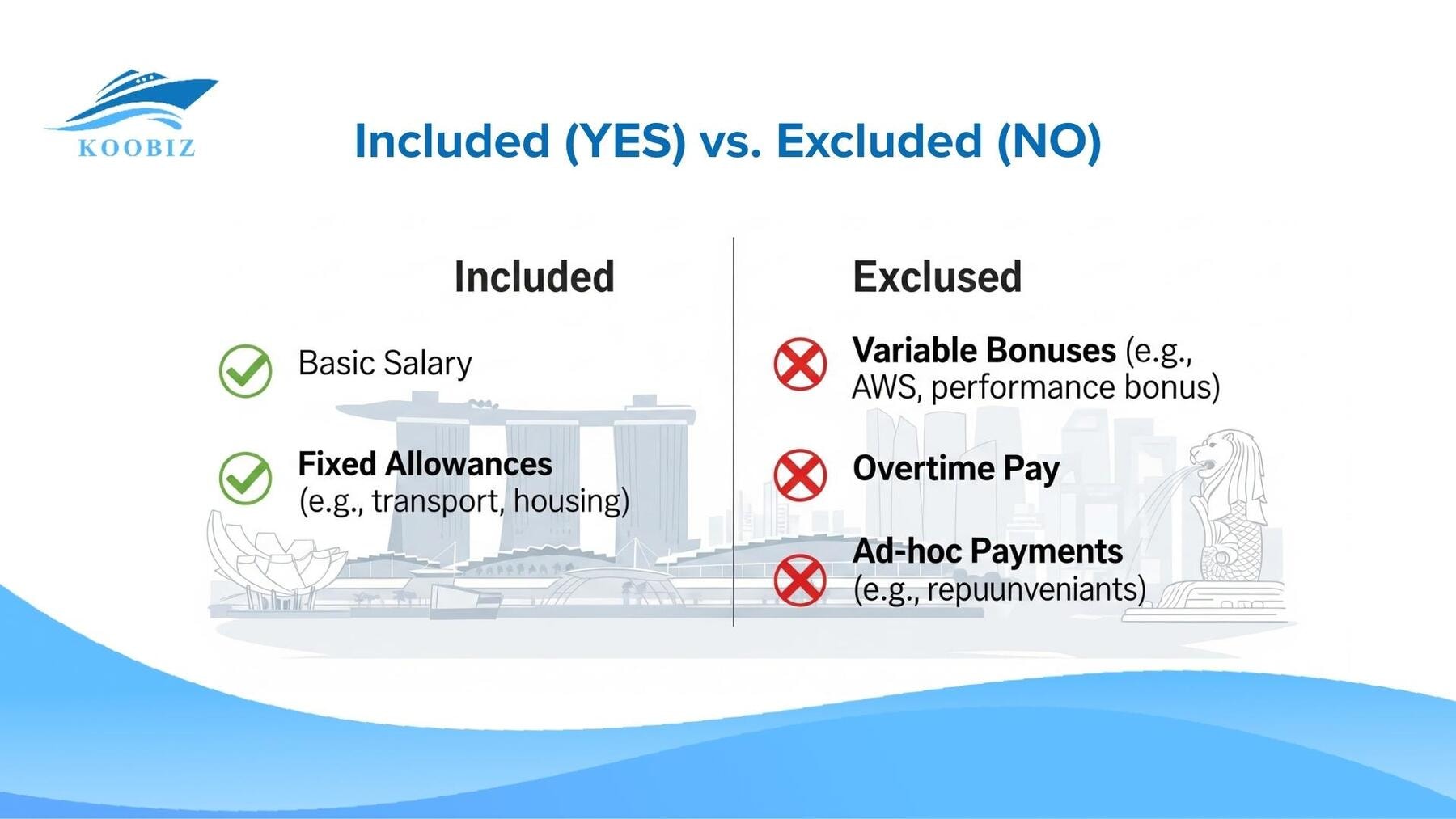

Shareholder vs Director: Understanding the Legal Distinction

In the context of Singapore corporate law, the Shareholder is the owner who provides capital and enjoys dividends, whereas the Director is the executive officer responsible for managing the company’s affairs and operations.

| Feature | Shareholder (The Owner) | Director (The Manager) |

|---|---|---|

| Core Function | Provides capital; owns a piece of the company. | Manages operations; legally responsible for the company. |

| Key Activities | Voting at AGMs, receiving dividends. | Signing contracts, hiring staff, opening bank accounts. |

| MOM Status for EP | Allowed (Considered passive investment). | Restricted (Considered “working/moonlighting”). |

| Requirement | None (Can hold 100% shares). | Needs Letter of Consent (LOC) or Nominee Director. |

While these roles often overlap in small businesses founded by citizens or Permanent Residents (PRs), MOM regulations force a strict separation for EP holders. Confusing these two roles is where most foreign entrepreneurs inadvertently breach their visa conditions.

Rights of an EP Holder as a Shareholder

You have the unrestricted right to hold up to 100% of the shares in a Singapore private limited company, as MOM classifies this as passive investment rather than employment.

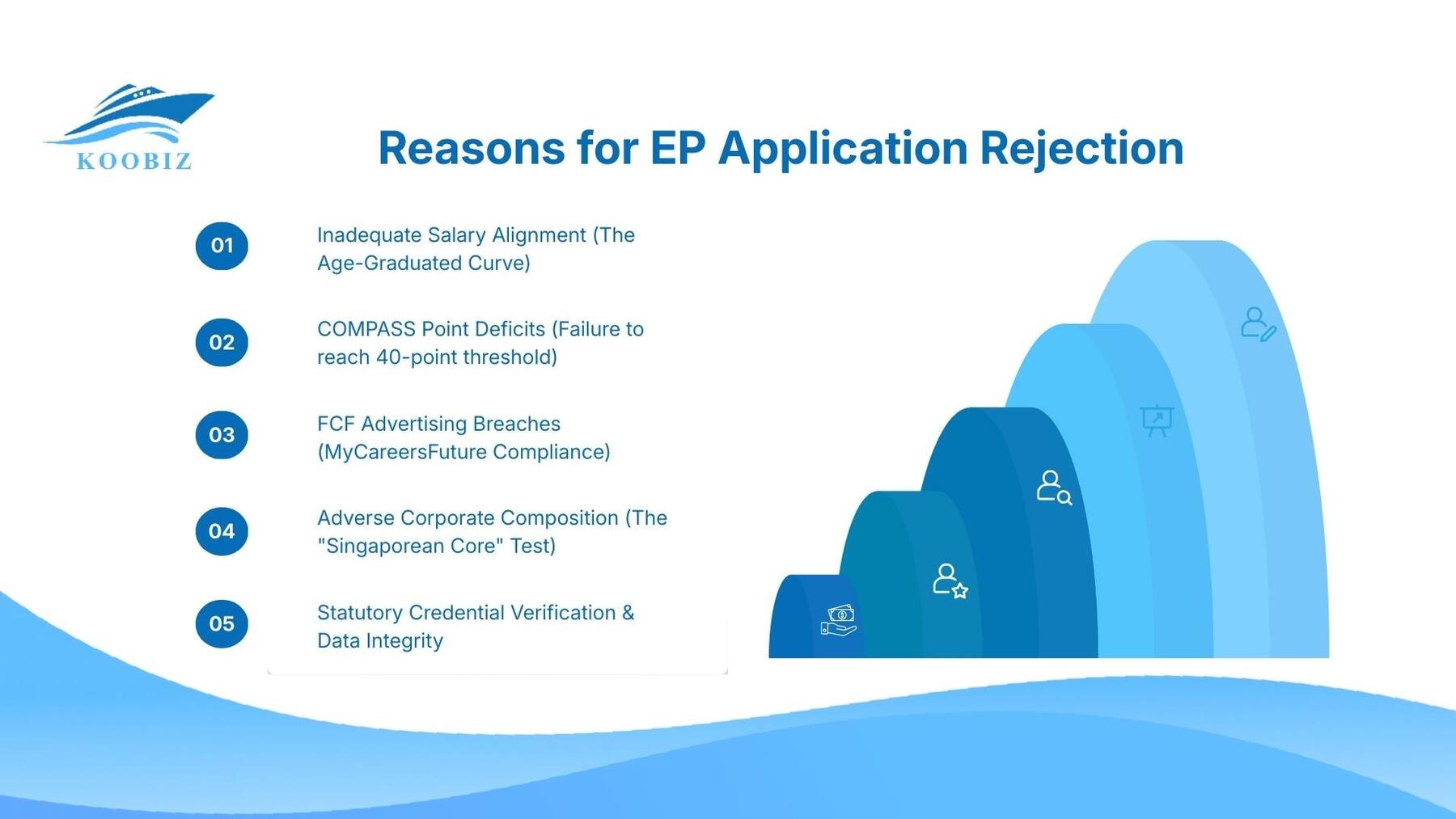

Restrictions on Acting as a Local Director

You cannot act as the local resident director of a new entity without a Letter of Consent (LOC), as directorship is considered “employment” and violates the “no moonlighting” condition of your EP.

Exceptions: When You Can be a Director

MOM generally prohibits EP holders from acting as directors for unrelated entities, but specific exceptions exist for corporate hierarchies.

You generally need a Letter of Consent (LOC) to be a director, which MOM typically issues an LOC only where the appointment is a secondary directorship within the same corporate group, such as when the new company is a subsidiary or affiliate of the EP holder’s existing employer. This framework is designed to accommodate regional or group executives overseeing related entities, and it rarely applies to personal startups or independent ventures.

Separately, EP holders are strongly advised to obtain a written Letter of No Objection from their current employer before acquiring shares or accepting any formal role. While this letter is not mandated by MOM, it is an important contractual safeguard. It confirms that the employer consents to the investment or appointment, reducing the risk of breach of employment terms, particularly clauses relating to conflicts of interest or outside business activities.

Risks of Non-Compliance for EP Holders

There are three severe consequences for EP holders who illegally act as directors or employees of their own companies: immediate revocation of the work pass, financial penalties, and a potential permanent ban from working in Singapore.

Singapore takes its manpower laws seriously. The authorities actively monitor ACRA records and income declarations.

Visa Cancellation

If an Employment Pass holder is found to be “moonlighting” — meaning actively working for their own startup while holding an EP sponsored by another employer — the Ministry of Manpower (MOM) may cancel the EP with immediate effect. In practice, the individual is usually issued a Short-Term Visit Pass (STVP), commonly valid for about 30 days (the exact duration depends on MOM’s assessment), to allow time to settle personal and business matters before departing Singapore.

Fines and Prosecution

Under the Employment of Foreign Manpower Act (EFMA), penalties are severe. Offenders can face fines of up to SGD 30,000 and/or imprisonment for up to 12 months (or more for severe illegal employment offenses).

Future Ban

In addition to immediate penalties, MOM may impose restrictions or a complete ban on future work pass applications. This includes Employment Passes, S Passes, and Work Permits. Such a ban can effectively end the individual’s ability to work in Singapore and severely limit professional prospects within the region.

Given these high stakes, it is crucial to use the correct legal structure when setting up your business. This is where services like Koobiz become essential for safe incorporation.

Real-World Scenarios: Compliant vs. Non-Compliant

To better understand how these rules apply in practice, let’s look at three scenarios of EP holders attempting to start a business.

These case studies illustrate the difference between passive ownership, illegal operation, and compliant structuring.

Scenario 1: The Passive Investor (Compliant)

Meet John. He is a Marketing Director at a large multinational firm in Singapore on an EP. He sees potential in his friend’s new cafe venture and transfers $50,000 in exchange for 30% equity. John attends quarterly shareholder meetings to vote on the budget, but he never serves coffee, manages the staff, or signs supplier contracts.

Verdict: Compliant.

John’s role is purely that of a shareholder. His involvement is confined to capital injection and high-level voting rights that come with equity ownership. As he carries out no managerial or operational functions, his dividends are considered passive investment income, which is permitted under EP rules.

Scenario 2: The “Silent” Director (Non-Compliant)

Meet Sarah. She is a Software Engineer on an Employment Pass who wants to do freelance work on the side. She sets up a consultancy company and appoints a friend as a “dummy” director on paper. In practice, Sarah spends her evenings coding for clients, issuing invoices, and responding to customer emails using her personal account.

Verdict: Non-Compliant.

Even though she works after hours, Sarah is actively “working” for an entity other than her visa sponsor. This constitutes “moonlighting.” If discovered, she faces immediate EP cancellation and a potential ban from Singapore.

Scenario 3: The Tech Founder Strategy (Compliant)

Meet Mike. He wants to launch a SaaS platform but knows he cannot legally work on it yet. Mike incorporates the company using a Nominee Director service (like Koobiz) and takes 100% shareholding. He hires a local developer to build the product. Mike provides the capital and the vision (as a shareholder) but does not write code or manage daily operations. Once the company gains traction, he applies for an EntrePass to actively run it.

Verdict: Compliant.

Mike clearly separates ownership from employment. By using the correct legal structure, he is able to own the business without breaching his EP conditions until he secures the appropriate visa to actively run the company.

How to Register a Company as an EP Holder: A Step-by-Step Guide

To register a Singapore company safely as an EP holder, follow this structured process to ensure you satisfy the local director requirement while retaining 100% ownership.

Since you cannot act as the local director initially, the standard incorporation steps are modified to include the Nominee Director arrangement.

Step 1: Secure a Nominee Director

Engage a corporate service provider (like Koobiz) to provide a local resident director.

This satisfies the Companies Act requirement while you remain the 100% shareholder. Ensure you sign a Power of Attorney and Indemnity Agreement to limit their authority purely to compliance.

Step 2: Name Reservation & Document Preparation

Check your desired business name availability on the ACRA portal and prepare your documents.

Once the name is approved, compile your passport, proof of Singapore residential address, and the Nominee Director’s particulars for the incorporation application.

Step 3: Submit Incorporation to ACRA

Authorize your corporate secretary to submit the application digitally via BizFile+.

Upon approval (usually within hours), you will receive your Unique Entity Number (UEN) and the electronic Certificate of Incorporation, confirming you are the legal owner.

Step 4: Open Corporate Bank Account

Schedule an appointment with a bank to open your corporate account.

You will serve as the sole authorized signatory, ensuring you have full control over company funds. The Nominee Director may need to sign the initial resolution, but they will not have access to the account.

This structure allows you to own a legitimate Singapore company while keeping your EP status safe. However, if your goal is to quit your job and run the business full-time, you need a different strategy.

Alternatives for Foreign Entrepreneurs in Singapore

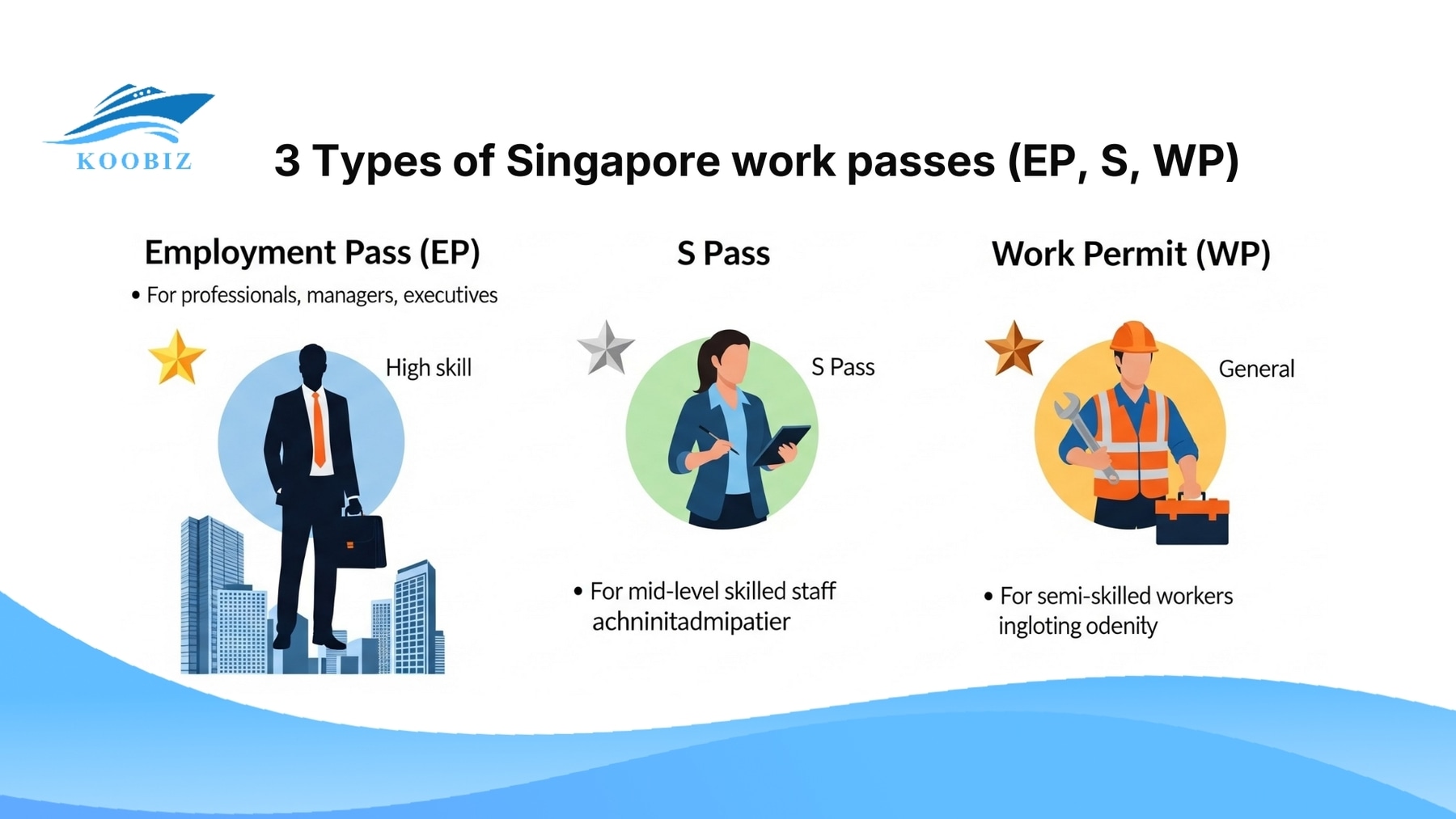

If you wish to act as the Director and actively manage your business, you must transition from an Employment Pass to an entrepreneurial visa such as the EntrePass or the ONE Pass.

Staying on an EP limits your potential to scale the business personally. Singapore offers specific visa categories designed for founders.

Employment Pass vs. EntrePass

While the Employment Pass is tied to a specific job offer, the EntrePass is designed for foreign entrepreneurs who want to start and actively operate a new business in Singapore.

| Feature | Employment Pass (EP) | EntrePass |

|---|---|---|

| Primary Purpose | For professionals with a specific job offer. | For entrepreneurs starting a new business. |

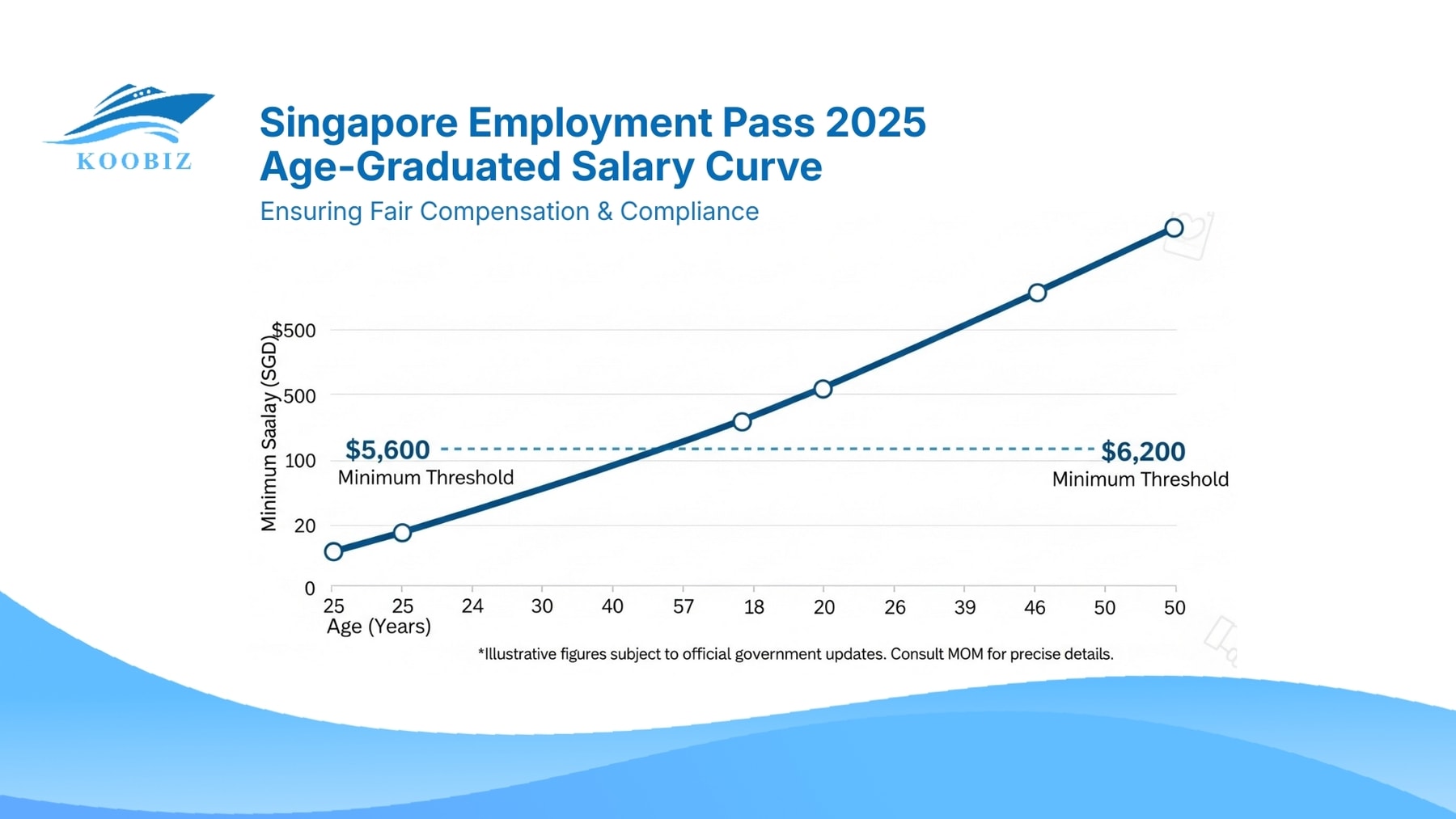

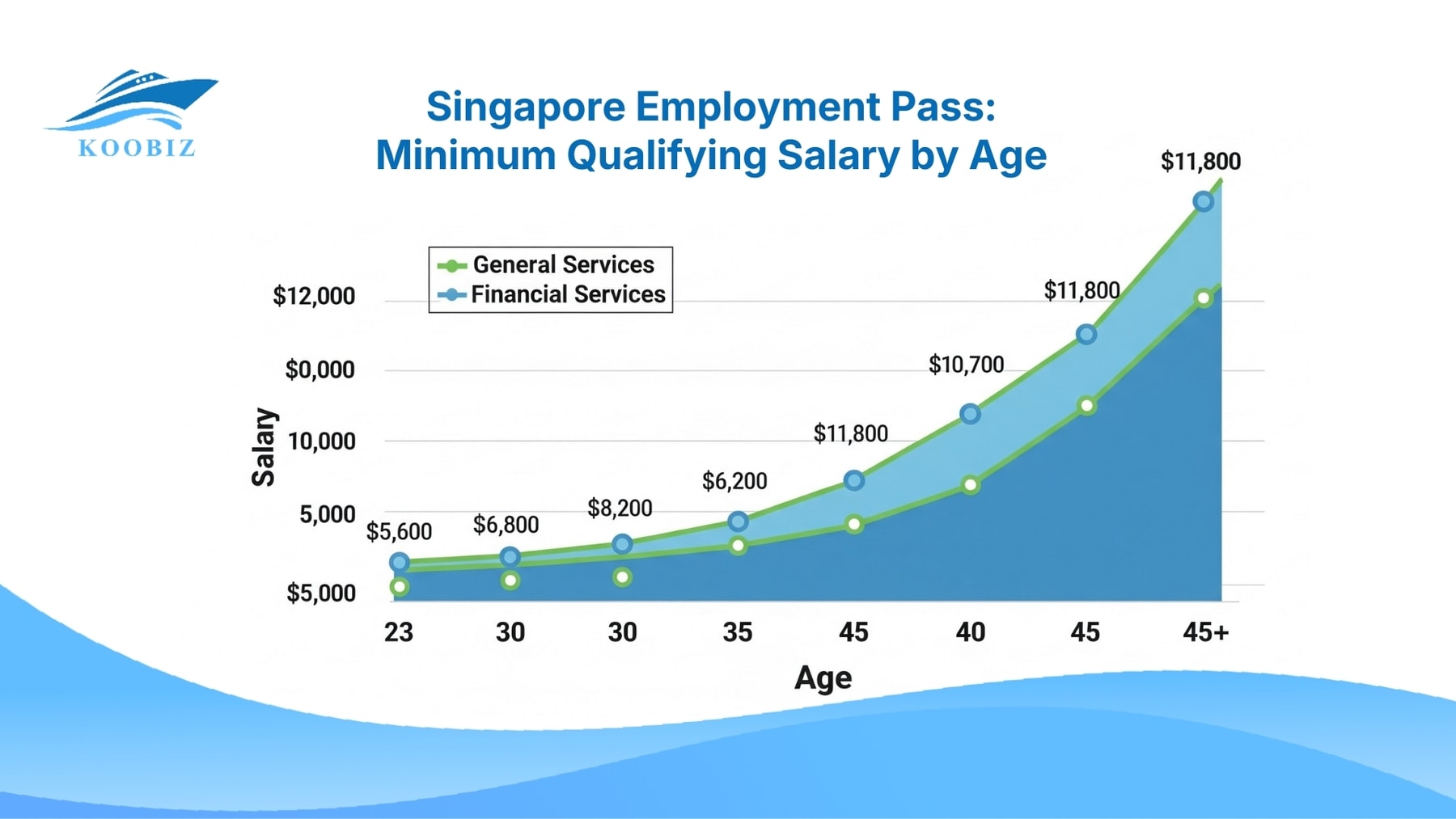

| Eligibility Basis | Salary (>SGD 5,600/mth) & Qualifications. | VC backing, Innovative IP, or Track Record. |

| Directorship Status | Restricted (Needs LOC/Nominee). | Allowed (You can be the local director). |

| Renewal Criteria | Continued employment & salary requirement. | Total business spending & local employees hired. |

ONE Pass and Tech.Pass Flexibility

The Overseas Networks & Expertise (ONE) Pass and Tech.Pass are premium visa categories that offer significantly more flexibility, allowing holders to start, operate, and be directors of multiple companies simultaneously.

| Feature | ONE Pass | Tech.Pass |

|---|---|---|

| Target Audience | Top talent (Business, Arts, Sports, Academia). | Established Tech Leaders & Experts. |

| Criteria | Earn ≥ SGD 30,000/month or outstanding achievements. | Proven track record in scaling tech companies. |

| Flexibility | Work for/start multiple companies; no new pass needed. | Start/operate businesses, mentor startups, lecture. |

These “Rare Attributes” in the visa ecosystem provide the ultimate freedom for high-net-worth individuals or top-tier tech founders.

Frequently Asked Questions on EP Business Ownership

Can I sign contracts for my new company while on EP?

No. Signing contracts, invoices, or cheques is considered “working” as a director, which is prohibited without an LOC. These tasks must be handled by your Nominee Director or a local manager.

Do I need to inform my current employer if I just own shares?

Yes, check your employment contract first. While MOM allows shareholding, your employer might have non-compete clauses. Transparency prevents conflicts of interest that could lead to termination and EP cancellation.

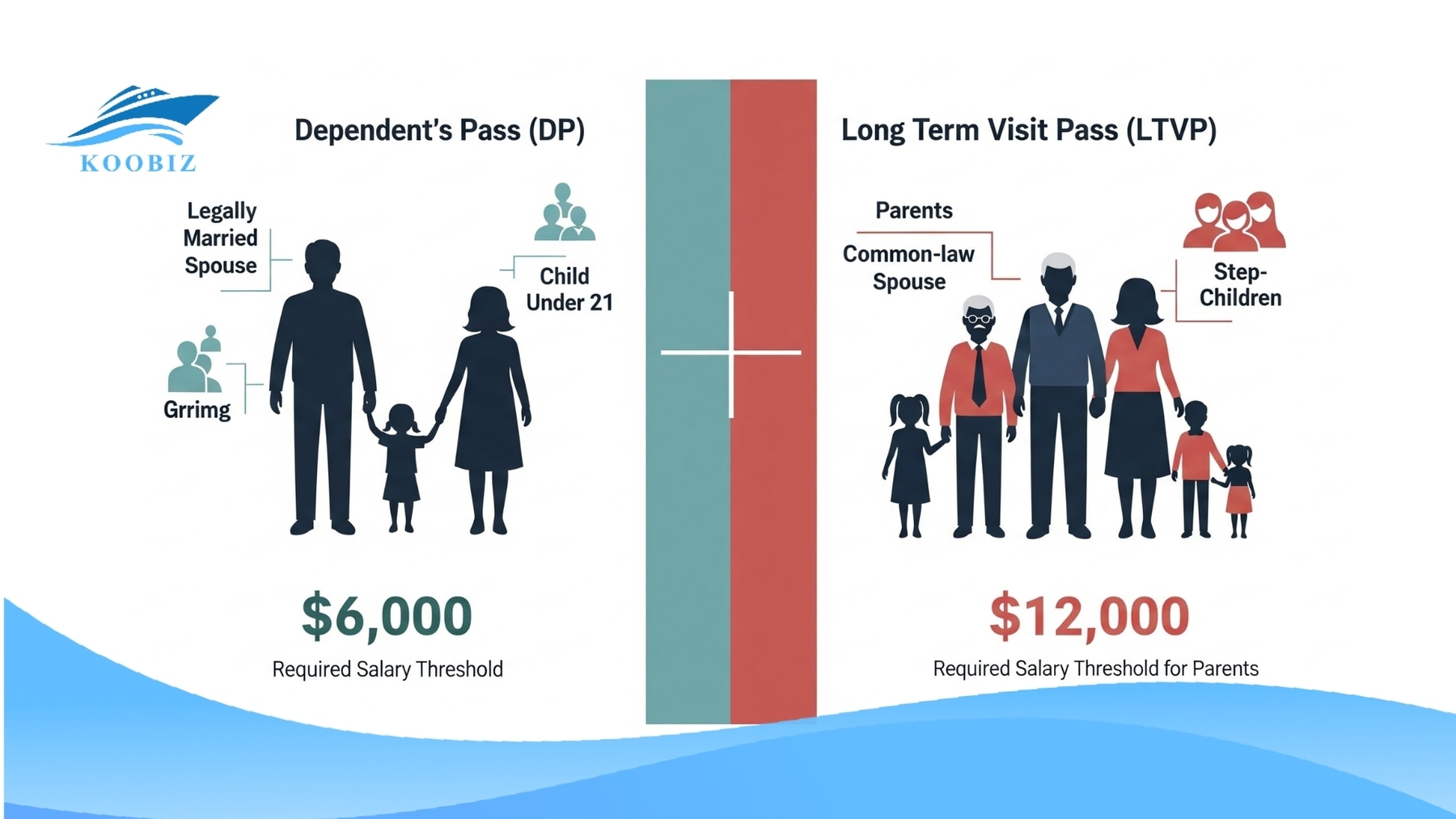

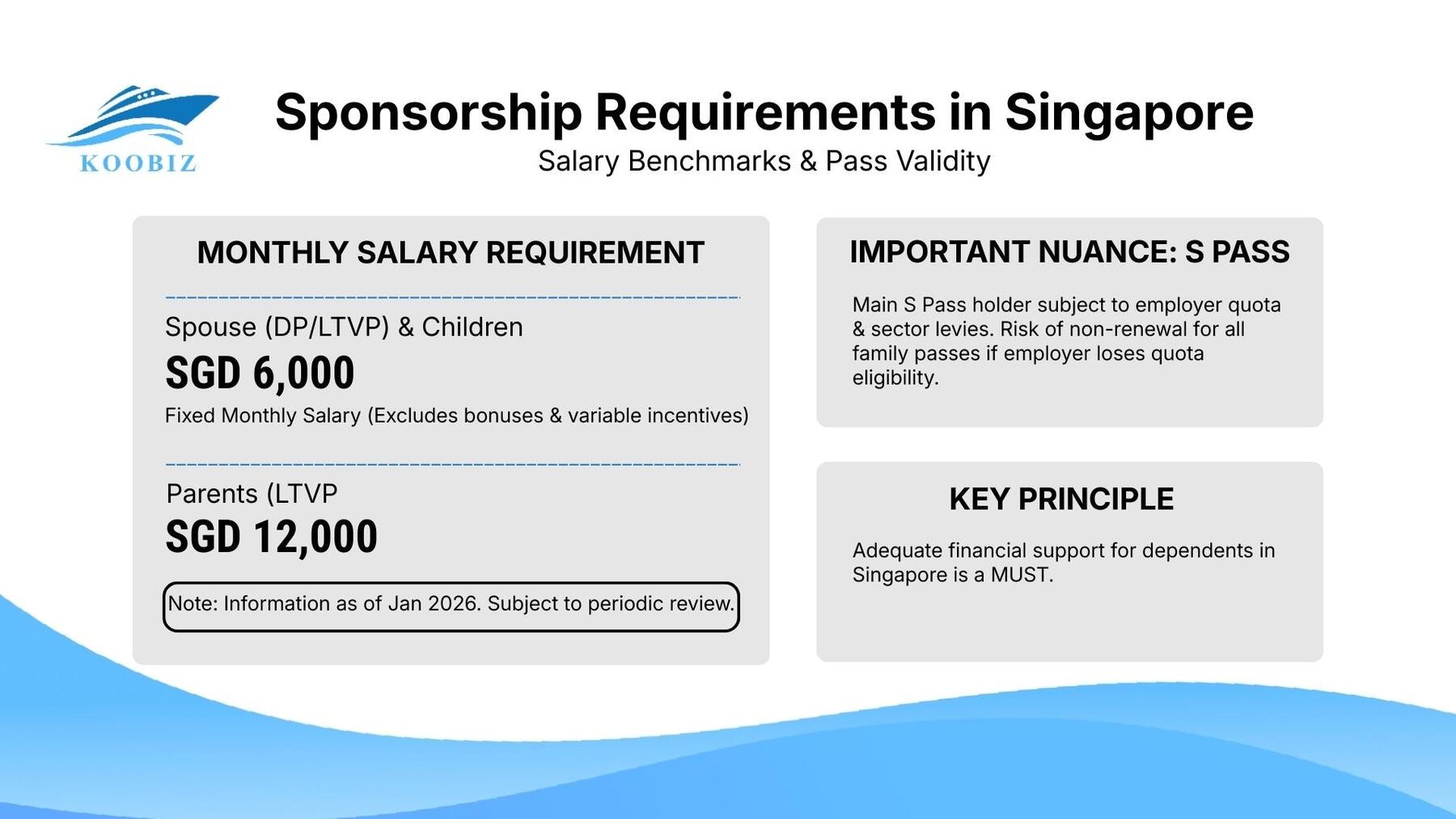

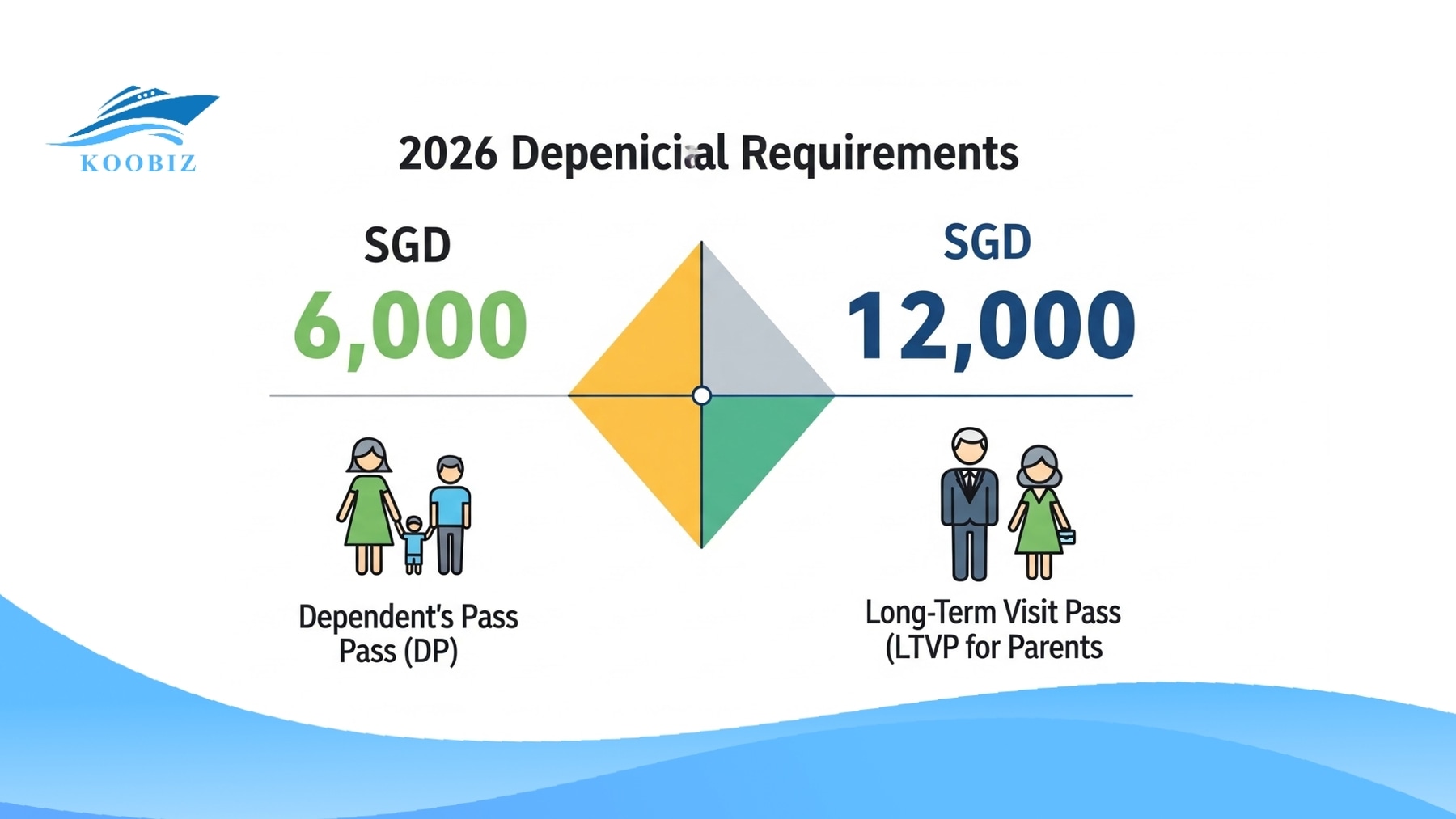

Can my spouse (on Dependant’s Pass) be the local director?

Generally, no. DP holders can no longer work via a simple LOC. To be a director, they must either own 30% of the business and hire a local (via LOC) or apply for their own Employment Pass or Work Permit.

What is the minimum paid-up capital to register the company?

The statutory minimum is SGD 1. However, if you intend to apply for a work pass under this company in the future, a paid-up capital of around SGD 50,000 is typically recommended to demonstrate financial viability to MOM.

Can I use my home address as the registered office?

Yes, subject to HDB/URA approval under the Home Office Scheme. However, most owners use a professional registered address service (like Koobiz) to keep their home address private from public ACRA records.

Can I hire employees for my new company?

Yes, your company can hire locals and foreigners. However, you cannot hire yourself while holding an EP with another employer. To work for your own company, you must obtain a new work pass under the new entity.

About Koobiz

Navigating the complexities of Singapore’s corporate regulations while holding an Employment Pass can be daunting. At Koobiz (koobiz.com), we specialize in bridging the gap for foreign entrepreneurs. Whether you need a trusted Nominee Director, seamless Company Incorporation, or expert advice on Tax and Accounting compliance, our team ensures your business foundation is solid and legally compliant.

Don’t let visa restrictions stop your entrepreneurial journey. Contact Koobiz today for a consultation on how to structure your Singapore business safely and effectively.