A Private Limited Company (Pte Ltd) is a business entity separate from its owners, offering limited liability and tax benefits.

Pte Ltd Meaning & Characteristics

In Singapore, Pte Ltd stands for a Private Limited Company. It is a business structure that operates as a separate legal entity distinct from its shareholders and directors. This means the company has its own rights to own property, enter contracts, and sue or be sued in its own name.

The defining feature of a Pte Ltd is limited liability. If the business incurs debt or faces legal action, the financial liability of shareholders is limited only to the amount of capital they invested. Their personal assets, such as savings and property, are legally protected and cannot be used to settle company debts.

Key Characteristics:

- Ownership: Shares are held privately by no more than 50 shareholders.

- Legal Identity: The company is taxed as a separate entity, distinct from the individual owners.

- Suffix: The company name must end with “Pte. Ltd.” or “Private Limited.”

- Transferability: Shares can be transferred to new owners, but cannot be offered to the general public.

Why Choose a Pte Ltd? (The Benefits)

Choosing a Pte Ltd structure is popular because it offers significant financial and legal protection compared to other entities.

- Tax Incentives: Singapore offers attractive tax exemptions for new startups (SUTE) and a competitive corporate tax rate capped at 17%. Dividends paid to shareholders are also tax-free.

- Limited Liability: Shareholders are not personally liable for business debts beyond their share capital, protecting personal wealth like homes and savings.

- Credibility: The “Pte Ltd” suffix boosts brand image, making it easier to secure bank financing and build trust with suppliers and clients.

- Perpetual Succession: The company has perpetual existence, meaning it continues to operate legally even if a shareholder passes away or resigns.

- Capital Raising: It is easier to expand by issuing new shares to investors rather than relying solely on personal loans.

The Downsides: Considerations Before You Register

While a Pte Ltd offers robust protection, it comes with stricter regulations and higher operational costs compared to simpler business forms.

- Higher Compliance Costs: You must hire a qualified Company Secretary within six months and often need professional accounting services, increasing overhead.

- Administrative Burden: Directors are responsible for mandatory annual filings with ACRA and holding an Annual General Meeting (AGM). Failure to comply leads to penalties.

- Complex Closing Process: Winding up or striking off a company is a more formal and lengthy legal process, unlike closing a Sole Proprietorship which is relatively simple.

- Strict Rules: Directors must strictly adhere to the Singapore Companies Act, limiting the operational freedom found in sole proprietorships.

Comparison: Pte Ltd vs. Sole Proprietorship vs. LLP

Choosing the right entity depends on your risk tolerance and tax planning needs. The table below highlights the critical differences.

| Feature | Pte Ltd | Sole Proprietorship | LLP |

|---|---|---|---|

| Legal Status | Separate Legal Entity | Not separate (Same as owner) | Separate Legal Entity |

| Liability | Limited to share capital | Unlimited (Personal assets at risk) | Limited to capital contribution |

| Tax Rates | Corporate Tax (Flat 0-17%) | Personal Tax (Tiered 0-24%) | Personal Income Tax (Partners) |

| Compliance | High (AGM, Secretary required) | Low (Simple annual renewal) | Medium (Annual declaration) |

| Best For | Scalable businesses & SMEs | Low-risk, one-person biz | Professional firms (Lawyers, etc.) |

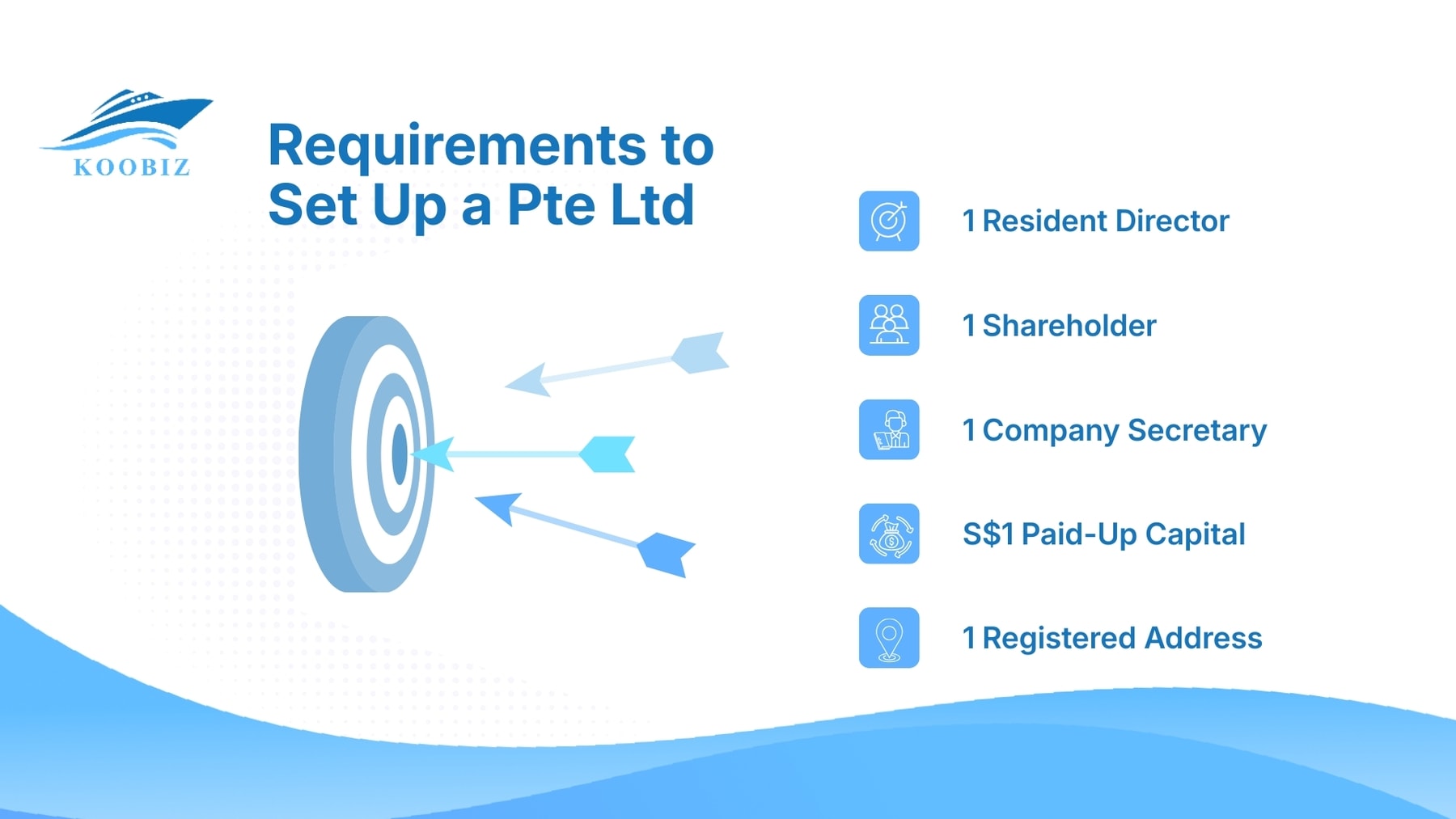

Requirements to Set Up a Pte Ltd in Singapore

To incorporate a company, you must meet five statutory requirements mandated by ACRA.

- Resident Director: You need at least one director who is ordinarily resident in Singapore (Citizen, Permanent Resident, or EntrePass holder).

- Shareholders: A minimum of 1 shareholder is required, up to a maximum of 50. 100% foreign ownership is permitted.

- Company Secretary: You must appoint a qualified local Company Secretary within six months after incorporation. A sole director cannot also be the secretary.

- Paid-Up Capital: The minimum paid-up capital is just S$1, which can be increased later.

- Registered Address: A physical Singapore address is required for official mail; P.O. Boxes are not accepted.

Quick Overview of the Registration Process

The registration process is fully digital via ACRA’s BizFile+ portal and typically takes less than a day if all documents are in order.

- Name Reservation: Log in to BizFile+ to check and reserve your company name.

- Prepare Documents: Prepare the Constitution and have all directors and shareholders sign the Consent to Act (Form 45).

- Submit Application: Submit the incorporation details via Singpass. Foreigners without Singpass must engage a Registered Filing Agent (Corporate Service Provider). The government registration fee is S$300.

- Approval: Once approved, ACRA will issue a Unique Entity Number (UEN) and a digital BizProfile via email.

Post-Incorporation: Staying Compliant

Once your Pte Ltd is registered, you must adhere to key statutory deadlines to avoid penalties or legal issues.

Immediate Actions

- First Board Resolution: Holda meeting to confirm the appointment of directors, open a corporate bank account, and adopt the company seal (optional).

- Issue Share Certificates:These serve as formal proof of ownership for shareholders.

- CorpPass Registration: Set up CorpPass immediately; it is the digital key for all government transactions

- Appoint Company Secretary: Must be done within 6 months after incorporation.

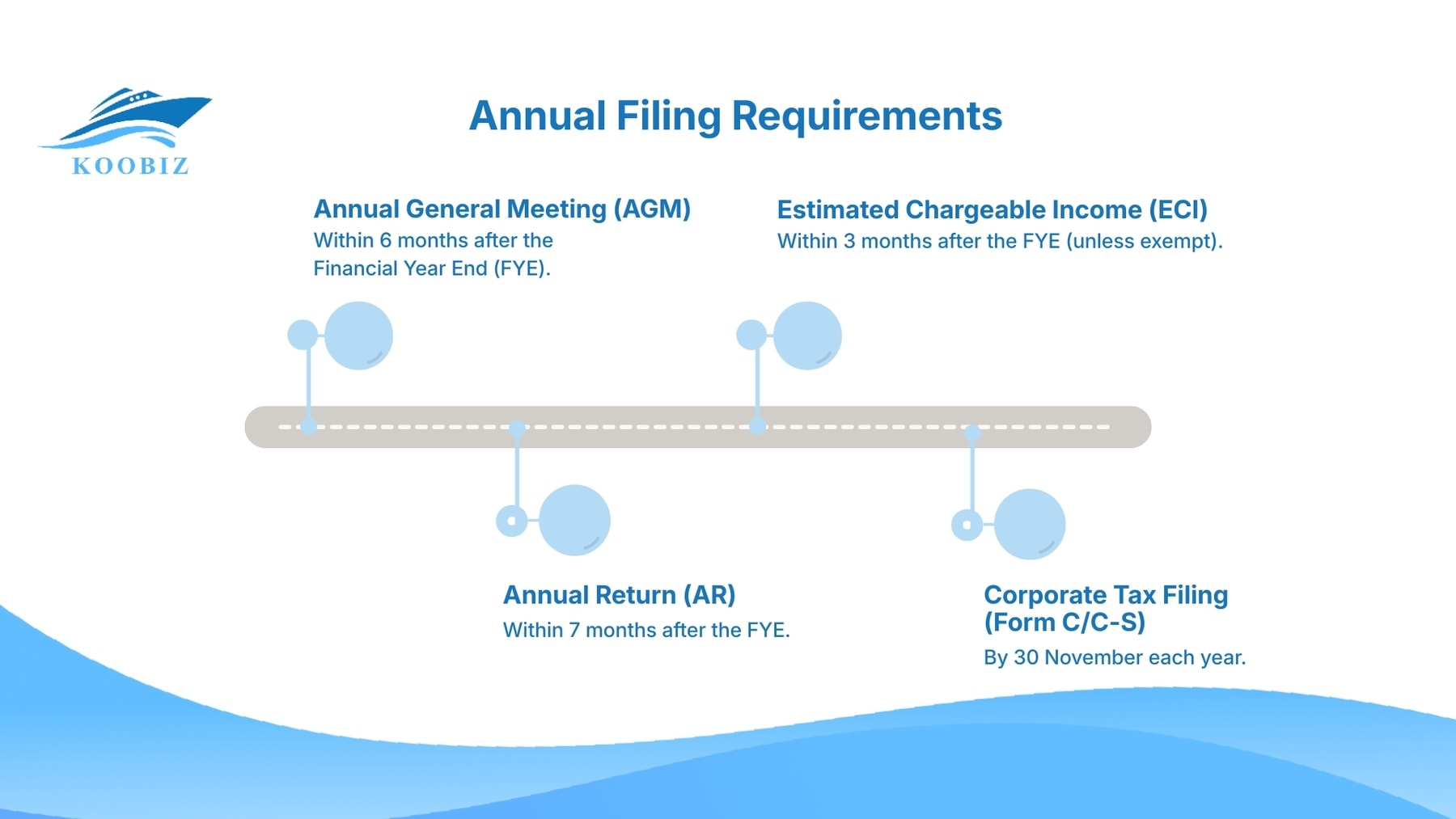

Annual Filing Requirements

You must file returns with two key government bodies each year: ACRA and IRAS.

| Authority | Requirement | Deadline |

|---|---|---|

| ACRA (Accounting and Corporate Regulatory Authority) | Annual General Meeting (AGM) | Within 6 months after the Financial Year End (FYE). |

| ACRA | Annual Return (AR) | Within 7 months after the FYE. |

| IRAS (Inland Revenue Authority of Singapore) | Estimated Chargeable Income (ECI) | Within 3 months after the FYE (unless exempt). |

| IRAS | Corporate Tax Filing (Form C/C-S) | By 30 November each year. |

Note: Most startups qualify as a “Small Company” and are exempt from audit if their annual revenue or assets are under S$10 million.

FAQ

Can a foreigner own 100% of a Pte Ltd in Singapore?

Yes, foreigners can own 100% of the shares but must appoint a local resident director.

How much does it cost to register a Pte Ltd?

Government fees are S$315, while professional service fees range from S$600 to S$2,000.

What is the minimum paid-up capital?

You can register with as little as S$1, which can be increased later as the business grows.

Can I run a Pte Ltd on my own?

Yes, but foreigners need a local nominee director until they secure an Employment Pass.

How long does the registration process take?

ACRA typically approves applications within 15 minutes to one business day if documents are in order.

[SUMMARIES]

A Pte Ltd constitutes a separate legal entity that safeguards shareholders’ personal assets through limited liability while offering significant tax incentives, such as a capped 17% corporate tax rate and tax-free dividends.

Incorporation requires meeting specific statutory criteria, including appointing at least one resident director and a qualified company secretary, possessing a registered local address, and having a minimum paid-up capital of S$1.

Operational maintenance involves stricter ongoing compliance compared to sole proprietorships, necessitating mandatory Annual General Meetings (AGM) and timely filings with ACRA and IRAS to avoid legal penalties.

[/SUMMARIES]