[SUMMARIES]

Mandatory Requirement: Most Singapore-incorporated companies must file financial statements in XBRL format with ACRA, except for specific exemptions, such as solvent Exempt Private Companies (EPCs) that choose to file their financial statements in PDF format.

Two Taxonomies: Companies must choose between ‘Full XBRL’ and ‘Simplified XBRL’ based on their company type and whether they are required to file a full set of financial statements with ACRA, rather than on revenue or asset thresholds.

BizFinx Tool: Companies may use ACRA’s BizFinx Preparation Tool or other ACRA-compatible accounting software to prepare, validate, and submit XBRL financial statements.

Compliance is Key: Errors in XBRL mapping or applying an incorrect taxonomy may result in resubmission requests or filing delays. Engaging professional assistance, such as Koobiz, helps ensure accuracy and regulatory compliance

[/SUMMARIES]

Navigating the regulatory landscape of Singapore can be daunting for business owners, particularly when it comes to the technicalities of filing financial statements in XBRL format. Whether you are a newly incorporated startup or an established enterprise, understanding ACRA’s digital reporting requirements is crucial for maintaining good standing.

At Koobiz, we often encounter clients confused about whether they should file under the ‘Simplified XBRL’ or are required to adopt the ‘Full XBRL’ taxonomy. This comprehensive guide will demystify the XBRL mandate, helping you determine exactly which template applies to your business, how to execute the filing process using BizFinx or other ACRA-compatible tools, and how to avoid common compliance pitfalls in the evolving 2025 landscape.

What is XBRL Filing?

XBRL Filing refers to the mandatory process for most Singapore-incorporated companies to convert and submit their financial statements to ACRA in a machine-readable format.

While XBRL (eXtensible Business Reporting Language) is the global standard technology used to tag financial data (like revenue, assets, and liabilities), XBRL Filing refers to the specific compliance action Singapore companies must take. Instead of just uploading a static PDF of your accounts, companies required to file in XBRL must use the ACRA-approved taxonomy to map their financial figures into this digital format and submit them as part of their Annual Return. This ensures that the data is not just stored, but is ready for analysis and comparison by regulators and investors.

Why Does ACRA Require It?

To understand why this matters to your business, we must look at the objective behind the mandate: transparency and efficiency.

ACRA requires most Singapore-incorporated companies to file financial statements in XBRL format to achieve several key objectives:

- Enhance Transparency: It ensures financial data is presented in a consistent, standardized format, making the marketplace more transparent for all stakeholders.

- Improve Efficiency: Being machine-readable, XBRL allows regulators and auditors to analyze vast amounts of data instantly without manual processing.

- Facilitate Comparison: It allows investors to easily compare the financial performance of different companies within the same industry (comparing apples to apples).

- Boost Pro-Business Reputation: A transparent corporate environment builds trust with international investors and strengthens Singapore’s status as a trusted global business hub.

For companies working with Koobiz, this transition to digital reporting is not just a compliance hurdle but a step towards better financial visibility and governance.

Who Must File Financial Statements in XBRL Format?

The majority of Singapore-incorporated companies are required to file their financial statements in XBRL format with ACRA.

However, the scope of this requirement depends on the specific type of business entity you operate. Generally, the mandate applies primarily to companies limited by shares, while companies limited by guarantee may be subject to different filing requirements depending on their regulatory status. Specifically, if your company is Singapore-incorporated (unlimited or limited by shares), you are legally obliged to file your financial statements in XBRL format, using either the Full or Simplified taxonomy, unless you fall into a specific exempted category.

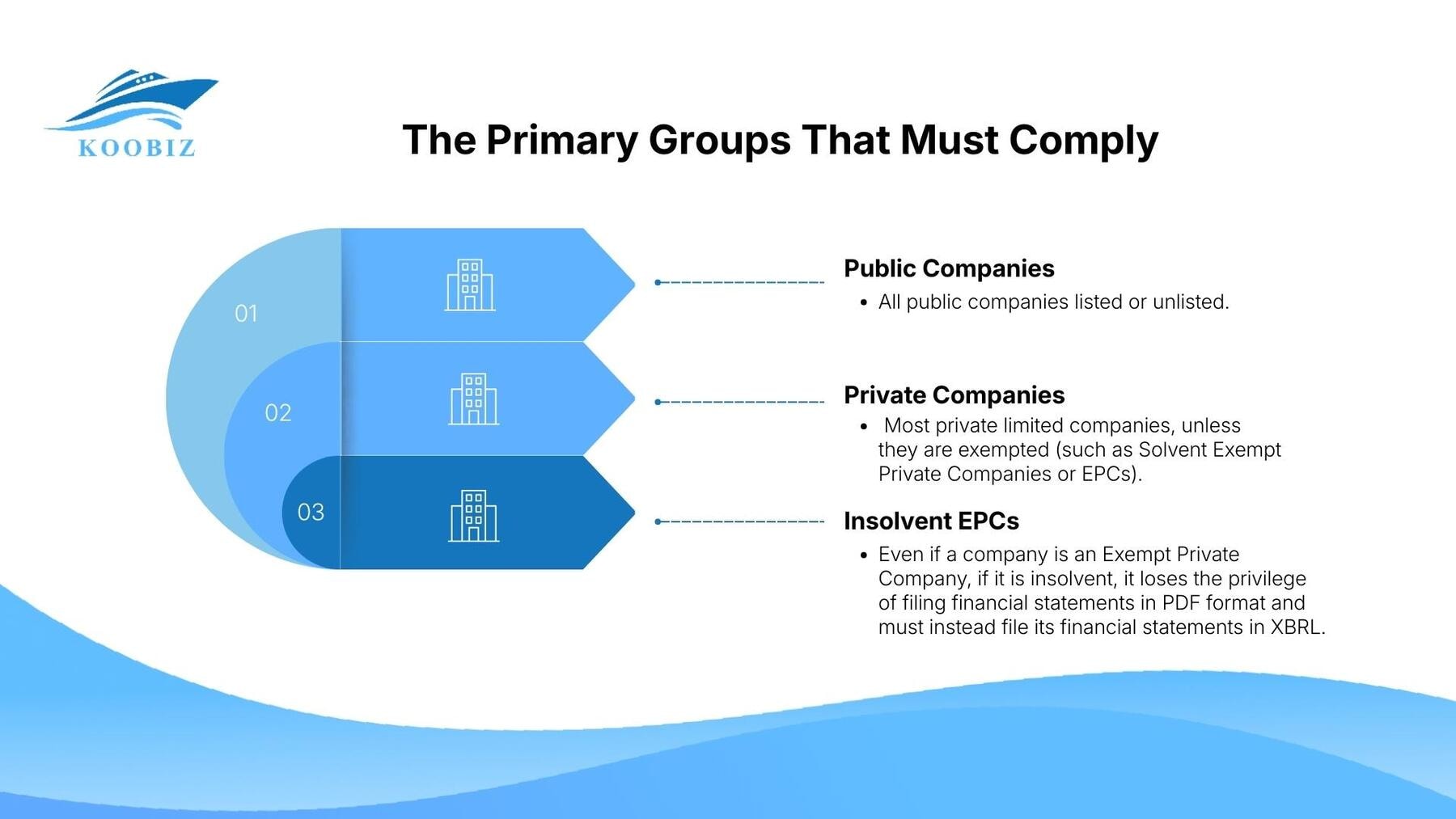

The primary groups that must comply include:

- Public Companies: All public companies listed or unlisted.

- Private Companies: Most private limited companies, unless they are exempted (such as Solvent Exempt Private Companies or EPCs).

- Insolvent EPCs: Even if a company is an Exempt Private Company, if it is insolvent, it loses the privilege of filing financial statements in PDF format and must instead file its financial statements in XBRL.

Understanding these distinctions is the first step in compliance. If your company falls within the mandatory group, the next critical decision is determining the depth of data you need to report—whether to use the Full or Simplified taxonomy.

Full vs. Simplified XBRL: Which Taxonomy Applies to You?

The Full and Simplified XBRL taxonomies are applied based on a company’s filing obligations with ACRA, rather than its size or public accountability.

Choosing the correct XBRL taxonomy is important, as using the wrong one may result in your Annual Return being rejected or delayed. The table below outlines the key differences between Full XBRL and Simplified XBRL to help you determine which option applies to your company.

| Feature | Full XBRL Taxonomy | Simplified XBRL Taxonomy |

|---|---|---|

| Applicable Companies | Publicly accountable or larger entities | Smaller, privately held companies (SMEs) |

| Revenue Criteria | Exceeds SGD 500,000 | SGD 500,000 or less |

| Total Assets Criteria | Exceeds SGD 500,000 | SGD 500,000 or less |

| Data Elements (Tags) | ~210 elements (High granularity) | ~120 elements (Key highlights only) |

| Notes to Accounts | Comprehensive disclosure required | Limited disclosure required |

Companies with revenue or total assets above SGD 500,000 are required by ACRA to file financial statements using the Full XBRL taxonomy. In contrast, Simplified XBRL is designed for smaller companies, allowing startups and SMEs to meet ACRA’s filing requirements with fewer disclosures and lower compliance effort.

How to Prepare and File XBRL Financial Statements

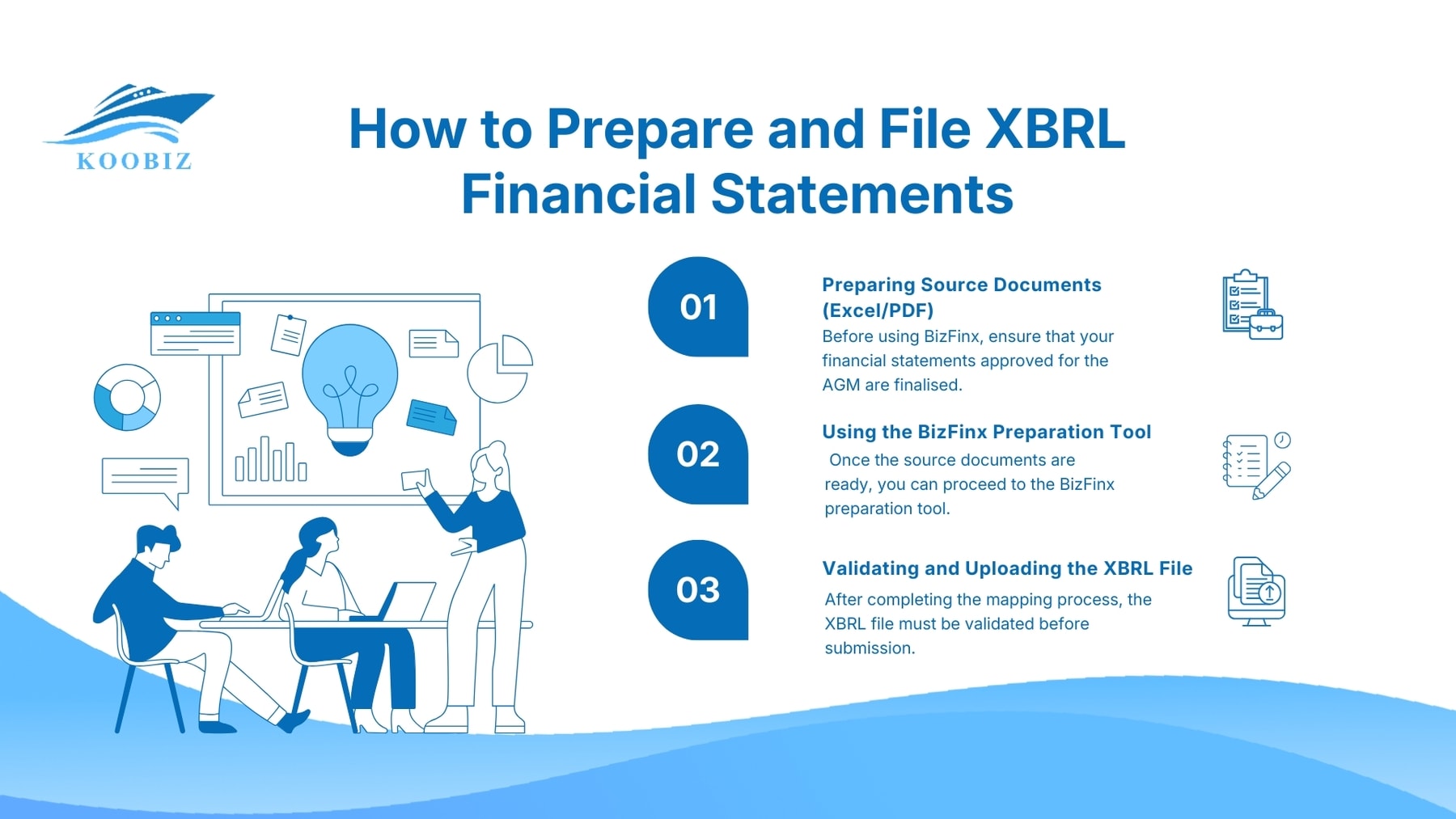

Preparing XBRL financial statements generally follows three main steps: preparing the source documents, mapping data in BizFinx, and validating the file before submission.

ACRA provides a free tool called BizFinx to help companies prepare and file XBRL financial statements. Although BizFinx is free to use, accurately interpreting financial figures and mapping them to the correct XBRL tags requires technical knowledge. Whether the filing is handled internally or outsourced to a professional service provider, the overall workflow remains the same.

Step 1: Preparing Source Documents (Excel/PDF)

Before using BizFinx, ensure that your financial statements approved for the AGM are finalised.

- The Directors’ Statement and Auditors’ Report (if applicable) should also be completed at this stage.

- If you intend to import data into BizFinx, preparing an Excel template in advance can help reduce manual data entry.

Step 2: Using the BizFinx Preparation Tool

Once the source documents are ready, you can proceed to the BizFinx preparation tool.

- Input Basic Data: Enter the company UEN and financial period.

- Select Template: Choose “Full” or “Simplified” based on the criteria discussed in the previous section.

- Mapping (Tagging): Mapping (tagging) is the key step in the XBRL process, where figures from the financial statements are mapped to the relevant XBRL tags within BizFinx. For example, “Cash at Bank” in your balance sheet must be mapped to the “Cash and Cash Equivalents” tag in the taxonomy.

Step 3: Validating and Uploading the XBRL File

After completing the mapping process, the XBRL file must be validated before submission.

- Validation: Use the ‘Validate’ function in BizFinx to run system checks on the XBRL file.BizFinx checks for common issues such as arithmetic inconsistencies (for example, Assets not equalling Liabilities plus Equity) and missing mandatory disclosures.

- Generation: After all validation errors have been resolved, the system will allow you to generate the XBRL (.xml) file.

- Upload: Log in to the BizFile+ portal to file your Annual Return and upload this generated .xml file as the financial statement component.

We have covered the standard procedures and definitions. Now, we will delve into the exceptions and common challenges that specific business models might face.

Exemptions and Special Cases in XBRL Filing

There are specific exemptions for Solvent Exempt Private Companies (EPCs) and certain other entities, allowing them to bypass full XBRL filing under strict conditions.

Although ACRA prioritizes a ‘digital-first’ approach, the agency understands that for some business models, the cost outweighs the benefit. Knowing whether you qualify for these exemptions can save your business significant time and budget.

Filing Requirements for Solvent vs. Insolvent EPCs

A frequent question we handle at Koobiz revolves around Exempt Private Companies (EPCs).

- Solvent EPCs: If your EPC is solvent (able to pay its debts), you are exempt from filing financial statements with ACRA entirely. You only need to make a solvency declaration during the Annual Return. The bottom line: You are completely exempt from XBRL filing.

- Insolvent EPCs: If an EPC is insolvent, it must file financial statements. If this happens, you are required to file in XBRL format (usually Simplified, assuming revenue criteria are met).

- Voluntary Filing: A solvent EPC may choose to file financial statements voluntarily. If they do, they can choose to file in either PDF or XBRL format.

Exemptions for CLGs and Foreign Companies

ACRA recognizes that not every entity fits the standard commercial mold.

- Companies Limited by Guarantee (CLGs): Commonly used for non-profits and charities, CLGs get a pass on the complex data entry. They are only required to file a PDF copy of their financial statements.

- Foreign Companies (Singapore Branch): Singapore branches of foreign companies verify their accounts based on the laws of their home country. They are exempt from XBRL filing and you only need to file a PDF copy of their financial statements.

Common Challenges and Best Practices for XBRL Mapping

Misunderstanding the Scope / The Expert Fix

XBRL is not just data entry; it is a translation of financial concepts. A mismatch between a line item in your PDF report and the ACRA taxonomy tag creates a misleading public record.

Avoiding Common Validation Errors in BizFinx

Validation errors often occur due to arithmetic imbalances or missing mandatory tags.

- Rounding Off: A common issue is rounding discrepancies where the total assets do not match the sum of individual components due to decimal rounding.

- Negative Values: Some tags expect positive values (e.g., “Less: Expenses”), while others expect negative values. Getting the sign wrong is a classic error.

- Unmapped Data: Leaving mandatory fields blank because the specific line item doesn’t exist in your accounts (you should enter “0” rather than leaving it null if mandatory).

In-House Preparation vs. Outsourcing to Corporate Services

Given these complexities, businesses face a choice:

- In-House: Requires training staff on BizFinx and accounting standards. It is cost-effective for simple accounts but risky if staff are inexperienced.

- Outsourcing: Outsourcing to Koobiz (The Expert Route). This ensures that the mapping is done by accountants who understand both the financial standards (FRS) and the technical taxonomy.

Emerging Trends in 2025: ESG and Enhanced Data

ACRA is no longer satisfied with just ‘balancing the books.’ In 2025, the agency is tightening its lens.

The compliance landscape is evolving. Beyond basic financial data, moving beyond basic financial figures to demand a 360-degree view of corporate health and sustainability.

- Mandatory Climate Reporting: Starting FY2025, listed issuers are required to report climate-related disclosures (Scope 1 and Scope 2 greenhouse gas emissions). While this currently targets public companies, it is the ‘canary in the coal mine’ for private enterprises.

- Enhanced Data Granularity: The latest taxonomies require more precise tagging of revenue streams and expenses. The days of using ‘Other Expenses’ as a catch-all bucket are over. Relying on vague tags is now a compliance red flag that invites unnecessary scrutiny.

Frequently Asked Questions (FAQ)

What if my revenue is exactly SGD 500,000?

If your revenue (and assets) is exactly SGD 500,000 or less, you qualify for the Simplified XBRL taxonomy. You only move to Full XBRL if you exceed this amount.

Can I apply for an exemption from XBRL filing?

Yes, companies can apply for specific exemptions (e.g., if the company is dormant or has specific regulatory reasons) by lodging a specific transaction form with ACRA, though approval is case-by-case.

My company is a Solvent EPC. Should I file voluntarily?

This is a strategic choice. Filing voluntarily can improve your credit standing with banks and suppliers, as it shows transparency. If you choose to file, you can submit a PDF copy or use XBRL.

Conclusion

XBRL is more than just a regulatory checkbox; it is your company’s digital financial footprint. Whether you are navigating the nuances of the Full vs. Simplified taxonomy or troubleshooting BizFinx validation errors, precision is paramount.

At Koobiz, we specialize in decoding the complex corporate landscape of Singapore for international and local entrepreneurs. From company incorporation to tax, accounting, and audit services, we ensure your business remains compliant so you can focus on growth. If you are unsure about your XBRL obligations or need assistance with your Annual Return, our team of experts is ready to help.

Visit Koobiz.com today for professional assistance with your Singapore corporate filing needs.