[SUMMARIES]

Yes Foreigners can open bank accounts in Singapore, but requirements differ sharply between residents (pass holders) and non-residents.

No-EP options exist, but they usually require high deposits (Priority/wealth tiers) or fintech alternatives (Wise, Revolut).

Digital convenience: Residents with Singpass/MyInfo often get near-instant approvals; non-residents face stricter KYC and may need a branch visit.

Critical Documents: Passport and a recent proof of address are essential. Koobiz can help prepare and verify these documents to satisfy banks’ compliance checks.

Hidden Costs: “Fall-below” and early-closure fees are common; choose accounts that match how you’ll use them.

[/SUMMARIES]

Yes, foreigners can open a bank account in Singapore as long as they meet certain conditions related to residency status, valid passes, or minimum deposit requirements. Whether you’re an expat moving for work with an Employment Pass or a non-resident investor exploring wealth management options, Singapore’s banking system is open – but structured in tiers. That said, complying with stringent Anti-Money Laundering (AML) rules can be challenging without proper support. At Koobiz, we help international clients navigate both personal and corporate banking with ease. This guide explains the key differences between resident and non-resident requirements, outlines the documents you’ll need, and shows how an account can be opened even without a traditional work visa.

Can a foreigner open a bank account in Singapore?

Yes, foreigners can open a bank account in Singapore, as the country’s regulatory framework allows international access to its financial system, though approval depends heavily on your residency status and financial profile.

To understand this landscape effectively, it’s important to note that Singapore banks assess foreigners under two main profiles: residents and non-residents. While MAS does not prohibit non-resident banking, individual banks apply their own stringent compliance rules. In practice, this means approval depends on your visa status and financial commitment, expats with valid passes enjoy a smoother process, while others may need higher deposits or fintech alternatives. At Koobiz, we emphasize preparation: banks expect a clear and legitimate reason for banking in Singapore, such as employment, property ownership, or business incorporation.

Singapore’s banks continue to serve a growing international clientele, supported by robust KYC standards that safeguard both customers and institutions.

Eligibility Criteria: Residents vs. Non-Residents

Residents typically enjoy low-deposit personal accounts with instant digital approval, whereas Non-Residents generally face higher entry barriers, such as mandatory in-person visits or minimum deposits exceeding S$200,000 for Priority Banking.

However, understanding which category you fall into is the first critical step in your banking journey.

| Feature | Residents (The Streamlined Path) | Non-Residents (The Premium/Alternative Path) |

|---|---|---|

| Who fits this profile? | Holders of Employment Pass (EP), S-Pass, Student Pass, Dependent Pass (DP), or LTVP. | Tourists, Short-term visitors, and Overseas Investors living outside Singapore. |

| Entry Barriers | Low. Often eligible for instant digital approval via Singpass/MyInfo. | High. Generally requires mandatory in-person branch visits or Priority Banking status. |

| Deposit Requirements | Low initial deposits (often just S$1,000 or even S$0 for youth accounts). | High entry thresholds (often S$200,000+) or specific valid reasons (e.g., property purchase). |

| Koobiz Insight | Banks like DBS and OCBC offer “Personal Savings Accounts” specifically tailored for this group. | Be wary of “Fall-below fees” and strict onboarding checks if you lack local ties. |

Can you open a bank account without an Employment Pass?

Yes, it’s possible to open a bank account without an Employment Pass by using Priority Banking options, Student or LTVP passes, or fintech platforms, depending on your needs and financial profile. Despite common belief, banking in Singapore isn’t limited to employees; there are several situations where a work pass isn’t necessary.

Scenario 1: The “Priority Banking” Route (For Investors)

For High-Net-Worth Individuals (HNWIs) living overseas, Singapore banks are eager to do business. You do not need a work visa; you need capital.

- Requirement: A minimum Asset Under Management (AUM) or deposit, typically ranging from S$200,000 to S$350,000.

- Banks: DBS Treasures, OCBC Premier, UOB Privilege, and international banks like Citibank IPB (International Personal Bank).

- Benefit: Often allows for remote account opening without flying to Singapore, provided you can pass video KYC and notarize documents. Koobiz can assist in connecting you with relationship managers for this specific tier.

Scenario 2: Students and Dependents (LTVP/Student Pass)

If you are in Singapore to study or accompany a spouse, your “pass” is your golden ticket.

- Student Pass: Major banks have specific “Youth” or “Frank” accounts with no initial deposit requirements and age waivers for fall-below fees.

- LTVP/Dependent Pass: Holders are treated similarly to EP holders for compliance purposes. You simply need your valid pass and proof of address.

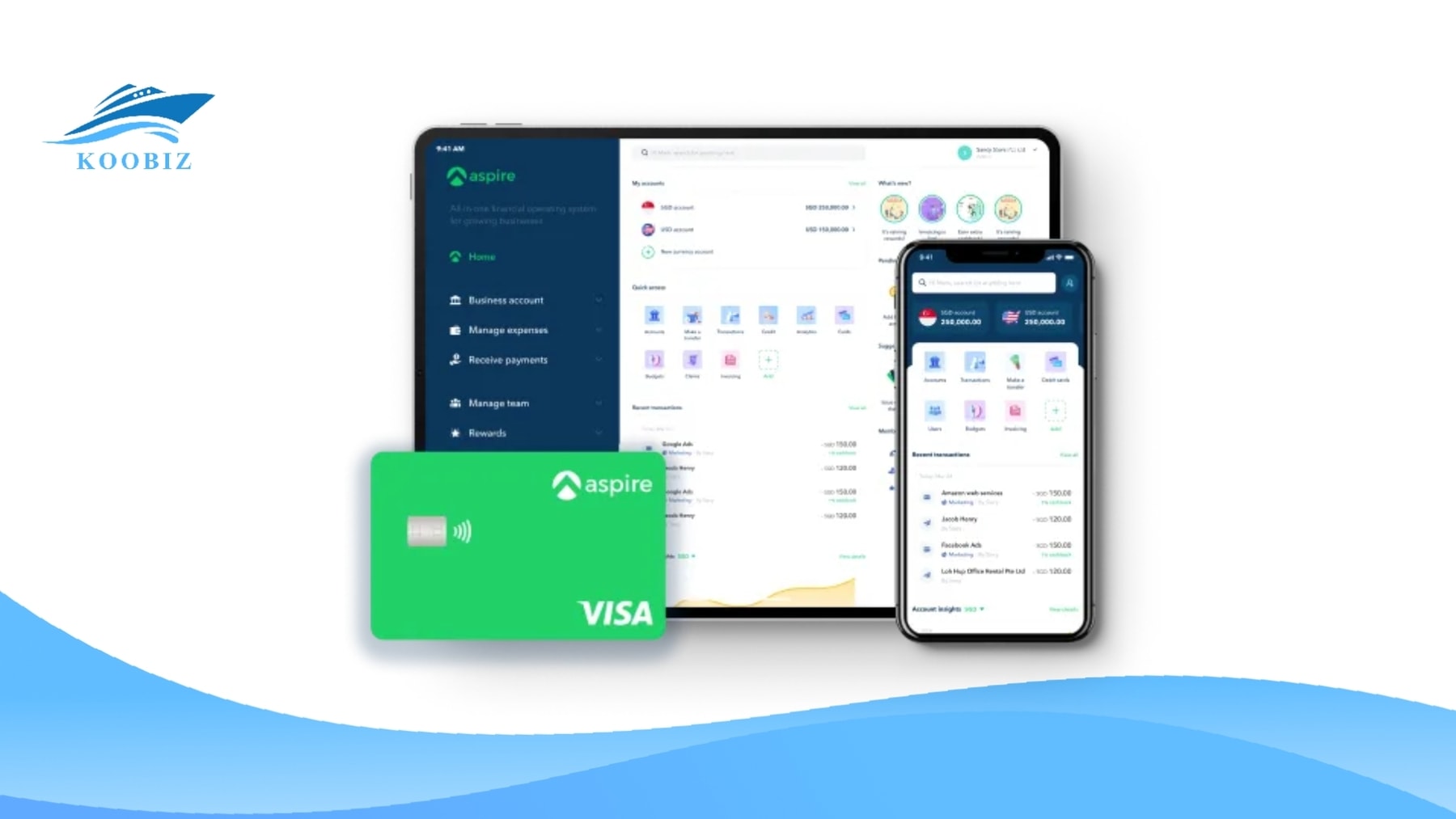

Scenario 3: Tourists and Short-Term Visitors (The Fintech Route)

For a tourist wanting a local account for convenience, traditional banks will likely say “No.” The solution lies in Fintech.

- Solution: Platforms like Wise, Revolut, or Aspire (for businesses).

- Mechanism: These are not full bank accounts but “payment institutions” regulated by MAS. They provide you with local SGD bank account details (PayNow, Account Number) to receive and send funds locally.

- Accessibility: 100% online setup, often using your home country’s proof of address.

What documents are required to open an account?

The three essential documents are a valid passport, proof of legal status (visa or pass), and a compliant proof of residential address. In practice, the proof of address is usually the most challenging requirement for foreigners to meet.

Valid Passport

- Must have at least 6 months of validity remaining.

- For online applications, a clear scan or photo of the biodata page is required.

Proof of Legal Status

- Residents: Employment Pass, S-Pass, Student Pass, or Dependent Pass. An “In-Principle Approval” (IPA) letter from MOM is sometimes accepted by specific branches (like DBS Expat specific centers) but not always for online applications.

- Non-Residents: Entry stamp/white card (SG Arrival Card acknowledgement).

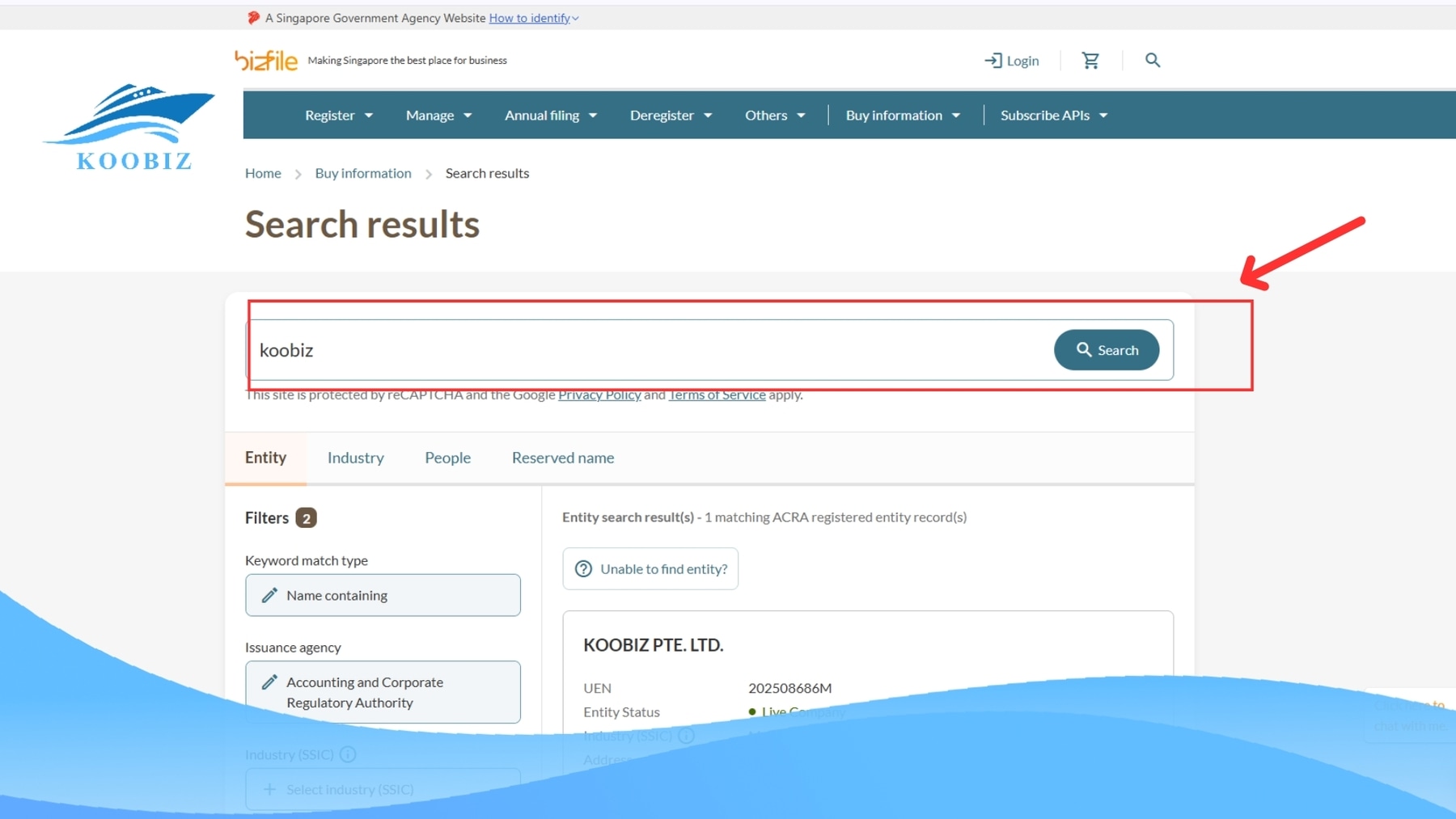

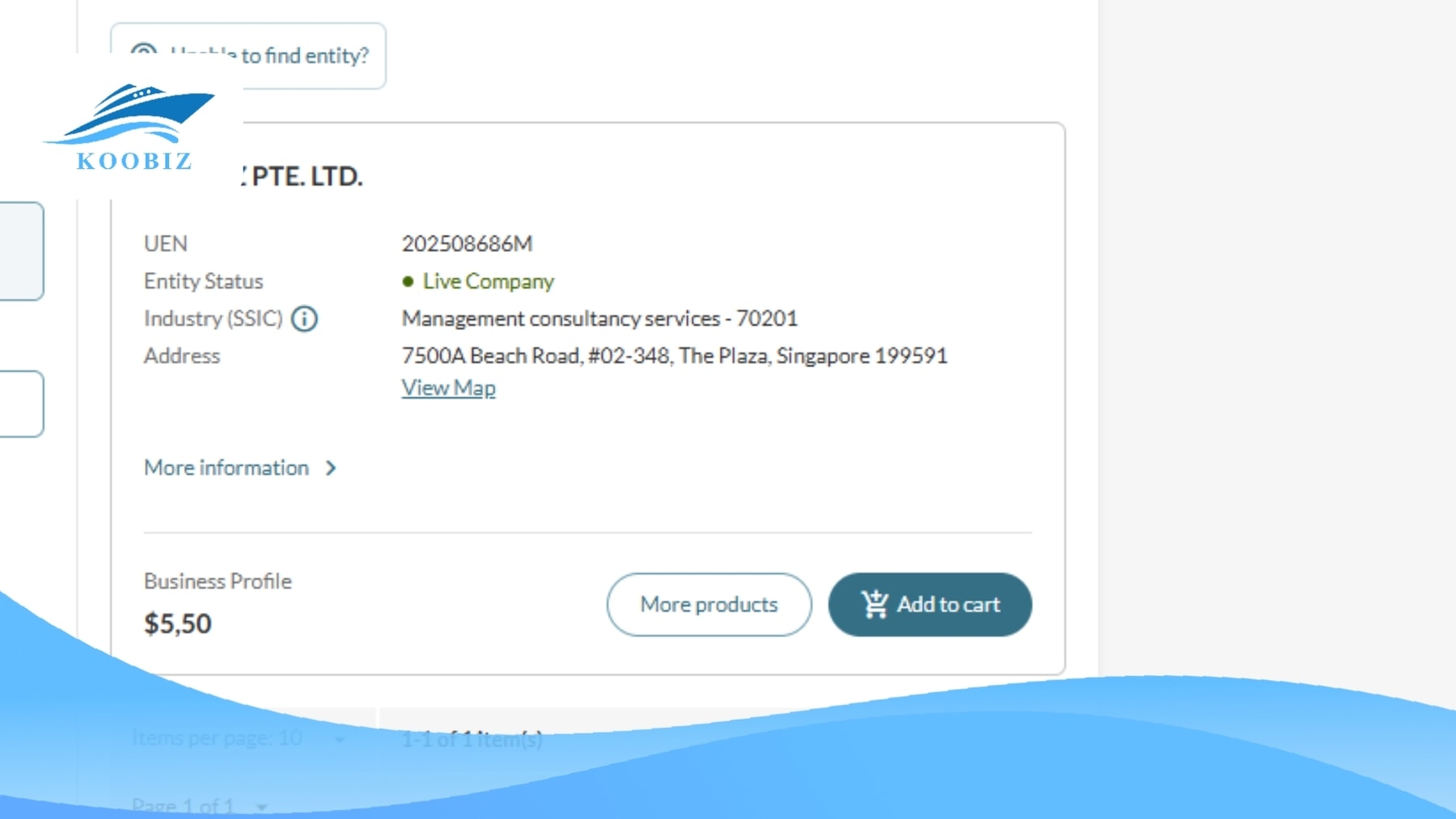

Proof of Residential Address (The Koobiz Compliance Tip)

This is where many fail. Banks require a document issued within the last 3 months.

- Accepted: Utility bill (SP Group), Telco bill (Singtel/Starhub), Tenancy Agreement (stamped), or a bank statement from another reputable bank.

- Not Accepted: E-commerce invoices, handwritten letters from landlords without stamping.

- For Non-Residents: You may need to provide proof of your overseas address (e.g., a utility bill from your home country) and a reference letter from your home bank.

Tax Residency Declaration

- You must declare where you pay taxes under the Common Reporting Standard (CRS). Have your Tax Identification Number (TIN) from your home country ready.

Top Banks in Singapore for Foreigners

The top banking choices for foreigners are DBS, OCBC, and UOB for local presence, while Citibank and HSBC offer superior global connectivity for expats.

Let’s break down the strengths of each to help you choose.

DBS / POSB

- Best For: Accessibility and Digital Innovation.

- Why: They have the largest network of ATMs across the island. Their app, digibank, is world-class.

- Foreigner Friendly? Yes, especially if you have a pass. They have dedicated “Expat” programs.

OCBC

- Best For: Digital Onboarding and Students.

- Why: Known for the “Frank” account (great for students) and the “360 Account” (great for salary crediting).

- Foreigner Friendly? Highly. They allow instant account opening for specific nationalities (e.g., Malaysia, Indonesia, China, Hong Kong) via their app even before arriving in Singapore (in some cases).

UOB

- Best For: Regional Southeast Asia connectivity.

- Why: If you travel frequently to Thailand, Vietnam, or Malaysia, UOB’s regional footprint is advantageous.

- Foreigner Friendly? Yes, but often perceived as slightly more traditional in their branch requirements compared to the aggressive digital push of DBS/OCBC.

International Banks (Citibank, HSBC, Standard Chartered)

- Best For: Expats with existing relationships.

- Why: If you are a Citigold or HSBC Premier customer in your home country, you can often “transfer” your status and open a Singapore account remotely before you land.

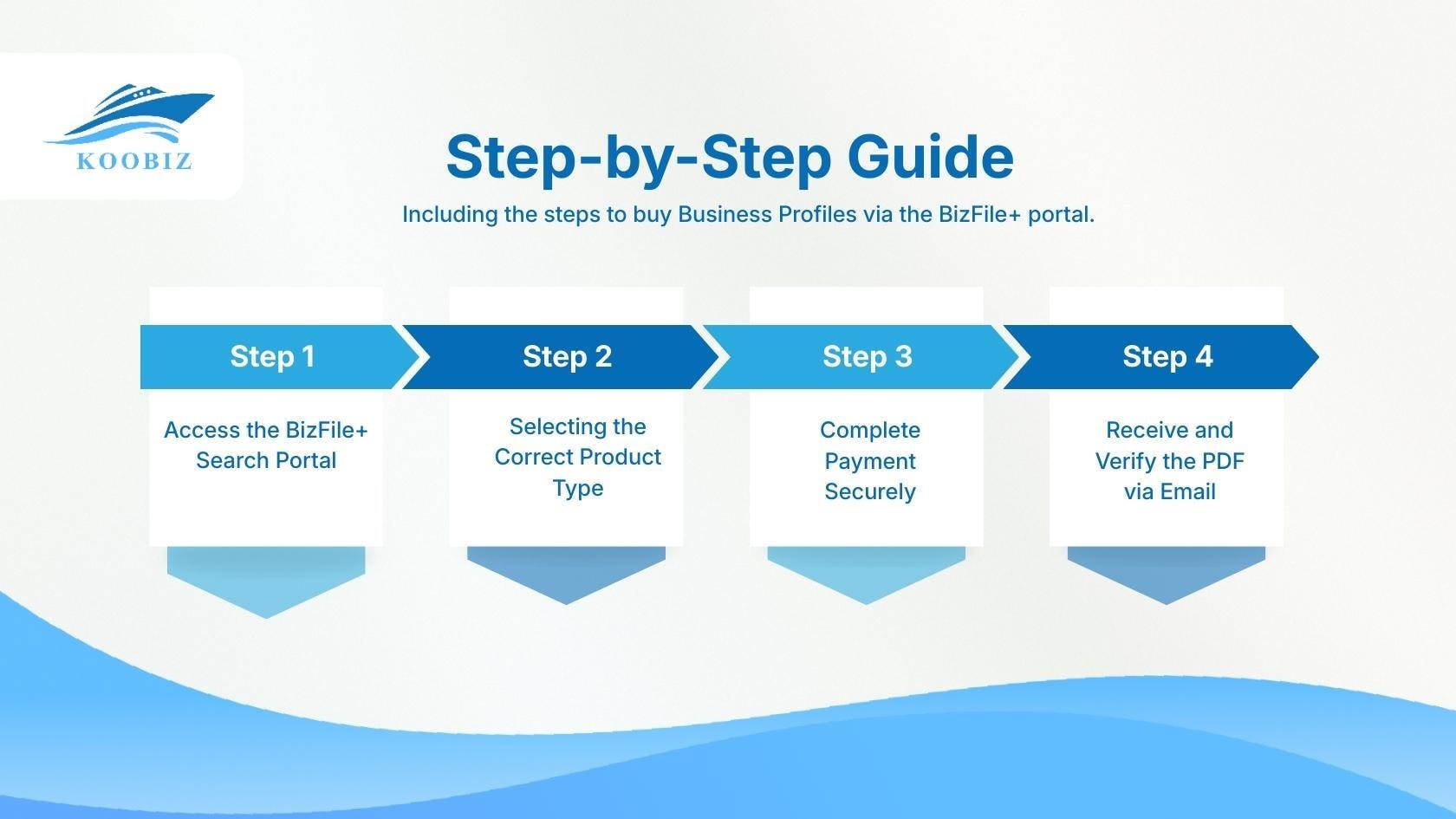

How to Open a Singapore Bank Account: A Step-by-Step Guide

The process involves four key steps: Selecting the right bank, preparing your document portfolio, submitting the application (Online/Offline), and funding the account.

Let’s walk through the actual execution.

Step 1: Choose Your Bank and Account Type

- Analyze your needs: Do you need a multi-currency account (MCA)? Most expats do. DBS Multiplier and UOB One are popular choices.

- Check minimums: Ensure you can meet the initial deposit (usually S$1,000 – S$3,000).

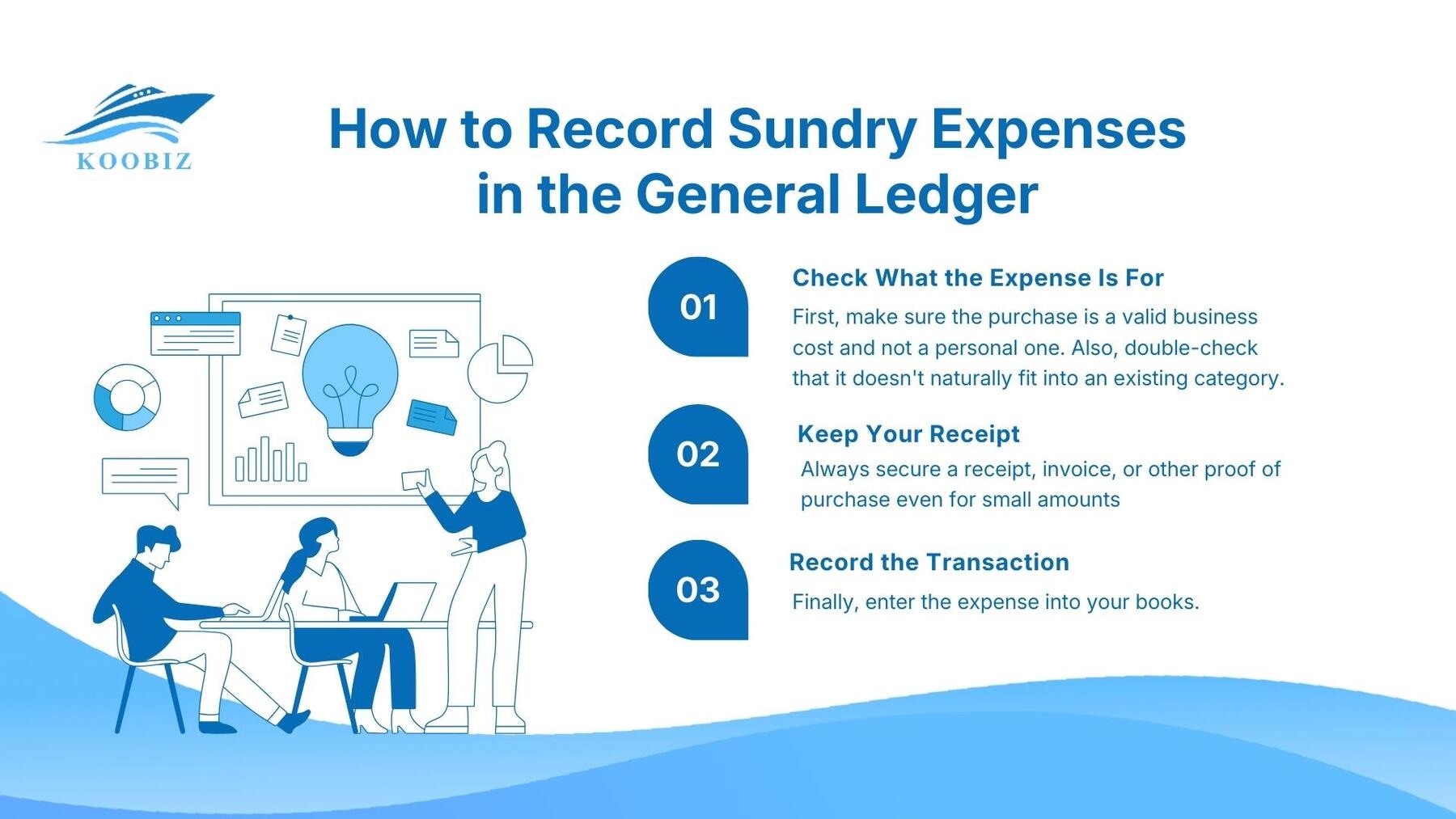

Step 2: Prepare and Digitize Documents

- If your documents (like proof of address from home) are not in English, you must get them officially translated/notarized. Koobiz offers translation and notarization coordination services for our corporate clients.

Step 3: Application Submission

- Method A: Online (Recommended for Residents): Download the bank’s app. Use “Singpass” (if you have set it up) to auto-fill your data. Approval can be instant.

- Method B: In-Branch (For Non-Residents/Complex Cases): Schedule an appointment. Walk-ins can result in long waits. Bring original documents.

Step 4: Verification and Funding

- Verification: You may need to do a video call or visit a branch for biometric verification.

- Funding: Transfer the initial deposit via FAST transfer (if you have another local account), Wise, or an inbound telegraphic transfer.

Real-Life Banking Scenarios: Success Stories & Strategies

To help you visualize your banking journey, here are three common scenarios that foreigners encounter and the specific strategies they used to succeed.

Understanding which “persona” you fit into can save you weeks of rejection and frustration.

Case A: Sarah, The New Expat (Standard Path)

- Profile: Sarah just moved to Singapore from the UK as a Marketing Manager. She has an “In-Principle Approval” (IPA) letter but no physical Employment Pass card yet. She lives in a temporary serviced apartment.

- The Challenge: Most banks rejected her online application because she didn’t have Singpass yet.

- The Strategy: Sarah visited a DBS branch in person with her IPA letter and a “Proof of Employment” letter from her HR that also verified her temporary residential address.

- Koobiz Takeaway: If you haven’t received your Singpass yet, the “Company Letter” is your most powerful tool to bridge the gap before you get your official rental agreement.

Case B: Wei, The Foreign Investor (Non-Resident Path)

- Profile: Wei lives in China and wants to buy a condo in Singapore. He visits Singapore frequently on a tourist visa but has no work pass.

- The Challenge: He was rejected for a standard savings account because he had “no local ties.”

- The Strategy: Wei approached OCBC Premier Banking. By agreeing to deposit S$200,000 (Assets Under Management), he bypassed the need for a work pass. The bank assigned him a Relationship Manager who handled the onboarding.

- Koobiz Takeaway: Money talks. If you are a non-resident, “Priority Banking” is often the only door open to you.

Case C: Liam, The Digital Nomad (Fintech Path)

- Profile: Liam is a freelance consultant in Singapore for 2 months. He has no long-term lease and no local employer.

- The Challenge: Every local bank required a 6-month lease or an Employment Pass.

- The Strategy: Liam opened a Wise account. He used his home address in Australia for verification. Wise provided him with local SGD bank details (Account Number & Bank Code), allowing clients to pay him in SGD via PayNow.

- Koobiz Takeaway: Don’t force a square peg into a round hole. If you don’t fit the strict banking criteria, Fintech is a perfectly legal and efficient bridge.

Now that we have covered the standard “Happy Path” for eligible foreigners, let’s address the complexities: costs, lack of addresses, and digital alternatives that serve as the safety net for those who don’t fit the standard mold.

Understanding Banking Costs and Account Features

Singapore banks charge fees like “fall-below” and early-closure penalties that can catch newcomers off guard – knowing these charges in advance can help you avoid unnecessary costs.

Fall-Below Fees

Most standard accounts (like DBS Multiplier or OCBC 360) require a Minimum Average Daily Balance (MADB), usually between S$3,000 and S$5,000.

- If your balance drops below this average for the month, you are charged a fee (approx. S$2 – S$10).

- Solution: If you cannot maintain this, look for “no minimum balance” accounts like the Standard Chartered JumpStart or digital bank accounts.

Early Account Closure Fees

If you close your account within the first 6 months, banks often charge a penalty (approx. S$30 – S$50).

- Koobiz Advice: Only open an account you intend to keep for at least half a year.

Multi-Currency Features

Most modern bank accounts in Singapore include multi-currency (MCA) features, allowing you to hold currencies like USD, EUR, AUD, and SGD under one account number, an essential benefit for expats earning income in foreign currencies.

How to Open a Bank Account Without a Local Address?

You cannot open a traditional bank account without a proof of address, but you can use temporary solutions or Employer Letters to bridge the gap.

This is a classic “Catch-22”: You need a bank account to rent a house, but you need a house to open a bank account.

- Solution 1: The Company Letter: Ask your HR to provide a formal letter stating your employment and your temporary accommodation address (e.g., serviced apartment). Many banks accept this temporarily.

- Solution 2: Updating Later: Open the account using your overseas address (if the bank allows, usually for expats) and update it to a local address once you sign your tenancy agreement.

- Solution 3: Koobiz Assistance: For business owners incorporating in Singapore with Koobiz, we assist in drafting the necessary resolutions and registered address documents that can support your corporate banking applications, which often smooths the path for personal banking relationships later.

Traditional Banks vs. Digital Banks vs. Fintech Apps

Traditional banks offer full-service reliability and ATMs, Digital Banks offer fee-free convenience, while Fintech apps provide the easiest access for non-residents.

Let’s compare them for the foreigner’s context:

| Category | Examples | Key Features | Pros | Cons & Limitations |

|---|---|---|---|---|

| Traditional Banks | DBS, UOB, OCBC | Physical branches, checking books, ATMs, mortgages. | Full-service reliability, SDIC insured, high-value transaction support. | Strict KYC, requires proof of address, often has monthly fees/minimums. |

| Digital Banks | GXS, MariBank, Trust | Fully licensed by MAS, no physical branches. | Great interest rates, no fall-below fees, fully mobile experience. | Often restricted to Residents (Singpass), deposit caps (e.g., S$75k). |

| Fintech Apps | Wise, Revolut, Aspire | Payment institutions (not banks), multi-currency wallets. | Easiest for non-residents/tourists, excellent FX rates, remote opening. | Funds safeguarded but not SDIC insured, no interest on deposits (usually). |

Can You Open a Bank Account in Singapore from Overseas?

Yes, but usually only if you qualify for Priority Banking or are an existing customer of an international bank with Singapore presence.

Remote opening is a privilege, not a standard feature.

- Priority Banking: If you are willing to deposit S$200k+, relationship managers will facilitate courier documents and video calls to open the account while you are still abroad.

- Standard Accounts: Generally require you to be physically present in Singapore or at least have a Singpass to prove you are “digitally present.”

What is Singpass and How Does it Simplify the Process?

Singpass is Singapore’s trusted digital identity system that allows residents to auto-fill banking applications via MyInfo, reducing approval times from days to seconds.

For foreigners, getting Singpass is a true game changer. Once your EP or LTVP is approved, you can register for Singpass and use the “Retrieve MyInfo with Singpass” option when applying for a bank account. The bank automatically accesses your verified personal and address details, eliminating the need to upload passport scans or utility bills and often enabling instant account activation.

At Koobiz, we know that banking is just one part of settling or doing business in Singapore. From company incorporation and tax compliance to guiding foreigners through complex banking requirements, our team is here to simplify the process and align regulatory steps with your financial objectives.

Ready to start your journey in Singapore?

Visit Koobiz.com today for expert assistance with Company Incorporation, Corporate Banking consultation, and Accounting services tailored for the Singapore market. Let us handle the paperwork so you can focus on your success.