[SUMMARIES]

A Non-Executive Director (NED) in Singapore provides independent oversight and strategic guidance without participating in daily business operations. While they do not manage the company, NEDs share the same legal and fiduciary liabilities as executive directors under the Singapore Companies Act.

[/SUMMARIES]

Understanding the role of a Non-Executive Director is vital for robust corporate governance in Singapore. In this guide, Koobiz simplifies the complexities of board leadership, breaking down the essential duties, legal liabilities, and qualifications you need to know. We provide a clear, detailed roadmap to help you navigate the distinction between executive and non-executive functions with confidence.

What Is a Non-Executive Director?

A Non-Executive Director (NED) is a member of a company’s board of directors who is not part of the executive management team and does not engage in the day-to-day operations of the business. Their primary purpose is to provide independent oversight, objective strategic guidance, and constructive challenges to the executive directors. By operating outside of daily management, NEDs play a crucial role in corporate governance, helping to monitor performance, manage risk, and safeguard the interests of shareholders and stakeholders.

Key Responsibilities and Duties

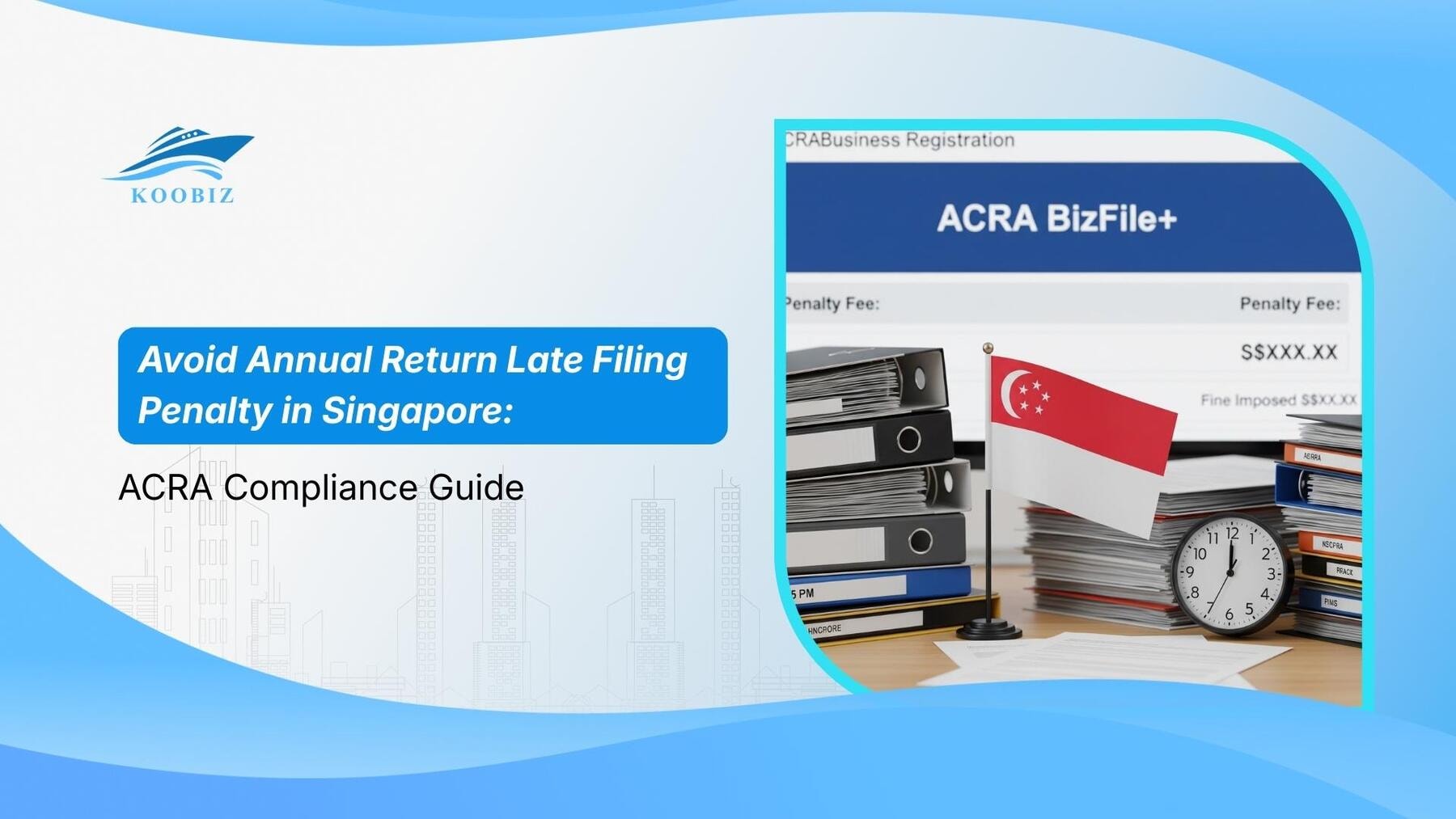

While their specific mandate may vary by organization, Non-Executive Directors generally balance strategic oversight with legal compliance to ensure sustainable long-term value.

Responsibilities

The broader strategic and oversight roles of a Non-Executive Director include:

- Strategy Development: Constructively challenging and contributing to the development of the company’s strategic direction.

- Performance Monitoring: Scrutinizing the performance of executive management in meeting agreed goals and objectives.

- Risk Management: Ensuring robust risk management frameworks and internal controls are in place.

- Succession Planning: Leading the process for appointing and removing executive directors and planning for future leadership needs.

Duties

The specific legal and fiduciary obligations required of the role include:

- Fiduciary Duty: Acting in the best long-term interests of the company and its shareholders.

- Financial Integrity: Ensuring the accuracy of financial information and systems of risk management are robust and defensible.

- Compliance: Overseeing compliance with statutory obligations and relevant laws.

- Remuneration: Determining appropriate levels of executive remuneration and compensation structures.

[IMAGE: Đồ họa Infographic hình tròn hoặc sơ đồ tư duy (Mind map) tóm tắt 4 trụ cột trách nhiệm chính của NED: Strategy (Chiến lược), Performance (Hiệu suất), Risk (Rủi ro), và People (Nhân sự/Kế nhiệm). Giúp người đọc hình dung tổng quan công việc.]

Why Companies Appoint Non-Executive Directors

At its core, companies appoint Non-Executive Directors to bring independent objectivity to the boardroom. Business leaders often get “tunnel vision” from focusing on daily operations; a NED provides a fresh, unbiased perspective to spot risks and opportunities that insiders might miss.

Beyond general oversight, companies specifically seek NEDs for these critical scenarios:

- Bridging Skills Gaps: Bringing specialized expertise (e.g., cybersecurity, ESG, or market expansion) that the current executive team lacks.

- Enhancing Credibility & Investment: Investors and banks often require an experienced board before providing capital or supporting an IPO.

- Crisis Management: Providing steady guidance during turbulent times, such as regulatory scrutiny or reputational damage.

- Succession Planning: Managing the sensitive transition of leadership, particularly in family-owned businesses or when a CEO departs.

- Mediating Conflicts: Acting as a neutral party to resolve disputes between shareholders and management.

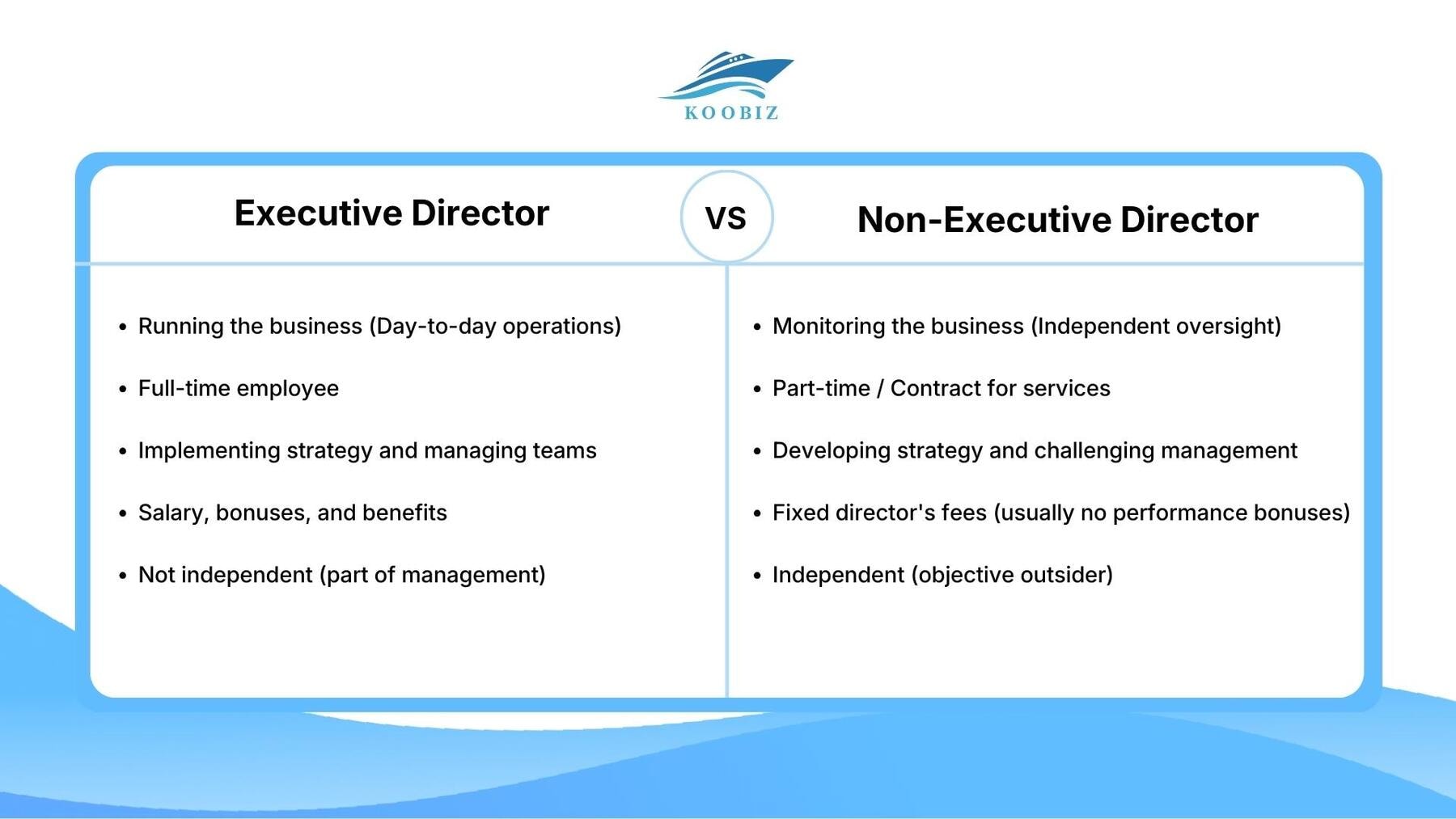

Executive vs. Non-Executive Directors: What’s the Difference?

While both sit on the same board of directors and share equal legal liabilities, their roles differ fundamentally in focus and engagement. The Executive Director is the “doer” managing the company, while the Non-Executive Director is the “monitor” ensuring it is managed correctly.

[IMAGE: Bảng so sánh trực quan, Bên trái là “Executive Director”, bên phải là “Non-Executive Director”]

| Feature | Executive Director | Non-Executive Director |

|---|---|---|

| Primary Focus | Running the business (Day-to-day operations) | Monitoring the business (Independent oversight) |

| Employment Status | Full-time employee | Part-time / Contract for services |

| Key Responsibility | Implementing strategy and managing teams | Developing strategy and challenging management |

| Remuneration | Salary, bonuses, and benefits | Fixed director’s fees (usually no performance bonuses) |

| Independence | Not independent (part of management) | Independent (objective outsider) |

Legal Duties and Liabilities in Singapore

In Singapore, the law does not distinguish between Executive and Non-Executive Directors; both bear the same fiduciary duties and legal responsibilities under the Companies Act and common law.

Legal Duties

Key obligations every NED must uphold include:

- Duty of Good Faith: You must act honestly and in the best interests of the company, ensuring personal interests do not conflict with business decisions.

- Duty of Care and Diligence: You are expected to exercise reasonable diligence and skill, monitoring the company’s affairs rather than being a “sleeping director.”

- Duty of Disclosure: Under Section 156 of the Companies Act, you must disclose any conflicts of interest or property holdings that might compete with the company.

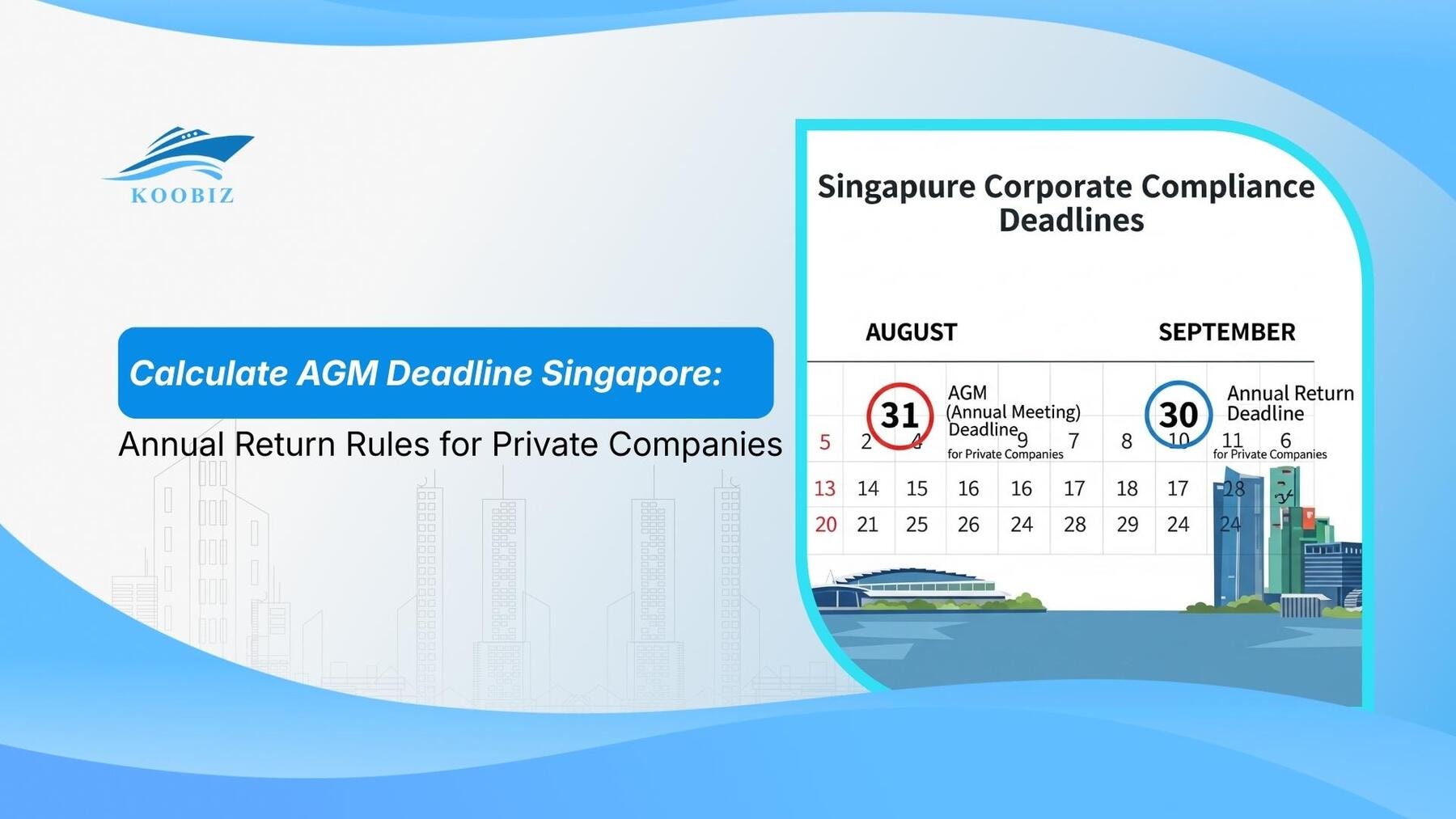

- Statutory Compliance: Ensuring the company complies with statutory requirements, such as filing annual returns, holding AGMs, and maintaining accurate financial records.

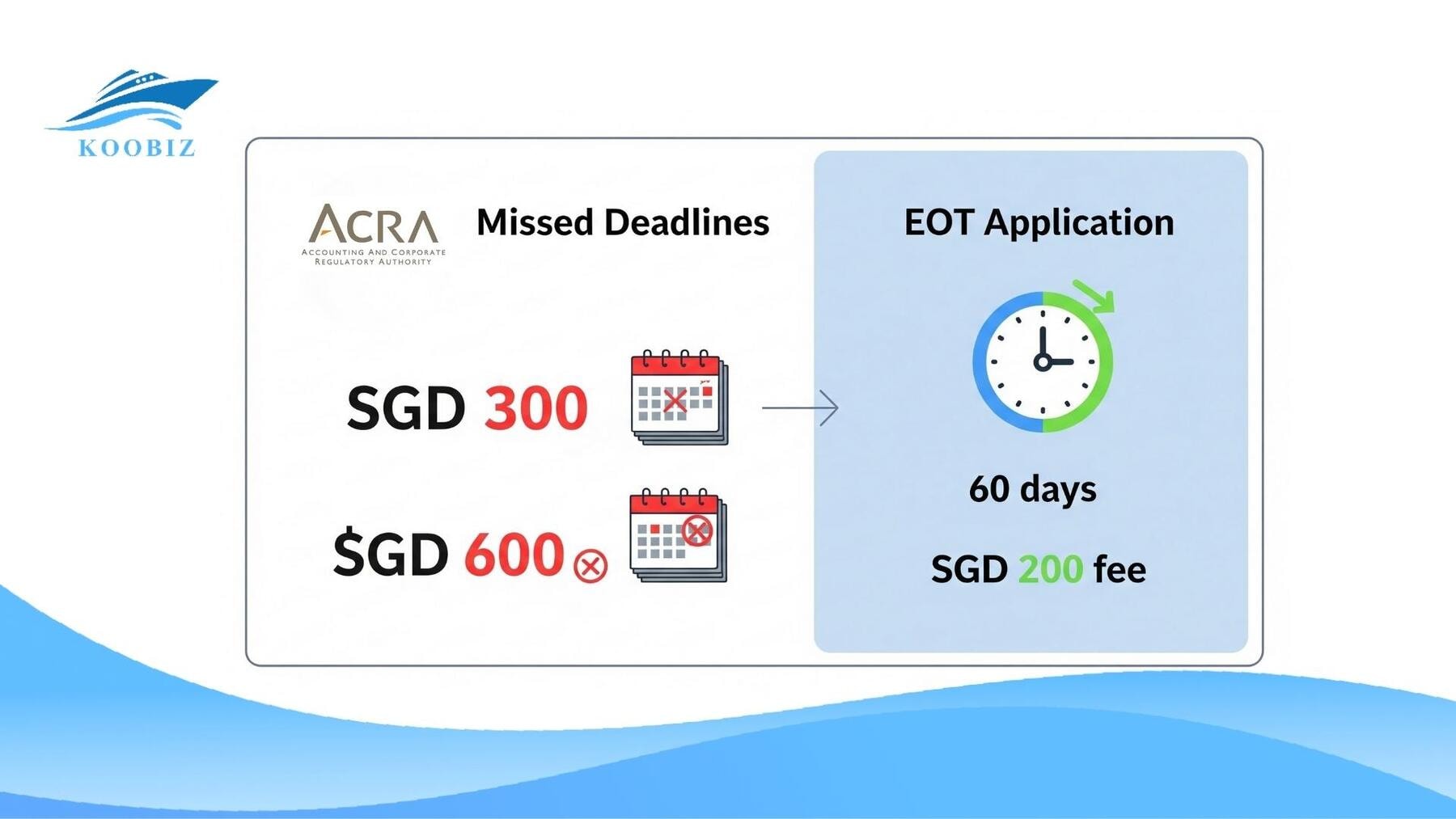

Liabilities

Failure to discharge these duties can lead to severe consequences:

[IMAGE: Hình ảnh minh họa ]

- Civil Liability: The company or shareholders can sue you for damages to recover losses caused by negligence or breach of trust.

- Criminal Penalties: Breaching statutory duties is a criminal offense punishable by fines (up to SGD 5,000) or imprisonment (up to 12 months).

- Disqualification: You may be disqualified from acting as a director for up to 5 years if convicted of serious offenses or for persistent default in filing requirements.

- Personal Liability: If the company continues trading while insolvent, you may be held personally liable for the debts incurred.

How to Become a Non-Executive Director in Singapore

Becoming a NED requires a transition from “operational leadership” to “strategic oversight,” often necessitating a build-up of specific credentials and networks within Singapore’s corporate ecosystem.

Qualifications and Skills Required

While there is no single statutory qualification, the following are standard benchmarks for aspiring NEDs:

- Relevant Experience: A strong track record in C-suite roles or senior management is essential to command respect.

- Mandatory Training (for Listed Companies): First-time directors of SGX-listed companies must undergo training in the Listed Entity Director (LED) Programme by the Singapore Institute of Directors (SID).

- Financial Literacy: The ability to read and scrutinize financial statements is non-negotiable for all board members.

- Specialized Expertise: Modern boards actively seek skills in ESG (Environmental, Social, and Governance), Cybersecurity, Digital Transformation, and Legal/Compliance.

- Soft Skills: High emotional intelligence (EQ), independence of mind, and the ability to influence without authority.

The role comes with unique hurdles that differ significantly from executive management:

- Information Asymmetry: NEDs rely on management for data; they often have less information than executives but share the same legal liability.

- “Noses In, Fingers Out”: Striking the delicate balance of providing deep oversight (“noses in”) without micromanaging daily operations (“fingers out”).

- Time Commitment: The role is increasingly demanding, requiring significant time for board preparation, committee meetings (Audit, Remuneration), and crisis management.

- Liability vs. Control: Bearing full personal liability for company failures (e.g., data breaches, financial fraud) despite having limited control over daily execution.

Best Practices for Success & Real-World Examples

To succeed as a Non-Executive Director, one must move beyond simply attending meetings to becoming a proactive “Critical Friend” to the business.

Best Practices for Success

- Continuous Education: Regulations change rapidly. Successful NEDs consistently upgrade their skills through SID courses, focusing on emerging risks like ESG and Cybersecurity.

- The “Critical Friend” Mindset: The ability to challenge management’s assumptions constructively without being adversarial is the hallmark of a great NED.

- Deep-Dive Diligence: Do not rely solely on board papers. Effective NEDs visit company sites, speak to employees, and understand the “ground reality” of the business.

- Active Listening: In the boardroom, the power of a NED often lies in asking the right question rather than giving the right answer.

Real-World Examples & Archetypes

- The “Industry Titan” (e.g., Mr. Koh Boon Hwee): A prominent figure in Singapore (serving on boards like SGX, GIC, and Agilent), he exemplifies the Strategic NED who brings immense credibility, networks, and high-level vision to multiple diverse organizations.

- The “Governance Guardian” (e.g., Tan Huay Lim): Often a former audit partner or CFO, this NED archetype chairs Audit Committees (like at Sheng Siong or REIT managers), ensuring that financial reporting is rigorous and minority shareholders are protected.

- The “Transformation Specialist”: A modern archetype where a tech veteran joins the board of a traditional bank or retailer specifically to guide digital transformation and challenge legacy thinking.

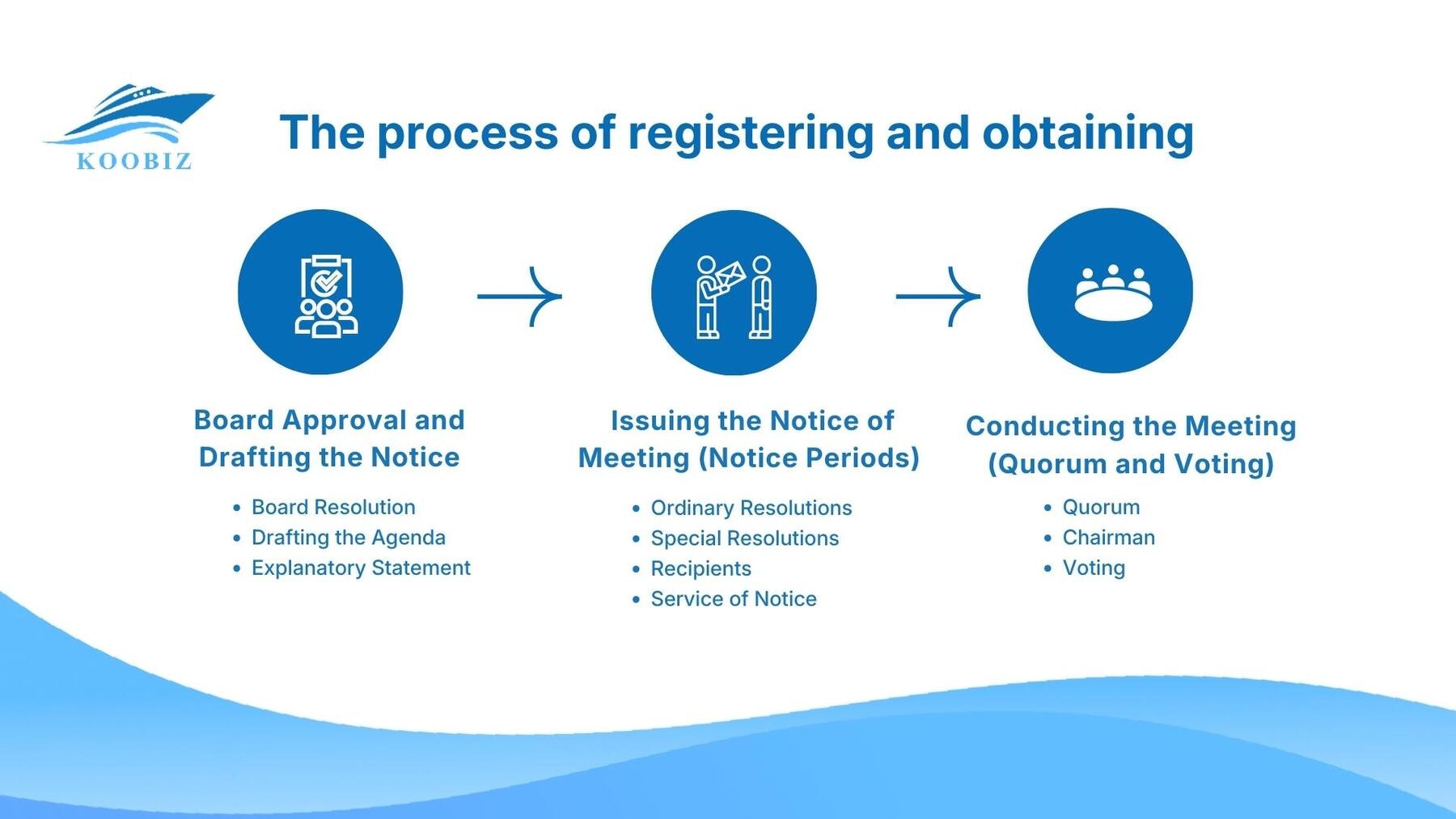

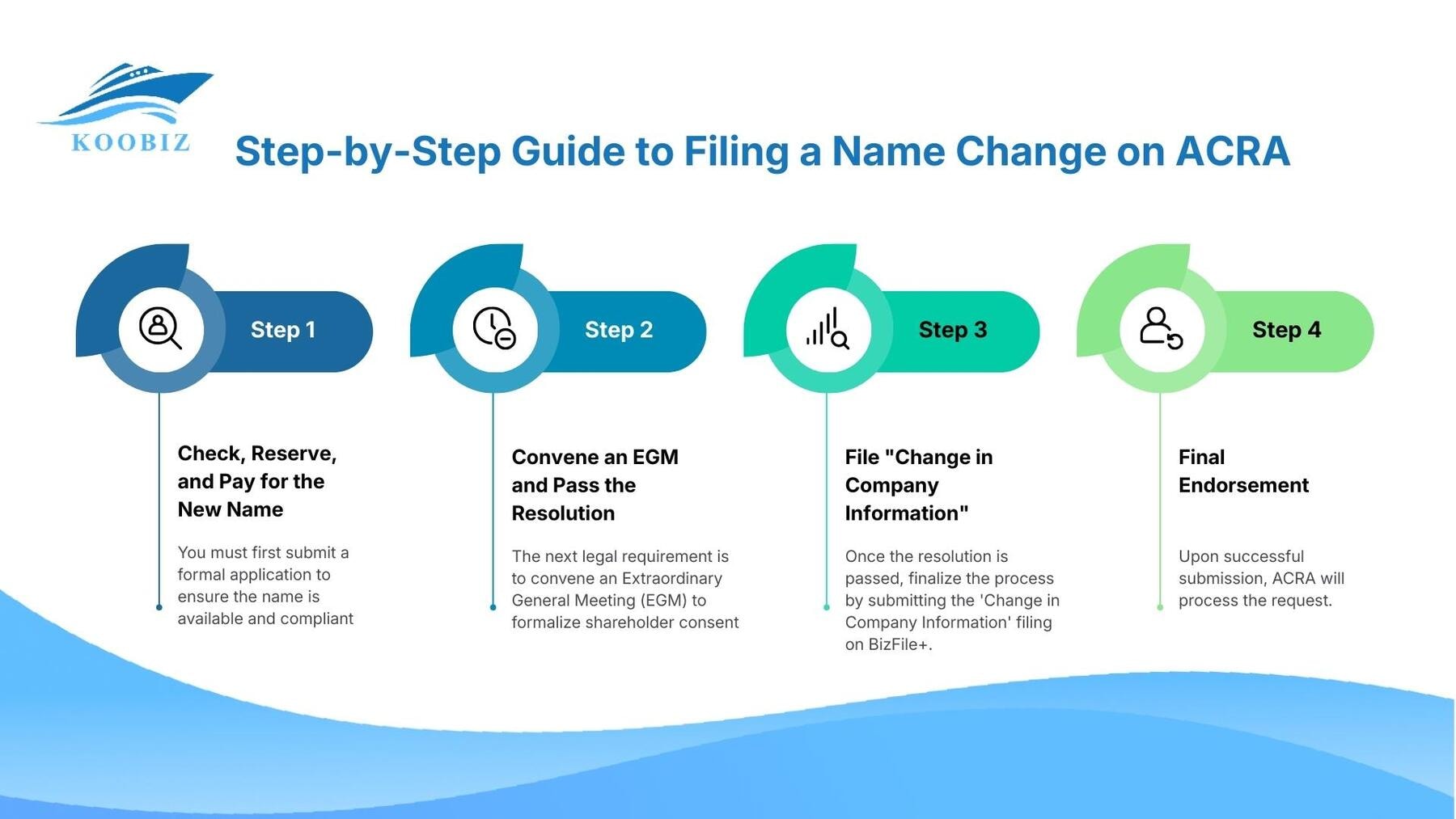

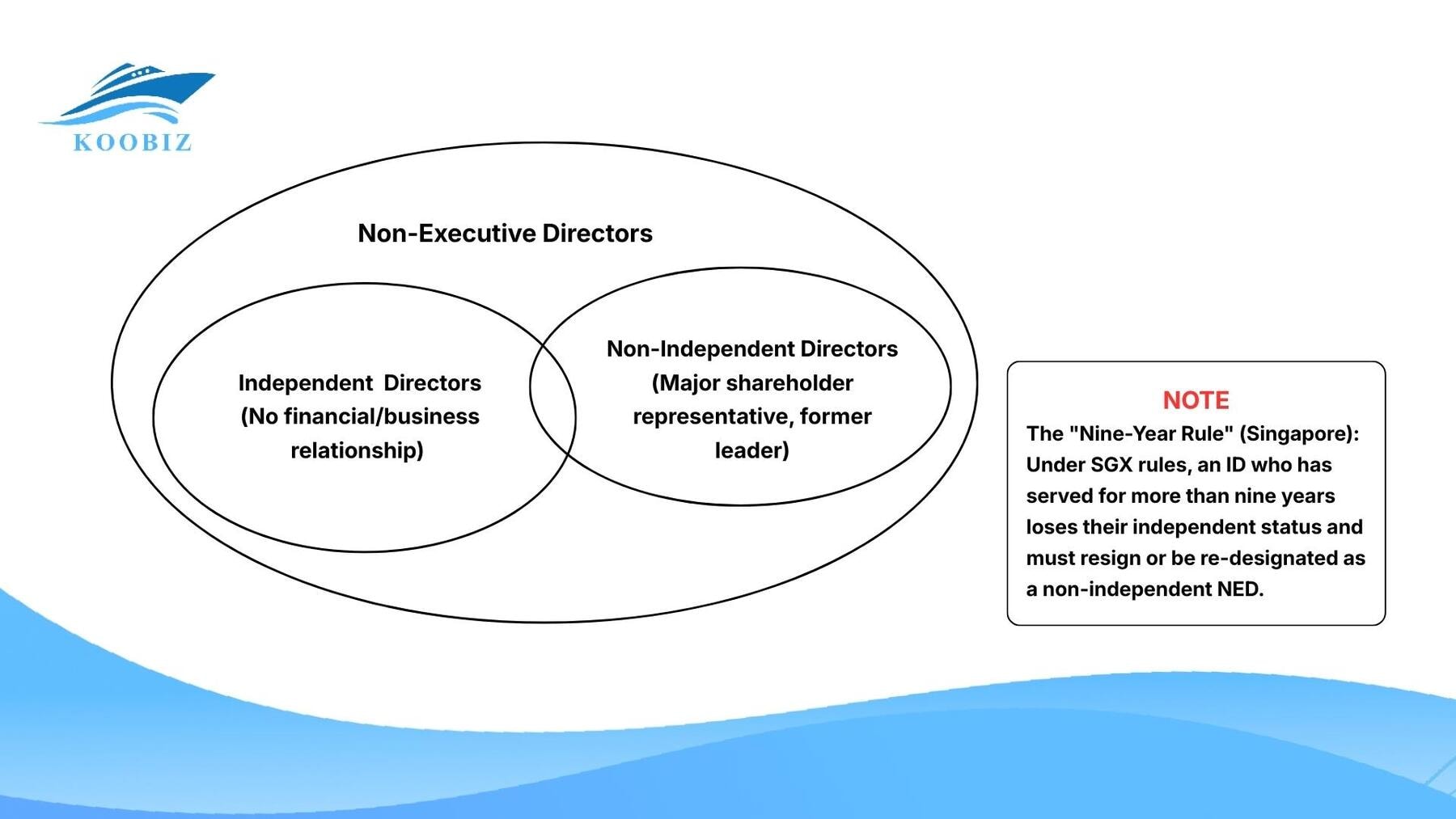

Independent Directors vs. Non-Executive Directors

It is a common misconception that these terms are interchangeable. While all Independent Directors are Non-Executive Directors, not all Non-Executive Directors are Independent.

[IMAGE: Biểu đồ Venn hoặc sơ đồ phân loại (Classification Diagram). Vòng tròn lớn là “Non-Executive Directors”, bên trong chia thành 2 nhóm: “Independent” (Không có quan hệ tài chính/kinh doanh) và “Non-Independent” (Đại diện cổ đông lớn, cựu lãnh đạo). Ghi chú thêm quy tắc “9 năm” (9-Year Rule) tại Singapore để làm rõ ranh giới độc lập.]

Independent Directors (IDs)

An Independent Director is a NED who has no material relationship with the company, its related corporations, 10% shareholders, or its officers that could interfere with their exercise of independent business judgment.

- Key Requirement: They must be free from any business or financial connection (other than board fees and shareholdings).

- The “Nine-Year Rule” (Singapore): Under SGX rules, an ID who has served for more than nine years loses their independent status and must resign or be re-designated as a non-independent NED.

- Role: Critical for protecting minority shareholders and staffing key committees (Audit, Nominating, Remuneration).

Non-Independent Non-Executive Directors (NI-NEDs)

A Non-Independent NED is a director who does not work in the company (is “Non-Executive”) but has a relationship that compromises their independence.

- Scenario 1: The Major Shareholder. A significant investor (or their representative) sits on the board to monitor their personal investment. They are non-executive but lack independence due to financial bias.

- Scenario 2: The Former Insider. A former CEO stays on the board after retirement to provide continuity. They are non-executive but lack independence due to their historical ties and relationships with current management.

- Role: They provide oversight and strategic input but cannot be counted towards the “independent” quota required by corporate governance codes.

FAQs About Non-Executive Directors in Singapore

Can a foreigner be a Non-Executive Director in Singapore?

Yes, a foreigner can act as a NED. However, under the Companies Act, every Singapore company must have at least one director who is “ordinarily resident” in Singapore. Foreigners typically serve as additional directors alongside a local resident director.

Is there a limit to the number of directorships one can hold?

There is no statutory “hard cap” in the Companies Act. However, for SGX-listed companies, the Nominating Committee must assess whether a director with multiple board representations is able to adequately discharge their duties. If a director holds a significant number of directorships, they must convince the board they have sufficient time and capacity.

Do Non-Executive Directors have less liability than Executive Directors?

No. In Singapore law, all directors have the same fiduciary duties and liabilities. A NED can be sued or criminally charged just like an Executive Director if they fail to exercise reasonable diligence. The law does not accept “I was just a non-executive” as a valid defense for negligence.

How much are Non-Executive Directors paid in Singapore?

Remuneration varies widely by company size and industry. For small-to-mid-cap listed companies, fees often range from SGD 40,000 to SGD 80,000 annually. For large-cap companies or banks, fees can exceed SGD 100,000 to SGD 200,000+. Unlike executives, NEDs typically receive fixed fees and do not get performance bonuses to preserve their independence.