[SUMMARIES]

Mandatory Coverage: WICA is compulsory for all manual employees, non-manual employees earning ≤S$2,600/month, and (New for 2025) Platform Workers.

No-Fault System: Employees can claim compensation without proving employer negligence, ensuring faster payouts compared to common law suits.

Increased Limits (Nov 2025): New higher compensation caps apply for Death (S$269k), Permanent Incapacity (S$346k), and Medical Expenses (S$53k).

Strict Compliance: Failure to maintain adequate WICA insurance is a serious offense punishable by fines up to S$10,000 or imprisonment.

Koobiz Support: Koobiz assists businesses not only with incorporation but also with navigating Singapore’s regulatory landscape to ensure full MOM compliance.

[/SUMMARIES]

Setting up a business in Singapore goes beyond ACRA registration—it also requires full compliance with Ministry of Manpower (MOM) regulations to protect both your employees and your company. One of the most critical statutory obligations is Work Injury Compensation Act (WICA) Insurance.

WICA is not an optional policy. It is a mandatory insurance framework that enables fast and simplified compensation for work-related injuries or occupational diseases. For employers, it reduces exposure to costly legal disputes; for employees, it ensures financial protection during recovery. Whether you are a local startup or a foreign investor, WICA compliance is essential.

In this 2025 guide, Koobiz explains WICA in detail, from compulsory coverage and limits to the claims process, helping your business stay compliant, protected, and resilient.

What is WICA Insurance?

WICA Insurance is a mandatory policy under the Work Injury Compensation Act that provides cost-efficient, no-fault compensation to employees injured or stricken with diseases during their employment.

To appreciate the value of WICA, it is essential to understand how it differs from conventional liability insurance. Its defining feature is the “no-fault” principle. Unlike traditional claims, where an injured employee must prove employer negligence through a lengthy and costly legal process, WICA only requires proof that the injury or disease occurred in the course of employment-fault is irrelevant.

This approach benefits both sides: employees gain faster access to medical expenses and wage compensation, while employers avoid the uncertainty and cost of civil litigation, as long as claims are resolved under the Act.

Who Must Be Covered? (Mandatory Requirements)

WICA insurance is mandatory for manual employees, lower-income non-manual employees, and platform workers (effective 2025).

Understanding WICA eligibility can be confusing, so we’ve summarised the mandatory rules to help you avoid penalties.

Manual Employees

WICA is mandatory for all manual workers regardless of salary. This covers roles involving physical labour, machinery or equipment (e.g., construction, factory operators, drivers, cleaners, technicians).

Non-Manual Employees

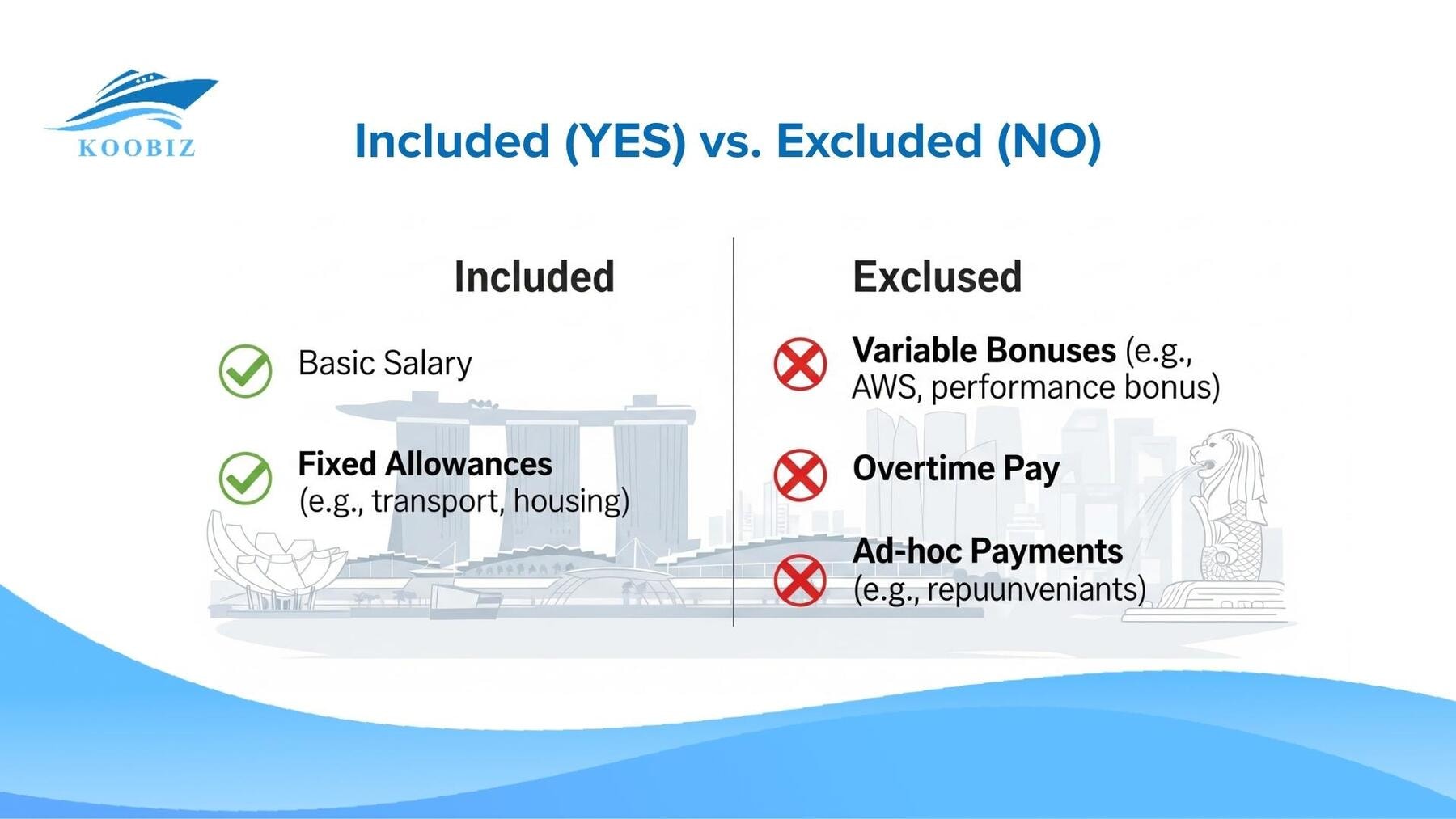

For non-manual employees, insurance is mandatory only if monthly salary ≤ S$2,600 (exclude OT, bonus, AWS). Office staff above this threshold aren’t legally required to be insured, though employers remain liable for valid claims. Many employers therefore insure everyone to transfer risk.

Platform Workers (New 2025 Requirement)

Mandatory for Platform Operators.

Under the Platform Workers Act, Platform Operators must provide WICA for workers (e.g., delivery riders, private-hire drivers) who are subject to significant operator control.

Local vs. Foreign Staff

The Act applies equally to citizens, PRs and foreign work pass holders (Work Permit, S Pass, Employment Pass). Employers cannot exclude foreign workers.

Note on Exemptions:

Generally excludes independent contractors/freelancers (contract for service), domestic helpers (separate scheme), and uniformed government personnel.

Coverage Benefits & Limits (Updated Nov 2025)

The WICA framework provides three main types of compensation benefits: medical expenses, lost wages during medical leave, and lump-sum payouts for permanent disability or death.

Understanding these limits is essential for financial planning. Below is a detailed comparison of the coverage benefits, featuring the increased limits effective from November 1, 2025.

| Benefit Type | Max Limit / Calculation | Coverage Details |

|---|---|---|

| Medical Expenses | Up to S$53,000 or 1 year from the accident date (whichever is reached first). | Covers hospital bills, consultation fees, surgical costs, and rehabilitation fees. No copayment is required from the employee. (Increased from S$45,000). |

| Medical Leave Wages (MC) | Full pay for up to 14 days (or 60 days if hospitalized). 2/3 pay for the subsequent period, up to one year. | Compensates the employee for lost income while they are recovering and unable to work. |

| Death Benefit | Min: S$91,000** <br> Max: **S$269,000 | A lump sum paid to the dependents of an employee who dies due to a work-related accident. Calculated based on age and average monthly earnings. (Increased from S$225,000). |

| Permanent Incapacity (PI) | Min: S$116,000

Max: **S$346,000** (plus 25% for total permanent incapacity). |

A lump sum for employees who suffer permanent disability (e.g., loss of a limb or sight). The amount depends on the % of incapacity assessed by a doctor. (Increased from S$289,000). |

Real-World Case Studies (Examples)

To illustrate how these regulations apply in daily business operations, let’s examine two common scenarios faced by Singapore employers.

These examples highlight the practical application of the rules discussed above.

Case Study 1: The Construction Worker (Manual)

Scenario: Ahmed is a construction site supervisor earning S$3,500 per month.

Analysis: Even though his salary is above the S$2,600 threshold, his role involves manual labor (supervising on-site, handling tools).

Verdict: Mandatory Coverage. His employer must buy WICA insurance. If Ahmed is injured by falling debris, the insurance will cover his medical bills and pay for his medical leave wages without him needing to sue the company.

Case Study 2: The Admin Executive (Non-Manual)

Scenario: Sarah is an HR Assistant earning S$2,500 per month.

Analysis: Her role is non-manual (desk-bound). Her salary is S$2,500, which is below the S$2,600 threshold.

Verdict: Mandatory Coverage. Her employer is legally required to insure her. If she develops Carpal Tunnel Syndrome (a work-related disease) due to her duties, she is eligible to claim under WICA. However, if she gets a promotion and her salary rises to S$2,700, insurance becomes optional – though highly recommended to protect the company from liability.

WICA vs. Common Law: Which Route Should You Choose?

Employees generally have two routes to seek compensation: filing a claim under WICA or suing the employer under Common Law, but they cannot pursue both simultaneously.

This decision is critical and often irreversible once a judgment is made.

| Feature | Work Injury Compensation Act (WICA) | Common Law Suit |

|---|---|---|

| Basis of Claim | No-Fault (Employee only needs to prove injury happened at work) | Fault-Based (Must prove employer was negligent) |

| Speed of Process | Faster (Streamlined process managed by MOM) | Slower (Court proceedings can take years) |

| Compensation Limits | Capped at statutory limits (e.g., max S$346k for incapacity) | Unlimited (Based on proven damages, including pain & suffering) |

| Legal Costs | Minimal / None (No lawyer required) | High (Lawyer fees required) |

| Certainty of Outcome | High (Formula-based calculation) | Uncertain (Depends on judge’s ruling and evidence) |

| Best For | Accidents where fault is unclear or speed is prioritized. | Severe injuries due to gross negligence with high damages. |

Key Rule: An employee must elect a single route. Accepting compensation under WICA typically waives the right to pursue a Common Law claim, while commencing a Common Law action will generally suspend or terminate the WICA claim.

How to File a Work Injury Compensation Claim in Singapore

Filing a claim involves a structured 5-step process starting from immediate notification to the final disbursement of funds.

For employers and HR managers, knowing this workflow is vital to avoid procedural delays.

Step 1: Notify Employer

The injured employee must inform the employer of the accident as soon as possible. Prompt notification ensures that the incident is documented and the claims process can begin immediately without disputes over the timeline.

Step 2: Submit Report (iReport)

The employer is legally required to submit an incident report to the MOM via the iReport system. This must be done within 10 days of being notified of the accident or diagnosis. This applies if the accident results in death, more than 3 days of medical leave, or at least 24 hours of hospitalization.

Step 3: Medical Assessment

The employee undergoes a medical examination by a registered doctor. The doctor will assess the extent of the injury and determine the percentage of permanent incapacity (if any) once the condition stabilizes.

Step 4: Notice of Assessment (NOA)

Once the medical report is ready, MOM (or the designated insurer) will calculate the compensation based on statutory limits and issue a Notice of Assessment (NOA). This document officially states the compensation amount payable to the employee.

Step 5: Payment

If no objection is raised by either party within 14 days of the NOA, the employer (or their insurer) must make the payment within 21 days. Late payments can incur interest charges, so timely disbursement is critical.

Frequently Asked Questions (FAQs)

Can I claim both WICA and private personal accident insurance?

Yes. WICA does not prevent an employee from claiming against their own personal accident insurance policies. These are separate contracts.

Does WICA cover me if I’m working from home?

Yes. With the rise of hybrid work, WICA covers injuries sustained while working from home (WFH), provided the injury arose out of and in the course of employment (e.g., tripping over a laptop cable while on a video call). It does not cover domestic accidents unrelated to work duties.

Can I claim if the accident was my own fault?

Yes. Because WICA is a no-fault system, an employee is eligible for compensation even if their own carelessness contributed to the accident, provided it wasn’t a deliberate act of self-harm.

Is WICA insurance mandatory for foreign workers on S Pass?

Yes, if they meet the criteria (Manual worker OR Non-manual earning ≤S$2,600). The pass type (S Pass, E Pass, Work Permit) does not exempt the employer from WICA obligations if the nature of work and salary fall within the mandatory scope.

Ensure Full Compliance with Koobiz

Beyond obtaining the right insurance, total business compliance requires expert structuring, accurate reporting, and ongoing adherence to Singapore’s regulatory framework.

Operating a business in Singapore means managing compliance across ACRA, IRAS, and MOM – where even minor errors, such as employee misclassification or late WICA reporting, can result in significant penalties.

At Koobiz, we streamline corporate compliance for startups and established businesses alike. From company incorporation and corporate secretarial support to banking and tax advisory, we work as your long-term strategic partner.

Don’t leave compliance to chance. Build your business on a strong, compliant foundation.

Contact Koobiz today for a consultation on entity structuring and compliance checks.

- Website: koobiz.com

- Services: Incorporation, Corporate Secretary, Accounting, Tax, and Banking Advisory.