[SUMMARIES]

Beyond Bookkeeping: Modern accountants in Singapore act as strategic business partners, not just data recorders, helping SMEs navigate complex financial landscapes.

Strict Compliance: Their core role involves adhering to rigorous IRAS tax regulations (GST, ECI, Form C-S) and ACRA statutory filings (Annual Returns, XBRL) to avoid costly penalties.

Strategic Growth: Accountants drive expansion through precise cash flow management, budgeting, and acting as Virtual CFOs to interpret financial data for better decision-making.

Outsourcing Advantage: For most SMEs, outsourcing accounting to Corporate Service Provider (CSP) offers a cost-effective alternative to hiring in-house, providing access to expert teams and specialized software.

Tech-Driven Efficiency: The profession now relies heavily on cloud technology and AI automation to provide real-time financial insights and sustainability reporting.

[/SUMMARIES]

Accountants are the architects of financial stability who navigate complex IRAS and ACRA compliance while acting as strategic advisors for growth. Whether you are a startup founder or an established SME owner, understanding this multifaceted role is crucial.

This article delves into the operational, compliance, and strategic functions of modern accountants, helping you decide whether to hire in-house or leverage professional experts.

What is the Role of an Accountant in a Singapore SME?

An accountant for a Singapore SME is a financial professional responsible for interpreting, recording, and analyzing financial data to ensure regulatory compliance and facilitate strategic decision-making.

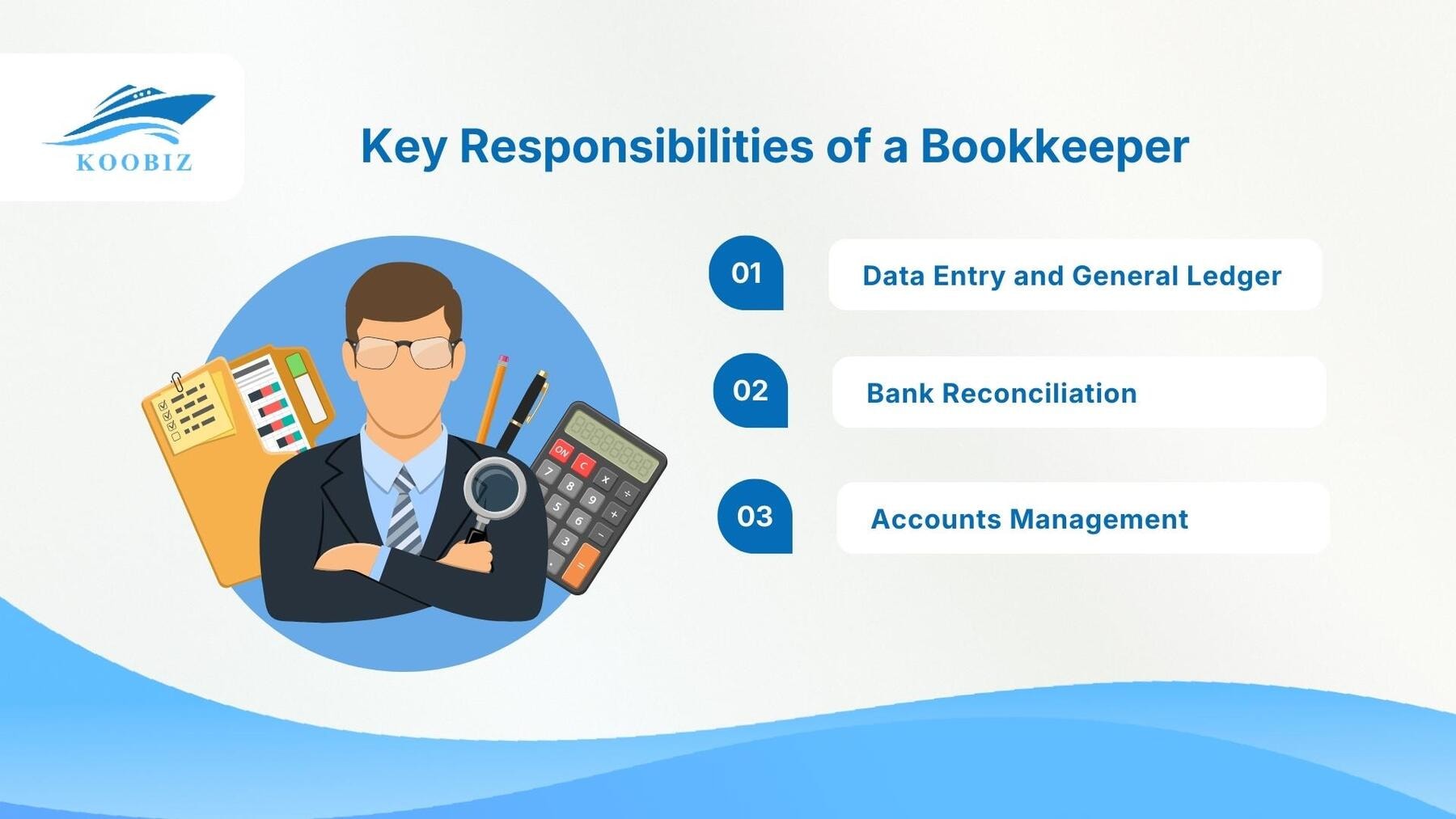

To understand this role more deeply, we must look beyond the stereotype of data entry. In the modern business context, specifically within Singapore’s framework, an accountant serves as a vital bridge between the company’s operational activities and its financial health.This critical function involves:

- Maintaining the integrity of financial records (bookkeeping) and ensuring that every dollar is accounted for.

- Providing financial visibility required to secure loans, attract investors, or simply manage cash flow effectively.

- “Business integrity,” drives Koobiz experts to ensure your company remains in good standing with Singaporean authorities while maximizing operational efficiency.

Core Responsibilities: Ensuring Compliance with IRAS (Inland Revenue Authority of Singapore) and ACRA (Accounting and Corporate Regulatory Authority)

Singapore enforces rigorous adherence to laws, where errors can lead to stiff penalties or company striking-off. A competent accountant safeguards your business by managing complex deadlines and forms, allowing you to focus on core operations without the anxiety of non-compliance.

Managing Tax Obligations (GST, ECI, and Form C-S)

Navigating Singapore’s tax system requires precision regarding strict IRAS timelines and specific criteria for GST, Estimated Chargeable Income (ECI), and Corporate Income Tax (Form C-S/C).

- Estimated Chargeable Income (ECI): Accountants must calculate and file the ECI within three months from the end of the financial year – A mandatory estimate of the company’s taxable income.

Pro Tip: Companies with a financial year that have annual revenue of less than SGD 5 million AND predicted zero chargeable income , are exempt from filing ECI. Your accountant will verify if you qualify for this administrative waiver.

- Depending on the company’s annual revenue, the accountant determines which form to file.

- Form C-S Lite: For the simplest companies with revenue ≤ SGD 5 million and straightforward tax matters.

- Form C-S: For qualifying small companies with revenue ≤ SGD 5 million.

- Form C: For larger companies or those claiming complex deductions.

GST Registration and Filing: If a company’s taxable turnover exceeds SGD 1 million, mandatory GST registration is triggered. Accountants manage the quarterly GST F5 filings, ensuring that output tax collected and input tax paid are reconciled accurately. Koobiz specialists ensure optimizing the tax position with sensible advisory based on the newest update.

Financial Reporting and ACRA Annual Returns

Every Singapore company must hold an Annual General Meeting (AGM) and file Annual Returns with ACRA, adhering to Singapore Financial Reporting Standards (SFRS). The accountant prepares the necessary unaudited or audited financial statements and converts them into the mandatory XBRL (eXtensible Business Reporting Language) format for the BizFile+ portal—a technical requirement that often trips up business owners attempting DIY filings.

Note: Solvent Exempt Private Companies (EPCs) with revenue ≤ SGD 5 million may be eligible to file a simplified XBRL set or be exempt from filing financial statements with ACRA entirely, though they must still prepare them.

How Do Accountants Drive Business Growth for SMEs?

Accountants drive business growth by transforming historical data into future-focused strategies, utilizing cash flow forecasting and advisory services to improve profitability.

Transitioning from “defense” (compliance) to “offense” (growth), the modern accountant becomes a strategic partner. While compliance keeps the business safe, strategic accounting propels it forward. By analyzing trends in the financial data, our team can identify which product lines are most profitable, where unnecessary costs are hemorrhaging cash, and when the business has enough liquidity to invest in expansion. This shift from reactive reporting to proactive advising is what separates a standard bookkeeper from a value-adding accountant.

Cash Flow Management and Budgeting

Effective cash flow management involves monitoring the timing of cash inflows and outflows to ensure the business always has the liquidity to operate.

Cash is the oxygen of any SME. An accountant creates detailed cash flow forecasts that predict potential shortages before they happen. Instead of spending blindly, an accountant helps the business owner set realistic spending limits for marketing, hiring, and operations. This discipline ensures that the company creates a sustainable “burn rate,” vital for startups and growing SMEs in Singapore’s high-cost environment.

Acting as a Strategic Advisor (Virtual CFO Services)

A Virtual CFO provides high-level financial strategy, performance analysis, and decision support without the cost of a full-time executive.

Many SMEs cannot afford a full-time Chief Financial Officer (CFO), yet they face complex financial decisions. This is where the “Virtual CFO” service comes into play. In this capacity, the accountant interprets financial ratios (like Return on Investment or Gross Margin) to guide data-driven decisions. Should the company lease or buy equipment? Is it financially viable to open a new branch? Is the business valuation ready for potential investors?.

Case Study: From Chaos to Clarity for a Singapore Retailer

Let’s look at a practical example involving a typical Singapore SME scenario.

The Challenge: “TechGadget SG,” a growing electronics retailer, faced a common dilemma: sales were hitting record highs, yet their bank balance remained dangerously low. The owner was overwhelmed by manual data entry, had missed a GST filing deadline resulting in penalties, and was unsure which product lines were actually profitable.

The Accountant’s Intervention:

- Immediate Compliance Fix: Koobiz experts stepped in to perform a “financial health check.” We immediately rectified the missed GST returns and successfully negotiated a waiver for the penalty with IRAS by demonstrating the company’s otherwise clean track record.

- Digital Integration: We migrated their messy spreadsheets to a cloud accounting system , integrating it directly with their Shopify store and POS system. This eliminated over 80% of manual data entry per week using OCR tools.

- Strategic Pivot: Through detailed financial analysis, we discovered that while high-end laptops generated high revenue, the profit margins were razor-thin due to shipping and warranty costs. Conversely, accessories and cables had 60% margins but were being under-marketed.

The Result: Guided by these insights, the business shifted its marketing budget to focus on high-margin accessories. Within six months, net profit increased by 20%, and cash flow stabilized, giving the owner the confidence and capital to open a second outlet. This case study demonstrates that an accountant provides the roadmap for survival and expansion, not just tax filing.

Outsourced Accounting Services in Singapore: In-House vs. Outsourced

Outsourcing accounting services is often the superior choice for SMEs, offering cost savings, access to a wider range of expertise, and greater scalability compared to hiring in-house.

Deciding between an in-house team and an outsourced provider is a pivotal choice for Singapore business owners. The table below highlights the key differences:

| Aspect | In-House Accountant | Outsourced (e.g., Koobiz) |

|---|---|---|

| Cost | High fixed cost (SGD 4,000–6,000/mth + CPF/Benefits) | Variable, often starting from SGD 300/mth |

| Expertise | Limited to one person’s experience | Team with industry-wide knowledge & regulatory updates |

| Continuity | Risk of gaps due to leave or resignation | Guaranteed coverage via Service Level Agreements (SLAs) |

| Scalability | Difficult to scale up/down quickly | Flexible scaling based on transaction volume |

| Software | Company bears full cost of software | Access to enterprise-grade tools often included |

We have established the fundamental roles of an accountant: keeping the business legal through compliance and making it profitable through strategy.. As we look toward the future of accounting for Singapore SMEs, we must cross the boundary into the realm of technology and specialized micro-niche functions.

How Modern Technology is Changing What Accountants Do

There are three main technology trends reshaping accounting: Cloud Computing, Automation, and Artificial Intelligence, all of which enhance speed and accuracy.

Technology has revolutionized the “how” of accounting, allowing professionals to deliver value faster. Implemented systems that talk to each other—connecting the Point of Sale (POS) system directly to the accounting software, and linking bank feeds for automatic reconciliation. This allows accountants from Koobiz provide real-time dashboards rather than month-old reports.

Cloud Accounting Software: Xero, QuickBooks, and Myr

Cloud accounting platforms like Xero and QuickBooks allow for real-time collaboration, accessible data from anywhere, and seamless integration with other business apps.

- Accessibility: Business owners can view their P&L on their phone while traveling.

- Integration: These platforms integrate with payroll software (like Talenox or HReasily) and e-commerce platforms (Shopify), creating a unified data environment.

- Security: Cloud providers offer bank-level security. Our team specializes in migrating SMEs to these platforms to ensure data is secure and accessible.

Automating Routine Tasks and AI Analytics

Automation tools use Optical Character Recognition (OCR) and AI to process invoices and expenses, while predictive analytics forecast future trends.

Modern accountants utilize tools (like Dext or Hubdoc) that allow clients to simply snap a photo of a receipt. The software automatically extracts the data (date, amount, vendor, GST) and pushes it to the accounting system. Beyond basic automation, AI in accounting is now enabling predictive analytics. By analyzing historical data, AI tools can help accountants forecast cash flow trends with greater accuracy, predicting potential shortfalls months in advance.

Specialized Accounting Functions You Might Need

Beyond general practice, there are specialized accounting branches like Forensic Accounting and ESG Reporting that address specific risks and emerging global standards.

Forensic Accounting and Fraud Prevention

Forensic accounting involves the investigation of financial records to detect fraud, embezzlement, or financial discrepancies, often for legal proceedings.

While we hope to never need them, forensic accountants are crucial when internal controls fail. If an SME suspects employee theft or needs to settle a partnership dispute, a forensic accountant dives deep into the digital trail. They reconstruct financial events to find missing funds. This is a specialized service that adds a layer of security to the business assets.

Sustainability Reporting and Green Finance

Sustainability reporting is the practice of measuring and disclosing a company’s Environmental, Social, and Governance (ESG) performance to attract green investment and meet evolving regulatory expectations.

Singapore is positioning itself as a hub for green finance. While currently mandatory mostly for listed companies, ESG reporting is trickling down to the SME sector. Banks are increasingly offering “Green Loans” with better interest rates to companies that can prove their sustainability. Accountants are now tasked with measuring non-financial metrics—such as carbon footprint or waste management costs—and integrating them into the company’s reporting structure. This emerging role positions the accountant as a guardian of the company’s long-term sustainability and social license to operate.

Why Choose Koobiz?

At Koobiz, we don’t just file your taxes; we fuel your growth.

- Comprehensive Support: From incorporation to Virtual CFO services, we handle the entire financial lifecycle.

- Compliance Guarantee: Our deep knowledge of IRAS and ACRA regulations ensures you never miss a deadline.

- Transparent Pricing: No hidden fees—just clear, value-driven packages tailored to your business size.

Conclusion

Koobiz accountants specialize in empowering businesses to thrive in the competitive Singaporean market. From Singapore company incorporation to ongoing tax, accounting, and audit services, our team acts as your dedicated financial partner, ensuring a seamless start for your venture.

Schedule a free consultation at Koobiz.com today and unlock your SME’s growth potential—don’t wait for the next filing deadline!