[SUMMARIES]

The Private Limited Company (Pte Ltd) is the superior choice for foreign investors, offering a separate legal entity that shields personal assets and provides access to corporate tax incentives unavailable to simpler structures.

Established corporations expanding into Singapore should prioritize a Subsidiary over a Branch Office to ensure liability protection for the parent entity and secure tax residency status for local exemptions.

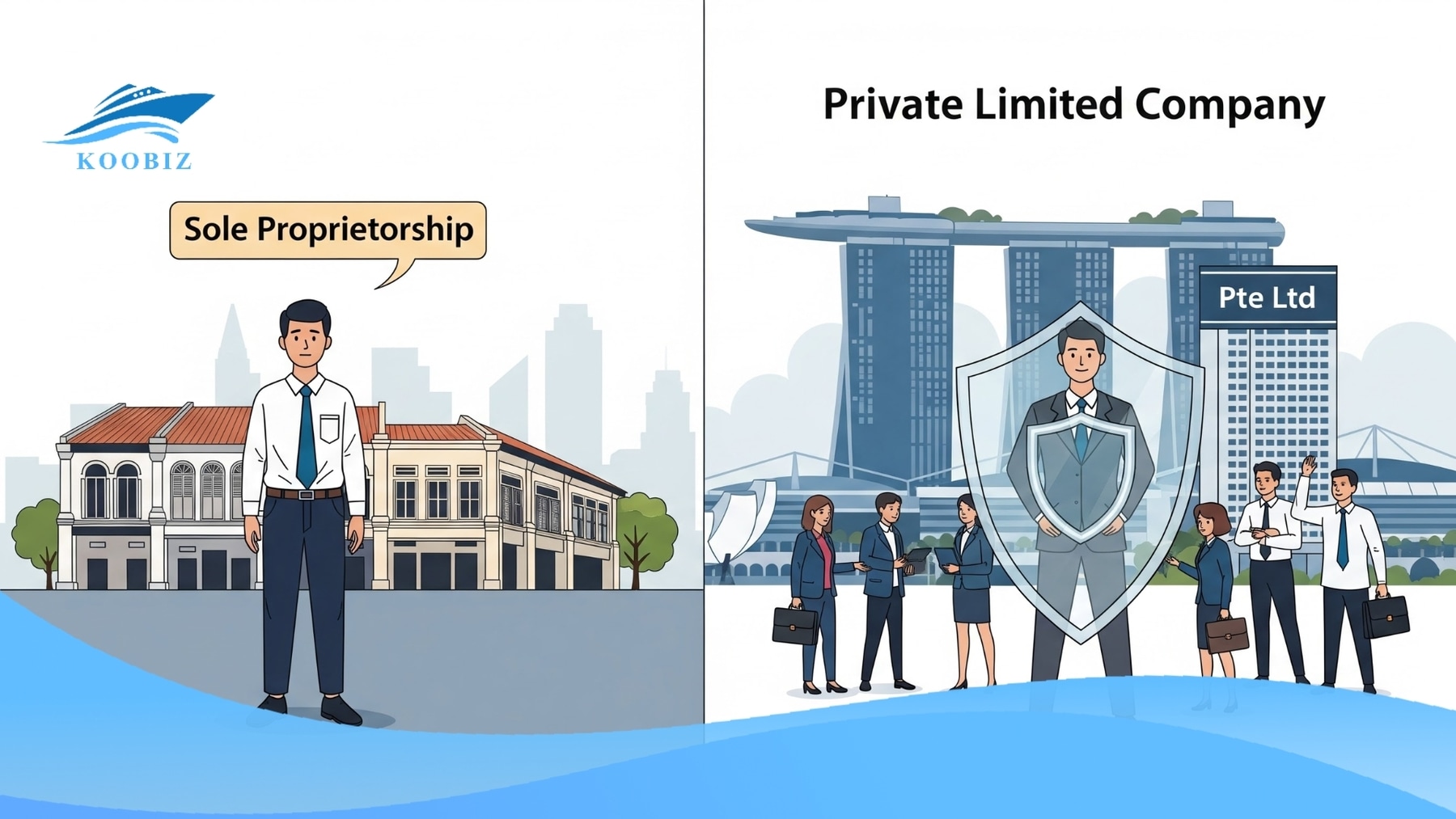

Alternative structures like Sole Proprietorships and LLPs are generally unsuitable for non-residents due to significant drawbacks including unlimited liability exposure, higher personal tax rates, and strict requirements for local authorized representatives.

[/SUMMARIES]

Singapore offers a variety of business structures, but for most international entrepreneurs, the Private Limited Company (Pte Ltd) stands out as the superior choice due to its tax efficiency and legal protection.Although ACRA’s framework recognizes four primary entity types, foreign investors will find a comparative evaluation of five distinct entry strategies to be a more effective guide. .

Certain options, including Sole Proprietorships and LLPs, present significant drawbacks for non-residents, such as personal liability exposure and onerous administrative requirements. Conversely, established foreign corporations must often choose between a Subsidiary and a Branch Office, a decision that impacts tax residency and liability.

Making the wrong choice can lead to unnecessary tax burdens or legal complications down the road. You need a structure that balances operational freedom with maximum asset protection.

To help you navigate this landscape, Koobiz has compiled a comprehensive guide analyzing the legal status, liability, and strategic advantages of the key business structures in Singapore.

What Are the 5 Main Types of Business Structures for Foreigners?

For the purpose of foreign investment, the five most relevant structures are: Private Limited Company (Pte Ltd), Sole Proprietorship, Limited Liability Partnership (LLP), Subsidiary Company, and Branch Office.

Note: While ACRA officially groups “Subsidiaries” and “Branch Offices” under broader registration categories, we present them here as distinct options because of their specific applications for international operations.

To determine which structure best serves your objectives, a clear understanding of each one’s definition and fundamental characteristics is essential..

What Is a Private Limited Company (Pte Ltd)?

A Private Limited Company (Pte Ltd) is a separate legal entity distinct from its shareholders and directors, limited by shares and capable of suing or being sued in its own name.

This structure is the most common and preferred choice for entrepreneurs because it provides a protective shield over personal assets.

- Separate Legal Entity: The company has its own rights and obligations, separate from the owners .

- Limited Liability: Shareholders are only liable for the amount of their paid-up capital. If the company incurs debt, personal assets remain safe.

- Perpetual Succession: The entity continues to exist even if shareholders die or transfer their shares, ensuring business longevity.

What Is a Sole Proprietorship?

A Sole Proprietorship is the most straightforward business structure, defined by the legal unity of a single owner and their enterprise. Although registration is relatively simple, this form presents considerable disadvantages for foreign nationals, including substantial liability exposure and regulatory complexities..

- Unlimited Liability: The owner bears full personal responsibility for all business debts and legal liabilities. Creditors have the right to claim the owner’s personal assets, such as savings and property, to satisfy business obligations.

- Foreigner Restrictions: While foreign registration is permitted, non-resident owners are mandated to appoint a locally resident authorized representative (a Singapore citizen, Permanent Resident, or eligible pass holder). Crucially, business registration does not confer the right to work in Singapore; a separate work pass must be obtained, creating a significant operational hurdle.

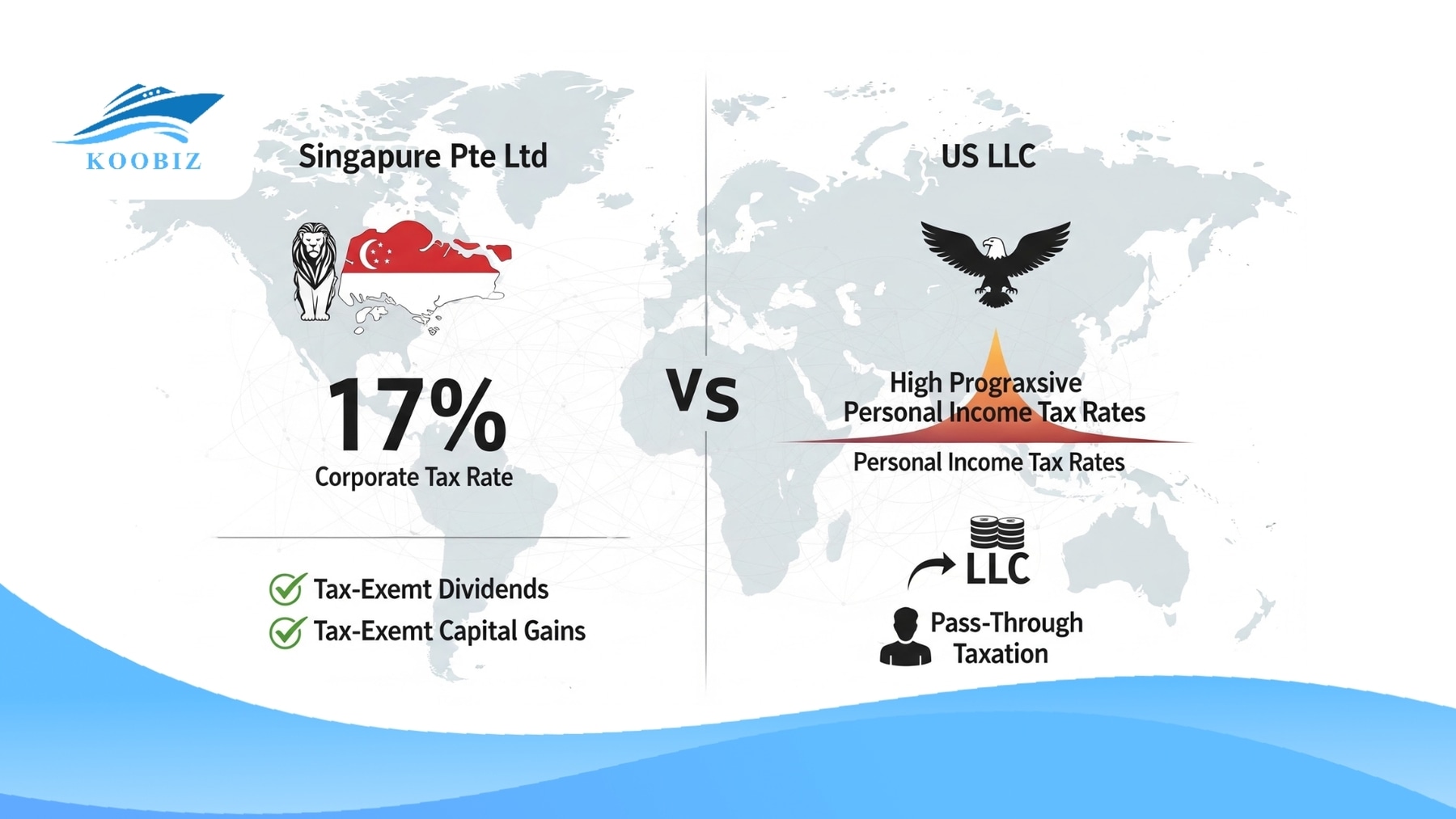

- No Corporate Tax Rates: Business profits are not taxed at corporate rates. Instead, they are treated as the owner’s personal income and taxed at individual progressive rates, which can be markedly higher than corporate taxes for owners with substantial earnings.

What Is a Limited Liability Partnership (LLP)?

A Limited Liability Partnership (LLP) is a versatile business format that offers the best of both worlds: the flexible, collaborative spirit of a traditional partnership, along with the legal protection usually found in a private limited company.

This format is typically favored by professionals such as lawyers, accountants, and architects who want to team up with others, without being personally held responsible for mistakes made by their partners.

- Liability Protection: Partners are not personally liable for the wrongful acts or misconduct of other partners, though they remain liable for their own.

- Compliance: LLPs have fewer compliance requirements than Pte Ltd companies (e.g., no need to file annual returns if a declaration of solvency is lodged), but they do not enjoy the same corporate tax exemptions.

What Is a Subsidiary Company?

A Subsidiary Company is essentially a private limited company set up in Singapore that is mostly owned by another company. That parent company could be based overseas or right here in Singapore.

For international businesses looking to grow into Singapore, this is usually the top choice. It lets you establish a local presence and adapt to the market, all while staying connected to your main global brand.

- Distinct Entity: It is treated as a local resident company, separate from the foreign parent company.

- Liability Shield: The parent company’s liability is limited to the share capital subscribed in the subsidiary.

- Tax Benefits: As a resident entity, a subsidiary is eligible for local tax incentives and exemptions, unlike a Branch Office.

What Is a Branch Office?

A Branch Office is a registered legal extension of a foreign parent company, not a separate legal entity, meaning the parent bears full responsibility for its acts and omissions.

This structure is typically used by multinational corporations that prefer centralized management and do not mind the extended liability.

- Extension of Parent: The Branch is the same legal entity as the headquarters. Its name must match the foreign parent company exactly.

- Unlimited Liability for Parent: Any lawsuit or debt incurred by the Singapore branch is legally the responsibility of the foreign head office.

- Non-Resident for Tax: A Branch is generally considered a non-resident entity for tax purposes, making it ineligible for many local tax exemptions available to Pte Ltd companies.

Koobiz Insight: If you are unsure which structure fits your business model, our team at Koobiz provides free consultation to assess your liability tolerance and tax goals.

Quick Comparison of the 5 Business Structures

| Structure | Legal Status | Liability | Tax Status | Setup Cost | Annual Compliance | Ideal For |

|---|---|---|---|---|---|---|

| Private Limited (Pte Ltd) | Separate Entity | Limited | Corporate Tax (Resident) | Medium | High (AGM, Returns) | SMEs, Startups, Foreigners |

| Sole Proprietorship | Not Separate | Unlimited | Personal Income Tax | Low | Low | Small Local Businesses |

| Limited Liability Partnership (LLP) | Separate Entity | Limited | Taxed at Partner Level | Low-Medium | Low-Medium | Professional Firms |

| Subsidiary Company | Separate Entity | Limited | Corporate Tax (Resident) | Medium | High | Foreign Companies (Independence) |

| Branch Office | Extension of Parent | Unlimited (Parent) | Corporate Tax (Non-Resident) | High | High (Parent accounts required) | MNCs (Centralized Control) |

Still undecided? Get a Free Assessment from Koobiz

Which Business Structure Is Best for Foreigners?

The Private Limited Company (Pte Ltd) wins on tax efficiency and liability protection, the Subsidiary is best for corporate expansion, while the Branch Office suits MNCs prioritizing centralized control over tax benefits.

Choosing the right structure is not just about registration ease; it is about long-term operational efficiency, tax residency, and risk management.

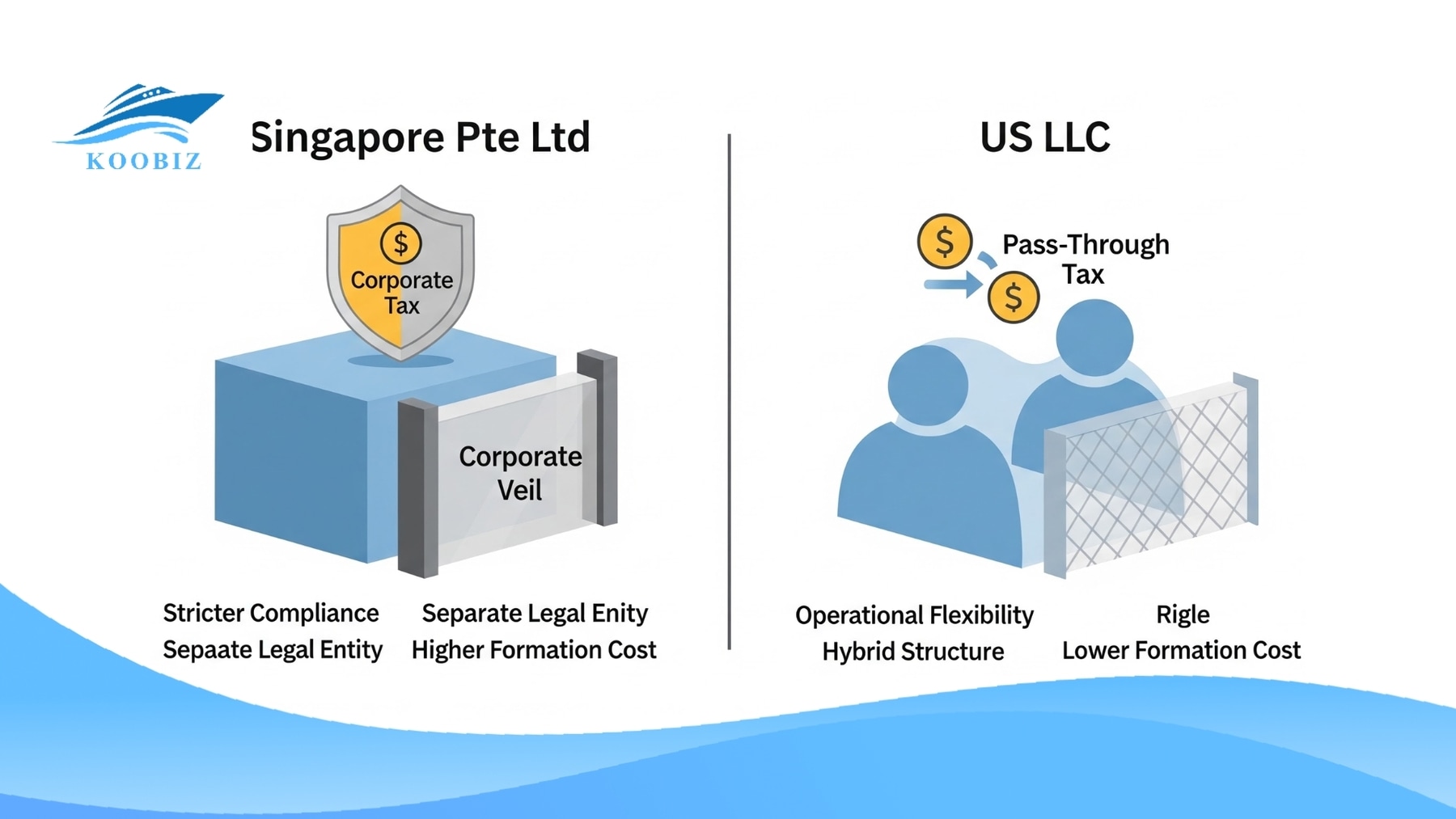

How Do Pte Ltd, Subsidiary, and Branch Office Compare?

When comparing the three most relevant options for foreign investors, the distinctions lie primarily in legal liability and tax residency status.

| Feature | Private Limited (Pte Ltd) | Subsidiary Company | Branch Office |

|---|---|---|---|

| Liability | Limited. Shareholders are protected; liability is limited to share capital. | Limited. Parent company is protected; liability is limited to share capital. | Unlimited. Parent company is fully liable for all debts and lawsuits. |

| Tax Residency | Resident. Eligible for tax exemptions (SUTE) and Double Taxation Agreements. | Resident. Eligible for tax exemptions (SUTE) and Double Taxation Agreements. | Non-Resident. Not eligible for local tax exemptions or treaties. |

| Ownership | Can be owned by individuals (foreign or local) or corporations. | Majority owned by a foreign or local corporate entity. | Not a separate entity; it is a registered extension of the foreign parent. |

| Legal Status | Separate Legal Entity. | Separate Legal Entity. | Same Legal Entity as Parent. |

What Are the Key Differences Between Sole Proprietorship and Pte Ltd?

The Private Limited company offers superior protection and tax efficiency, whereas a Sole Proprietorship exposes the owner to unlimited risk and higher personal tax rates.

Many entrepreneurs mistakenly choose Sole Proprietorship for its low initial cost, only to face significant hurdles later.

- Risk Profile: In a Sole Proprietorship, if the business fails, your personal savings, house, and car can be seized to pay debts. In a Pte Ltd, your personal assets are legally untouchable regarding business debts.

- Funding Capabilities: A Pte Ltd can raise capital by issuing new shares to investors. A Sole Proprietorship cannot issue shares, limiting fundraising to personal loans.

- Perception: A Pte Ltd (suffixed “Pte Ltd”) carries a professional image and credibility that appeals to suppliers, banks, and clients, unlike a Sole Proprietorship.

Real-World Scenarios: Choosing the Right Entity

To clarify these legal definitions, let’s look at three practical case studies of Koobiz clients (names anonymized) to see which structure they chose and why.

Case Study 1: The E-commerce Entrepreneur (Sarah from UK)

- Situation: Sarah runs a dropshipping business. She lives in London but wants to incorporate in Singapore to sell globally. She considered a Sole Proprietorship for its simplicity.

- The Problem: As a non-resident, registering a Sole Proprietorship required finding a local authorized representative, which was complicated. Furthermore, she was worried about suppliers suing her personally.

- The Koobiz Solution: Sarah incorporated a Private Limited Company (Pte Ltd).

- Result: She gained limited liability protection and qualified for tax exemptions, reinvesting the savings into ads.

Case Study 2: The Tech Expansion (TechCorp USA)

- Situation: A successful US software company wanted to hire sales staff in Singapore. They considered a Branch Office to keep things simple and centralized.

- The Problem: If the Singapore team made a mistake leading to a lawsuit, the US Head Office would be fully liable. Also, a Branch Office is not eligible for local tax grants.

- The Koobiz Solution: They set up a Subsidiary Company.

- Result: The Subsidiary acts as a firewall; if the Singapore office fails, the US assets are safe. They also accessed local government grants for tech adoption that a Branch Office would have missed.

Case Study 3: The Market Testing (GreenEnergy Germany)

- Situation: A German energy firm wanted to explore the Asian market but had no clients yet. They did not want to deal with complex annual tax filings.

- The Problem: Setting up a full company requires a Company Secretary and annual filing, which felt like too much admin for a non-revenue phase.

- The Koobiz Solution: They registered a Representative Office (RO) (See “Bonus Option” below).

- Result: This allowed them to move two staff members to Singapore to conduct market research. Since an RO cannot earn revenue, they had zero tax liability and minimal paperwork, perfectly suiting their 2-year exploration phase.

Having established the definitions and comparative advantages of the various business structures through definitions and case studies, we now transition to the specific legal requirements, operational nuances, and “unique attributes” that foreign investors must navigate after selecting their entity.

Ready to start your business journey? Koobiz specializes in company incorporation and corporate services for international clients. From setting up your Pte Ltd to providing a reliable Nominee Director, we handle the complexities so you can focus on growth. Contact Koobiz today for a free consultation.

Disclaimer: This article provides general information and does not constitute legal or tax advice. Regulations can change, and you should consult with a professional corporate service provider like Koobiz to understand the specific implications for your business.