[SUMMARIES]

Definition: ACRA is the national regulator for business entities and public accountants in Singapore.

Mandate: Registration with ACRA is mandatory for all profit-generating businesses (with minor exceptions).

Platform: All transactions are conducted via BizFile+, the central online filing portal.

Compliance: Key ongoing requirements include holding AGMs and filing Annual Returns.

Consequences: Non-compliance leads to penalties, summons, or the striking off of the company.

[/SUMMARIES]

For any entrepreneur looking to establish a foothold in Southeast Asia’s business hub, navigating the regulatory landscape is the first crucial step. At the heart of this ecosystem lies an acronym that every business owner will encounter repeatedly: ACRA. Whether you are registering a new company, updating your office address, or filing annual financial reports, your interactions with the Accounting and Corporate Regulatory Authority define your business’s legal standing.

At Koobiz,we work closely with local and international clients to incorporate and manage Singapore companies, and we consistently see that businesses with a clear understanding of ACRA’s role face fewer compliance challenges over time. This guide aims to clearly explain what ACRA does, outline its key responsibilities, highlight essential compliance requirements, and clarify how it differs from other authorities such as IRAS, helping you navigate Singapore’s corporate landscape with confidence.

What is ACRA in Singapore?

ACRA is the national regulator of business entities, public accountants, and corporate service providers in Singapore, operating as a statutory board under the Ministry of Finance.

To understand the full scope of this entity, it is helpful to look at its origins. Formed on April 1, 2004, ACRA was created through the merger of the Registry of Companies and Businesses (RCB) and the Public Accountants Board (PAB). This merger aimed to synergize the monitoring of corporate compliance with the oversight of public accountants.

As a statutory board, ACRA functions differently from a typical government department. It has the authority to administer and enforce the Companies Act, impose regulatory penalties, maintain national business registers, and continuously upgrade digital systems such as BizFile+ to support a pro-business yet highly transparent environment.

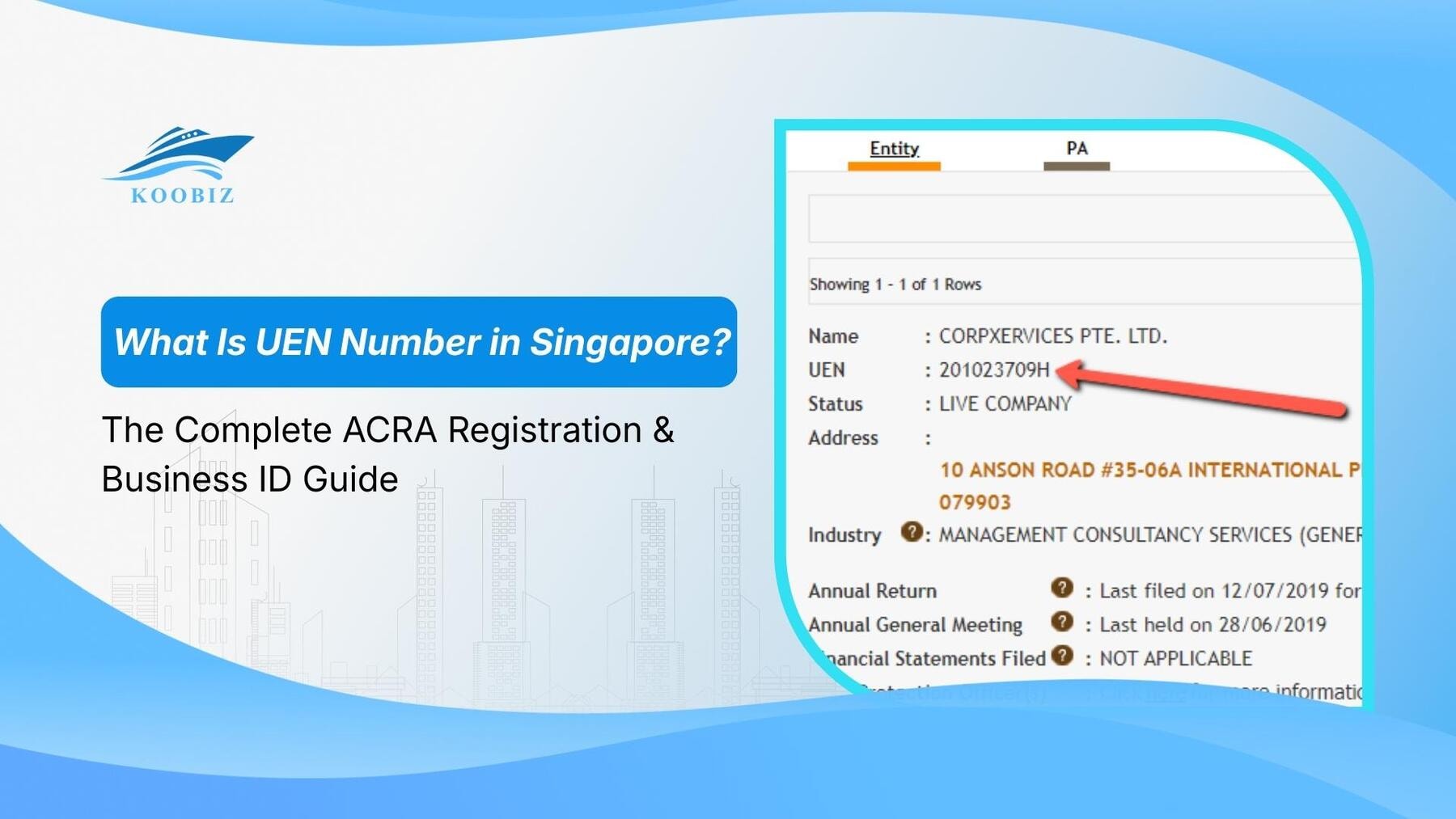

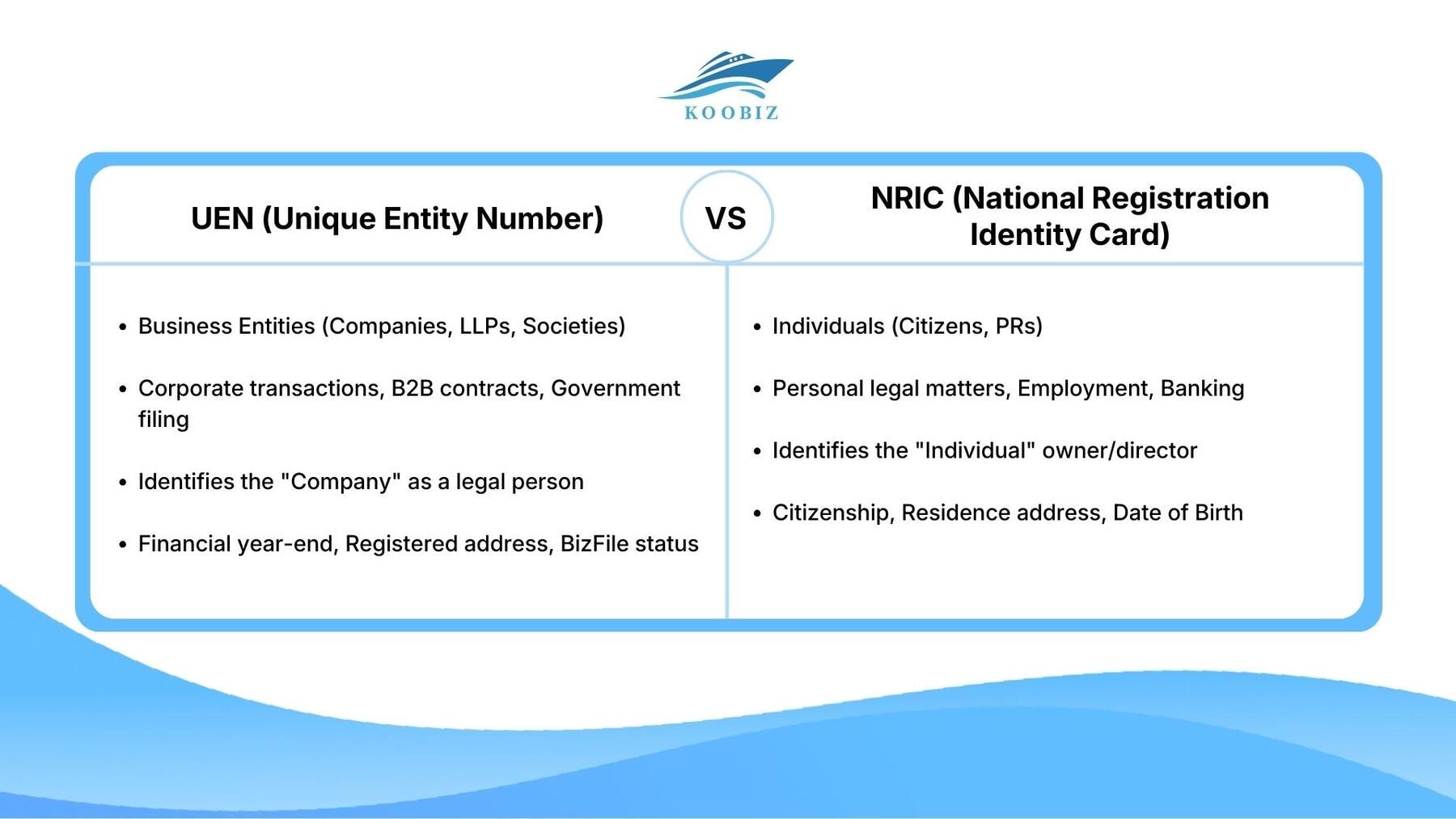

For startup founders and business owners, ACRA represents more than a compliance authority, it is the legal starting point of the company’s existence. ACRA is the body that incorporates your entity and issues the Unique Entity Number (UEN), which serves as the official identifier for all dealings with government agencies, banks, and commercial counterparties. Without registration and recognition by ACRA, a business has no legal standing in Singapore.

What are the Key Functions of ACRA?

ACRA acts as both a gatekeeper and a guardian for Singapore’s business ecosystem. Its role goes beyond just paperwork; it ensures that Singapore remains a trusted place to do business.

Although ACRA’s scope of authority is extensive, from a practical perspective, its functions can be distilled into four core responsibilities that are most relevant to startup founders and business owners:

1. Registering Business Entities

ACRA is the starting point for every business in Singapore. It administers the Companies Act and the Business Names Registration Act, overseeing the incorporation of all legal entities, including Private Limited Companies, Sole Proprietorships, and Limited Liability Partnerships (LLPs).

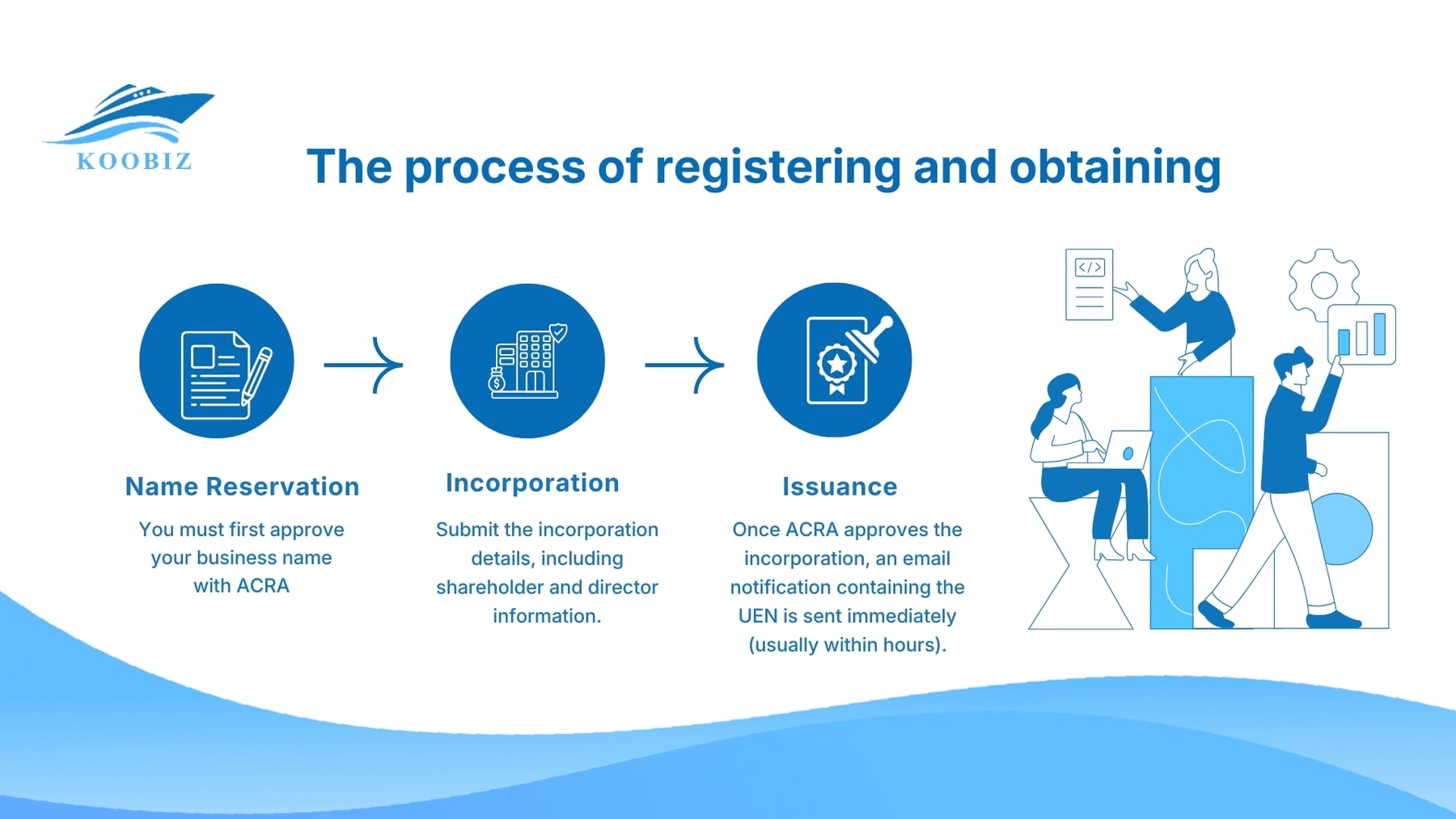

During incorporation, ACRA reviews and approves company names, verifies compliance with statutory requirements, and ensures that the chosen business structure aligns with Singapore law. Only after these checks are completed will ACRA issue the Certificate of Incorporation, formally bringing the company into legal existence.

When clients appoint Koobiz to assist with incorporation, we liaise directly with ACRA’s systems to reserve company names, submit incorporation documents, and complete the registration process accurately and efficiently, ensuring full compliance from day one.

2. Enforcing Corporate Compliance

Once a business is live, ACRA shifts to its role as an enforcer. It monitors companies to ensure they remain active, transparent, and compliant with statutory laws. This includes monitoring key statutory obligations such as the timely filing of Annual Returns and the holding of Annual General Meetings (AGMs). Where these requirements are not met, ACRA has the authority to impose late filing penalties, issue composition fines, or take enforcement action against directors. These measures help maintain the integrity and reliability of Singapore’s corporate registry.

3. Regulating Public Accountants and Service Providers

ACRA does not just regulate businesses; it also regulates the professionals who serve them. This includes registering Public Accountants (auditors) and Corporate Service Providers (CSPs). By maintaining strict standards for these professionals, ACRA ensures that the financial statements and statutory advice you receive are of high quality. This gives business owners confidence when hiring licensed agents to handle their affairs.

> 2025 Regulatory Update: Under the Corporate Service Providers Act 2024, ACRA has introduced tighter registration and reporting requirements for CSPs, including enhanced disclosures for nominee arrangements, as part of Singapore’s strengthened AML framework.

4. Facilitating Information and Transparency

ACRA serves as the central authority responsible for maintaining Singapore’s official corporate registry. It ensures that key information relating to every registered entity, such as its registered address, directors, and shareholders, is kept accurate, up to date, and publicly accessible.

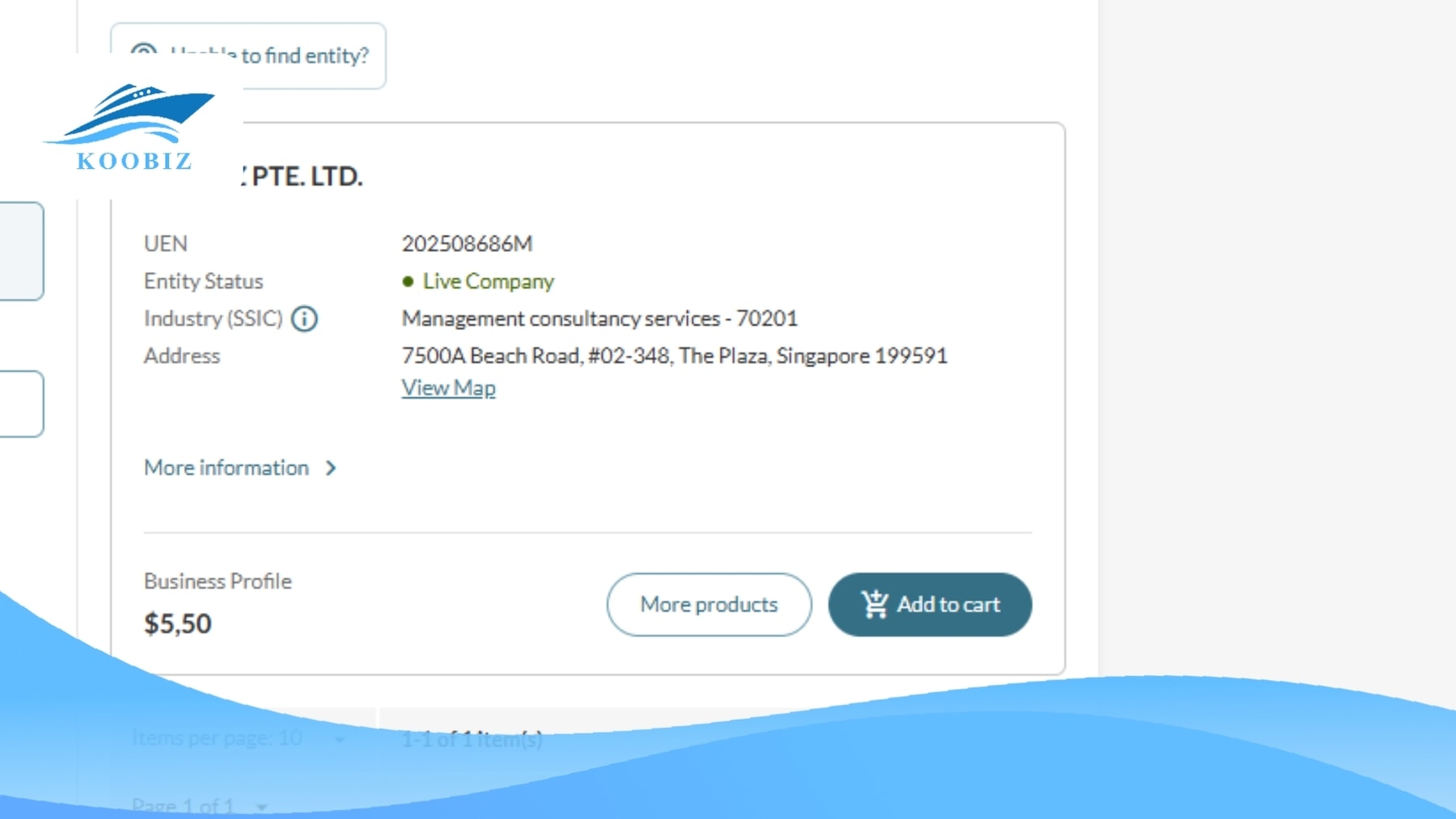

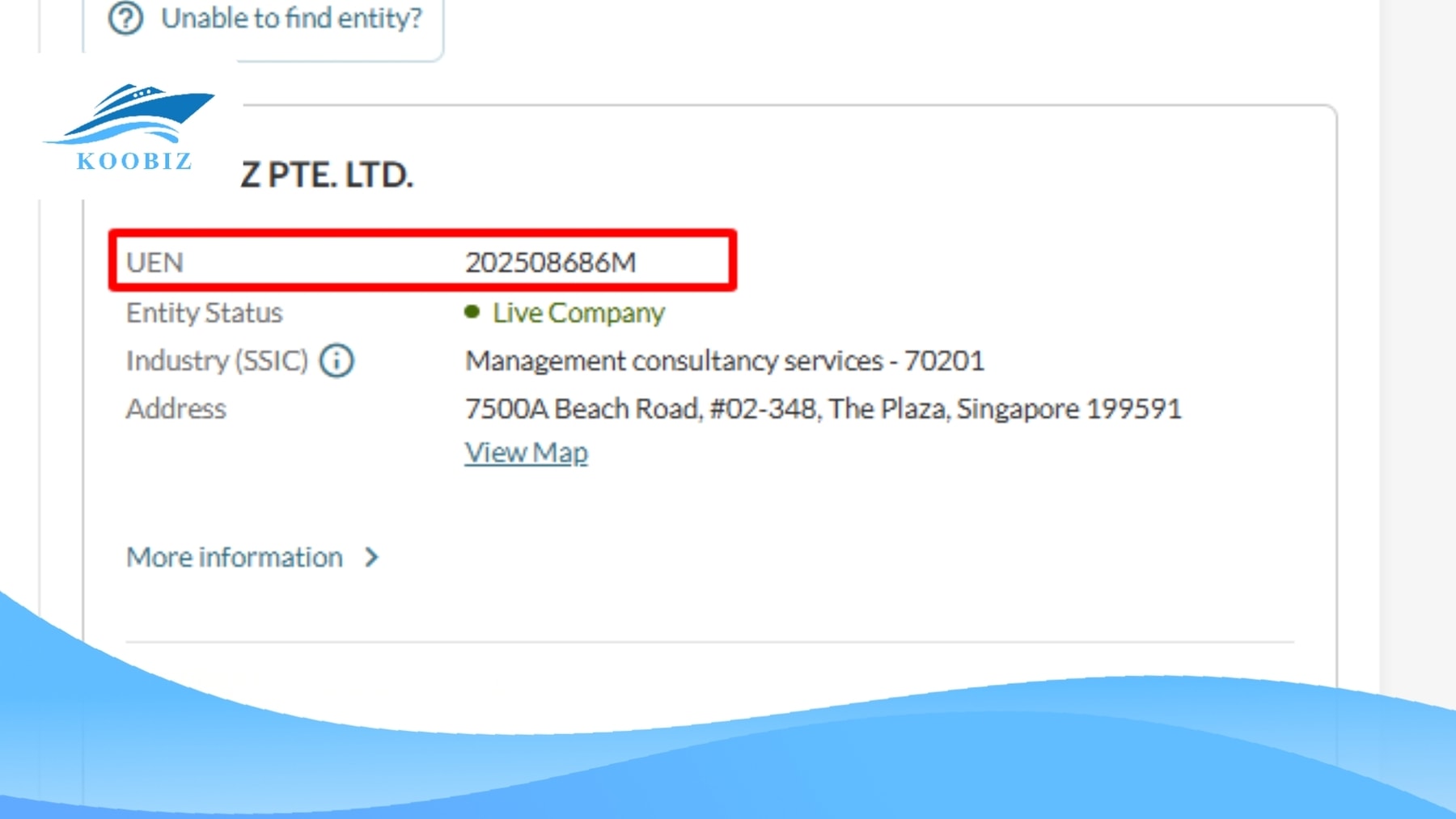

Through platforms such as BizFile+ iShop and its open data services, ACRA enables third parties to purchase official business profiles and extracts. This accessibility supports a transparent business environment, allowing investors, banks, and counterparties to perform due diligence efficiently and with confidence.

Is Registration with ACRA Mandatory for Startups?

Yes, registration with ACRA is mandatory for any individual or group intending to carry out a business activity for profit in Singapore on an ongoing basis.

ACRA registration for startups in Singapore 2025 remains a critical first step. This requirement is strictly enforced under the Business Names Registration Act. The definition of “business activity” is broad, covering any trade, commerce, craftsmanship, profession, or any other activity carried on for the purpose of gain. Whether you are opening a cafe, launching a tech startup, or running a consultancy firm, you must register before you commence operations.

There are very limited exceptions to this rule. You do not need to register if you are:

- Doing business under your full name as reflected in your NRIC (National Registration Identity Card) regarding a sole proprietorship.

- A hawker with a license from the Singapore Food Agency (SFA).

- A craftsman working from home (subject to specific HDB schemes).

(Note: These exemptions are subject to ACRA’s latest guidelines—always verify on their official site before proceeding.)

For most professional ventures and foreign founders, incorporating a Private Limited Company (Pte Ltd) with ACRA is the preferred and standard approach. This registration provides a Unique Entity Number (UEN), which is essential for opening a corporate bank account, hiring employees, and applying for government grants, processes that Koobiz routinely assists clients with. Operating a business without proper ACRA registration constitutes an offence and may result in fines or criminal liability..

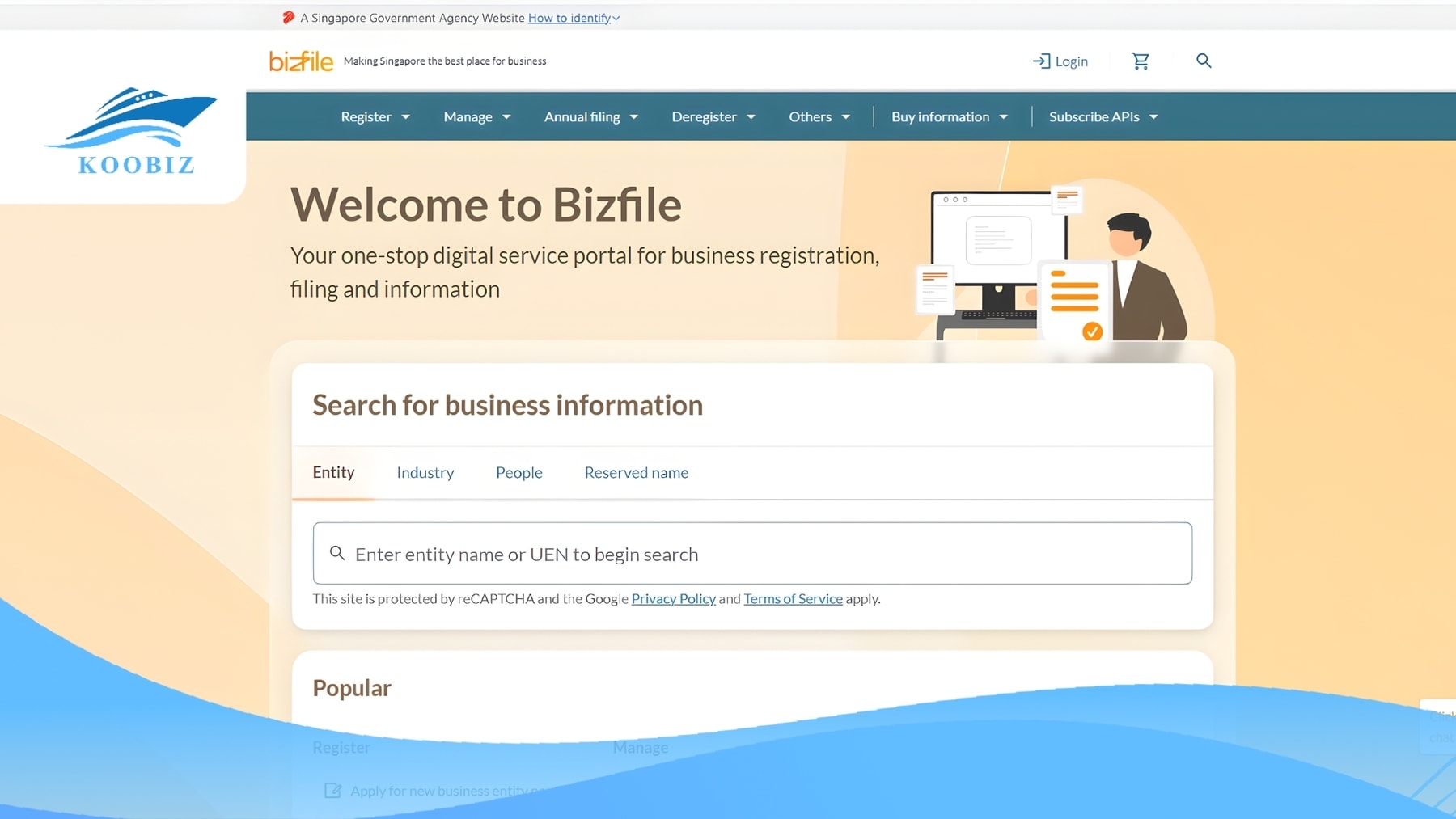

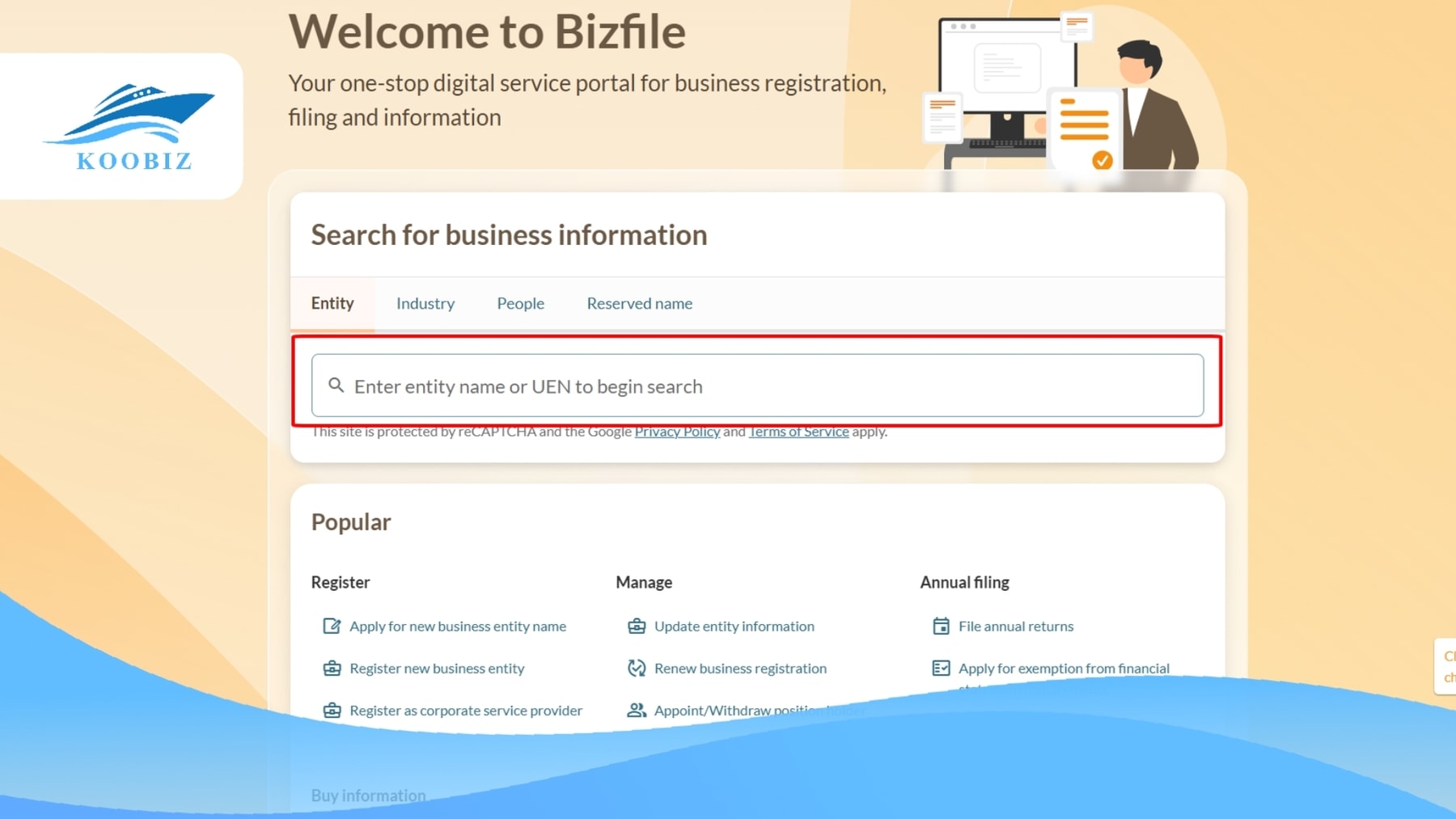

BizFile+: The Digital Gateway to ACRA

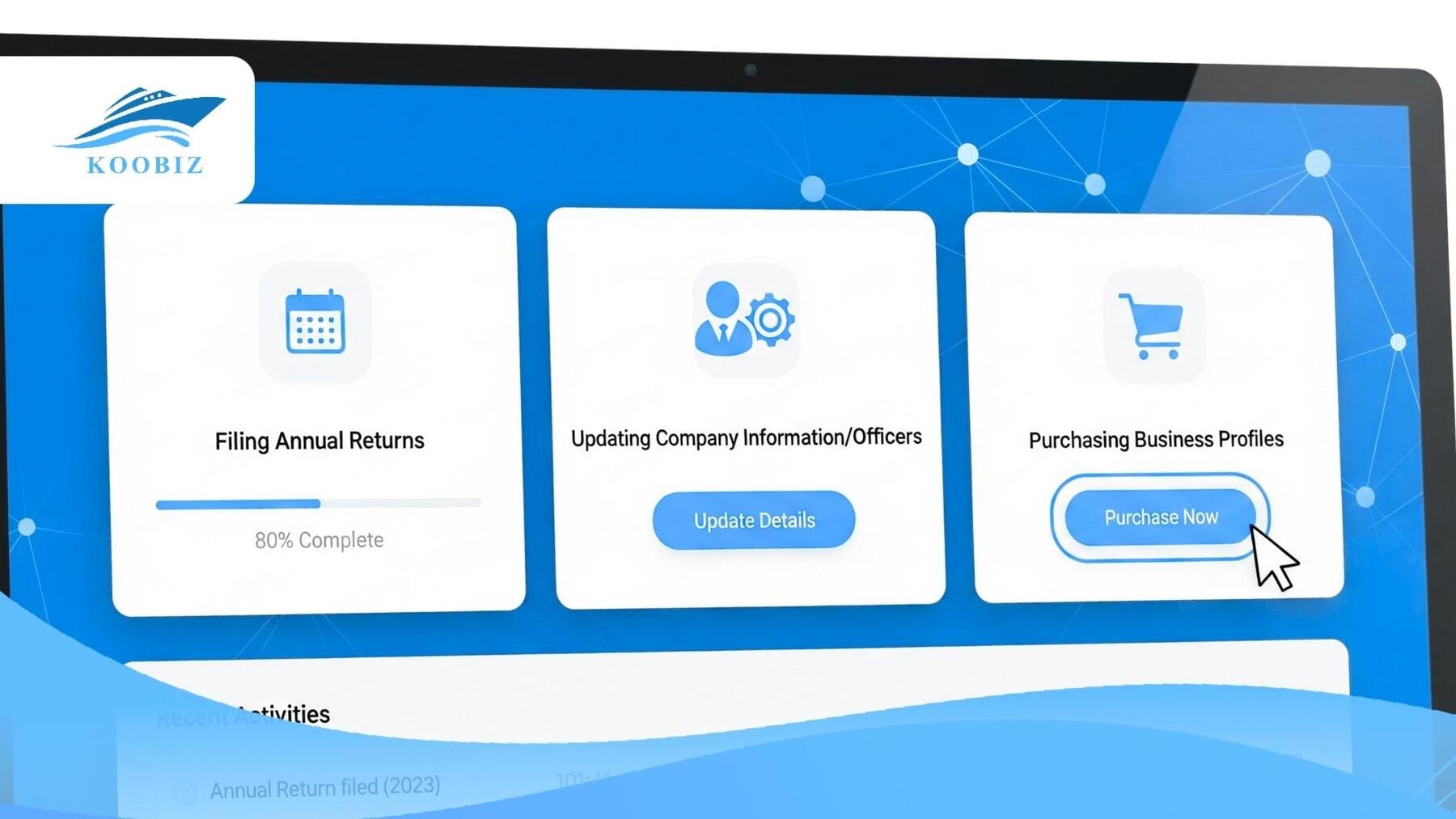

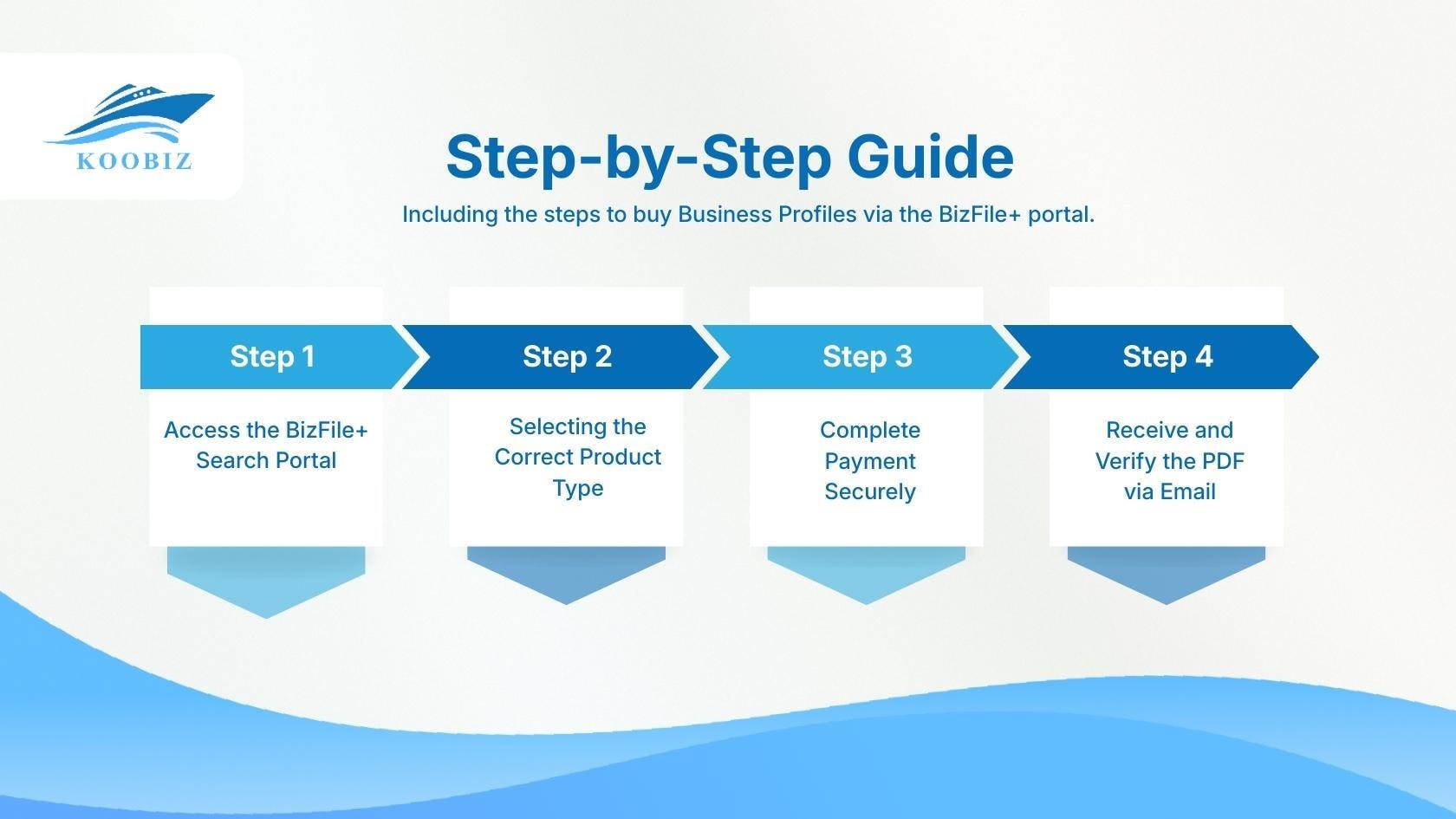

BizFile+ is ACRA’s integrated online portal that enables business owners to complete more than 400 corporate filings and information requests through a single digital system..

Previously, dealing with regulatory matters involved physical forms and in-person submissions. Today, BizFile+ reflects Singapore’s Smart Nation approach by acting as the primary digital interface between businesses and the regulator. The platform is fully paperless, accessible 24/7, and designed to allow companies to manage statutory obligations efficiently and at their own convenience.

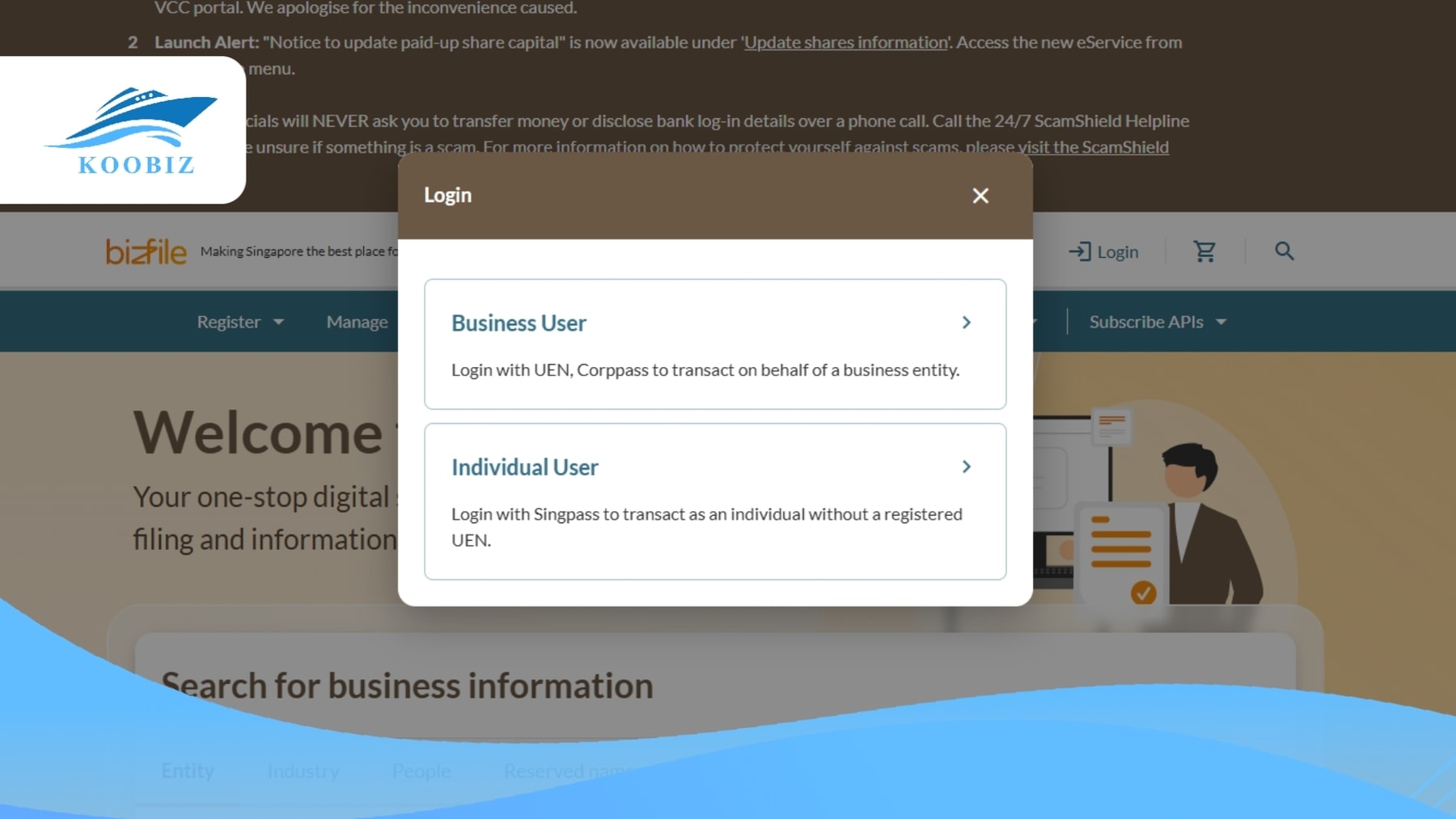

Accessing BizFile+ requires a SingPass (Singapore Personal Access) ID for locals, or a Corppass for corporate entities. Through this portal, you will conduct almost every administrative interaction with ACRA, including:

- Incorporating a new company.

- Updating registered office addresses or officers’ details.

- Filing annual returns.

- Applying to strike off a company.

For first-time founders, the breadth of available functions can feel complex, particularly given the number of filing options and regulatory pathways.

- Internal Link: For a step-by-step walkthrough on using the portal efficiently, read our detailed guide: [Navigate the BizFile Portal: A Guide for Singapore Business Owners to Manage ACRA Compliance].

What are the Ongoing Compliance Requirements?

To remain compliant, Singapore companies must fulfill two key annual obligations: holding an Annual General Meeting (AGM) and filing Annual Returns (AR).

A company’s “Live” status depends on timely compliance with these statutory requirements. Missing ACRA filing deadlines in 2025 and beyond may result in late penalties, enforcement actions, or further compliance complications.

Holding the Annual General Meeting (AGM)

The AGM is a mandatory session where directors present financial statements to shareholders for review.

- Listed Companies: Must hold within 4 months of Financial Year End (FYE).

- Non-Listed Companies: Must hold within 6 months of FYE.

- Exemption: Private companies may skip the AGM if they distribute financial statements to all members within 5 months of FYE, or if all members pass a resolution to dispense with it.

Filing Annual Returns (AR)

After the AGM, you must file an Annual Return via BizFile+. This submission updates your company particulars and lodges your financial statements.

- Deadline: Non-listed companies must file within 1 month after the AGM (typically resulting in a 7-month window from FYE).

At Koobiz, our corporate secretarial team tracks these timelines for you, ensuring every filing is accurate and on time.

BEYOND THE BASICS: TRANSPARENCY, RISKS, AND COMPARISONS

With the core compliance framework established, it is equally important to understand the broader regulatory context. This includes the high level of market transparency in Singapore, the potential consequences of non-compliance, and how ACRA’s role differs from that of other authorities within the financial and regulatory ecosystem.

Public Access to Corporate Data and Transparency

Singapore maintains a transparent business environment where corporate data is treated as public record, accessible to anyone through ACRA’s iShop and open data portals.

This commitment to transparency is a fundamental pillar of Singapore’s strong pro-business reputation. ACRA operates on the principle that a company’s ownership structure, management details, and core registration information should be independently verifiable. Such openness significantly reduces fraud risk and enhances confidence among investors and commercial counterparties. Unlike jurisdictions where corporate ownership can remain largely opaque, Singapore ensures that essential company data is publicly available.

As a result, any party, including potential investors, business partners, or even competitors, can legally obtain a company’s Business Profile. This document typically includes the UEN, incorporation date, registered address, principal business activities, paid-up capital, and particulars of directors and shareholders. At the same time, this transparency works both ways, enabling you to conduct proper due diligence on counterparties before entering into commercial arrangements.

- Internal Link: Need to check a competitor or partner? Learn how to download reports in our guide: [Conduct ACRA Company Search: Buy Business Profiles & UEN Reports].

What Happens If You Non-Comply with ACRA Regulations?

Failure to comply with ACRA regulations results in a tiered system of enforcement actions, ranging from financial composition sums to court prosecution and company striking off.

ACRA is known for being efficient but also strict. Ignorance of the law is not a valid defense in Singapore. Non-compliance usually stems from missing filing deadlines or failing to update changes in company particulars.

Understanding Late Lodgement Fees and Penalties

For minor breaches, such as filing the Annual Return late, ACRA usually issues a Late Lodgement Fee. This acts as a penalty to encourage timely compliance.

- The fee typically starts at SGD 300 and can go up to SGD 600 per breach depending on the length of the delay.

- If the breach continues, ACRA may issue a Composition Sum, which is an offer to settle the offense out of court by paying a fine.

- Failure to pay the composition sum can lead to the issuance of a Summons, requiring the company director to attend court (with potential fines up to S$5,000 per charge).

Can ACRA Strike Off Your Company?

In severe cases, or where there is reasonable cause to believe that a company is not carrying on business (e.g., failure to file ARs for multiple years), ACRA has the power to strike off the company from the register.

A company that is struck off is effectively extinguished as a legal entity. Its corporate bank accounts are frozen, control over remaining assets may pass to the state, and it loses all capacity to conduct business. In addition, directors linked to a strike-off caused by regulatory breaches may face future restrictions, including disqualification from holding directorships in other Singapore companies.

ACRA vs. IRAS: What is the Difference?

While ACRA governs the legal existence and compliance of a business entity, IRAS (Inland Revenue Authority of Singapore) focuses exclusively on tax administration and revenue collection.

New business owners often confuse the two because both require annual filings. However, they serve distinct purposes and operate on different timelines. The table below outlines the key differences:

| Feature | ACRA (The Registrar) | IRAS (The Taxman) |

|---|---|---|

| Primary Focus | Corporate Governance & Legal Existence | Tax Administration & Revenue Collection |

| What You Report | Ownership, officers, and financial position | Taxable income, expenses, and deductions |

| Key Filing | Annual Return (via BizFile+) | Corporate Income Tax Returns (Form C-S/C) |

| Core Objective | Transparency & Companies Act compliance | Collecting the correct amount of tax for the state |

A company can be compliant with ACRA (filing ARs on time) but non-compliant with IRAS (failing to file tax returns), and vice versa. Successful business management requires satisfying both authorities simultaneously. Koobiz provides integrated accounting and tax services to ensure that information submitted to ACRA aligns perfectly with declarations made to IRAS, preventing discrepancies that could trigger audits.

Conclusion

Understanding ACRA is the first step toward building a sustainable and legally robust business in Singapore. From the moment of incorporation via BizFile+ to the annual rhythm of AGMs and filing returns, ACRA is the regulatory companion that ensures the integrity of Singapore’s world-class business environment. While the regulations may seem stringent, they are designed to protect you and your stakeholders.

That said, staying on top of regulatory updates, filing timelines, and compliance obligations can divert attention away from growing your business. This is where Koobiz adds value. As a trusted corporate services partner, we manage the full spectrum of ACRA-related matters, ranging from incorporation and corporate secretarial support to annual compliance and tax planning.

Ready to start your Singapore business journey without the regulatory headache?

Visit Koobiz.com today to explore our incorporation packages and let us handle the paperwork while you focus on growth.

Disclaimer: The information provided in this guide is for general informational purposes only and does not constitute legal or professional advice. Regulations and fees are subject to change. Please consult with a qualified corporate service provider or refer to official ACRA resources for the most up-to-date information.