[SUMMARIES]

Definition: Sundry expenses are small, infrequent costs that don’t fit into a standard spending category (e.g., a one-time donation or a minor repair).

Recording: To avoid clutter, these small items are grouped together under a single line in your accounts, often called “Sundry” or “Miscellaneous.”

Differentiation: Unlike regular operating expenses (which are predictable, like utilities), sundry expenses are uncommon and irregular.

Compliance: These costs are usually tax-deductible, but because the category is broad, it’s important not to mix in personal spending. Keeping receipts is crucial.

Materiality: If a certain type of small expense happens often or involves a significant amount, it should get its own category in your books for better transparency.

[/SUMMARIES]

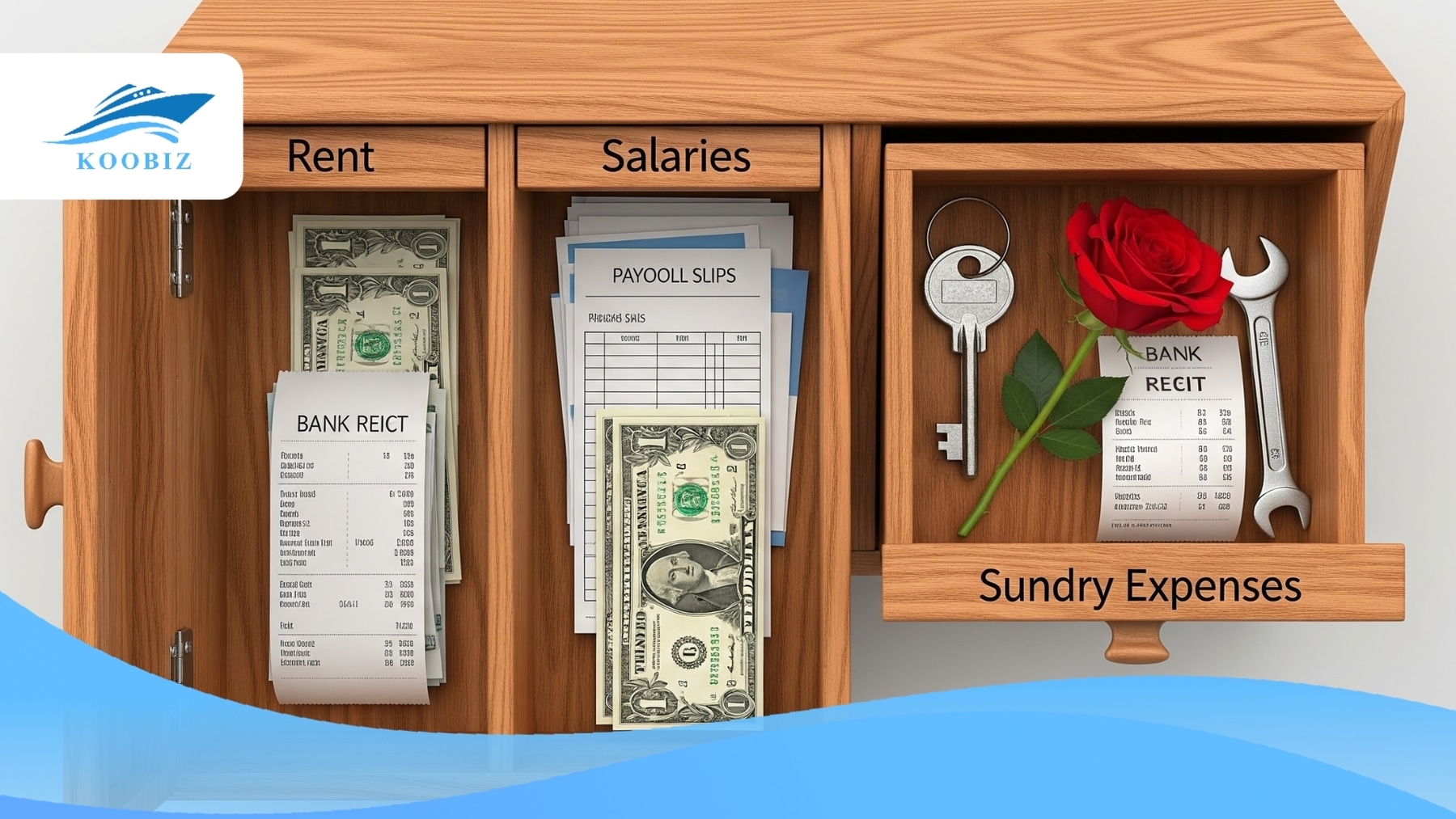

Running a small business means keeping track of all kinds of spending—from your biggest bills to those small, surprising costs that occasionally arise. While regular expenses like rent and supplies are straightforward, what about the one-off purchase of a get-well gift for a team member or a single, unexpected bank fee? These are called sundry expenses.

Handling these minor costs correctly is key to keeping your financial records clear and ready for tax season. At Koobiz, we know that for Singaporean small business owners, simple bookkeeping is the foundation of good financial management and peace of mind.

This guide will explain sundry expenses in plain English. We’ll cover what they are, provide everyday examples, show how they differ from your regular bills, and walk you through the simple steps to record them properly.

What Are Sundry Expenses in Small Business Accounting?

Sundry expenses are a category of miscellaneous costs that originate from irregular operational activities and are characterized by their small value and infrequent occurrence.

Think of your business expenses like items in a toolbox. Major costs like rent or salaries are your core tools, each with its own dedicated spot. Sundry expenses are the occasional odd items—like a specific screwdriver used once a year—that don’t need their own permanent space.

In accounting, the “Sundry” account acts as this practical, organized “catch-all” drawer. It’s the designated place for those legitimate, minor business costs that don’t belong to any other regular category.

Here’s why this approach is so useful, especially for keeping clear financial records: if you created a separate account for every tiny, one-off expense—such as “Client Flowers” or “Emergency Office Key”—your financial reports would quickly become overcrowded and hard to understand.

Grouping these occasional items under a single “Sundry Expenses” label keeps your bookkeeping clean and efficient. It’s important to remember, however, that this drawer is for business-use items only. It should not become a place for unclear or personal transactions, as maintaining accurate records is key for compliance and clarity.

10 Common Examples of Sundry Expenses for SMEs

There are typically three main groups of sundry expenses—Administrative, Financial, and Social—classified based on the nature of the incidental cost.

Correctly identifying these minor costs saves your bookkeeper valuable time that would otherwise be spent tracking down the details of a small, one-off receipt.

Below are 10 common examples that Koobiz frequently encounters when managing accounts for small businesses:

- One-off Bank Service Charges: A one-time charge, like a fee for ordering a new checkbook or for an unexpected international transfer, separate from your regular monthly account fees.

- Small Charitable Donations: A modest, one-off donation to a local fundraiser or charity that isn’t part of a formal company program.

- Office Decor or Minor Repairs: Purchasing a single lightbulb, a holiday decoration for reception, or a small amount of paint for a quick touch-up.

- Flowers or Gifts for Employees: Occasional purchases for special moments, such as get-well flowers or a small farewell present for a departing colleague.

- Courier or Postage Fees: A rare need to send a physical document via express mail when the business usually operates digitally..

- Incidental Travel Costs: A parking fee or toll charge incurred during an unusual business errand, separate from regular travel allowances.

- Subscriptions (One-time): Purchasing a single-use access pass to a premium article or a stock image, rather than a recurring software subscription.

- Refreshments for Ad-hoc Meetings: Buying coffee and donuts for an unplanned client visit, distinct from regular pantry supplies.

- Replacement of Low-Value Tools: Buying a new stapler or a pair of scissors to replace a broken one.

- Training Materials (Minor): Purchasing a specific book or guide for a one-off project reference.

Koobiz Tip: While these examples are common, consistency is key. If “Postage Fees” become a weekly occurrence, they cease to be sundry and require their own category.

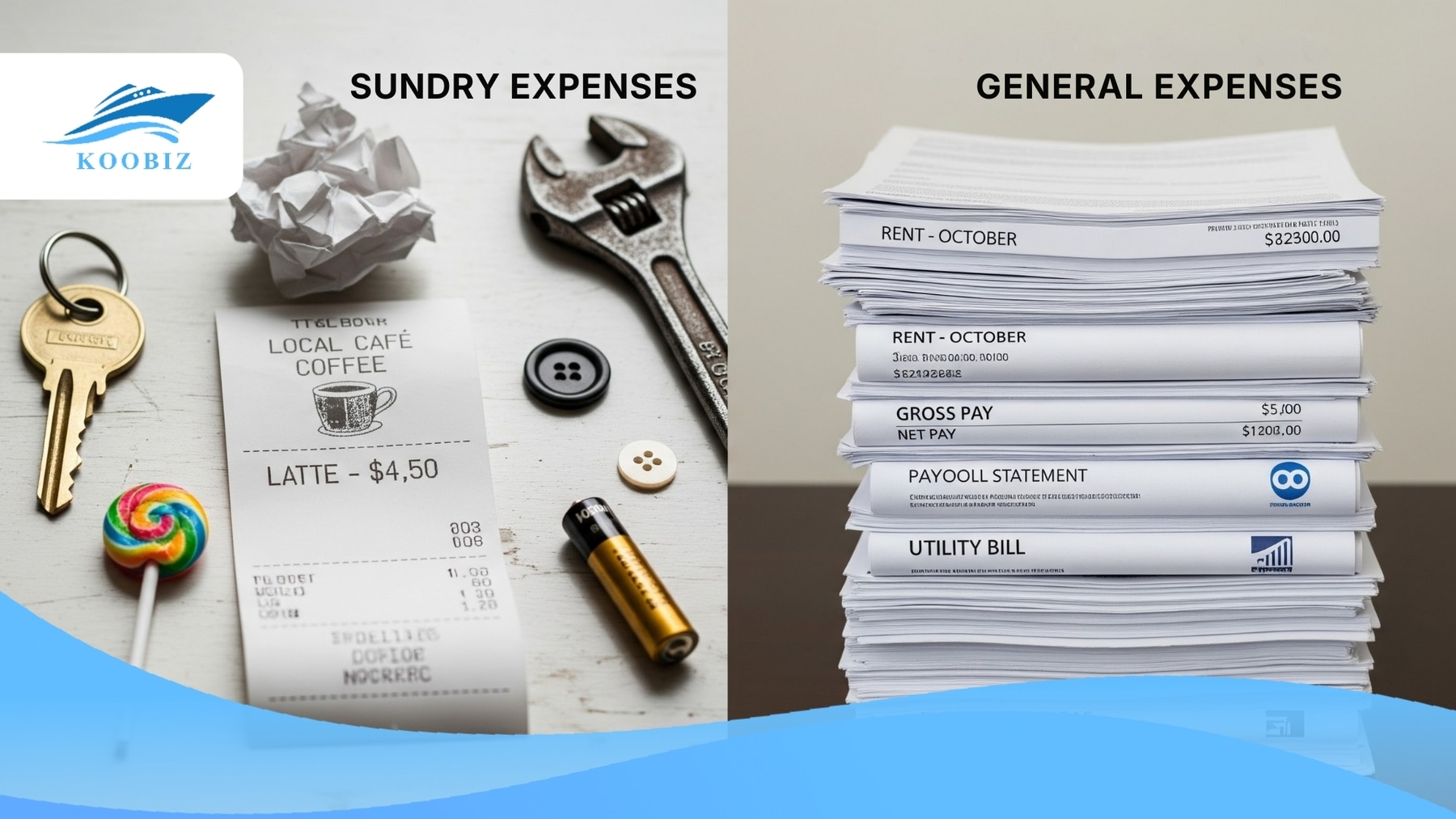

Sundry Expenses vs. General Expenses: What is the Difference?

Sundry expenses excel at handling the unpredictable and rare, whereas General Expenses are optimized for the regular, recurring, and significant operational costs of a business.

Understanding the difference between these two types of costs is essential for creating accurate budgets and analyzing your finances.

Even though both show up as costs on your profit and loss statement, they tell very different stories:

General Expenses (often listed as “General & Administrative”) are your core operating costs. Think of them as the predictable expenses of running your business day-to-day—like rent, electricity, insurance, and regular salaries. Because they are steady, you can reliably forecast and budget for them each year.

Sundry Expenses, on the other hand, are the small, unpredictable surprises. By their nature, they are almost impossible to budget for precisely. For instance, you can plan for your monthly internet bill, but you can’t plan for the one-time cost of replacing office keys after a lock change.

In short, general expenses are your planned “cost of doing business,” while sundry expenses are the unplanned, minor costs that pop up along the way.

The table below highlights the key differences between the two categories:

| Feature | Sundry Expenses | General Expenses |

|---|---|---|

| Frequency | Occur sporadically or rarely | Occur regularly (monthly/quarterly) |

| Value | Typically immaterial (low value) | Often carry material (significant) value |

| Predictability | Entirely random | Fixed or variable within a known range |

| Examples | One-off gifts, bank fees, minor repairs | Rent, salaries, utilities, insurance |

According to standard accounting practices, keeping these separate prevents the distortion of financial ratios. If you lump huge general expenses into “Sundry,” you hide critical cost drivers from management view.

How to Record Sundry Expenses in the General Ledger

Recording sundry expenses involves a standard accounting method that requires identifying the transaction source, verifying the amount, and posting a journal entry that debits the expense and credits the payment account.

This practice guarantees that every transaction, no matter how minor, is properly tracked and keeps your financial records complete and reliable.

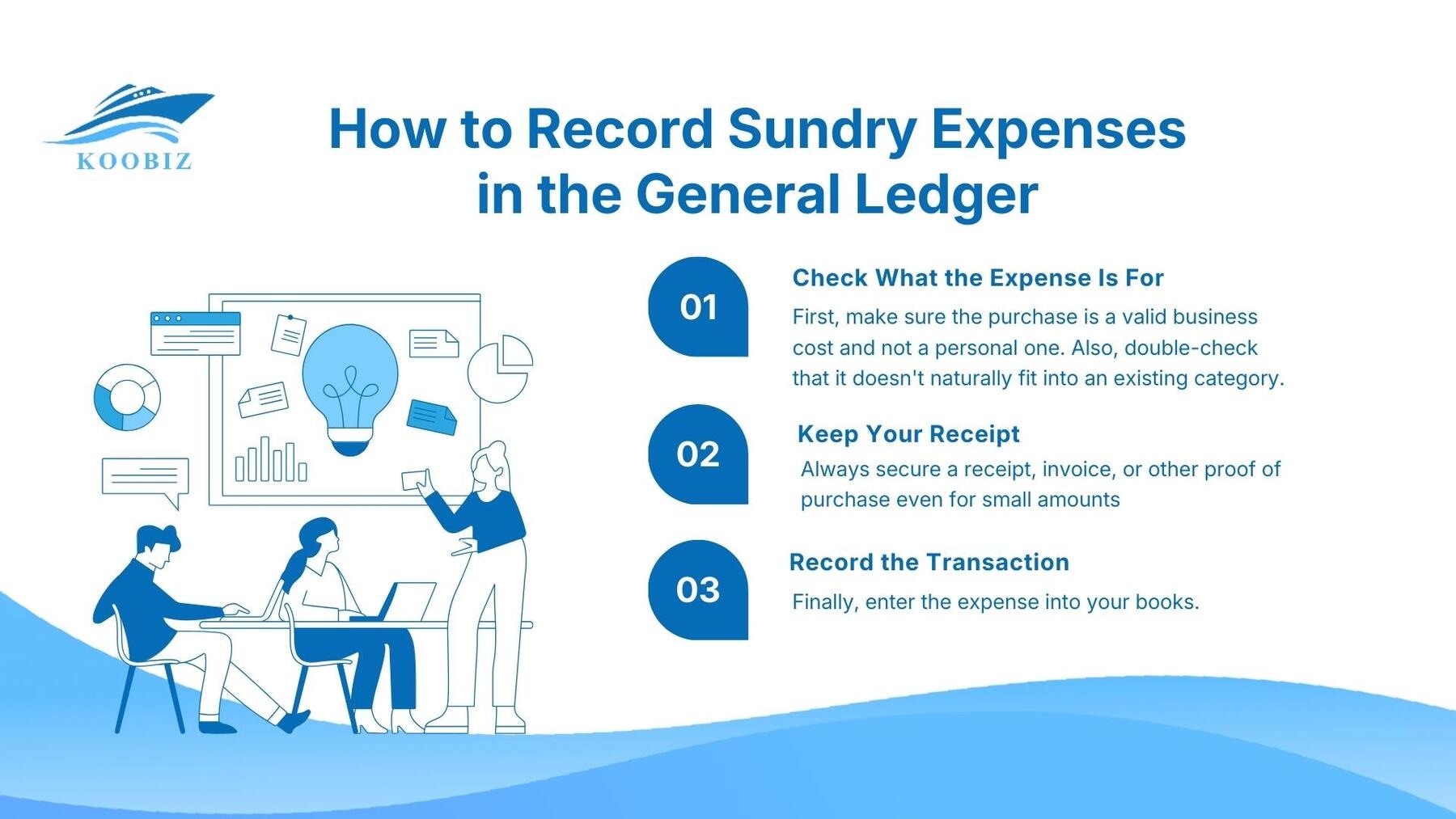

To help you handle these expenses consistently, we recommend following three simple steps:

Step 1: Check What the Expense Is For

First, make sure the purchase is a valid business cost and not a personal one. Also, double-check that it doesn’t naturally fit into an existing category. For example, a shipping fee should go to a ‘Shipping’ account if you have one, not to sundry.

Step 2: Keep Your Receipt

Always secure a receipt, invoice, or other proof of purchase—even for small amounts. Having this digital or physical paper trail is crucial for your records and in case of any future questions or reviews.

Step 3: Record the Transaction

Finally, enter the expense into your books. You will record it by adding the amount to your “Sundry Expenses” account and showing the corresponding decrease in where the money came from, such as your “Bank” or “Cash” account.

Creating a Sundry Expense Journal Entry

Recording a miscellaneous expense in your books is straightforward. The basic idea is that you add the cost to your “Sundry Expenses” account and show the corresponding reduction in your cash or bank balance.

For instance, suppose your business spends $50 from petty cash for a one-time cleaning service to address a spill. The entry you make would be:

- Debit: Sundry Expenses — $50

- Credit: Cash / Petty Cash — $50

- Description: One-off cleaning fee for spill.

This simple entry clearly explains where the money went. At Koobiz, we strongly advise always adding a short, clear note for every entry like this. This creates a “digital paper trail” that is incredibly helpful when preparing for tax filing or during any financial review.

When to Create a New Ledger Account Instead of Using Sundry

There is a tipping point where a cost transitions from being “sundry” to requiring its own dedicated account. This transition happens when the expense becomes recurring, predictable, or exceeds a specific materiality threshold set by the company.

A good rule of thumb is to create a new account if you’re recording the same type of expense in the sundry category more than a few times a month, or if the total annual cost for that item becomes substantial (for example, exceeding $500).

Why does this matter? If you start using a courier service every week but keep recording it under “sundry,” you’ll lose sight of your true shipping costs. By creating a dedicated “Courier & Postage” account, you can clearly see that expense, which may help you make smarter decisions—like negotiating a better contract with your delivery company.

Case Study: Real-World Scenarios at “Lion City Trading”

To see these rules in action, let’s follow a typical month at “Lion City Trading Pte Ltd,” a fictional local business.

Scenario A: The Farewell Gift (Sundry)

The Situation: A long-time employee is leaving, and the manager buys a farewell gift hamper for $80 using petty cash.

The Decision: The accountant records this as a Sundry Expense.

The Reasoning: This is a one-off event. It is not part of the regular payroll or employee benefits scheme, and the amount is immaterial relative to the company’s revenue.

Scenario B: The New Zoom Subscription (Not Sundry)

The Situation: The sales team signs up for a Zoom Pro account at $20/month to host client calls.

The Decision: The accountant creates a new sub-account under “Software Subscriptions” or “Telecommunications.”

The Reasoning: Although $20 is a small amount, it is a recurring monthly cost. If placed in Sundry, it would appear 12 times a year, cluttering the account. Separating it helps track software costs accurately.

Scenario C: The Parking Fine (Not Sundry – Non-Deductible)

The Situation: A delivery driver receives a $50 parking ticket while making a delivery.

The Decision: This is recorded under “Fines & Penalties” (a non-deductible expense account), not Sundry.

The Reasoning: While it is a rare and small expense, classifying it as “Sundry” is dangerous. Fines are strictly non-tax-deductible in Singapore. Burying it in Sundry increases the risk of accidentally claiming it as a deduction during tax filing, which could lead to penalties from IRAS.

Managing Tax and Compliance for Sundry Expenses

Is handling sundry expenses risky? Yes, because tax authorities often view the “Miscellaneous” account as a hiding place for non-deductible personal expenses, requiring businesses to maintain impeccable documentation. They want to ensure that businesses aren’t hiding personal or non-deductible expenses in this “miscellaneous” category. That’s why keeping clear records for every item is essential for compliance.

At Koobiz, our tax specialists often review clients’ sundry accounts first because that is exactly where auditors look. A bloated sundry account raises immediate red flags.

Are Sundry Expenses Tax Deductible?

Yes, sundry expenses are generally tax-deductible provided they are “wholly and exclusively” incurred in the production of income and are not capital in nature. However, the “sundry” label itself doesn’t make something deductible. Each cost must be reviewed on its own.

Deductible Example: A one-time bank fee for a business transaction.

Non-Deductible Example: A traffic fine or a personal meal.

Partially Deductible: Certain gifts or entertainment expenses may have caps or specific criteria under Singapore tax law.

It is crucial to scrutinize every item. You cannot claim tax relief on a “Sundry” total of $10,000 if $2,000 of that is for private family dinners.

The Concept of Materiality: When is an Expense “Too Big” for Sundry?

The concept of materiality dictates that an item is material if its omission or misstatement could influence the economic decisions of users taken on the basis of the financial statements. In simpler terms, you should never hide a large asset purchase in the sundry expenses account.

A common mistake small businesses make is expensing a piece of equipment, like a $2,000 laptop, under “Sundry Expenses” because it was a one-time purchase. This is incorrect. A laptop is a fixed asset (Capital Expenditure or CapEx) and should be capitalized and depreciated over time. Recording it as a sundry expense (Operating Expense or OpEx) distorts the profit immediately and violates accounting principles.

Audit Red Flags: Why You Should Limit the Sundry Account

Auditors view large balances in the sundry expense account as a high-risk area because it often indicates lazy bookkeeping or an attempt to conceal sensitive payments.

If your “Sundry Expenses” line item constitutes a significant percentage (e.g., more than 5-10%) of your total expenses, it suggests poor classification. Auditors will almost certainly ask for a breakdown of this account. If you cannot provide receipts for these aggregated costs, or if the breakdown reveals questionable items, you could face penalties or disallowed deductions.

To maintain “audit-proof” books:

- Review the Sundry account monthly.

- Reclassify recurring items to specific accounts.

- Ensure every transaction, no matter how small, has a corresponding receipt or invoice attached in your accounting software.

According to financial best practices observed by audit firms, keeping the sundry account balance below 1-2% of total revenue is a good benchmark for a healthy set of accounts.

Conclusion

Handling sundry expenses properly is a key part of maintaining clear, compliant, and insightful financial records for your business. By categorizing these small costs correctly and keeping meticulous records, you not only simplify tax filing and reduce audit risk but also gain a more accurate picture of where your money is going.

If navigating Singapore’s accounting standards feels overwhelming, or if you need help setting up a clear and compliant bookkeeping system, Koobiz is here to support you.

About Koobiz

Koobiz (koobiz.com) is your trusted partner for business growth in Singapore. We provide a full suite of corporate services, including Company Incorporation, Corporate Secretary support, Tax Filing, Accounting & Auditing, and assistance for international clients opening business bank accounts in Singapore. Let our experts manage the complexities of compliance, so you can focus on running and growing your business.