[SUMMARIES]

Definition: An EGM is any shareholder meeting other than the mandatory Annual General Meeting (AGM), used for urgent or special business.

Key Difference: While AGMs are routine and held annually, EGMs are ad-hoc and convened only when specific, urgent decisions are required.

Procedure: Convening an EGM requires strict adherence to notice periods (14 or 21 days), quorum requirements, and proper voting protocols under the Companies Act.

Shareholder Rights: Shareholders holding at least 10% of voting rights have the legal power to requisition an EGM if the board refuses to do so.

Compliance: Failure to follow proper EGM procedures can render resolutions invalid; Koobiz recommends professional secretarial oversight for all corporate proceedings.

[/SUMMARIES]

In the dynamic corporate landscape of Singapore, business agility often requires swift decision-making that cannot wait for the annual review cycle. While most business owners are familiar with the Annual General Meeting (AGM), the Extraordinary General Meeting (EGM) plays an equally critical role in corporate governance. The purpose of an EGM goes beyond a simple definition; it involves mastering the strategic legal mechanisms required to approve major transactions, amend constitutions, or restructure leadership.

For Singapore companies, navigating the procedural nuances of an EGM—from drafting notices to ensuring a valid quorum—is essential to prevent legal disputes. At Koobiz, where we specialize in Singapore company incorporation and corporate secretarial services, we frequently guide clients through the complexities of convening valid meetings. Whether you are a director who needs to approve an urgent decision or a shareholder looking to exercise your rights, this guide will explain the EGM process, showing how it differs from the AGM, and ensure your company remains compliant with the Singapore Companies Act.

What is an Extraordinary General Meeting (EGM) in Singapore?

An Extraordinary General Meeting (EGM) is legally defined as any meeting of a company’s members (shareholders) that is not the mandatory Annual General Meeting (AGM), convened specifically to address urgent matters that arise between AGMs.

To distinguish an EGM from other corporate gatherings, three main keys define its nature and necessity:

- Urgency: The matters at hand are time-sensitive and cannot be postponed until the next scheduled AGM.

- Specificity: It is convened for a specific purpose or “special business,” such as removing a director or amending the constitution, rather than routine annual reviews.

- Irregularity: There is no statutory deadline to hold an EGM; it is an ad-hoc event triggered only by necessity.

Unlike the AGM, which follows a predictable yearly schedule to review accounts, the EGM is irregular and “extraordinary” in nature. It is a rapid-response mechanism for the company. Whenever an issue arises that requires shareholder approval—such as removing a director or approving a merger—and that issue is too critical to postpone, an EGM is called.

Koobiz advises that viewing the EGM as a strategic tool rather than just a compliance hurdle allows directors to manage corporate changes more effectively. Understanding this fundamental definition is the first step, but to truly grasp its operational value, we must distinguish it from its counterpart, the AGM.

AGM vs. EGM: What is the Difference Between These Key Shareholder Meetings?

The Annual General Meeting (AGM) serves as the routine health check of a company, whereas the Extraordinary General Meeting (EGM) acts as the emergency surgery room for specific, urgent corporate interventions. To visualize these differences clearly, refer to the comparison table below:

| Feature | Annual General Meeting (AGM) | Extraordinary General Meeting (EGM) |

|---|---|---|

| Nature & Urgency | Routine Health Check. Retrospective; reviews past performance. | Emergency Intervention. Prospective; addresses immediate, urgent changes. |

| Frequency | Mandatory. Must be held once every calendar year. | Ad-hoc. No fixed schedule; held only when necessary. |

| Timing (Singapore) | Within 4 months (listed) or 6 months (non-listed) of FYE. | Any time a decision is needed (e.g., funding rounds). |

| Business Agenda | “Ordinary Business”: Accounts, dividends, director re-elections. | “Special Business”: Constitution changes, director removal, mergers. |

- Frequency and Timing: The AGM is a mandatory statutory obligation. In Singapore, listed companies must hold an AGM within four months of their financial year-end, while non-listed companies have six months. In stark contrast, an EGM has no fixed schedule. A dormant company might never hold an EGM, whereas a rapidly expanding startup might hold several in a year.

- Business Agenda: The AGM deals with “ordinary business,” which is predictable: presenting financial statements, declaring dividends, and re-electing directors retiring by rotation. The EGM deals exclusively with “special business.” This includes anything outside the routine scope, such as altering the company’s constitution or changing the company name.

- Urgency: AGMs are retrospective, looking back at the past year’s performance. EGMs are prospective and urgent, looking forward to immediate changes required for the company’s survival or growth.

Understanding this distinction clarifies why an EGM might be necessary, but what specific events trigger the need to convene one?

When Should a Singapore Company Convene an EGM?

- Removal of a Director: While the Board can appoint directors, removing a director before their term expires usually requires an Ordinary Resolution passed at a general meeting. This is a common, often contentious, reason for EGMs.

- Amendment of Constitution: If a company wishes to update its Constitution (formerly Memorandum and Articles of Association), this requires a Special Resolution. Since the Constitution dictates how the company is run, changes are often urgent.

- Changes in Share Capital: Whether it involves the allotment of new shares that exceeds the directors’ mandate, or a reduction of share capital to return cash to shareholders, these actions dilute or alter ownership and thus require owner consent.

- Major Transactions: Under Singapore law, specifically Section 160 of the Companies Act, directors cannot dispose of the whole or substantially the whole of the company’s undertaking or property without shareholder approval.

- Winding Up: A decision to voluntarily wind up the company requires a Special Resolution passed at an EGM.

Need to check if your specific situation requires an EGM? Contact Koobiz today for a free compliance checklist.

How to Convene an EGM in Singapore: The Standard Procedure

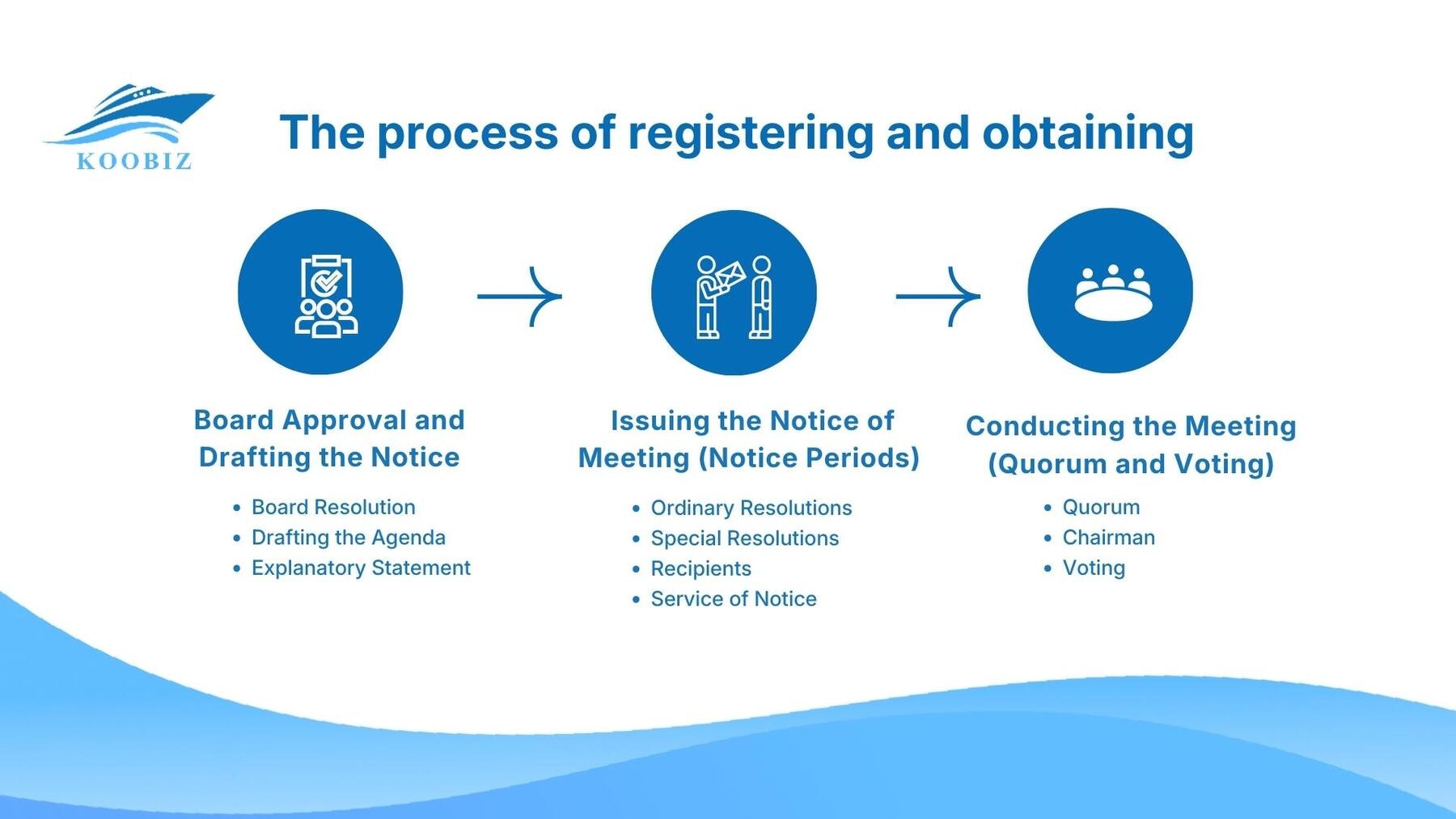

The standard procedure for convening an EGM involves a strict three-step legal process: Board approval, issuance of compliant notice, and the proper conduct of the meeting itself.

Step 1: Board Approval and Drafting the Notice

- Board Resolution:The Directors must pass a Board Resolution to approve the convening of the EGM.

- Drafting the Agenda: The Board must clearly define the resolutions to be voted on. These must be drafted as either:

- Ordinary Resolutions: Requiring >50% of the vote.

- Special Resolutions: Requiring ≥75% of the vote.

- Explanatory Statement: It is best practice, and often legally required, to include an explanatory statement/circular that provides shareholders with enough information to make an informed decision on the proposed resolutions.

Step 2: Issuing the Notice of Meeting (Notice Periods)

- Ordinary Resolutions: If the EGM is only for Ordinary Resolutions, a minimum of 14 days’ written notice is required.

- Special Resolutions: If the agenda includes any Special Resolution (e.g., changing the company name), a minimum of 21 days’ written notice is mandatory.

- Recipients: The notice must be sent to all members (shareholders), the auditors of the company, and any other person entitled to receive notice under the constitution.

- Service of Notice: The notice period excludes the day of service and the day of the meeting. Therefore, purely calculating 14 days on a calendar is often insufficient; a buffer is necessary.

Note for Public Listed Companies: If your company is listed on the SGX, stricter notice periods may apply under the Listing Manual (e.g., 14 calendar days for Ordinary Resolutions). Always verify against current listing rules.

Step 3: Conducting the Meeting (Quorum and Voting)

- Quorum: Before business can commence, a quorum must be present. Unless the company’s constitution says otherwise, the Model Constitution usually sets the quorum at two members present in person or by proxy.

- Chairman: The meeting is chaired by the Chairman of the Board. If they are absent, members can elect a chairman for the meeting.

- Voting: Voting is typically done by a show of hands initially. However, a poll can be demanded by the chairman, at least five members, or members representing at least 5% of voting rights.

Following this standard path ensures a smooth meeting. However, corporate reality is rarely simple, and complex scenarios often arise regarding shareholder rights and notice waivers.

Navigating Complex EGM Scenarios and Shareholder Rights

Navigating complex EGM scenarios involves understanding the exception clauses, minority rights, and modern adaptations that exist beyond the standard “Board-convened” meeting structure.

This section explores the “Unique Attributes” of the EGM ecosystem in Singapore.

Can Shareholders Force an EGM? (Member’s Right of Requisition)

Yes, shareholders holding at least 10% of the total paid-up voting shares have the statutory right to force the directors to convene an EGM.

According to Section 176 of the Companies Act, if members meet the 10% threshold and submit a valid requisition notice, the directors must proceed to convene the meeting within 21 days, to be held no later than two months after the requisition receipt.

If the directors fail to do so, Section 177 allows the requisitioning shareholders to convene the meeting themselves. Any reasonable expenses incurred by the shareholders in this process must be reimbursed by the company (which, in turn, can deduct this from the defaulting directors’ fees). This is a powerful tool for minority shareholders to hold the board accountable.

Is it Possible to Hold an EGM at Short Notice?

Yes, it is possible to hold an EGM with less than the statutory 14 or 21 days’ notice, provided that a specific majority of shareholders agree to it.

For private companies, an EGM can be held at short notice if members holding at least 95% of the total voting rights agree to it. This “Consent to Short Notice” is incredibly useful for SMEs where all shareholders are also directors or are in close communication. It allows for immediate decision-making without the mandatory waiting period.

Disclaimer: Always consult the Company Constitution first. While the Companies Act allows this, a specific clause in your Constitution could technically impose stricter requirements.

Ordinary Resolution vs. Special Resolution: Which One Do You Need?

The choice between an Ordinary Resolution and a Special Resolution depends entirely on the gravity of the decision being made, dictated by the Companies Act.

- Ordinary Resolution: Requires a simple majority (more than 50%) of the votes cast. This is used for the removal of a director or the issuance of shares (if authorized).

- Special Resolution: Requires a supermajority of at least 75% of the votes cast. This is reserved for fundamental changes in the company’s identity or structure, such as amending the Constitution, reducing share capital, or changing the company name.

Identifying the correct resolution type is critical. Passing a Special Resolution issue via an Ordinary Resolution threshold renders the decision legally void.

Modern EGM Formats: Virtual and Hybrid Meetings in Singapore

Effectively from 1 July 2023, the Companies, Business Trusts and Other Bodies (Miscellaneous Amendments) Act 2023 enables companies to conduct general meetings digitally.

- Virtual Meetings: Fully online meetings are permitted unless the company’s constitution explicitly prohibits them.

- Hybrid Meetings: Physical meetings with an option for virtual attendance are also standard.

However, the technology used must ensure that members can vote and ask questions in real-time.

Can the Court Order an EGM?

Yes, in rare circumstances where it is “impracticable” to call or conduct a meeting in the usual manner, the Singapore Court has the power to order an EGM.This usually happens in deadlock situations—for example, in a 50-50 shareholder dispute where one party refuses to attend to deny a quorum. The Court can order the meeting and even direct that “one member present in person or by proxy shall be deemed to constitute a meeting,” effectively breaking the deadlock.

Conclusion

A well-conducted EGM protects the board and empowers shareholders, while procedural errors can lead to costly disputes.Don’t navigate these complexities alone. Koobiz specializes in company incorporation, corporate secretarial services, and financial compliance in Singapore. We ensure your meetings are valid and your records immaculate.

For seamless restructuring, bank account opening, or general compliance, visit Koobiz.com today. Let us handle the details while you focus on business growth.