[SUMMARIES]

Top Contender: Xero remains the market leader for Singapore SMEs because of its ecosystem and reliable bank feeds; QuickBooks competes strongly with frequent promotions.

Compliance matters: Pick software listed on IRAS’s ASR+ register and confirm the integration level you need (Corporate tax, GST returns, InvoiceNow).

Funding Available: Eligible firms can apply for the Productivity Solutions Grant (PSG) to subsidize approved solutions.

Beyond Bookkeeping: Leading platforms offer AI-driven insights and native e-invoicing (InvoiceNow/Peppol).

Scalability Matters: Zoho Books is great for automation at low cost; NetSuite is better for enterprise/ERP needs.

[/SUMMARIES]

Managing finances in Singapore goes beyond spreadsheets. You need tools that automate routine work, ensure IRAS/ACRA compliance, and scale as your business grows. At Koobiz, we help businesses choose and implement the right accounting stack – from incorporation and chart-of-accounts setup to PSG applications and annual tax/audit support – so your accounting becomes a growth enabler rather than a manual burden.

What defines the best accounting software for Singapore SMEs?

The best accounting software for Singapore SMEs is a cloud-native ecosystem that automates core financial reporting while strictly adhering to local regulatory standards set by IRAS and ACRA.

The ideal solution for 2025 is cloud-native, automates core financial reporting, and is locally compliant. Focus on three attributes: Automation, Local compliance, and Accessibility. Practical capabilities include automatic bank feeds (DBS, OCBC, UOB), real-time P&L reporting, secure access via CorpPass, InvoiceNow (Peppol) support, and smooth GST handling. Koobiz advises choosing software with these local integrations – otherwise you’ll pay in manual work and compliance risk.

Is your software IRAS-compliant? Understanding ASR+

Yes, ensuring your chosen platform is listed on the IRAS Accounting Software Register Plus (ASR+) is absolutely crucial to avoid tax filing errors and streamline your statutory obligations.

Always verify that a product appears on IRAS’s Accounting Software Register Plus (ASR+). ASR+ level (often called tiers) indicates how tightly the software integrates with IRAS systems:

- Tier 1 (Core): Supports corporate tax submissions (e.g., Form C-S) where applicable.

- Tier 2 (GST-ready): Adds GST return submission (Forms F5/F8).

- Tier 3 (Digital ecosystem): Includes InvoiceNow/Peppol e-invoicing along with tax/GST submission.

Note: For the most current list of valid software, always refer directly to the IRAS ASR+ Listing.

Choosing non-compliant software means you will have to manually extract data and key it into the IRAS tax portal, a process prone to human error. According to IRAS, businesses using ASR+ software reduce their tax filing time significantly, ensuring accuracy and peace of mind.

The 7 best accounting platforms in Singapore (2025 Ranked List)

There are 7 standout accounting platforms dominating the Singapore market in 2025: Xero, QuickBooks Online, Zoho Books, Oracle NetSuite, MYOB (ABSS), Odoo, and Aspire.

Here is a detailed breakdown of each platform, including pros and cons, to help you find your perfect match.

Xero

Xero stands out as the premier cloud accounting solution for Singaporean SMEs, renowned for its user-friendly interface and massive ecosystem of over 1,000 third-party app integrations.

- Core Strength: Its “beautiful business” dashboard provides a real-time view of cash flow. Xero excels in bank reconciliation, automatically matching transactions from major Singapore banks.

- Compliance: Fully IRAS-compliant (ASR+ Tier 2/3 depending on add-ons).

- Koobiz Verdict: Recommended for 90% of our clients due to scalability.

Pros:

- Extensive ecosystem (Integrates with almost everything).

- Excellent bank feed stability in Singapore.

- Strong support for accountants and bookkeepers.

Cons:

- Price: Generally higher monthly cost; multi-currency requires the “Premium” plan.

- Limits: The entry-level “Starter” plan has very restrictive invoice limits.

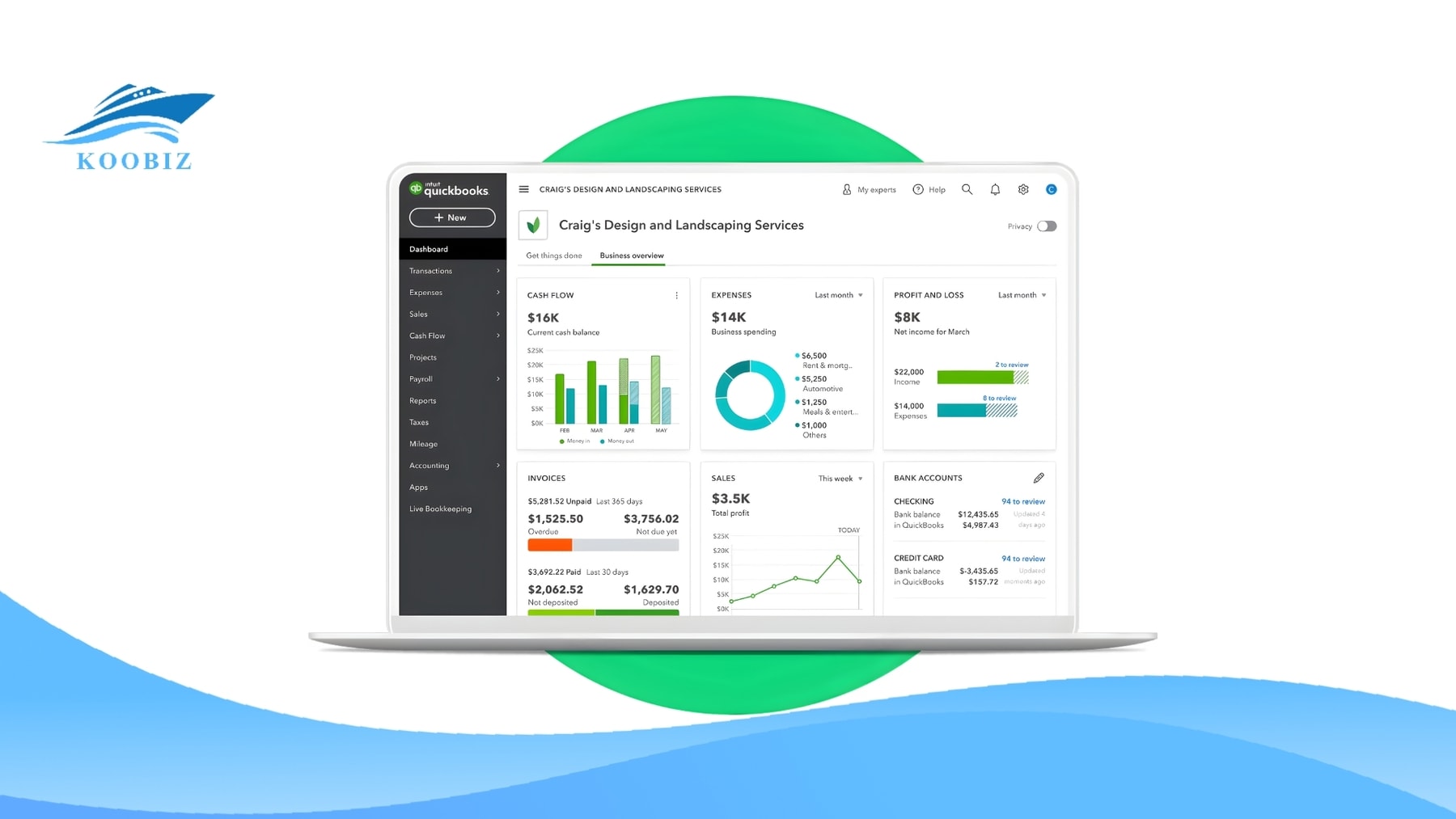

QuickBooks Online

QuickBooks Online is a global heavyweight offering an intuitive and affordable entry point, often featuring aggressive discounts (e.g. up to 50-70% depending on offers).

- Core Strength: Unbeatable mobile app functionality and aggressive pricing promotions. Great for freelancers needing to snap receipts on the go.

- Compliance: Fully localized for Singapore with GST tracking.

Pros:

- Promotions: Frequently offers significant discounts for new users.

- Mobile App: Best-in-class mobile experience.

- Ease of Use: Very intuitive for non-accountants.

Cons:

- Ecosystem: Smaller library of Asian-specific integrations compared to Xero.

- Support: Direct local support can sometimes be harder to access than dedicated local partners.

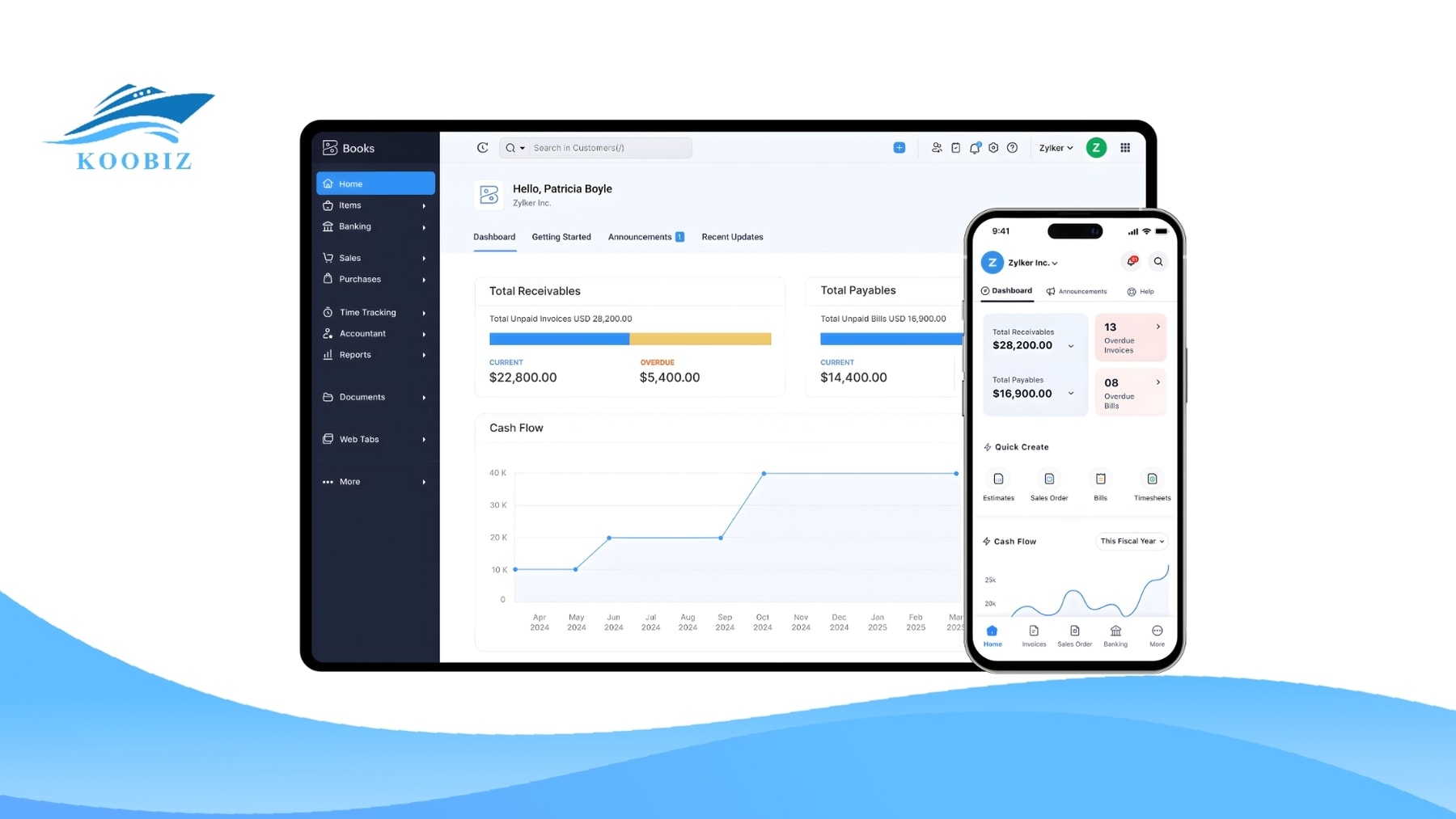

Zoho Books

Zoho Books is the best choice for businesses already invested in the Zoho ecosystem (CRM, Mail, Inventory), offering unparalleled automation.

- Core Strength: Automation workflows. You can trigger tasks based on accounting events (e.g., auto-emailing clients upon payment).

- Value: Highly competitive pricing, often bundling features that others charge extra for.

Pros:

- Automation: Powerful scripting and workflow rules.

- Value: Feature-rich even at lower price points.

- Ecosystem: Seamless if you use Zoho CRM.

Cons:

- Learning Curve: The interface can be overwhelming for users who just want simple bookkeeping.

- Integrations: Integration with non-Zoho apps can be trickier than with Xero.

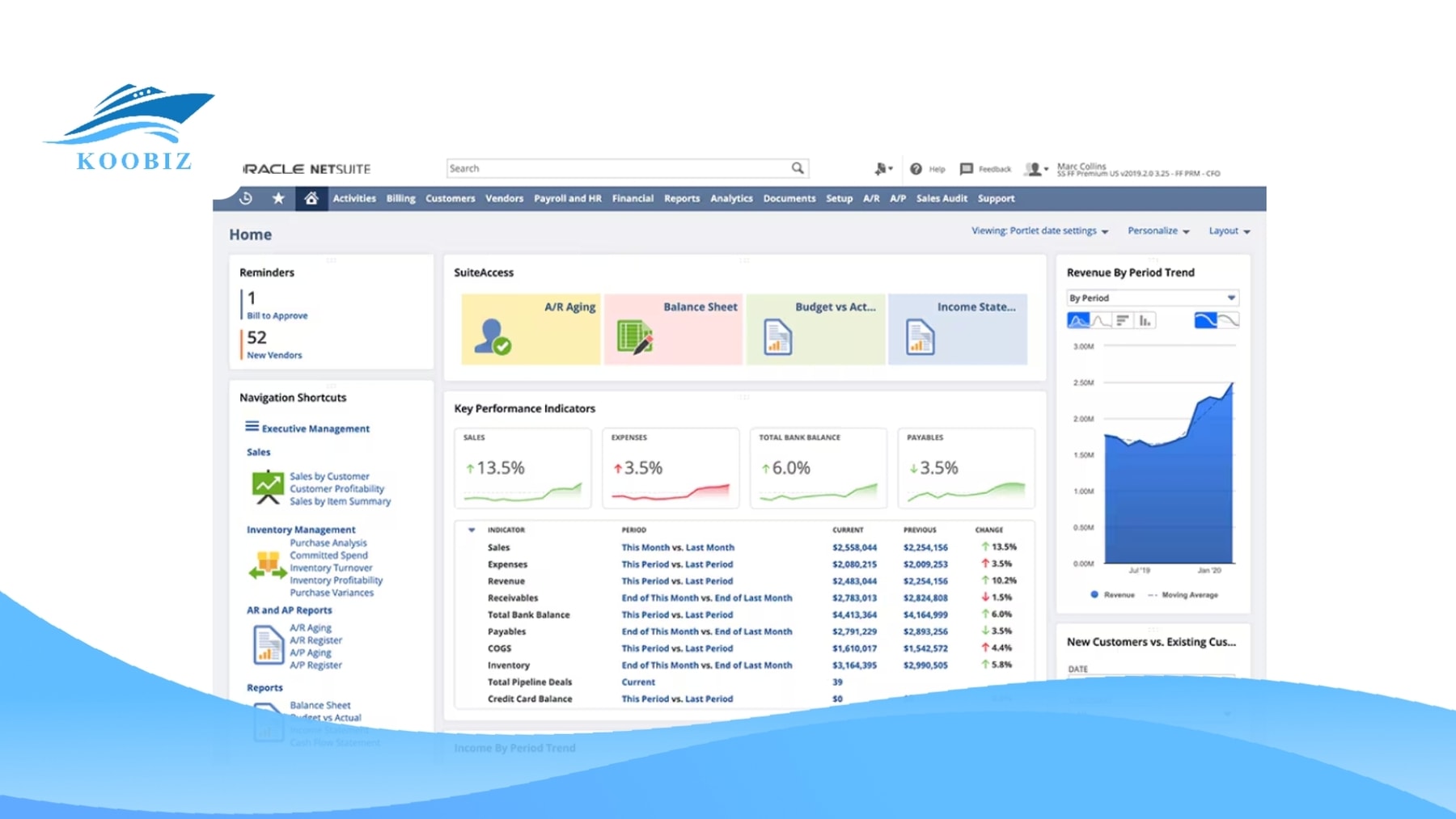

Oracle NetSuite

Oracle NetSuite represents the gold standard for rapidly scaling startups and established enterprises requiring a full ERP system.

- Core Strength: Unified database for Accounting, CRM, Inventory, and E-commerce. Handles multi-subsidiary consolidation effortlessly.

- Target Audience: Mid-to-large sized companies.

Pros:

- Scalability: You will never outgrow it.

- Depth: Handles complex supply chain and manufacturing needs.

- Consolidation: Perfect for HQs managing regional branches.

Cons:

- Cost: Significant investment (often five-to-six figures annually).

- Complexity: Long implementation time (months, not days).

MYOB (ABSS)

MYOB, now known in Asia as ABSS, remains a trusted choice for traditional trading businesses.

- Core Strength: Stability and robust inventory management. Many older accounting firms are deeply familiar with it.

- Deployment: Offers desktop/hybrid models.

Pros:

- Inventory: Very strong stock handling capabilities.

- Familiarity: Long-standing presence in the Singapore market.

- Licensing: Perpetual license options available (pay once).

Cons:

- Legacy: Lacks the “work from anywhere” agility of true cloud native apps.

- UI: Interface feels dated compared to modern SaaS tools.

Odoo

Odoo is a highly modular, open-source platform allowing businesses to “stack” apps (HR, POS, Manufacturing).

- Core Strength: Modularity. Start with accounting, then add modules as you grow.

- Flexibility: Open-source nature allows for deep customization.

Pros:

- Customizable: Can be tailored to exact workflows.

- All-in-One potential: Can replace multiple disparate software tools.

Cons:

- Technical Setup: implementation can be complex and may require developer support.

- Cost Creep: Adding many modules can increase costs unexpectedly.

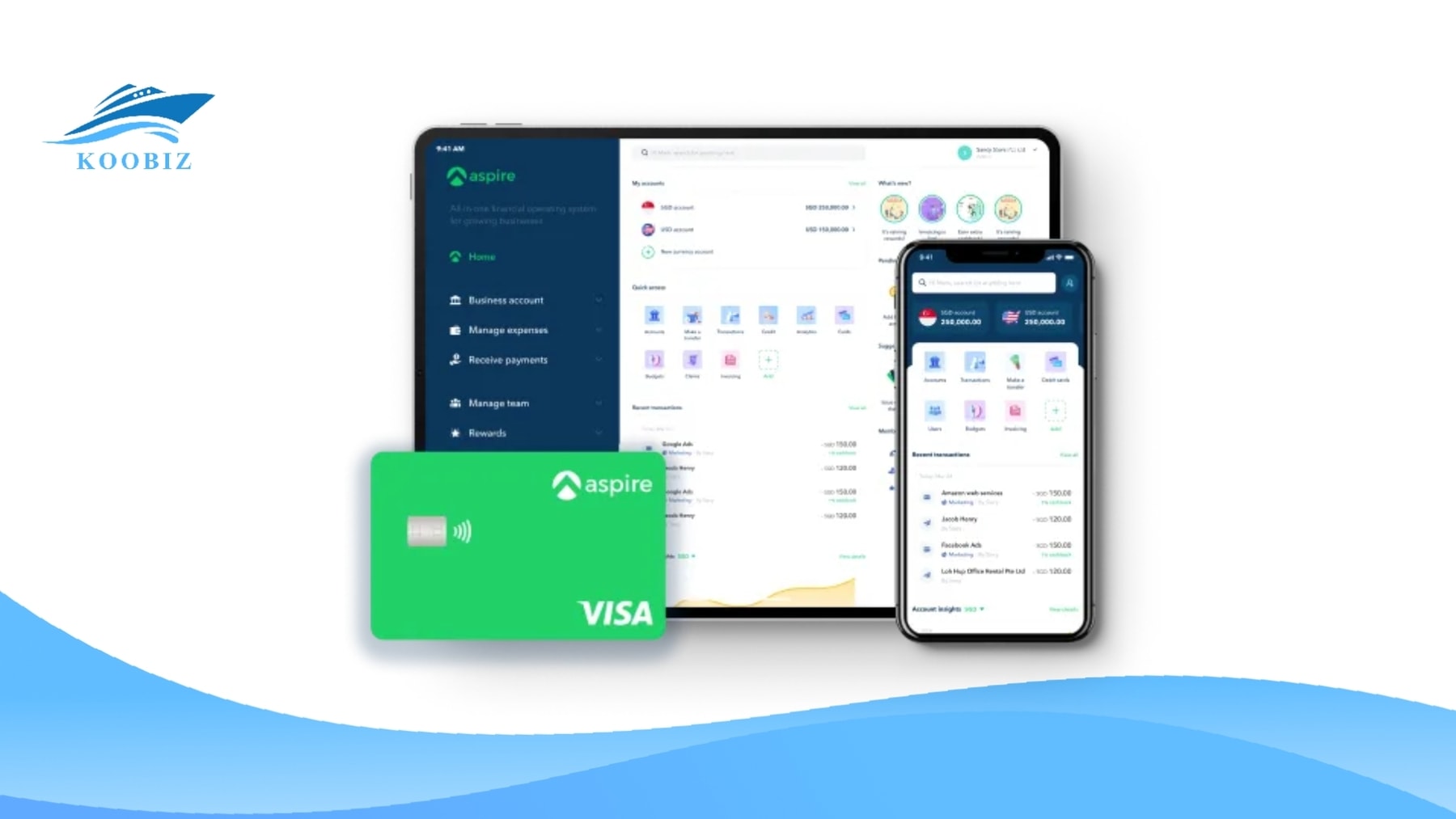

Aspire

Aspire is technically a fintech operating system, not a traditional general ledger. It serves as a powerful complement to Xero/QuickBooks rather than a total replacement for complex accounting needs.

- Core Strength: Integrated business account, corporate cards, and spend management. It syncs data seamlessly to accounting software.

- Best For: Digital startups wanting an “all-in-one” finance dashboard.

Pros:

- Efficiency: Automates expense categorization and receipt matching.

- Speed: fast account opening and card issuance.

- Cost: No monthly subscription fees for the core account.

Cons:

- Not a full GL: Lacks deep accounting features like depreciation schedules or complex audit trails (best paired with Xero).

Comparison of Key Features: Price vs. Functionality

Xero wins on ecosystem depth, QuickBooks on entry-level pricing/promos, and NetSuite on enterprise power.

To make an informed decision, you must weigh the current market pricing against functionality.

Note: Prices below are indicative. Always check vendor websites for live promotions (e.g., “70% off for 6 months”).

| Software | Pricing Model | Multi-Currency | User Limits | Ideal For |

|---|---|---|---|---|

| QuickBooks | Subscription (Check for Promos) | Available | Flexible | Micro-businesses |

| Zoho Books | Tiered Subscription | Mid-tier Plans | Flexible | Budget-conscious Automation |

| Xero | Tiered Subscription | Premium Plan Only | Flexible | Scaling SMEs |

| MYOB (ABSS) | License / Subscription | Version Dependent | License-based | Traditional Trading |

| NetSuite | Custom Quote | Native | Per User Fee | Large Enterprises |

| Odoo | Free / Per App Fee | Enterprise Version | Per App/User | Tech-savvy / Custom Needs |

| Aspire | Free (FX/Trans. Fees apply) | Native (FX focused) | Unlimited | Digital Startups (Fintech) |

At Koobiz, we advise clients to look at the “Total Cost of Ownership,” including the cost of add-ons and the potential need for a migration consultant.

Having identified the top players in the market, it is essential to look beyond the software features themselves. The next logical step for a Singaporean business owner is to understand how to fund this investment and how to handle the technical transition.

How to Offset Costs with the Productivity Solutions Grant (PSG)

- Eligible Singapore SMEs may get up to 50% support for approved IT solutions via PSG. Key points: your business must be registered and operating in Singapore with minimum local shareholding requirements; apply on the Business Grants Portal and receive approval before purchasing; not every vendor/partner is PSG-eligible. Koobiz can help identify PSG-approved vendors and prepare the application.

Cloud vs. Desktop Accounting: Which Suits Your Business Model?

Cloud accounting offers real-time accessibility and automatic backups, whereas desktop software provides offline security.

- Cloud (The Modern Standard): Tools like Xero and QuickBooks allow you to run your business from anywhere. This is essential for utilizing the InvoiceNow network.

- Desktop (The Traditionalist): Solutions like older versions of MYOB reside on your office hard drive. This appeals to businesses with specific data sovereignty requirements or poor connectivity, though these are becoming rarer in Singapore.

The Rise of AI in Accounting: Automated Forecasting & Cash Flow

The latest frontier in 2025 is the integration of Artificial Intelligence (AI), moving accounting from retrospective reporting to proactive insights.

- Xero JAX-style assistants let you query finances with natural language.

- Anomaly detection flags suspicious transactions automatically.

- These AI features give SMEs early warnings on cash flow and help reduce routine manual checks.

Switching Accounting Software: A Migration Checklist

Switching accounting software requires a disciplined migration strategy.

- Cut-off Date: Choose a clean break point (e.g., financial year-end).

- Chart of Accounts: Map your old codes to the new system.

- Opening Balances: Accurately enter balances for all accounts as of the cut-off date.

- Parallel Run: Koobiz Tip: Run both systems for one month to ensure P&L parity before full switch-over.

Navigating the landscape of accounting software in Singapore can be daunting, but making the right choice is foundational to your company’s compliance and efficiency. Whether you choose Xero for its ecosystem or NetSuite for its power, the goal remains the same: clarity and control over your finances.

At Koobiz, we guide you from incorporation to a production-ready finance stack: company setup, choosing ASR+ software, PSG applications, data migration, and ongoing tax and audit support. Our approach reduces implementation risk and keeps you compliant from day one.

Ready to discuss options for your business? Visit Koobiz.com to schedule a consultation — we’ll assess your needs and recommend a tailored, cost-effective accounting setup.