[SUMMARIES]

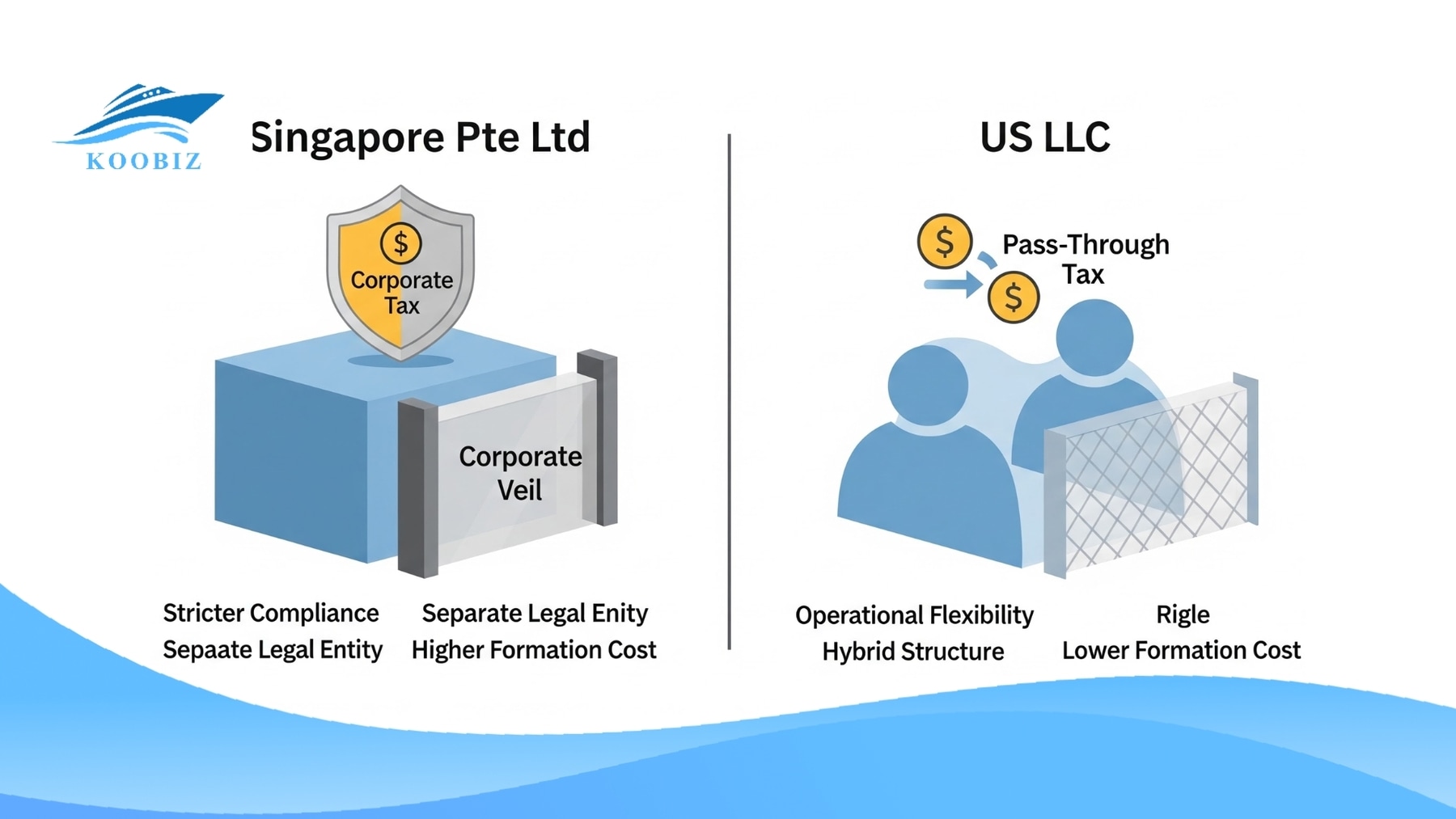

A Sole Proprietorship is the simplest business structure where the owner and business are legally identical, resulting in unlimited liability for debts, whereas a Private Limited Company (Pte Ltd) exists as a separate legal entity that shields shareholders’ personal assets through limited liability.

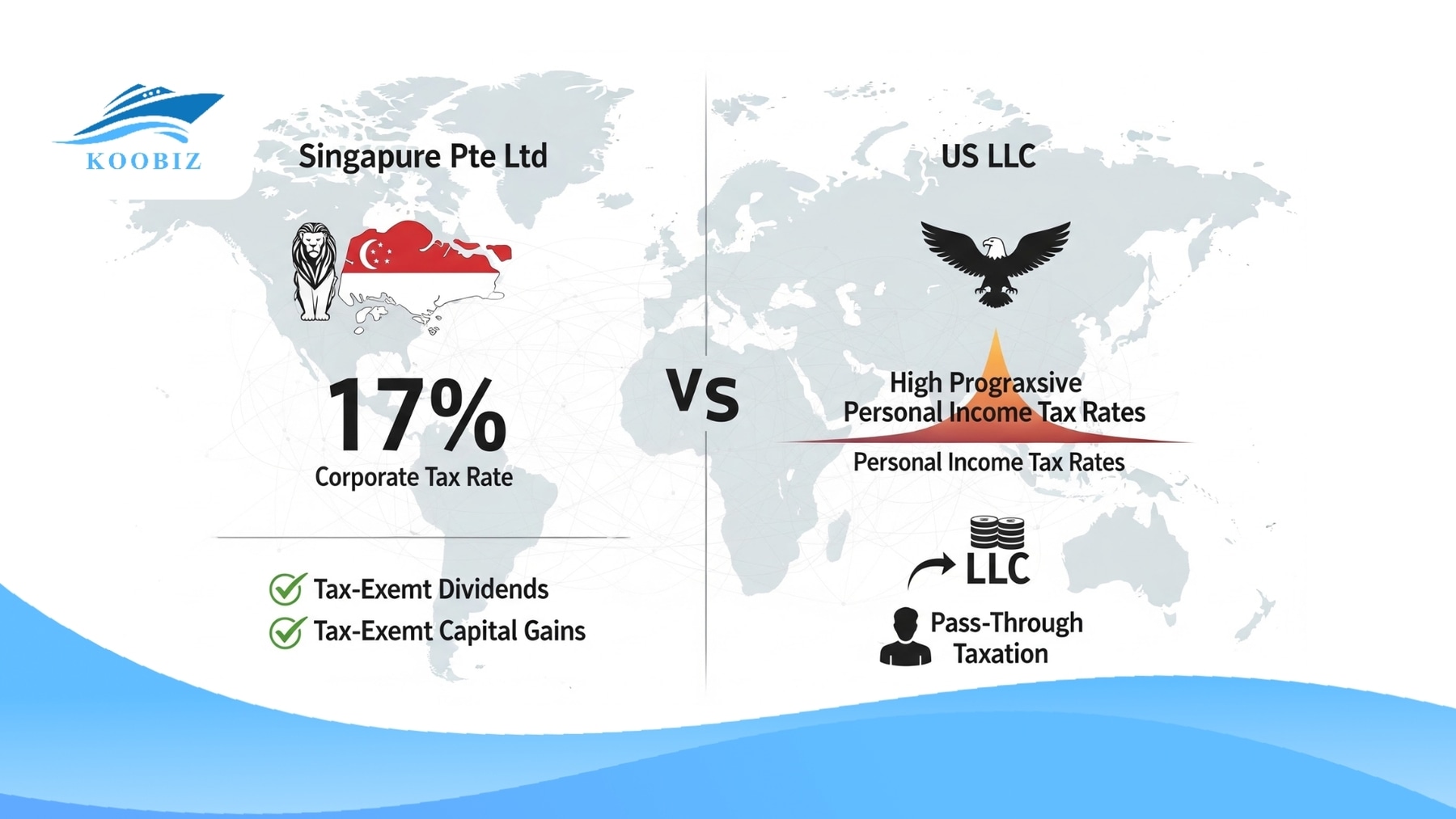

Tax implications differ significantly, as Sole Proprietors are taxed at personal progressive rates (0-24%), while Pte Ltd companies pay a flat 17% corporate tax rate and can utilize the Start-Up Tax Exemption (SUTE) to substantially lower their effective tax burden.

While Sole Proprietorships are cost-effective for low-risk freelancers, scalable businesses should prioritize the Pte Ltd structure to facilitate capital raising, bearing in mind that “converting” later is a complex legal process involving asset transfers rather than a simple administrative update.

[/SUMMARIES]

Choosing between a Sole Proprietorship and a Private Limited Company (Pte Ltd) is a pivotal decision for Singapore founders – it affects liability, taxation, funding options and long-term scalability. A Sole Proprietorship is simple and cheap to run for very small operations; a Pte Ltd adds administrative overhead but gives limited liability, clearer investor appeal and access to corporate tax reliefs that often reduce effective tax for growing businesses.

At Koobiz, we help founders pick the right structure and manage the conversion process (company formation, asset transfer, and compliance) so you can focus on growth rather than paperwork.

What is a Sole Proprietorship in Singapore?

A Sole Proprietorship is an unincorporated business owned by one individual (or an entity) where there is no separate legal personality – the owner and the business are the same. To understand the implications of this definition, we must look at how the Accounting and Corporate Regulatory Authority (ACRA) views this entity.

It is the simplest form of business structure in Singapore. It is easy to set up and maintain, making it popular among freelancers and small shop owners. However, because it is not a separate legal entity, the owner has full control but also bears full responsibility for the business.

What is a Private Limited Company (Pte Ltd)?

A Pte Ltd is an incorporated company limited by shares that exists as a separate legal entity from its shareholders and directors. It can own property, enter contracts and be sued in its own name. A Pte Ltd is the dominant structure for startups and SMEs that plan to scale, hire staff, borrow, or attract external investors.

- Pros: limited liability, perpetual succession, easier capital raising.

Cons: higher compliance (company secretary, filings), slightly higher administrative costs.

What are the Key Differences between Sole Proprietorship and Pte Ltd?

The Pte Ltd structure generally triumphs in liability protection and tax efficiency, while the Sole Proprietorship wins on setup simplicity and low compliance costs. To fully grasp which structure suits your current stage, we need to compare them across three critical dimensions: liability, taxation, and scalability.

How Do Liability and Legal Status Differ?

Because a Sole Proprietorship has no corporate veil, owners bear unlimited liability: personal assets (home, car, savings) may be at risk to satisfy business debts. A Pte Ltd shields personal assets in normal circumstances – only the company’s capital is exposed – making it the safer structure when entering leases, large contracts or taking loans.

| Feature | Sole Proprietorship | Private Limited Company (Pte Ltd) |

|---|---|---|

| Legal Status | Not a separate legal entity. The owner and the business are treated as the same legal person. | Separate legal entity. The company has its own legal identity distinct from its owners (shareholders). |

| Liability | Unlimited. The owner is personally responsible for all business debts and losses. | Limited. Shareholders are only liable up to the amount of their paid-up capital. |

| Risk to Assets | High. Personal assets (home, car, savings) can be seized to pay off business creditors. | Low. Personal assets are legally protected. Only the money invested in the company is at risk. |

| Legal Capacity | Cannot sue or be sued in its own name. The owner sues or is sued personally. | Can sue, be sued, and own property in its own name. |

What is the Difference in Tax Rates and Incentives?

Sole Proprietors report profits on their personal tax return and pay personal income tax (progressive rates). Companies pay corporate tax at a flat rate (headline 17%), with schemes that can reduce effective tax for qualifying start-ups. For early stage companies, the Start-Up Tax Exemption (SUTE) provides generous relief on the first portions of chargeable income in qualifying years – a common reason small but growing businesses convert to Pte Ltd.

| Tax Criteria | Sole Proprietorship | Private Limited Company (Pte Ltd) |

|---|---|---|

| Tax Basis | Profits are taxed as the owner’s Personal Income. | Profits are taxed as Corporate Income. |

| Tax Rate | Progressive Rate: 0% to 24% (for income >S$1M). | Flat Rate: Capped at 17%. |

| Tax Exemptions | Not eligible for corporate tax incentives. | Eligible for Start-Up Tax Exemption (SUTE) and Partial Tax Exemption. |

| YA 2025 Rebates | 60% Personal Income Tax Rebate (Capped at S$200). | 50% Corporate Income Tax Rebate (Capped at S$40,000). |

| Tax Efficiency | Efficient for low profits. Tax burden increases sharply as profits rise. | Highly efficient for higher profits due to the flat rate and exemptions. |

Important Updates for 2025:

- Start-Up Tax Exemption (SUTE): For the first 3 consecutive YAs, qualifying new Pte Ltd companies enjoy a 75% exemption on the first S$100,000 of chargeable income and a 50% exemption on the next S$100,000.

- 2025 Rebates: To support businesses, a 50% Corporate Income Tax Rebate (capped at S$40,000) has been announced for YA 2025. Residents also receive a 60% Personal Income Tax Rebate (capped at S$200), which provides minor relief for sole proprietors.

Which Structure is easier to scale and raise capital?

Pte Ltd is far better for growth and fundraising. It can issue shares to investors and adopt multiple share classes; a Sole Proprietorship cannot. Investors and banks prefer the clarity of corporate ownership and limited liability that a Pte Ltd provides.

| Feature | Sole Proprietorship | Private Limited Company (Pte Ltd) |

|---|---|---|

| Capital Sources | Limited to personal savings and personal loans. Cannot issue shares. | Can raise funds by issuing new shares to investors (VCs, Angels) or obtaining corporate loans. |

| Ownership Transfer | Difficult. Requires selling individual assets and novating contracts. | Easy. Ownership is transferred by selling or issuing shares. |

| Business Continuity | No Perpetual Succession. Business typically ceases if the owner dies or retires. | Perpetual Succession. Business continues indefinitely regardless of changes in shareholders. |

| Investor Appeal | Low. Investors cannot own a “piece” of the company easily. | High. Preferred structure for investors due to clear legal framework and liability protection. |

Investors, venture capitalists (VCs), and banks prefer dealing with Pte Ltd companies because the structure allows for clear ownership distribution through shares. A Sole Proprietorship cannot issue shares; therefore, raising external capital is extremely difficult unless the owner takes out a personal loan.

Is a Sole Proprietorship or Pte Ltd better for your business?

Yes, a Sole Proprietorship is better for low-risk, small-scale operations, while a Pte Ltd is better for businesses planning to scale, hire staff, or incur debt. Deciding between the two depends entirely on your business roadmap and risk tolerance.

If you are a freelancer, a small hawker stall owner, or a consultant with minimal operating costs and virtually zero liability risk, the Sole Proprietorship is ideal due to its ease of registration and minimal compliance requirements (no need for a company secretary or complex annual returns). However, if your business involves signing rental leases, hiring employees, taking trade credit, or if you plan to seek investment, the Pte Ltd is the superior choice. The administrative cost of a Pte Ltd is an insurance premium for the safety of your personal assets and the credibility of your brand.

Expert Note from Koobiz: Many entrepreneurs start as Sole Proprietors to test the market and later convert to a Pte Ltd once revenue stabilizes. If you are unsure, consulting a corporate service provider like Koobiz can help clarify your specific needs.

Real-World Scenarios: Choosing the Right Structure

To help you visualize which structure suits your needs, let’s look at two common scenarios facing Singapore entrepreneurs.

Case Study A: The Freelance Graphic Designer (Sole Proprietorship)

Profile: Sarah runs a home-based design studio. She works alone, has no employees, and her annual net profit is around S$60,000.

Decision: Sarah chooses a Sole Proprietorship.

Why?

- Cost: Setup is approximately S$115 (S$15 name application + S$100 registration), and she avoids the ~S$600+ annual cost of a Company Secretary.

- Tax: Her profit of S$60,000 puts her in a low personal tax bracket with an effective tax rate of approximately 3.25% (before rebates). The flat 17% corporate rate would be higher in this specific range, even with exemptions.

- Risk: She has no debts and minimal overheads, so unlimited liability is a manageable risk.

Case Study B: The E-commerce Startup (Pte Ltd)

Profile: “GreenGoods” is founded by two partners, Mark and Lin. They plan to import sustainable products, rent a warehouse, and hire 3 staff members. They need S$100,000 in initial capital and project S$200,000 profit in Year 2.

Decision: They incorporate a Private Limited Company (Pte Ltd).

Why?

- Liability: Signing a warehouse lease and importing goods carries financial risk. If the business fails, the landlord cannot seize Mark or Lin’s personal homes.

- Tax Efficiency: On S$200,000 profit, the Start-Up Tax Exemption (SUTE) exempts 75% of the first S$100,000 and 50% of the next S$100,000. This leaves only S$75,000 chargeable. After applying the 17% rate and the 50% Corporate Tax Rebate (YA 2025), their tax bill is minimal compared to personal tax rates on that income.

- Funding: They can issue shares to an angel investor in exchange for capital.

How to Convert a Sole Proprietorship to a Pte Ltd?

You cannot “transform” the sole trader into a Pte Ltd by a single ACRA toggle. Conversion is a three-phase restructuring:

- Incorporate a new Pte Ltd via BizFile+ (reserve a company name; prepare constitution; appoint directors and secretary). ACRA charges S$15 for name reservation and S$300 for company incorporation.

- Transfer business assets (inventory, contracts, IP, bank balances) to the new company by sale/assignment agreements; novate supplier/lease contracts if required.

- Cease the Sole Proprietorship in BizFile+ (file Notice of Cessation) after transfers are complete so the owner’s personal exposure ends for new business operations.

Five Steps to Incorporate a New Pte Ltd

Incorporating a Pte Ltd is a structured legal process governed by ACRA. To ensure a smooth transition from your Sole Proprietorship, follow these five comprehensive steps:

Step 1: Reserve Company Name & Submit “No Objection” Letter

You typically want your new Pte Ltd to have the same name as your existing Sole Proprietorship (e.g., changing “ABC Trading” to “ABC Trading Pte Ltd”). ACRA usually rejects identical names, so you must submit a “No Objection Letter” signed by you (the Sole Proprietor) stating you consent to the new company using the name.

- Action: Log in to BizFile+ via SingPass to apply for the name and upload the letter.

- Cost: S$15 for name application.

Step 2: Appoint Key Officers

Before filing, you must have the consent of the people running the company.

- Director: Minimum one locally resident director (Singapore Citizen, PR, or EntrePass holder). You can be the director.

- Shareholder: Minimum one shareholder (can be the same person as the director).

- Company Secretary: Must be appointed within 6 months of incorporation.

Step 3: Prepare Constitution and Registered Address

- Constitution: You must adopt a Company Constitution (formerly Memorandum & Articles of Association). Most startups adopt the standard model constitution provided by ACRA.

- Address: You need a physical Singapore address for the office (P.O. Box is not allowed).

Step 4: File Incorporation with ACRA

Once the name is approved and documents are ready, submit the incorporation application.

- Action: Complete the “Application for Incorporation of Local Company” on BizFile+.

- Cost: S$300 registration fee.

Step 5: Issue Share Certificates

Upon successful registration, the company will receive a UEN (Unique Entity Number). You must then issue share certificates to the shareholders as proof of ownership.

Pro Tip: While you can do this manually, errors in the “No Objection” letter or constitution can cause rejections. Services like Koobiz specialize in handling this entire incorporate company process, ensuring all documents are compliant with Singapore’s Companies Act.

Transferring assets and ending the Sole Proprietorship

Use a Business Transfer Agreement to sell/assign assets to the new Pte Ltd. Novate key contracts (landlord, suppliers) so obligations continue under the company. When transfers complete and company bank accounts are live, file ACRA’s Notice of Cessation to stop the sole trader registration and remove ongoing personal exposure.

Ready to upgrade your business structure? Koobiz provides seamless incorporation services to help you convert from Sole Proprietorship to Pte Ltd without the paperwork headache. Contact Koobiz Today for a Free Consultation

Ongoing compliance: Sole Proprietors keep business records and file personal tax returns; Pte Ltd must maintain statutory registers, hold AGMs (where applicable), file Annual Returns and corporate tax returns.

Audit: Sole Proprietorships are not required to file audited accounts with ACRA; many small Pte Ltd companies are audit-exempt but still must prepare financial statements compliant with Singapore standards.

Foreigners & Sole Proprietorships: Foreigners living overseas who wish to register a sole proprietorship must appoint a locally-resident authorised representative (Singapore Citizen, PR or valid work-pass holder). For foreigners wanting a full local presence, Pte Ltd is the usual route.

Fees recap: Sole Proprietorship (typical first-year cost S$115 includes S$15 name + S$100 registration); Pte Ltd incorporation fees include S$15 name + S$300 registration.

Conclusion

Transitioning from a Sole Proprietorship to a Pte Ltd is a hallmark of business maturity in Singapore. While the Sole Proprietorship offers an easy start, the Pte Ltd structure provides the necessary armor—limited liability and tax efficiency—to survive and thrive in a competitive market. If you are ready to take the next step, Koobiz is here to assist with professional incorporate company services, ensuring your transition is smooth, compliant, and positioned for growth.