[SUMMARIES]

- Essential for Compliance: Every Singapore company requires at least one resident director; nominees fulfill this for foreign owners, enabling 100% foreign ownership without local partners.

- Benefits: Immediate incorporation, full control retention, privacy protection, and faster market entry for overseas entrepreneurs.

- Roles & Risks: Nominees manage statutory duties such as ACRA filings but also share legal liability. Key risks include trust, transparency, and compliance gaps. These can be reduced with clear agreements and proper oversight.

- Appointment Process: Choose qualified residents (Citizens/PR preferred), execute NDA/Indemnity, file with ACRA within 14 days, and update Central Registers per 2025 regulations.

- Replacement: Appoint new director before removing sole resident to avoid breaches; update ACRA and registers promptly.

- Key Advice: It is safer to use licensed professional companies that provide corporate services, because they know the rules and can help reduce risks when you appoint a nominee director.

[/SUMMARIES]

What is a Nominee Director in Singapore?

A Nominee Director in Singapore is a locally resident individual appointed to meet the legal requirement for every company to have at least one Singapore-based director. They act in a non-executive role solely to fulfil this statutory obligation.

Nominee director generally does not participate in the commercial management, financial decisions, or daily operations. Their primary function is to ensure the company stays compliant with the Accounting and Corporate Regulatory Authority (ACRA).

Key characteristics:

- Statutory Compliance: They serve as the official local representative.

- Non-Executive: They do not influence business strategy or operations.

- Safety Mechanism: They allow foreign owners to maintain full control of the business while satisfying local laws.

Benefits of Having a Nominee Director

For foreign entrepreneurs and international companies, appointing a Nominee Director is often the most strategic path to entering the Singapore market.

- 100% Foreign Ownership: You may incorporate and fully own your Singapore company without engaging a local partner.

- Immediate Legal Compliance:. A nominee fulfills this statutory obligation instantly, keeping your business compliant with ACRA regulations.

- Full Operational Control: Beneficiary Owners retain complete authority over the company’s bank accounts, strategy, and day-to-day decision-making without interference.

- Faster Market Entry: You can register your company immediately, even if you are currently overseas.

- Privacy Protection: For owners seeking privacy, a nominee shields the identity of the executive team, though shareholding structures remain visible.

Roles and Responsibilities of a Nominee Director

A Nominee Director’s role is strictly administrative and statutory. Key responsibilities include:

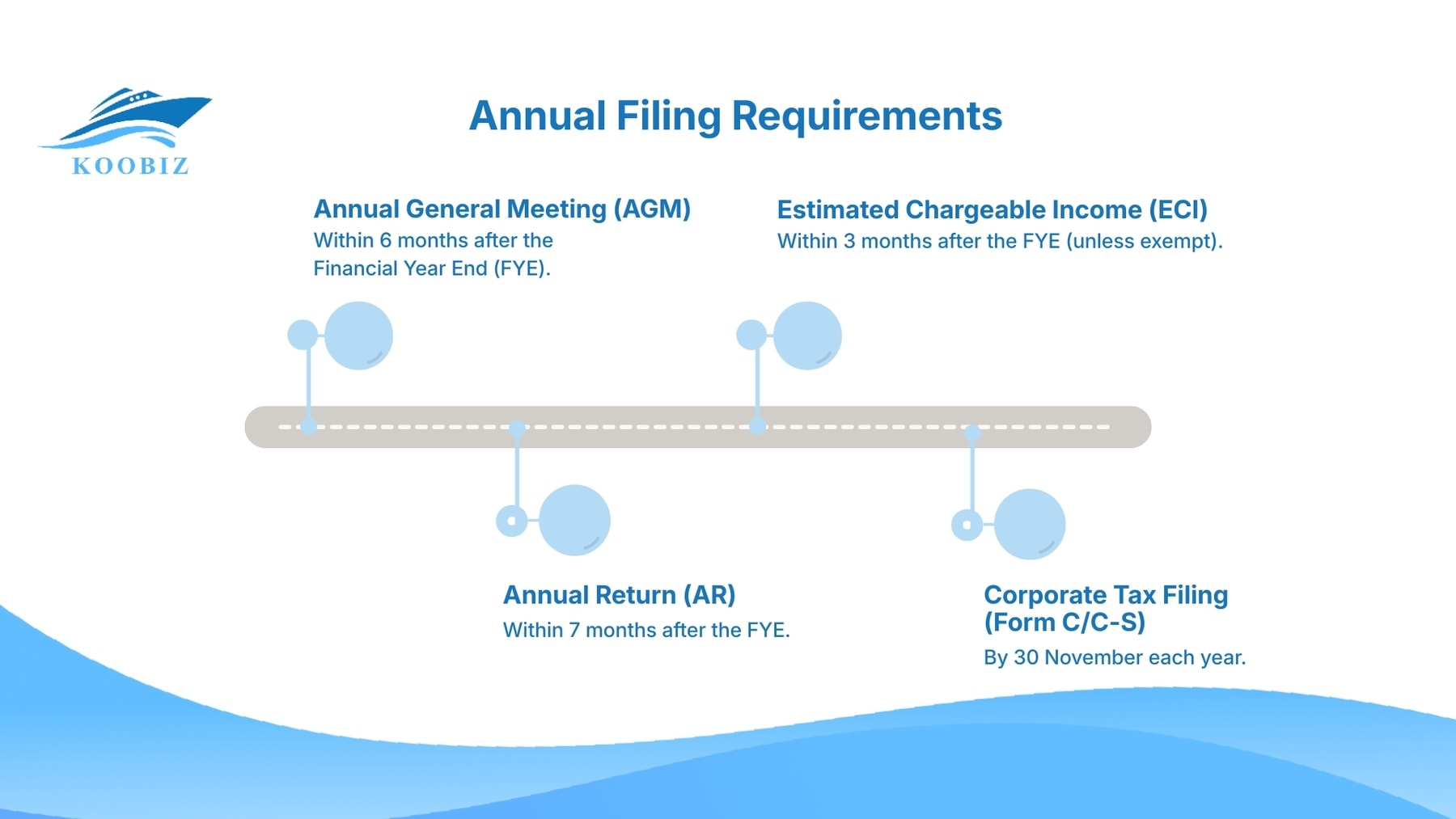

- Handling ACRA Compliance: Filing insurance ofAnnual Returns and Annual General Meeting (AGM) to avoid penalties.

- Meeting Residency Requirements: Serves as the required local director, fulfilling the obligations under the Singapore Companies Act..

- Receiving Official Correspondence: As the local representative, Nominee Director receive and forward important notices from government agencies

- Shared Legal Liability: A Nominee Director carries the same legal responsibilities as any director if the company violates the law.

Risks of Appointing a Nominee Director in Singapore

While essential for compliance, this arrangement carries specific risks that business owners must manage:

- Operational Disconnect (Limited Oversight): Since the nominee is not involved in daily operations, there can be a gap between what the company does and what the director knows. This disconnect can lead to accidental compliance lapses if communication is poor.

- The “Rogue Director” Risk (Trust Issues): The relationship relies heavily on trust. Without a strong legal agreement, there is a theoretical risk of a nominee acting without authorization or resigning suddenly, leaving the company legally vulnerable.

- Strict Liability Friction: Because nominees face personal jail time and fines for company breaches, they are extremely risk-averse and may refuse to sign documents that lack clarity.

- Conflicts of Interest: If you appoint a non-professional nominee (like a friend or associate) who has other business interests, their loyalties may be divided, potentially jeopardizing your company’s confidentiality.

- Reputation Damage: Your company’s credibility is linked to its directors. Appointing a nominee with a poor track record or connections to suspicious entities can negatively impact your business reputation with banks and partners.

How to Appoint a Nominee Director in Singapore

This is the fully updated step-by-step process, revised to include the critical 2025 “Central Register” regulations and the correct advice regarding Employment Pass holders.

Step 1: Identify a Qualified Candidate

You must select an individual who meets the strict residency criteria set by ACRA.

- Who Qualifies: A Singapore Citizen or Permanent Resident (PR).

- Who to Avoid: Employment Pass (EP) holders. Using an EP holder as a nominee for an unrelated business without a “Letter of Consent” is a breach of work pass conditions.

- Best Practice: Engage a licensed Corporate Service Provider (CSP). They provide professional nominees who are pre-vetted, ensuring you avoid the risks of appointing friends or unqualified individuals.

Step 2: Execute Legal Agreements

Before the appointment becomes official, you must protect your assets with proper documentation.

- Nominee Director Agreement (NDA): A contract stating the nominee acts only on your instructions and has no executive power.

- Deed of Indemnity: This protects the nominee against financial penalties, provided they have acted honestly.

- Undated Resignation Letter: Have the nominee sign a resignation letter with the date left blank. This effectively gives you the power to remove them immediately whenever you choose.

Step 3: Pass a Board Resolution

The company’s existing directors must formally approve the appointment.

- The Action: Hold a board meeting (or circulate a written resolution) to approve the new director.

- The Record: This resolution must be signed and filed in the company’s Minute Book by the Company Secretary.

Step 4: File the Appointment with ACRA

Once the paperwork is signed, the appointment must be registered with the government.

- The Deadline: The filing must be submitted within 14 days of the appointment.

- The Process: Your Company Secretary or Filing Agent will log into the ACRA BizFile+ portal to submit the appointment.

- The Result: The nominee’s name will appear on the company’s public Business Profile.

Step 5: Maintain the “Register of Nominee Directors” (Transparency Requirement)

Crucial Update: Singapore law now requires a secondary layer of disclosure to prevent money laundering.

- Private Register: You must update your internal Register of Nominee Directors (kept at your registered office).

- Central Register: You must update the company’s internal Register of Nominee Directors kept at your registered office. Unlike the Register of Controllers, this is not currently filed centrally but must be available to authorities upon request.

Privacy Note: Unlike the public profile, the detailed information in this Central Register is not open to the public; it is accessible only to law enforcement agencies.

By following these steps, you ensure your nominee arrangement is legally watertight, transparent to authorities, and secure for your business ownership.

Replacing or Removing a Nominee Director

Replacing a Nominee Director is a precise legal process. You must follow the correct order of operations to ensure your company does not breach the “local resident director” requirement during the transition.

1. Check the “Sole Local Director” Rule

Before you do anything, check if the current nominee is the only director residing in Singapore.

- The Rule: Under Section 145(1) of the Companies Act, a company cannot accept the resignation of its sole local director until a replacement has been appointed.

- The Action: If they are the only local director, you must appoint a new Singapore-resident director (or a new nominee) before the resignation can take effect.

2. Review the Nominee Agreement

Check the termination clause in your Nominee Director Agreement.

- Most professional agreements include a pre-signed, undated resignation letter.

- To remove the director, you simply “date” this letter effective as of the day you wish them to leave.

3. Pass a Board Resolution

The company’s Board of Directors must formally approve the change.

- The Meeting: Hold a board meeting (or circulate a written resolution) to accept the resignation of the outgoing director and approve the appointment of the incoming one.

- The Record: File this resolution in your company Minute Book.

4. Update ACRA (Public Register)

Your Company Secretary must log the change with the Accounting and Corporate Regulatory Authority (ACRA).

- The Deadline: You have 14 days from the effective date of resignation to update ACRA via the BizFile+ portal.

- The Result: The public register will reflect the new director’s name.

5. Update the “Register of Nominee Directors” (Critical 2025 Step)

You must update the transparency registers to reflect that the individual is no longer a nominee.

- Private Register: Update your internal register kept at the registered office.

- Central Register: Your Filing Agent must update ACRA’s Central Register of Nominee Directors (usually within 2 business days of the internal update) to remove the nominee’s status.

6. Finalize the Handover

- Ensure the outgoing nominee returns any company property or tokens.

- If they were a bank signatory (rare for professional nominees), strictly remove their authorization from the corporate bank account immediately.

Following these steps ensures a smooth, compliant transition when removing or switching a nominee director in Singapore.

Common Questions about Singapore Nominee Directors

1. Is a nominee director required for every Singapore company?

Yes, every Singapore company must have at least one director who is ordinarily resident in Singapore. If there are no eligible local directors, appointing a nominee director fulfills this legal requirement.

2. Does a nominee director control the company?

No, a nominee director does not manage or control the company. Their role is limited to legal compliance and formal representation. Business decisions remain with the actual owners or directors.

3. Can a nominee director be held liable for company misconduct?

Yes. Under Singapore law, there is no distinction between a “nominee” and a “real” director. They face full criminal and civil liability for the company’s compliance failures.

4. How long can a nominee director serve?

A nominee director can serve as long as required by the company, as defined in the appointment agreement. They can be replaced or removed by following legal and procedural steps.

5. Can a nominee director be a foreigner?

No, the nominee director must be a Singapore citizen, permanent resident, or someone with a valid employment pass and a local address.

6. Is the name of the nominee director public?

Yes, the nominee director’s name appears in the company’s public records filed with ACRA.

7. What are the costs involved?

Nominee directors typically charge an annual fee, which varies depending on the service provider and scope of responsibility. Costs should be clarified in the appointment agreement.

8. Can the nominee director open or operate company bank accounts?

They can, but CSPs almost never agree due to liability and AML risks. Professional nominee directors almost never act as bank signatories. Banking authority is exclusively retained by the foreign owners to ensure fund safety.