[SUMMARIES]

Single-Tier Support: For 2026, PWCS has been streamlined to a Single Tier covering gross monthly wages up to $3,000 at a flat 20% co-funding rate.

Automatic Payouts: Payouts are automatic, calculated by IRAS using your CPF data.

Wage Cap Rule: To qualify, the employee’s post-increase average gross monthly wage must be below $4,000. If the wage falls between $3,000 and $4,000, co-funding is capped at the $3,000 portion.

Qualifying Criteria: Only Singapore Citizens and PRs with a minimum average gross wage increase of $100 qualify. Employees generally must be existing staff with a baseline wage in 2025.

Compliance is Key: Increases must be genuine and sustained to avoid penalties.

[/SUMMARIES]

Rising manpower costs remain a top challenge for Singapore SMEs. The Progressive Wage Credit Scheme (PWCS) offers a vital solution, providing government co-funding to offset wage increases. For 2026, understanding this final year of the scheme is key to getting the most support.

At Koobiz, we help businesses navigate complex grant rules so you don’t leave money on the table. This guide explains the 2026 PWCS in simple terms—how it works, who qualifies, and how to ensure you receive your full payout without any issues, covering the Single Tier rate. What is the Progressive Wage Credit Scheme (PWCS) in 2026?

The Progressive Wage Credit Scheme (PWCS) is a transitional wage support mechanism introduced by the Singapore government to co-fund wage increases for lower-to-middle income employees.

This scheme serves as a financial cushion for employers as they transition to the mandatory Progressive Wage Model (PWM) across different sectors. Unlike broader past schemes, PWCS is highly targeted. In 2026, its defining feature is a focus on lifting the income bands up to $3,000, incentivizing employers to share productivity gains with their workers.

Key Highlights for 2026:

- Targeted Support: Co-funds wage increases for employees earning up to a gross monthly wage of $3,000.

- Single Tier Rate: Offers a consolidated support rate of 20% for the 2026 qualifying year.

- Automatic & Final: Payouts are auto-calculated and sent to you. As of now, 2026 is the last year of the scheme.

The scheme enables the government to co-fund a substantial share of the wage increases for eligible employees. For employers, this means that for every dollar you raise a worker’s salary (within the qualifying limits), the government reimburses a portion of that increase, thereby reducing the overall cost of retaining staff.

Which Employees Qualify for PWCS Payouts?

To qualify, employees must meet strict Citizenship, CPF, and Wage Threshold criteria, including a specific cap on post-increase wages.

At Koobiz, we frequently observe clients losing out on claims due to administrative oversights—such as delays or errors in updating PR status or CPF payment deadlines. To help your business capture every eligible dollar, please verify your workforce against this detailed checklist:

- Singapore Citizen or Permanent Resident (PR): The employee must be a Singapore Citizen or PR.

- Valid CPF History (Existing Baseline): Should have worked for you and received CPF contributions for at least 3 calendar months in the preceding year (2025). (It’s for retaining staff, not new hires).

- Mandatory CPF Contributions: You must have paid the mandatory CPF contributions for the employee by the stipulated deadline (usually 14th January of the following year). Late payments can disqualify the employee for the entire qualifying year.

- Wage Ceilings (The “Cliff” vs. The “Cap”):

- Co-Funding Ceiling ($3,000): The government only co-funds the portion of the wage up to $3,000.

- Eligibility Cap ($4,000): The employee’s average wage after the increase must be below $4,000. This is the most important rule.

- If their new wage is between $3,000 and $4,000, they are still eligible, but only on the portion up to $3,000.

- If their new wage hits $4,000 or above, they do not qualify at all.

- Minimum Wage Increase: Must have received an average gross monthly wage increase of at least $100 in 2026 compared to 2025.

What is “Average Gross Monthly Wage”?

It is not just the basic salary. It is calculated as the total annual wages (including basic salary, overtime, and bonuses, but excluding employer CPF) divided by the number of months CPF contributions were paid.

2026 Co-Funding Rates: Consolidated Wage Support

For the 2026 qualifying year, the government has streamlined the scheme into a Single Tier of support, covering all eligible employees earning up to $3,000.

Unlike 2024, which distinguished between Tier 1 ($2,500) and Tier 2 ($3,000), the 2026 framework applies a unified co-funding rate for the entire qualifying income band.

Table: PWCS Co-Funding Levels (Historical & Current)

| Qualifying Year | Wage Tier | Gross Monthly Wage Ceiling | Co-Funding Rate |

|---|---|---|---|

| 2026 | Single Tier | Up to $3,000 | 20% |

| 2025 | Single Tier | Up to $3,000 | 40% |

| 2024 | Tier 1 | Up to $2,500 | 50% |

| Tier 2 | > $2,500 to $3,000 | 30% |

Understanding the Transition:

- Single Tier (2026): All eligible employees earning up to $3,000 attract the 20% co-funding rate on their qualifying wage increase.

- Historical Context: The table illustrates the shift from the multi-tiered approach in 2024 to the consolidated single tier in 2025 and 2026. This simplifies calculations for employers.

The “Compounding” Effect:

It is important to note that PWCS supports sustained wage increases. This means if you gave a wage increase in 2025 (which attracted 40% co-funding), that same increase is co-funded again in 2026 at the 20% rate, provided the wage increase is sustained.

How is the PWCS Payout Calculated?

The PWCS payout is calculated by multiplying the Qualifying Wage Increase by the applicable Co-Funding Rate, prorated for the number of months CPF was paid.

IRAS uses a fair method based on Average Gross Monthly Wage (AGMW), not just one month’s salary.. Follow this step-by-step breakdown to estimate your 2026 payout:

Step 1: Determine the Average Gross Monthly Wage (AGMW)

- AGMW 2025: Total Wages in 2025 ÷ Months of CPF in 2025.

- AGMW 2026: Total Wages in 2026 ÷ Months of CPF in 2026.

Step 2: Calculate the Qualifying Wage Increase

- Formula: AGMW 2026 – AGMW 2025.

- Condition: This result must be ≥ $100.

Step 3: Apply the 2026 Co-Funding Rate

Multiply the qualifying increase by the 2026 Single Tier rate of 20%.

- Note: If AGMW 2026 > $3,000, cap the wage at $3,000 for calculation purposes.

- Calculation: (Capped Wage – AGMW 2025) x 20% = Support per month.

Step 4: Calculate the Total Annual Payout

Multiply the monthly support by the number of months CPF contributions were paid in the qualifying year (2026).

Step 5: Account for Sustained Increases

If you gave an increase in 2025 that was sustained into 2026, you may receive additional co-funding on that historical increase at the 2026 rate (20%), further boosting your total payout.

Real-World Case Studies: Calculating Your 2026 Payout

To help you visualize the potential returns, here are four scenarios illustrating how the 2026 Single Tier rates apply to different employee profiles.

Disclaimer: These calculations assume full-year employment. For partial years or variable wages, the “Average Gross Monthly Wage” formula applies.

Case Study 1: The Standard Increase

- Situation: Employee A had an average wage of $2,500 in 2025. In 2026, you increased this to $2,800.

- Qualifying Increase: $300 (Formula: $2,800 – $2,500).

- Calculation: $300 (Increase) x 20% (2026 Rate) = $60 per month.

- Total Annual Payout: $60 x 12 months = $720.

Case Study 2: The “Sustained” Boost

- Situation: Employee B received a raise in 2025, moving from $2,000 (in 2024) to $2,200 (in 2025). In 2026, their salary remains at $2,200 (no new increase).

- Qualifying Increase: $200 (The increase from 2024 to 2025 is “sustained”).

- Calculation: $200 (Sustained Increase) x 20% (2026 Rate) = $40 per month.

- Total Annual Payout: $40 x 12 months = $480.

Case Study 3: The “In-Between” Earner (Partial Coverage)

- Situation: Employee C earned $2,800 in 2025. You give a raise to $3,200 in 2026.

- Eligibility Check: The post-increase wage ($3,200) is below the $4,000 cap, so the employee is Eligible.

- Wage Cap Application: Since the new wage exceeds the $3,000 co-funding ceiling, you only calculate the increase up to $3,000.

- Qualifying Increase: $3,000 (Cap) – $2,800 (Baseline) = $200 (not the full $400 actual increase).

- Calculation: $200 x 20% = $40 per month.

- Total Annual Payout: $40 x 12 months = $480.

Case Study 4: The Ineligible High Earner (The $4,000 Cap)

- Situation: Employee D earned $3,500 in 2025. You give a significant raise to $4,100 in 2026.

- Outcome: Even though the increase is >$100, the post-increase average wage ($4,100) exceeds the $4,000 eligibility cap.

- Total Payout: $0. The employee is ineligible for PWCS.

Is Application Required for PWCS?

No, employers do not need to apply for PWCS; the payouts are computed automatically by the Inland Revenue Authority of Singapore (IRAS) based on CPF contribution data.

This automation reduces administrative friction, letting business owners concentrate on operations instead of paperwork. However, “automatic” does not mean “effortless.” There are prerequisites you must have in place to ensure the funds actually reach your bank account.

Key Requirements for Automatic Payout:

- GIRO or PayNow Corporate: Ensure you have a valid GIRO or PayNow Corporate account linked to your business UEN. IRAS no longer issues cheques for these grants. If you haven’t set this up, Koobiz can assist with opening the necessary corporate banking accounts and linking them to government agencies..

- Timely CPF: As noted earlier, CPF contributions must be paid on time. Retroactive payments made after the deadline typically do not qualify for the scheme.

Payout Timeline:

Eligible employers will receive a notification from IRAS (usually via letter or the myTax Portal) detailing the payout amount. Payouts for the 2026 qualifying year are expected to be disbursed by Q1 2027.

Strategic Considerations & Compliance for Employers

Employers must balance the pursuit of maximum payouts with strict adherence to “genuine wage increase” principles to avoid audits and penalties.

Navigating compliance is critical. Below are the key areas to watch:

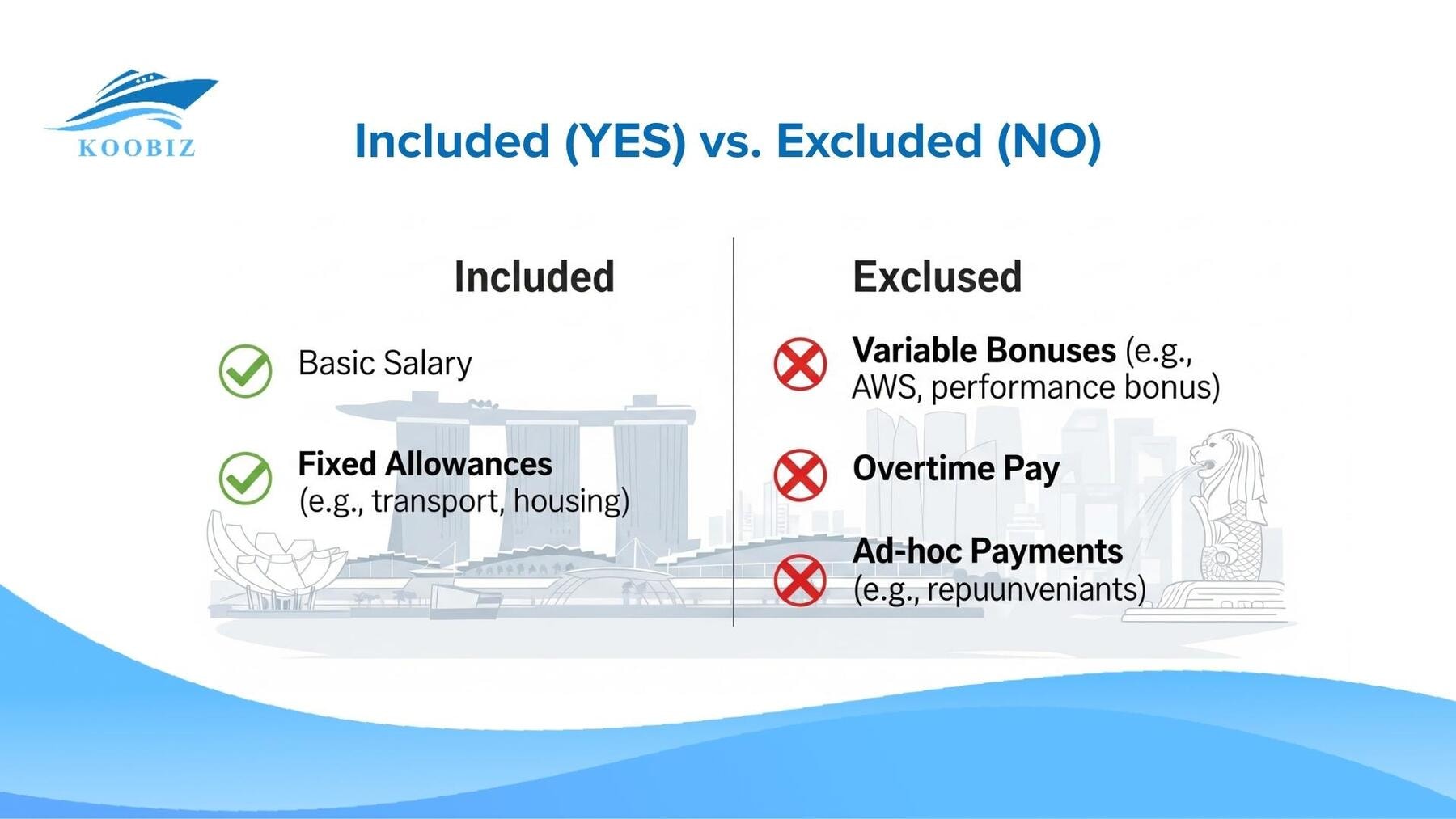

1. Key Exclusions

Not all employees qualify. To prevent conflicts of interest, the following are excluded:

- Business Owners & Directors: Sole proprietors, partners, and directors who are also shareholders.

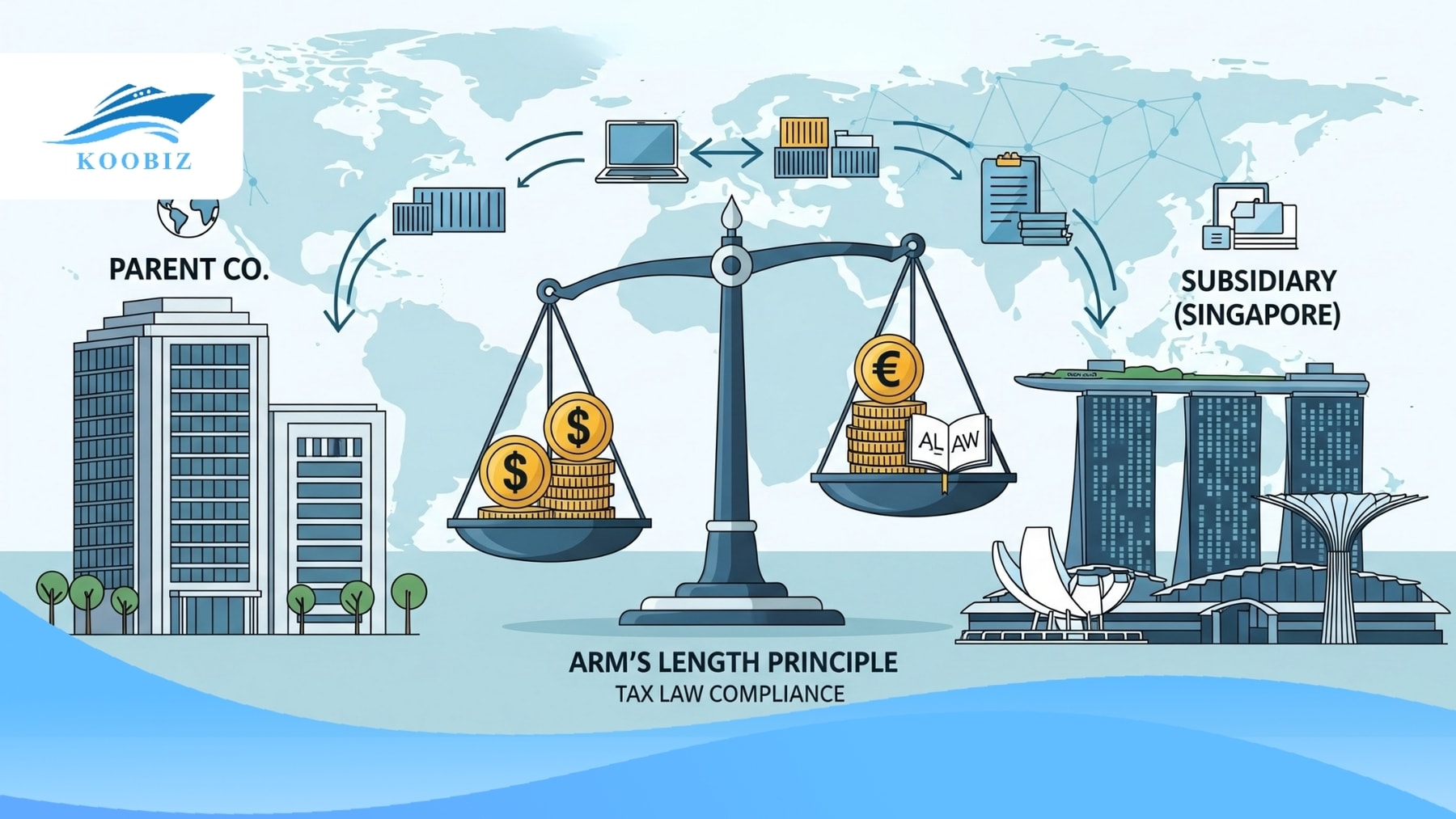

- Related Parties: Family members of owners are scrutinized. Unless their employment and salary are at “arm’s length” (market rate for genuine work), they are excluded.

- Shell Companies: Entities without active trade in Singapore.

2. Interaction with Other Schemes (JGI & SEC)

PWCS works alongside the Jobs Growth Incentive (JGI) and Senior Employment Credit (SEC), but you cannot “double dip.” The government applies a Net Benefit Rule, capping total support across schemes. Overpayments from one scheme may be offset against your PWCS payout.

3. Avoiding “Wage Jumping”

IRAS uses analytics to detect “wage jumping”—artificially inflating wages to claim subsidies and dropping them later.

- Red Flags: Drastic, short-term hikes or salaries inconsistent with market rates.

- Consequences: Denial of payouts, clawbacks, and penalties up to 400% or imprisonment.

4. Handling Disputes

If your payout is lower than expected, you have a two-month window to appeal via the myTax Portal. Ensure you verify your CPF data and check for exclusions (like the $4,000 cap or related party status) before submitting employment contracts and payslips as proof.

Conclusion

The Progressive Wage Credit Scheme (PWCS) represents a significant opportunity for Singapore businesses to offset the costs of talent retention in 2026. By understanding the Single Tier structure, verifying eligibility against the $4,000 cap, and maintaining strict compliance, you can turn a mandatory cost increase into a strategic advantage.

At Koobiz, we specialize in helping businesses navigate the complexities of the Singaporean corporate environment. Whether you need assistance with company incorporation, opening a corporate bank account, or managing your tax and accounting to ensure full compliance with grant requirements, our team is ready to support you. Don’t let administrative hurdles stop you from maximizing your benefits.

Contact Koobiz today to streamline your corporate operations and ensure you never miss a government incentive.

![How to Issue Compliant Share Certificates in Singapore [ACRA Guide]](https://cms.koobiz.com/wp-content/uploads/2026/01/how-to-issue-compliant-share-certificates-in-singapore-acra-guide.jpg)