[SUMMARIES]

A Singapore offshore company is a standard tax-resident Private Limited entity that conducts business internationally, leveraging the territorial tax system and Foreign-Sourced Income Exemption (FSIE) scheme to potentially achieve 0% tax on remitted foreign income.

Incorporation requires strict adherence to regulatory standards, including the mandatory appointment of a local resident director and navigating increasingly difficult corporate banking approvals, with high rejection rates for non-resident structures in 2025.

Investors must satisfy new economic substance rules under Section 10L to claim tax benefits on foreign asset disposal gains, balancing higher maintenance costs against the credibility of operating from a well-regulated, Tier-1 financial hub.

[/SUMMARIES]

A Singapore offshore company offers the perfect blend of a prestigious global business identity and exceptional tax efficiency. By forming a Singapore Private Limited company that operates internationally, you can benefit from the city-state’s territorial tax system for optimal fiscal advantages.

This guide walks you through the entire setup process from incorporation and requirements to banking and ongoing compliance. A Key Note on “Offshore” in Singapore: Singapore stands apart from traditional tax havens. It is a transparent, well-regulated financial hub. This means requirements like a local resident director and robust AML frameworks are in place, ensuring credibility. As an investor, it’s about balancing these reputable standards with operational planning to build a solid, trusted international business.

Your success in Singapore hinges on navigating key compliance areas. This includes understanding the Foreign-Sourced Income Exemption (FSIE) and the newer Section 10L economic substance rules. Furthermore, opening a corporate bank account has become more challenging, with notably higher rejection rates for non-residents in 2025.

This roadmap for 2025 explores the exact steps for incorporation, the pros and cons, and how Koobiz can help you establish your presence in Southeast Asia’s financial hub.

What is a Singapore Offshore Company?

Technically, a Singapore offshore company is a standard Singapore Private Limited Company (Pte Ltd) that conducts its revenue-generating activities entirely outside Singapore. Unlike jurisdictions with specific “International Business Company” (IBC) classifications, Singapore determines “offshore” status based on where business operations and management occur.

The key distinction is tax residency and treatment. A “Singapore Offshore Company” is a tax-resident entity that qualifies for tax exemptions on foreign-sourced income. This structure. offers the dual advantage of credibility from a reputable onshore jurisdiction and access to significant tax efficiencies.

Regulated by the Accounting and Corporate Regulatory Authority (ACRA), these companies must adhere to the same compliance standards as local businesses, including maintaining a local registered address and appointing a company secretary.

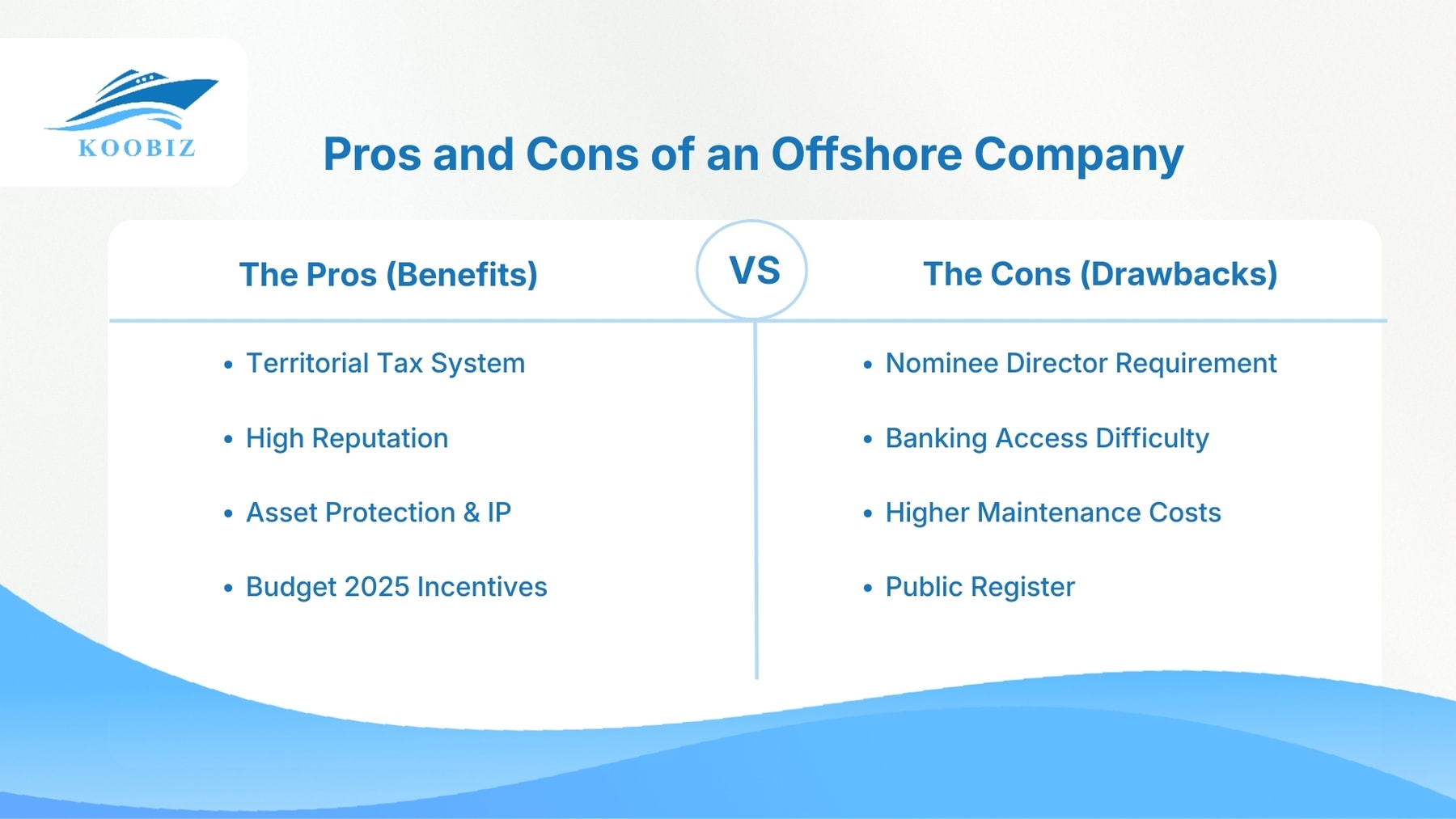

What are the Pros and Cons of a Singapore Offshore Company?

The Singapore offshore structure excels in reputation and tax efficiency but faces higher maintenance costs and stricter banking requirements than Caribbean jurisdictions.

The Pros (Benefits)

- Territorial Tax System: Potential for 0% tax on foreign-sourced income if not remitted to Singapore, or if it qualifies for the Foreign-Sourced Income Exemption (FSIE) scheme upon remittance.

- High Reputation: Singapore is a Tier-1 jurisdiction. Invoicing clients from a Singapore Pte Ltd signals trust and stability, unlike “blacklist” tax havens.

- Asset Protection & IP: Strong intellectual property laws and political stability make it ideal for holding assets.

- Budget 2025 Incentives: For Year of Assessment (YA) 2025, companies enjoy a 50% Corporate Income Tax Rebate (capped at S$40,000), reducing the effective tax burden even if some income becomes taxable.

The Cons (Drawbacks)

- Nominee Director Requirement: You strictly need a local resident director. This incurs an annual cost (typically S$6000+) if you lack a local partner.

- Banking Access Difficulty: While Singapore banks are superior in quality, opening accounts for offshore setups is increasingly difficult. Rejection rates for foreign-owned structures without physical presence can be high.

- Higher Maintenance Costs: Costs for a company secretary, registered address, and annual filings are higher than in jurisdictions like Belize.

- Public Register: Directors and shareholders are listed on the public ACRA register (BizFile+). Note: You can shield personal details using Nominee Shareholder/Director services.

Koobiz Note: Worried about the Nominee Director requirement? Koobiz offers trusted Nominee Director services to help you meet this obligation while protecting your control.

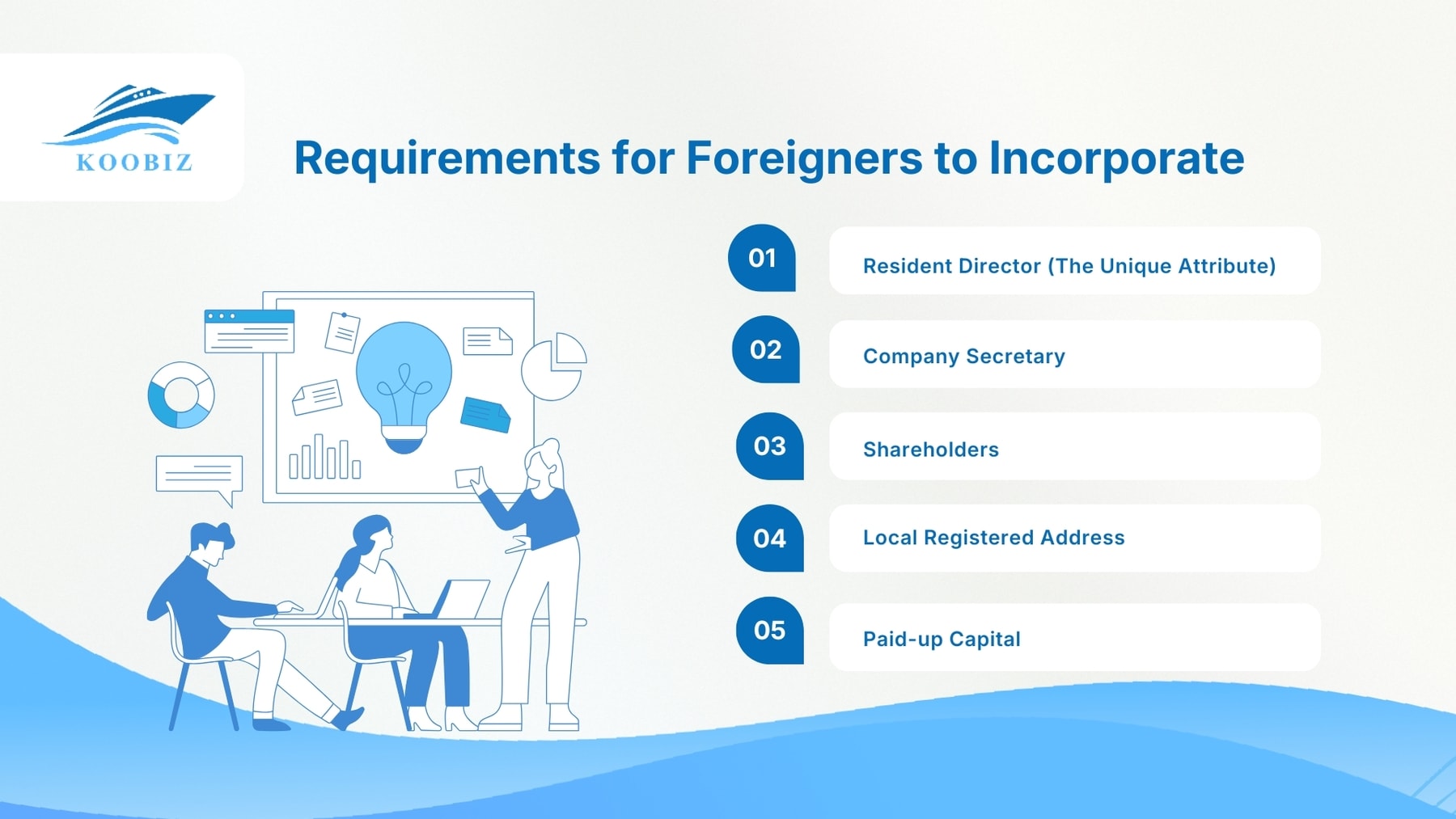

What are the Requirements for Foreigners to Incorporate?

Foreigners must meet five mandatory requirements to incorporate. Fulfilling these is the prerequisite for any ACRA application.

1. Resident Director (The Unique Attribute)

The biggest barrier for foreigners is the requirement for at least one director who is “ordinarily resident” in Singapore. This person must be a Singapore Citizen, a Permanent Resident, or an EntrePass holder.

- Role: They are responsible for ensuring the company complies with statutory requirements.

- Solution: Most foreign investors engage a Nominee Director service via a Corporate Service Provider (CSP) like Koobiz to satisfy this requirement legally.

2. Company Secretary

You must appoint a qualified Company Secretary.

- Requirement: This individual must be a natural person (not a corporation) and must be a resident of Singapore.

- Role: They handle official filings with ACRA and ensure ongoing governance compliance.

3. Shareholders

A Singapore Pte Ltd must have at least one shareholder.

- Ownership: Foreigners are allowed 100% foreign ownership.

- Flexibility: The shareholder can be an individual or a corporate entity (another company). There is no requirement for local shareholding.

4. Local Registered Address

Every company must have a physical local address in Singapore.

- Condition: It must be a physical office or residential address; P.O. Boxes are not accepted.

- Purpose: This is where official government mail (from ACRA and IRAS) is sent.

5. Paid-up Capital

You need to declare your initial share capital.

- Minimum: The minimum paid-up capital is only S$1.

- Flexibility: You can increase this amount later as your business grows.

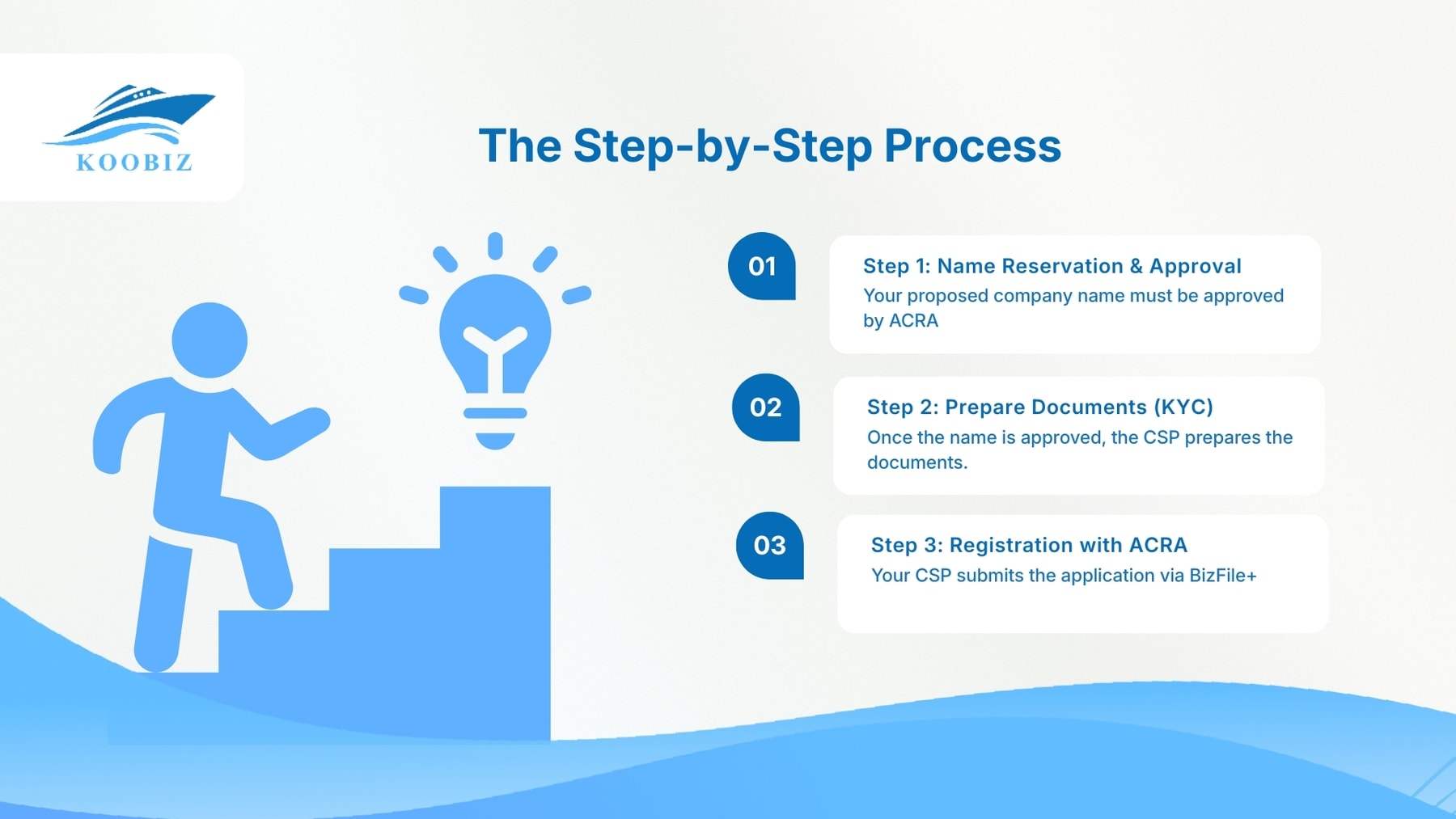

How to Register a Singapore Company: The Step-by-Step Process

Registration involves three steps: Name Reservation, Document Preparation, and ACRA Filing. Since foreigners cannot access ACRA’s BizFile+ system directly, a licensed Corporate Service Provider is mandatory.

Here is the workflow to get set up in as little as 24 hours.

Step 1: Name Reservation & Approval

Your proposed company name must be approved by ACRA.

- Must not be identical to an existing entity.

- Must not contain sensitive words (e.g., “Bank”, “Finance”) without extra approval.

Tip: Koobiz provides instant free name checks.

Step 2: Prepare Documents (KYC)

Once the name is approved, the CSP prepares the documents. You need to provide:

- Passport copies of all directors/shareholders.

- Proof of residential address (bank statement/utility bill).

- Brief description of business activities (SSIC Code).

- Note: Digital signatures are widely accepted.

Step 3: Registration with ACRA

Your CSP submits the application via BizFile+.

- Timeline: Incorporation usually takes 1-2 days for straightforward cases.

- Output: You receive an electronic Certificate of Incorporation and Business Profile (BizFile) via email.

Ready to start? Koobiz simplifies this process. We handle ACRA filing, provide the Nominee Director, and act as your Company Secretary.

Get your Singapore Company Incorporated Today

How Does the Tax System Work for Offshore Companies?

Singapore’s territorial tax system exempts foreign-sourced income from tax if specific conditions are met. However, the rules have tightened since 2024, particularly regarding capital gains.

1. Remitted Income (Dividends, Branch Profits, Services) – FSIE

For foreign-sourced dividends, branch profits, and service income remitted to Singapore, you can enjoy 0% tax under the Foreign-Sourced Income Exemption (FSIE) if you meet three conditions:

- “Subject to Tax” Condition: The income was subject to tax in the foreign jurisdiction (even if the effective tax was zero due to incentives).

- Headline Tax Rate Condition: The foreign jurisdiction has a headline corporate tax rate of at least 15%.

- Beneficial to Resident: The Comptroller is satisfied that the tax exemption would be beneficial to the person resident in Singapore.

2. Disposal Gains (Sale of Assets) – Section 10L

A crucial update for 2025: Gains from the sale of foreign assets (e.g., selling shares of a foreign subsidiary) remitted to Singapore are now taxable under Section 10L unless the company has “Adequate Economic Substance” in Singapore.

- What is Substance? Having distinct office space, qualified local employees, and incurring business expenditure in Singapore.

- Impact: Pure shell companies without substance may face tax on these gains.

Note: Large Multinational Enterprises (MNEs) may also be subject to Top-Up Taxes under Pillar 2 (Global Minimum Tax) rules if their effective rate falls below 15%.

Real-World Scenarios: Tax Efficiency in Action

Here are two common scenarios explaining when the “0% tax” claim applies.

Scenario A: The “Non-Remittance” Strategy (0% Tax)

Profile: TechGlobal Pte Ltd, a SaaS company with a UK founder in Bali.

- Operations: Software developed in Indonesia; sales to US/EU clients. No work performed in Singapore.

- Banking: Funds held in a corporate account outside Singapore (e.g., Hong Kong) or a non-SG fintech wallet.

- Tax Outcome: 0% Tax. Income is “foreign-sourced” and never remitted to a Singapore account.

- Koobiz Note: Ensure you don’t trigger tax residency in your country of residence (e.g., Indonesia).

Scenario B: The “FSIE” Strategy (Tax Treaty Benefit)

Profile: IndoTrade Pte Ltd, sourcing coffee from Vietnam for Germany.

- Operations: Registered branch in Vietnam pays local Corporate Income Tax (20%).

- Banking: Profits are remitted to a DBS Bank account in Singapore.

- Tax Outcome: 0% Tax (via FSIE).

- Condition Met: Income taxed in Vietnam (20%); Vietnam’s headline rate >15%.

- Result: No tax in Singapore on remitted dividends, avoiding double taxation.

Koobiz Tip: Unsure about your strategy? Our experts can review your FSIE eligibility.

What are the Challenges of Opening a Corporate Bank Account?

Caution: Opening a traditional bank account (DBS, OCBC, UOB) for an offshore company has become significantly harder in 2025. Rejection rates for foreign-owned structures without local physical presence are high.

- Physical Presence: Foreign directors are almost always required to visit Singapore for a face-to-face interview.

- Proof of Business: Banks require detailed “Source of Wealth,” supplier contracts, and a robust business plan.

- Fintech Alternatives: Many offshore companies now rely on Wise Business, Airwallex, or Aspire. While easier to open remotely, note that these often cannot offer credit facilities (loans) or cheque books like traditional banks.

What are the Ongoing Compliance and Maintenance Requirements?

You must hold an Annual General Meeting (AGM) and file Annual Returns to ACRA. Negligence leads to penalties and potential striking off.

Estimated Annual Maintenance Costs (2025 Estimates)

Budget for annual maintenance beyond the setup fee. Inflation and compliance costs have nudged these figures up:

- Nominee Director: ~S$6,000+ per year (often includes security deposit).

- Company Secretary & Address: ~S$2,500 per year.

- Tax & Annual Filing: ~S$600+ per year.

- Total Estimate: S$9,100 per year, depending on the CSP and complexity.

AGM and Annual Return Filing

- AGM: Held within 6 months of financial year-end.

- Annual Return: Filed with ACRA within 7 months of financial year-end.

- Solvency Declaration: Directors must declare the company is solvent.

How Does Singapore Compare to Other Offshore Jurisdictions?

Singapore offers superior reputation and banking quality, while jurisdictions like BVI or Seychelles offer lower costs but carry “blacklist” risks. The table below highlights the key differences:

| Comparison Factor | Singapore | BVI / Cayman Islands | Hong Kong |

|---|---|---|---|

| Reputation | Tier-1 (AAA Rated)

High trust with global clients. |

Tax Haven

Often flagged by EU/US authorities. |

Strong

Solid financial hub, but some political nuance. |

| Corporate Tax | 0% – 17%

0% possible via FSIE; requires tax planning. |

0%

No corporate tax by default. |

0% – 16.5%

Territorial system similar to Singapore. |

| Banking Access | World-Class

Strict KYC; often requires visit. |

Difficult

Limited local options; hard to bank globally. |

Difficult

Hard for startups to open accounts recently. |

| Compliance | High

Resident Director required. Audit for large firms. |

Medium

Economic Substance laws now enforced. |

High

Company Secretary & audit required. |

| Privacy | Public Register

Directors visible (Nominees used for privacy). |

Private

Directors not publicly visible. |

Public Register

Similar transparency to Singapore. |

Frequently Asked Questions

Can a foreigner own 100% of a Singapore company?

Yes. Foreigners can own 100% of the shares. No local partner is required for shareholding.

Do I need to be physically present to incorporate?

No. The entire process is online via a Corporate Service Provider like Koobiz using digital signatures. Physical presence is typically only needed for traditional bank account opening.

Is Singapore a tax haven?

No. Singapore is a value-adding business hub with competitive tax incentives, not a tax haven. It adheres to OECD standards, ensuring its high global reputation.

Conclusion

Setting up a Singapore offshore company offers a powerful vehicle for international business, combining tax efficiency with a world-class legal system. While requirements like Resident Directors and Economic Substance (Section 10L) are stricter than in Caribbean jurisdictions, the payoff in trust is worth it.

If you are ready to navigate the Singapore market, Koobiz is here to support you. From fast incorporation to Nominee Director services and tax filings, we ensure your offshore journey is compliant and hassle-free.

Contact Koobiz today for a free consultation on your Singapore setup