[SUMMARIES]

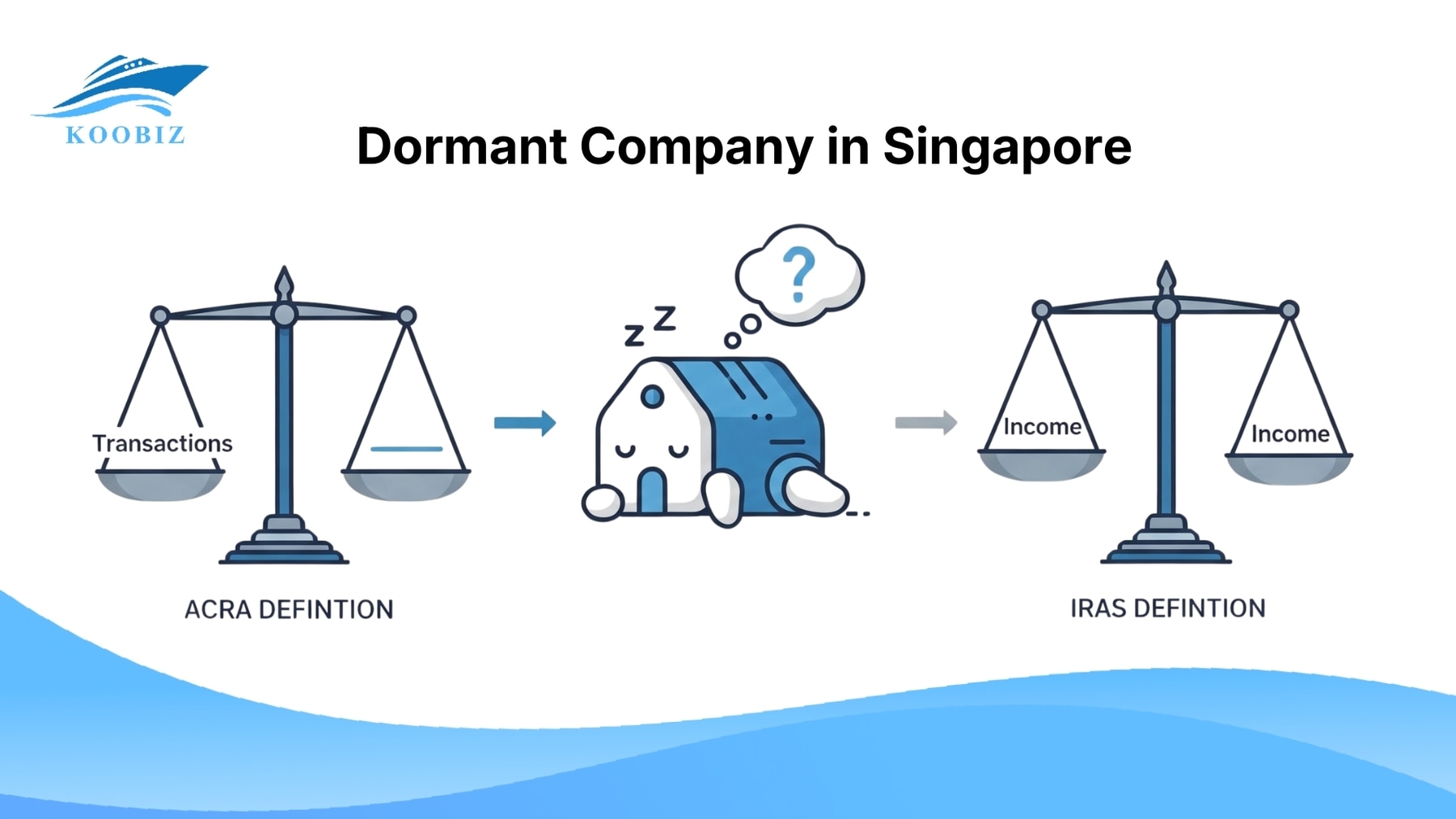

A dormant company is defined differently by regulators: ACRA bases status on the absence of accounting transactions (excluding statutory fees), while IRAS focuses strictly on the lack of revenue or income generation.

Strategic dormancy allows investors to cost-effectively hold assets like intellectual property and preserve corporate banking relationships without the administrative burden of active operations or mandatory audits.

Directors must maintain strict compliance despite inactivity, as mandatory obligations like appointing a Company Secretary, maintaining a registered address, and filing Annual Returns remain enforceable to avoid penalties.

[/SUMMARIES]

Primary Keyword: Dormant Company Singapore

Other Keywords: ACRA dormant company, IRAS dormant company, strike off vs dormant, inactive company singapore, dormant company requirements, company compliance singapore

A Dormant Company in Singapore refers to a registered business entity that has temporarily ceased trading activities and stopped generating income but retains its registration with ACRA for future use or asset holding. For business owners, understanding this status is crucial because “dormant” does not mean “exempt from all laws”; it essentially means the company is in a state of hibernation yet must still acknowledge statutory obligations.

While the primary intent of dormancy is often to pause operations, many investors often leverage this structure strategically to hold intellectual property or real estate without the administrative burden of an active trading firm. However, the concept of dormancy is not applied uniformly across Singapore’s regulatory framework. ACRA and IRAS assess dormancy based on different criteria, which means a company may qualify as dormant for corporate compliance purposes yet still be regarded as active from a tax perspective. Misunderstanding this distinction can lead to unintended non-compliance.To help you manage this effectively, this guide details the benefits, procedural steps for conversion, and the rigorous compliance checklist required to maintain a dormant status. Furthermore, we will explore the lifecycle options available to you, from “opening” a dormant entity with the help of incorporation experts like Koobiz, to eventually reactivating it when market conditions improve.

What Defines a Dormant Company in Singapore?

A dormant company is defined as a business entity that does not engage in significant accounting transactions or generate revenue during a specific financial period. To fully grasp this legal status, it is essential to distinguish between the definitions set by the two primary governing bodies in Singapore.

How does ACRA Define a Dormant Company?

ACRA determines a company’s dormant status primarily by assessing whether it has recorded any accounting transactions during the relevant financial year. Under Section 205B of the Companies Act, accounting transactions refer to entries that affect the company’s financial statements.Importantly, the legislation recognises that certain administrative activities are unavoidable. As such, a company remains dormant in the eyes of ACRA even if it engages in minimal administrative actions, such as paying fees to the Registrar, maintaining a registered office, or paying a penalty. This distinction ensures that paying for statutory compliance does not accidentally trigger “active” status.

How does IRAS Define a Dormant Company?

IRAS defines a dormant company differently, focusing entirely on the source of income rather than accounting entries. A company is considered dormant by IRAS if it does not carry on business and has no income for the whole of the basis period.

In practical terms, a company may continue to incur routine expenses, such as secretarial or statutory fees, which may be recorded as transactions for corporate purposes. However, provided there is no revenue or income stream, IRAS will continue to treat the company as dormant for tax assessment. It is also important to note that the mere holding of assets does not, in itself, disqualify a company from dormant status. A company is only considered active for tax purposes if those assets generate income, such as dividends, rental income, or similar returns.

What are the Benefits of Maintaining a Company Dormant?

Maintaining a dormant company can offer meaningful strategic and financial advantages compared to permanently striking off the entity. Rather than dissolving the company, dormancy allows business owners to temporarily suspend operations while preserving the legal structure, historical standing, and underlying asset value of the company.

Here are the key advantages:

- Asset & IP Protection: It allows you to hold intellectual property, trademarks, or real estate in a separate legal entity, insulating them from trading risks.

- Brand Preservation: You retain ownership of your company name and brand identity, preventing competitors from claiming them, which would happen if you struck off the company.

- Readiness for Funding: A company with an older incorporation date often appears more stable and established to investors and banks compared to a newly registered firm.

- Banking Continuity: You can potentially maintain your corporate bank account (subject to bank activity fees), avoiding the rigorous and time-consuming KYC process required to open a new account later.

- Cost Efficiency: Running a dormant company is significantly cheaper than an active one. You enjoy exemptions from audit requirements and can apply for waivers to skip filing complex tax returns (Form C-S/C).

- Ease of Reactivation: Resuming business is as simple as notifying ACRA and IRAS, whereas restarting after striking off requires a full re-incorporation process.

Koobiz Tip: While maintaining a dormant company is more cost-effective than operating an active entity, certain statutory obligations remain. These include maintaining a registered address and appointing a company secretary. Koobiz offers tailored solutions designed specifically to meet the compliance needs of dormant companies in a cost-efficient manner.

How to “Open” or Convert to a Dormant Company?

The process of “opening” a dormant company usually refers to either incorporating a new shelf company for asset holding or converting an existing active trading company into a dormant state. This procedure requires precise adherence to cessation protocols to ensure no loose ends trigger compliance issues.

Steps to Convert an Active Company to Dormant Status

Converting an active company to dormant involves three critical steps: ceasing trading, clearing liabilities, and notifying authorities.

- Cease Trading: Stop all business operations and issuing of invoices immediately.

- Clear Liabilities: Settle all outstanding debts, creditor payments, and staff salaries.

- Notify Authorities: Ensure all accounts are finalized up to the date of cessation.

Specifically, you must ensure that no further income hits the bank account. Any trailing income received after the declared cessation date can void the dormant status for that financial year, forcing you to file full tax returns.

Can You Incorporate a Company as Dormant from Day One?

Yes. In Singapore, it is permissible to incorporate a company with the intention that it remains dormant from inception. This approach is commonly adopted by investors who wish to reserve a company name, establish a holding structure, or prepare a corporate vehicle for future use without commencing immediate commercial activity.To do this, you would go through the standard incorporation process with a provider like Koobiz. Once incorporated, the company simply refrains from entering into any significant accounting transactions. You will then declare this status in your very first Annual Return filing to ACRA.

Ongoing Responsibilities and Compliance for Dormant Companies

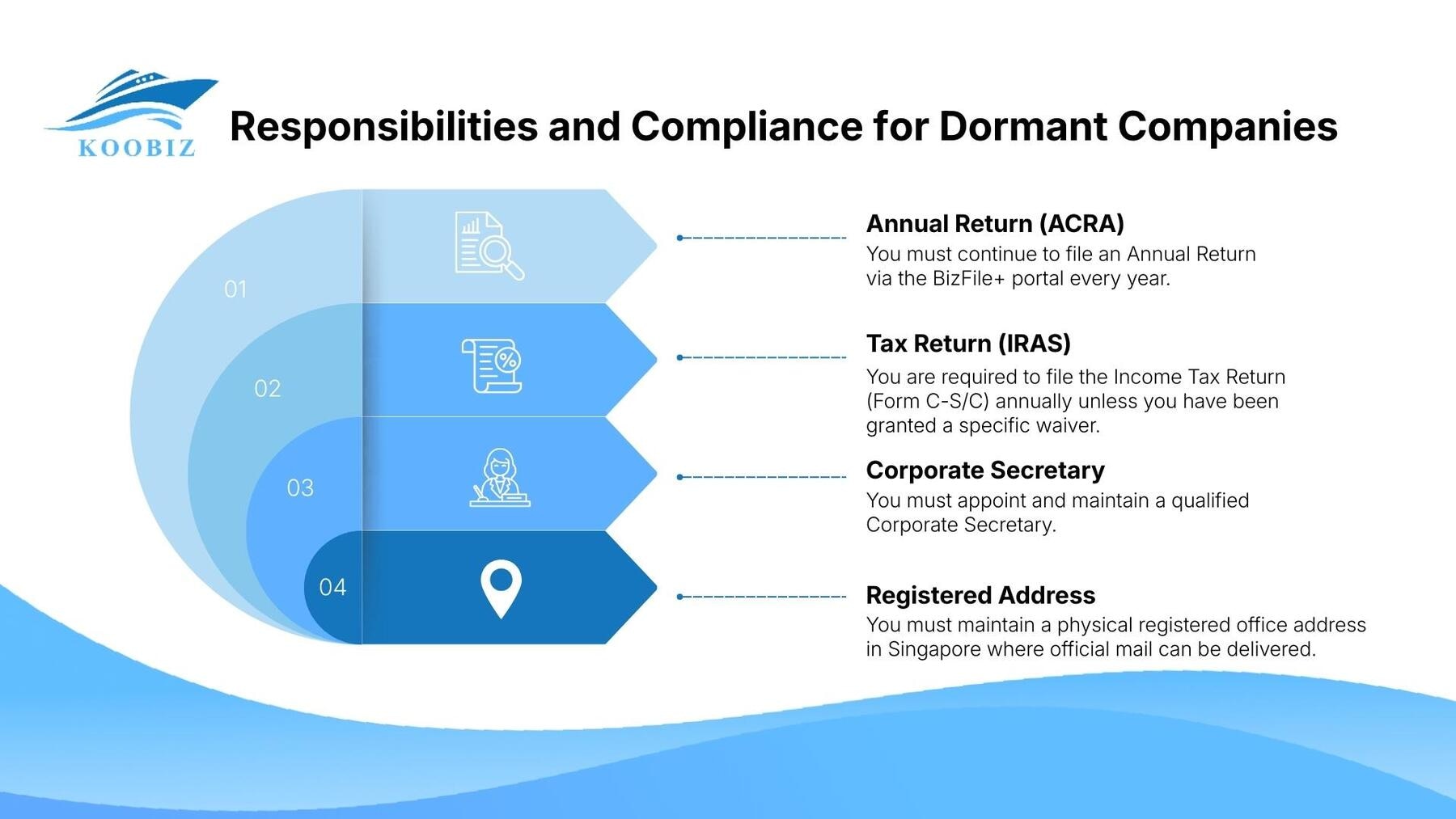

Even though a company is inactive, the directors are still legally responsible for specific statutory filings to maintain good standing. Ignoring these responsibilities can lead to penalties or involuntary striking off by ACRA.

To ensure your dormant company remains compliant, you must adhere to the following checklist:

- Annual Return (ACRA): You must continue to file an Annual Return via the BizFile+ portal every year. While “Dormant Relevant Companies” are exempt from preparing audited financial statements, lodging the return to confirm your status is mandatory to avoid composition fines.

- Tax Return (IRAS): You are required to file the Income Tax Return (Form C-S/C) annually unless you have been granted a specific waiver. Once a company is dormant, you should apply for a Waiver of Income Tax Return Submission to skip this requirement for future years.

- Corporate Secretary: You must appoint and maintain a qualified Corporate Secretary. This officer is essential for handling official communications with ACRA and IRAS and ensuring your registers are kept up to date.

- Registered Address: You must maintain a physical registered office address in Singapore where official mail can be delivered. This cannot be a P.O. Box.

Professional service providers such as Koobiz offer compliance-focused solutions specifically designed for dormant companies, enabling directors to meet these statutory requirements efficiently without incurring the costs associated with a fully active operating company.

Real-World Scenarios: Managing Dormancy Correctly

To make the regulations easier to understand, let’s look at three common scenarios faced by Singapore business owners. These examples highlight the subtle difference between staying compliant and accidentally becoming “active.”

Scenario 1: The “Safe” Holding Company (Compliant)

Situation: TechHold Pte Ltd was incorporated solely to hold a patent. It has no employees and conducts no sales. Its only expense is the annual fee paid to Koobiz for secretarial services and the ACRA filing fee.

Outcome: The company is regarded as dormant under both ACRA and IRAS..

- Why? The expenses (Secretarial/ACRA fees) are statutory requirements, which are “disregarded transactions” by ACRA. Since there is no income, it also satisfies IRAS rules.

Scenario 2: The “Accidental” Activation (Non-Compliant)

Situation: OldBiz Pte Ltd ceased trading two years ago. However, the director forgot to close a corporate subscription for a software tool, and the monthly fee of $50 continues to be deducted from the company bank account.

Outcome: The company is considered active by ACRA but remains dormant for IRAS purposes.

- Why? The software payment is an “accounting transaction” that is not a statutory requirement. Therefore, ACRA views the company as active, meaning it cannot claim the audit exemption for dormant companies if it crosses other thresholds. However, since it earned no income, IRAS still treats it as dormant for tax purposes.

Scenario 3: The Investment Income Trap (Tax Active)

Situation: WealthNest Pte Ltd holds shares in several other companies. It has no operations, but this year it received a $10,000 dividend from one of its investments.

Outcome:The company is considered dormant by ACRA but active by IRAS.

- Why? Receiving a dividend is income. Therefore, the IRAS tax waiver is revoked, and the company must file a tax return (Form C-S/C). However, ACRA may still consider it dormant if no other administrative costs were incurred, as the receipt of money itself might not count as a significant accounting transaction depending on how it’s recorded (though often it triggers administrative costs that would break dormancy).

How to Close a Dormant Company in Singapore

When the ongoing maintenance costs of a dormant company no longer justify its strategic or commercial value, directors may decide to permanently exit the structure. For solvent dormant companies, the most commonly adopted exit route is the striking-off procedure administered by ACRA.

Understanding the Striking-Off Process

Striking off is the process of removing the company’s name from the official register, effectively dissolving the entity. This is submitted via ACRA’s BizFile+ portal and is significantly faster and cheaper than a formal winding-up process (liquidation).

Specifically, the application takes approximately 4 to 5 months to process. Once approved, a notice will be published in the Government Gazette. If there are no objections from the public or tax authorities after a specific period, the company is struck off.

Key Pre-Conditions for a Successful Strike-Off

There are strictly four groups of conditions that must be met before ACRA will approve a strike-off application.

- No Assets/Liabilities: The company must have disposed of all assets and settled all debts.

- No Outstanding Tax: IRAS must have no outstanding tax queries.

- No Legal Proceedings: The company cannot be involved in any court cases.

- Unanimous Consent: All shareholders must agree to the striking off.

How to Reactivate a Dormant Company

One of the principal advantages of maintaining a dormant company is the ability to reactivate it efficiently when business opportunities arise. Reactivation does not require a complex approval process, but it must be handled carefully to ensure compliance with both ACRA and IRAS requirements.

Steps to Notify ACRA and IRAS of Reactivation

To reactivate, you primarily need to recommence business activities and notify the relevant authorities through your filings. There is no special “reactivation form” for ACRA; the change in status is simply reflected in your next Annual Return where you will no longer declare the company as dormant.

For IRAS, you must notify them within one month of recommencing business if you previously held a tax waiver. You will then be issued a Form C-S/C to file for the coming Year of Assessment. It is crucial to engage your Corporate Secretary or Koobiz to ensure these notifications are timed correctly to avoid penalties.

Frequently Asked Questions on Dormant Companies

Can a Dormant Company Hire Employees?

No, a dormant company generally cannot hire employees because paying salaries constitutes an accounting transaction. Under ACRA’s definition, an accounting transaction (other than statutory compliance costs) breaks the dormant status.

If a company hires staff and pays CPF (Central Provident Fund) contributions or salaries, it is engaging in operational activities. Therefore, if you intend to hire, the company must transition to “active” status and comply with all relevant employment and financial reporting standards.

Can a Dormant Company Hold Shares in Another Company?

Yes, a dormant company can hold shares in another company, and this is a very common structure for holding companies. Holding shares itself is a passive activity and does not trigger “active” status.

However, the nuance lies in the income. If the dormant company receives dividends from these shares, it may still be considered “dormant” by ACRA (if no accounting entry is required beyond receipt) but might be considered “active” for tax purposes by IRAS if that dividend income is taxable. Always consult a tax professional or Koobiz to understand the specific tax implications of your holding structure.

Ready to incorporate or manage your Singapore company?

Whether you are establishing a dormant holding company or require ongoing Company Secretary services to maintain compliance for an inactive entity, professional guidance can help minimise regulatory risk. Service providers such as Koobiz assist clients in navigating ACRA and IRAS requirements efficiently, allowing business owners to focus on long-term strategic planning.