[SUMMARIES]

The Certificate of Incorporation acts as a company’s permanent “birth certificate” issued by ACRA to prove its legal existence and separate entity status, distinct from the Business Profile which tracks dynamic details like current shareholders.

Since 2017, this document is issued by default as a valid digital E-Certificate, meaning founders generally do not receive a physical hard copy unless they specifically purchase a “Certificate of Confirmation” separately.

Retrieving this document is a critical step for opening bank accounts and signing contracts, and its authenticity can be instantly validated by stakeholders via the ACRA BizFile+ portal using the unique embedded QR code.

[/SUMMARIES]

The Certificate of Incorporation is the official legal document issued by the Accounting and Corporate Regulatory Authority (ACRA), serving as conclusive evidence that a company has been legally registered and currently exists in Singapore. For foreign entrepreneurs and local startups alike, possessing this document is the first definitive milestone in the business formation journey, validating the entity as a separate legal person distinct from its owners.

However, obtaining this document is not merely about receiving a piece of paper; specifically, many new directors struggle with the procedural nuances of retrieving the digital version via the BizFile+ portal or understanding why they did not receive a physical hard copy upon registration. This confusion often leads to delays in subsequent administrative tasks, such as setting up corporate bank accounts or signing office leases, where proof of valid incorporation is mandatory.

Furthermore, a common pitfall for investors is failing to distinguish between the Certificate of Incorporation and the Business Profile, as the former provides static proof of birth while the latter offers a dynamic snapshot of current company details. Understanding the specific function of each document is crucial for compliance and due diligence, ensuring that you present the correct verification materials to stakeholders, banks, and government bodies when requested.

To help you navigate these corporate requirements efficiently, the following sections will explore the essential definitions, components, and retrieval methods of the Certificate of Incorporation. Let’s begin by establishing a solid understanding of what this document actually represents in the Singaporean legal framework.

What is a Certificate of Incorporation in Singapore?

The Certificate of Incorporation is a statutory legal document that acts as the company’s primary legal proof of existence, confirming its valid formation and full compliance with the requirements of the Singapore Companies Act.

To elaborate on this definition, it is important to understand that this certificate is issued solely by ACRA, which is the national regulator of business entities in Singapore. When a company is successfully registered, ACRA issues this notification (usually via email) to confirm that the entity now has a legal personality. This means the company can own property, sue or be sued, and has perpetual succession. For entrepreneurs using services like Koobiz to handle their incorporation, this certificate is the primary deliverable that signals your business is ready to operate.

Historically, this document was a physical certificate with a seal, but in the modern digital economy of Singapore, it primarily exists as a secure electronic file. It serves as the ultimate proof of the company’s existence. Without it, a business cannot legally enter into contracts, open bank accounts, or apply for necessary licenses. It is the foundational document upon which all other corporate governance and operational activities are built.

Industry Insight: According to ACRA’s latest regulations, the electronic notification of incorporation is treated as admissible evidence in court, carrying the same legal weight as the traditional hard copy certificates used in the past.

What Information Does the Certificate of Incorporation Contain?

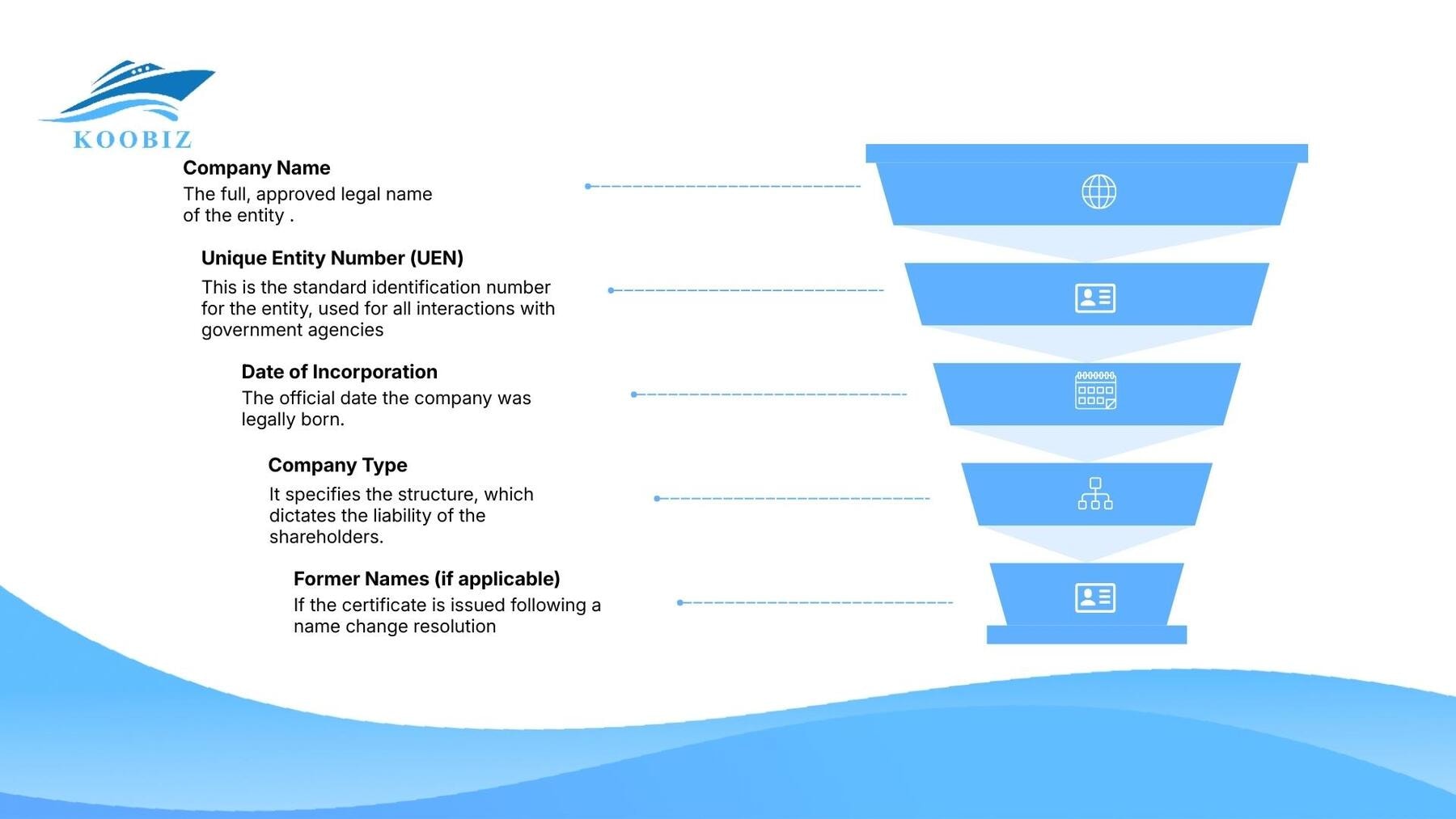

There are five key categories of information typically displayed on a standard Singapore Certificate of Incorporation, structured to provide immediate identification of the entity.

Specifically, the document is designed to be concise yet authoritative. Unlike the Business Profile which runs into multiple pages, the Certificate of Incorporation is usually a single-page document. The information contained within is static—meaning it reflects the state of the company at the specific moment of incorporation (or change of name).

- Company Name: The full, approved legal name of the entity (e.g., “Koobiz Pte. Ltd.“). This confirms that the name has been reserved and is compliant with ACRA’s naming policies.

- Unique Entity Number (UEN): This is the standard identification number for the entity, used for all interactions with government agencies (similar to a tax ID or social security number for the company).

- Date of Incorporation: The official date the company was legally born. This date is critical for determining tax cycles and annual filing deadlines.

- Company Type: It specifies the structure, such as “Private Company Limited by Shares,” which dictates the liability of the shareholders.

- Former Names (if applicable): If the certificate is issued following a name change resolution, it will often cite the previous name of the company to maintain historical continuity.

This concise data set allows third parties to quickly verify the identity of the business without wading through sensitive ownership details. It acts as a high-level identity card for the corporation.

Certificate of Incorporation vs. Business Profile: What is the Difference?

The Certificate of Incorporation serves as proof of existence (Static), whereas the Business Profile provides proof of current status (Dynamic), making them two distinct but complementary documents.

To distinguish these clearly, think of the Certificate of Incorporation as a person’s Birth Certificate, and the Business Profile as their current Identity Card or Passport. The Certificate proves that the company exists and when it was born. It does not change unless the company changes its name. On the other hand, the Business Profile (often called the “BizFile“) contains up-to-date information regarding the directors, shareholders, registered address, paid-up capital, and compliance status.

Comparison Table:

| Feature | Certificate of Incorporation | Business Profile (BizFile) |

|---|---|---|

| Nature | Static (Birth Certificate) | Dynamic (Current ID) |

| Content | Name, UEN, Date, Type | Directors, Shareholders, Address, Capital |

| Usage | Proof of Legal Personality | Due Diligence, KYC, Bank Account Opening |

| Frequency | Issued once (mostly) | Purchased frequently for updates |

Banks and investors usually require both documents. The Certificate proves the entity is real, while the Business Profile proves who currently owns and runs it. Koobiz advises clients to keep the latest copy of the Business Profile handy, as banks typically require a profile dated within the last 3 to 6 months.

Data Point: Financial institutions in Singapore adhere to strict Anti-Money Laundering (AML) regulations, which is why a Certificate of Incorporation alone is rarely sufficient for opening a corporate account; the Business Profile is needed to identify the Ultimate Beneficial Owners (UBOs).

Is the Certificate of Incorporation Issued as a Hard Copy?

No, the Certificate of Incorporation is not issued as a hard copy by default; ACRA has shifted to a fully digital issuance system known as the “E-Certificate” since 2017.

In the past, company owners would receive a sealed paper certificate. However, in line with Singapore’s Smart Nation initiative, the default mode of delivery is now an email notification containing a URL to download the digital certificate. This measure increases efficiency and reduces the risk of forgery. If a physical “hard copy” is absolutely required (perhaps for a foreign jurisdiction that insists on paper), it must be purchased separately.

This “hard copy” is officially termed a “Certificate of Confirmation of Registration” or a certified extract. It is not the “original” in the traditional sense, but rather a certified printout generated by ACRA. Most local transactions in Singapore, including banking and legal contracts, accept the digital PDF version without issue.

Why this matters for you:

- Speed: You receive it immediately upon incorporation approval.

- Cost: It is included in the incorporation fee (no extra courier costs).

- Storage: It can be stored in the cloud and shared easily with stakeholders.

How to Retrieve or Buy a Certificate of Incorporation from ACRA?

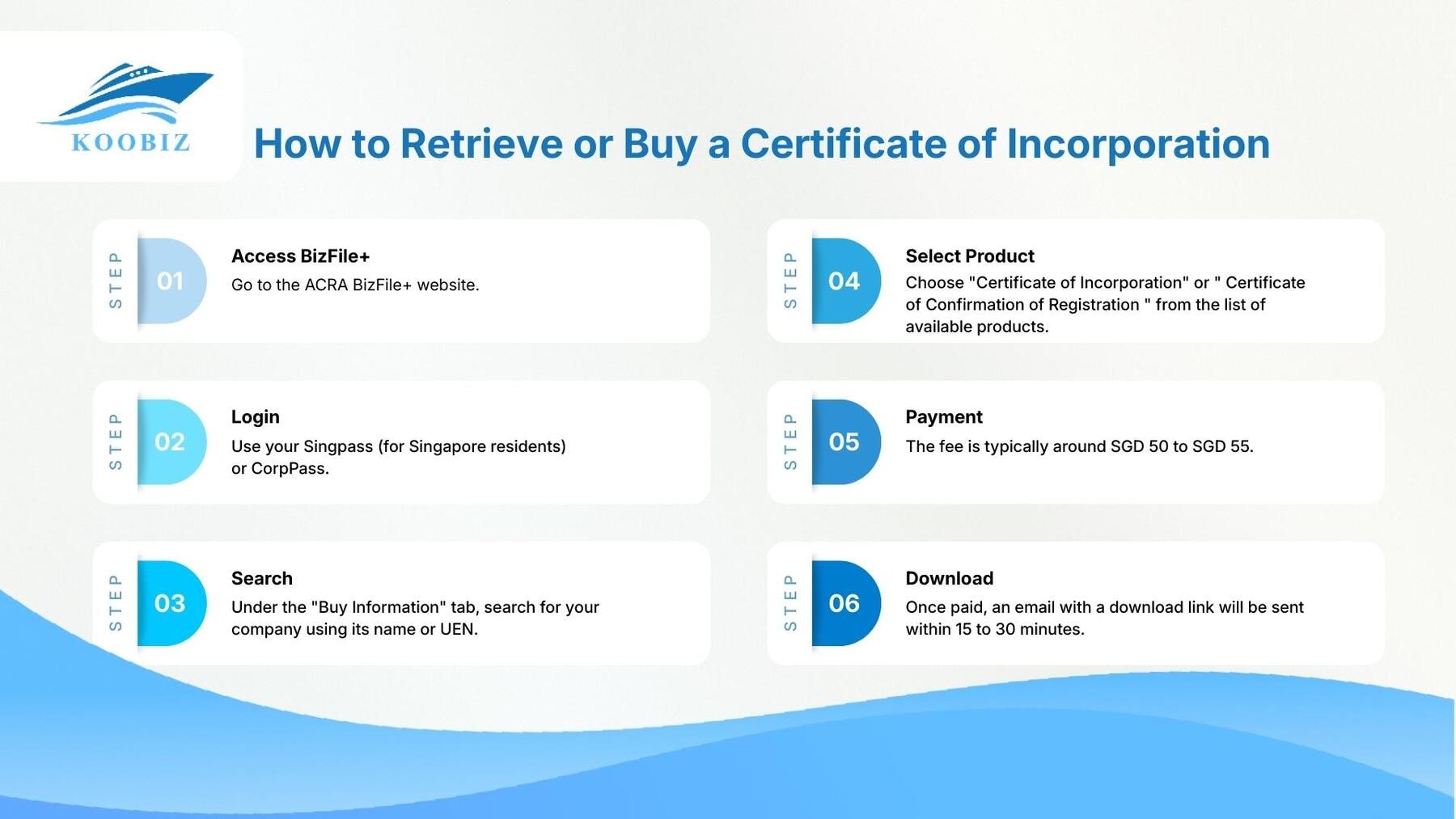

The standard method to retrieve the Certificate of Incorporation involves logging into the ACRA BizFile+ portal using a Singpass ID and paying a nominal fee for the purchase.

For business owners who have misplaced their original incorporation email or need a fresh copy, the process is straightforward but requires authorized access. Here is the step-by-step procedure:

- Access BizFile+: Go to the ACRA BizFile+ website.

- Login: Use your Singpass (for Singapore residents) or CorpPass. Foreigners without Singpass may need to engage a Registered Filing Agent like Koobiz to retrieve this on their behalf.

- Search: Under the “Buy Information” tab, search for your company using its name or UEN.

- Select Product: Choose “Certificate of Incorporation” or ” Certificate of Confirmation of Registration ” from the list of available products.

- Payment: The fee is typically around SGD 50 to SGD 55. Payment can be made via credit card or eNETS.

- Download: Once paid, an email with a download link will be sent within 15 to 30 minutes.

If you find navigating the government portals daunting, or if you are a foreign director without Singpass access, Koobiz offers comprehensive corporate secretarial services. We can retrieve these documents for you instantly, ensuring you have the right paperwork for your business needs.

Advanced Usage and Verification of the Certificate

While the basic definition and retrieval cover the needs of most new business owners, advanced corporate scenarios often require verification, legalization, and understanding the lifecycle of the certificate.

Moving beyond the standard domestic use, companies expanding globally or undergoing structural changes face complex requirements regarding their incorporation documents. It is not enough to just “have” the certificate; you must ensure it is legally accepted in the jurisdiction where you intend to do business. This section addresses the micro-semantics of verification and legal modification.

How to Verify the Authenticity of the Certificate?

To verify the authenticity of a Certificate of Incorporation, one must utilize the QR code embedded in the digital document or use ACRA’s online product authentication service.

With the rise of digital documents, the risk of digital forgery increases. To combat this, ACRA includes a unique QR code on all e-certificates. By scanning this code, third parties are directed to an ACRA-hosted page that confirms the details on the certificate are genuine and unaltered. Alternatively, you can verify the “Product Authentication Number” found on the certificate directly on the ACRA website. This is a critical step for investors conducting due diligence on a potential partner to ensure they are not being presented with a falsified PDF.

What is the Process for Notarising the Certificate for Overseas Use?

The process for notarising a Singapore Certificate of Incorporation for overseas use typically involves a two-step procedure: notarisation by a Notary Public and legalisation by the Singapore Academy of Law (SAL).

If you plan to set up a subsidiary in Vietnam, China, or Europe using your Singapore entity, foreign authorities will rarely accept a non-certified digital copy..

- Notarisation: A Notary Public must certify the document as a true copy.

- Legalisation (Apostille): The document is then sent to the Singapore Academy of Law (SAL) for an Apostille sticker (since Singapore is a member of the Hague Apostille Convention).

- Embassy Attestation: For non-Hague convention countries, further attestation by the respective embassy may be required.

This process transforms a domestic digital file into an internationally recognized legal document.

Does the Certificate Change When You Change the Company Name?

Yes, a new Certificate of Incorporation is issued whenever a company successfully passes a resolution to change its legal name, but the UEN remains the same.

It is a common misconception that the certificate is a “one-time” document. If Koobiz assists you in rebranding and changing your company name with ACRA, the regulator will issue a “Certificate of Incorporation on Change of Name.” This new certificate acts as proof of the name change and must be used in conjunction with the original certificate for historical tracing, although for most current dealings, the new certificate suffices. Crucially, the company’s unique identity number (UEN) stays constant, preserving its credit history and contractual obligations.

Can a Certificate of Incorporation Be Revoked?

Yes, a Certificate of Incorporation effectively becomes void if the company is “struck off” the register or wound up, meaning the separate legal personality of the company ceases to exist.

“Striking off” is the antonym to “Incorporation.” If a company fails to comply with regulatory requirements (like filing Annual Returns) or applies for voluntary striking off, ACRA will remove the company from the register. Once the company is dissolved, the Certificate of Incorporation loses its legal power. The company can no longer trade, and its assets may vest in the government. Therefore, maintaining the validity of this certificate is an ongoing process of corporate compliance, not just a one-time event at registration.

Start Your Business with Confidence

A Certificate of Incorporation is the cornerstone of your business’s legal identity. Whether you are verifying a partner or setting up your own venture, understanding the nuances of this document is key to navigating Singapore’s corporate landscape.

Ready to Incorporate?

Don’t let paperwork slow you down. Koobiz provides professional incorporation services to ensure you get your Certificate of Incorporation and Business Profile correctly and quickly. From registration to annual compliance, we handle the details so you can focus on growth.

Get a Free Consultation at Koobiz.com

Frequently Asked Questions (FAQs)

Here are common questions entrepreneurs ask about the Singapore Certificate of Incorporation.

1. Can I use the Certificate of Incorporation to open a bank account?

In most cases, the Certificate alone is not enough. Banks typically require a current Business Profile (dated within the last three to six months) in addition to the Certificate. The Business Profile allows the bank to conduct necessary due diligence on the directors and shareholders.

2. Does the Certificate of Incorporation expire?

No, the Certificate of Incorporation does not have an expiry date. It remains valid as long as the company remains active and registered with ACRA. It only becomes invalid if the company is struck off or wound up.

3. How long does it take to receive the Certificate of Incorporation?

If you incorporate with Koobiz or directly via ACRA, the electronic Certificate of Incorporation is usually emailed to you within 15 to 30 minutes after the registration is approved.

4. Is the electronic certificate valid for overseas tenders?

While valid in Singapore, overseas entities may require a “Certified True Copy” or a legalized version (Apostille). You should check the specific requirements of the foreign country where you intend to do business.

5. What if I lose the email with my Certificate?

Do not worry; you can purchase a re-print (technically a “Certificate of Confirmation of Registration“) from the ACRA BizFile+ portal at any time for a nominal fee.