[SUMMARIES]

Official Access: Conduct searches via the ACRA BizFile+ portal to retrieve verified corporate data.

Essential Documents: Buy Business Profiles for legal, banking, and due diligence requirements.

UEN Identification: Use the Unique Entity Number (UEN) to accurately track any registered entity in Singapore.

Legitimacy Verification: Ensure business partners are “Live” and compliant with Singapore’s regulatory standards.

Expert Support: Koobiz provides end-to-end assistance for incorporation and ongoing compliance management.

[/SUMMARIES]

Navigating the corporate landscape in Singapore requires transparency and accurate data. Whether you are an investor conducting due diligence or a business owner looking to verify a partner, a Conduct ACRA Company Search is your first step. At Koobiz, we understand that accessing official records like Business Profiles and performing a Basic UEN Search is critical for making informed decisions.

In the following sections, we will guide you through the official BizFile+ portal, compare different document types, and explain how to interpret entity statuses. By the end of this guide, you will have a clear roadmap for obtaining the corporate intelligence you need to succeed in the Singaporean market.

What is an ACRA Business Profile and Why Do You Need It?

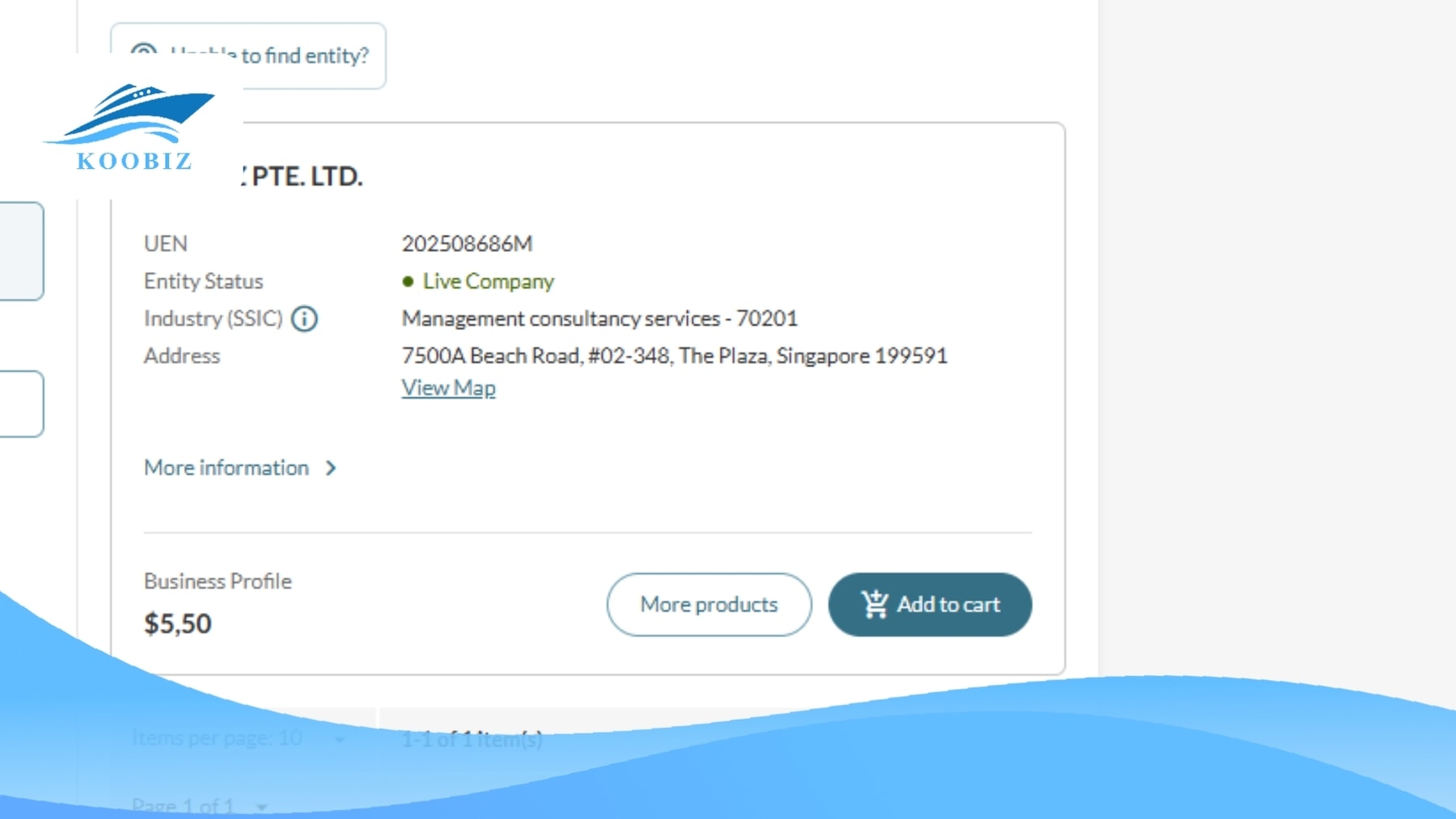

An ACRA Business Profile is a primary electronic document originated from the Accounting and Corporate Regulatory Authority (ACRA) that provides a comprehensive snapshot of a business entity’s current information and compliance status.

Often described as a company’s “corporate ID,” this document underpins virtually all legal, regulatory, and financial transactions. It is routinely required for key activities such as opening a corporate bank account, conducting due diligence, entering into commercial contracts, and fulfilling tax and regulatory filings. At Koobiz, we regularly assist clients in obtaining and interpreting their ACRA Business Profiles as part of incorporation, banking, and ongoing compliance processes.

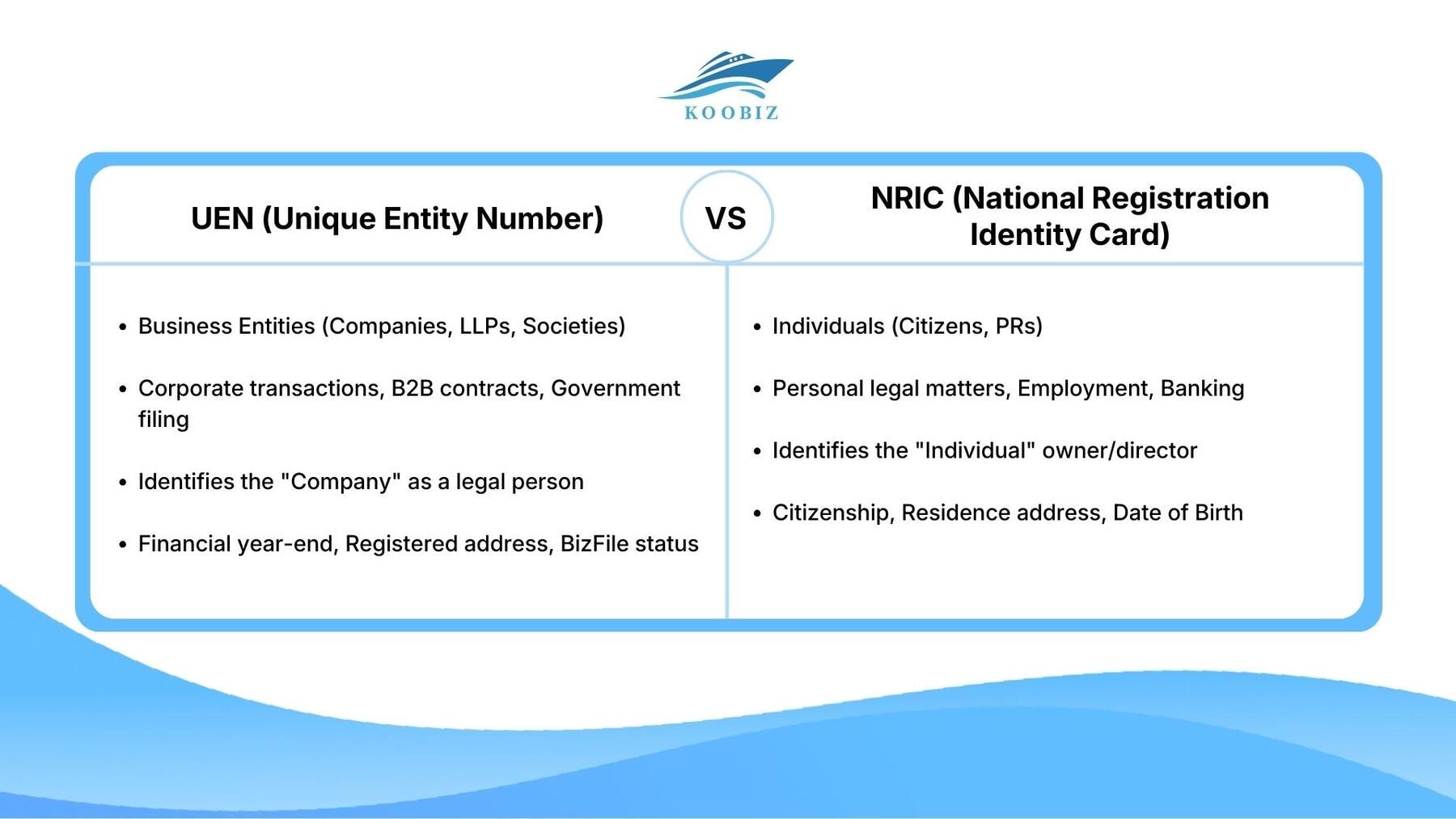

Business Entity Name, UEN, and Registered Office Address

These details establish the official legal identity of the company in Singapore.

- Entity Name: The official name registered and approved by ACRA.

- Unique Entity Number(UEN): A unique 9 or 10-digit universal identifier used across all government agencies

- Registered Office: The physical location where legal documents can be served.

The UEN, in particular, is essential for all interactions with authorities such as ACRA, IRAS, and CPF Board.

Paid-up Capital and Shareholder Details

This section outlines the company’s ownership and capital structure, providing insight into its financial standing and governance.

- Paid-up Capital: The actual amount of money the shareholders have contributed.

- Shareholder List: Names of shareholders and their respective shareholdings.

Paid-up capital is often reviewed by banks, counterparties, and regulators when assessing a company’s credibility, financial commitment, and risk profile.

According to the 2024 World Bank Business Ready (B-READY) report, transparent access to corporate registries like Singapore’s ACRA significantly reduces transaction costs and improves market trust, with Singapore ranking among the top globally and #1 in operational efficiency for business regulations.

Can Anyone Conduct an ACRA Company Search in Singapore?

Yes, anyone can conduct an ACRA Company Search because Singapore maintains a public register to ensure corporate transparency, provided the searcher pays the prescribed fee and follows the official portal guidelines.

While basic information such as a company’s name can be viewed without charge, accessing a full ACRA Business Profile requires a nominal fee via ACRA’s authorised portal. This framework promotes transparency while ensuring the proper use of corporate data. At Koobiz ensures that our clients understand the public nature of their data when we assist them with Singapore company incorporation.

Public Access vs. Corporate Privacy

In Singapore, the balance between transparency and privacy is managed by making “Public Registers” available while protecting sensitive personal data like home addresses of directors (which are often masked if an alternate address is provided).

BizFile+ Availability and Global Accessibility

The BizFile+ portal is generally available 24/7, allowing users from anywhere in the world to perform a lookup. However, users should be aware of occasional scheduled maintenance windows (typically on weekends or late nights Singapore time). This global accessibility makes Singapore one of the most business-friendly hubs globally.

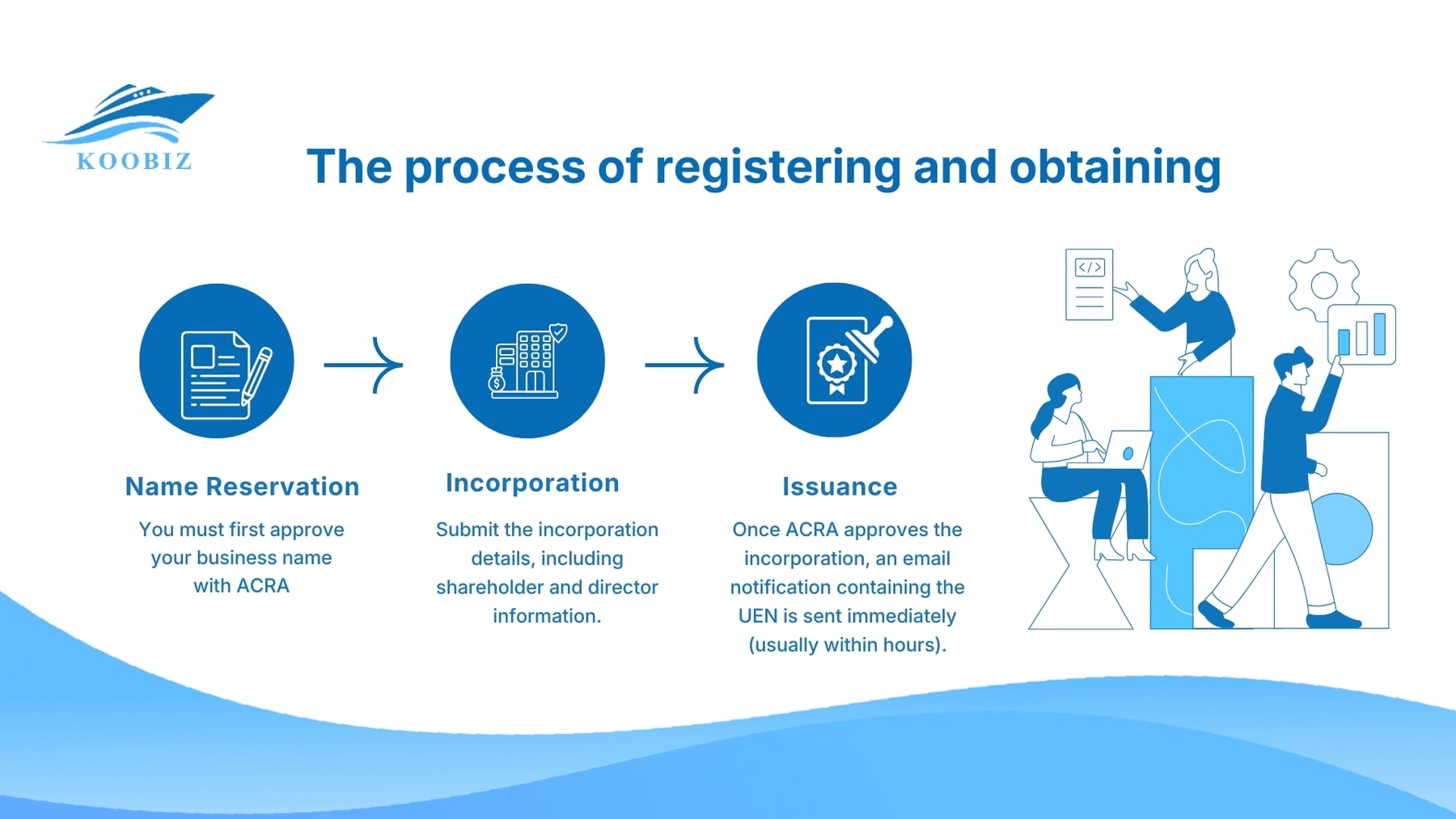

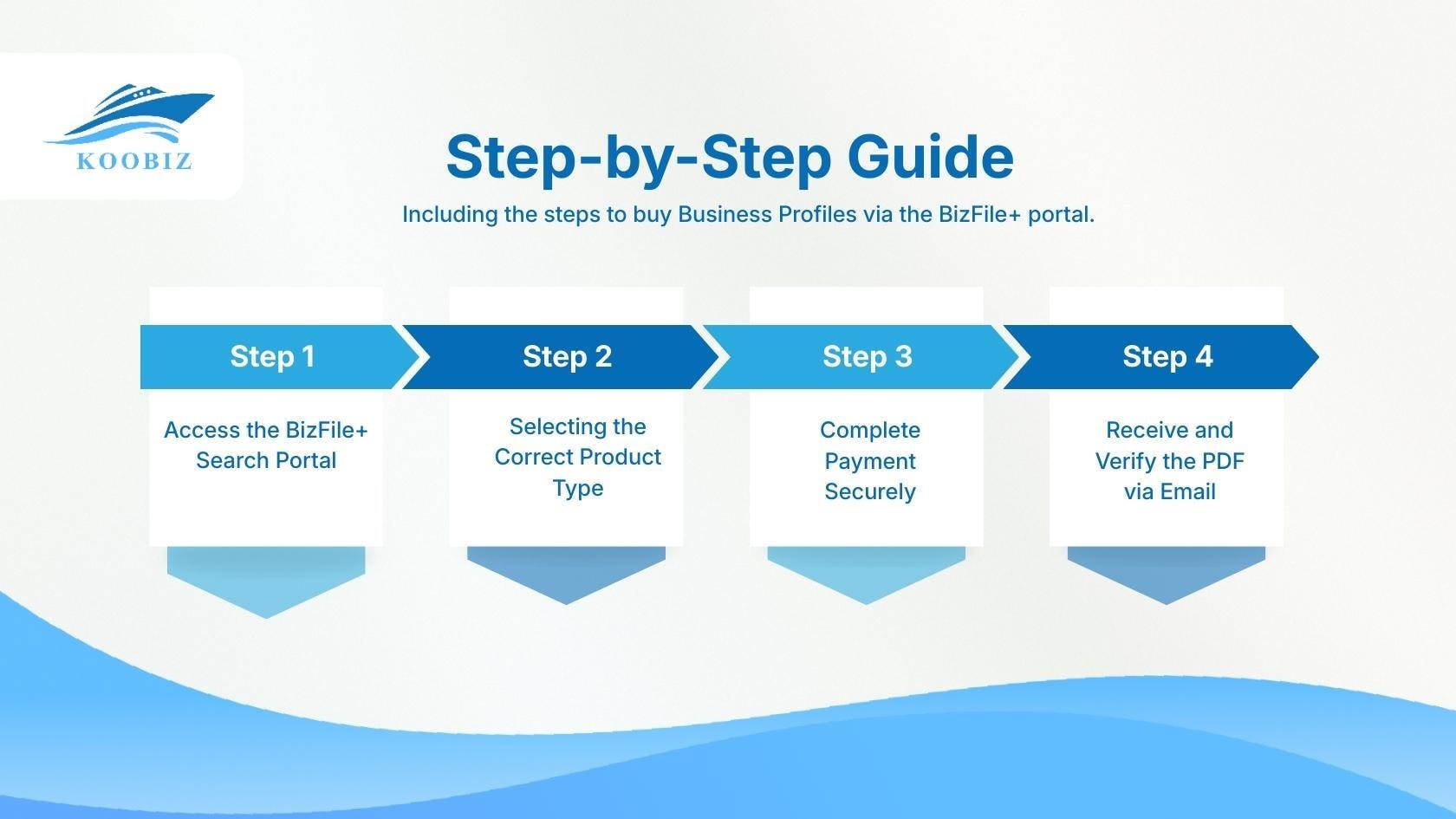

Step-by-Step Guide: How to Buy Business Profiles & UEN Reports

Buying ACRA reports involves a digital transaction method consisting of four distinct steps that result in the immediate delivery of a PDF document to your registered email address.

Following this process ensures you receive the most up-to-date information directly from ACRA’s database. For a smooth transaction, Koobiz recommends keeping your credit card or PayNow app ready for a seamless experience.

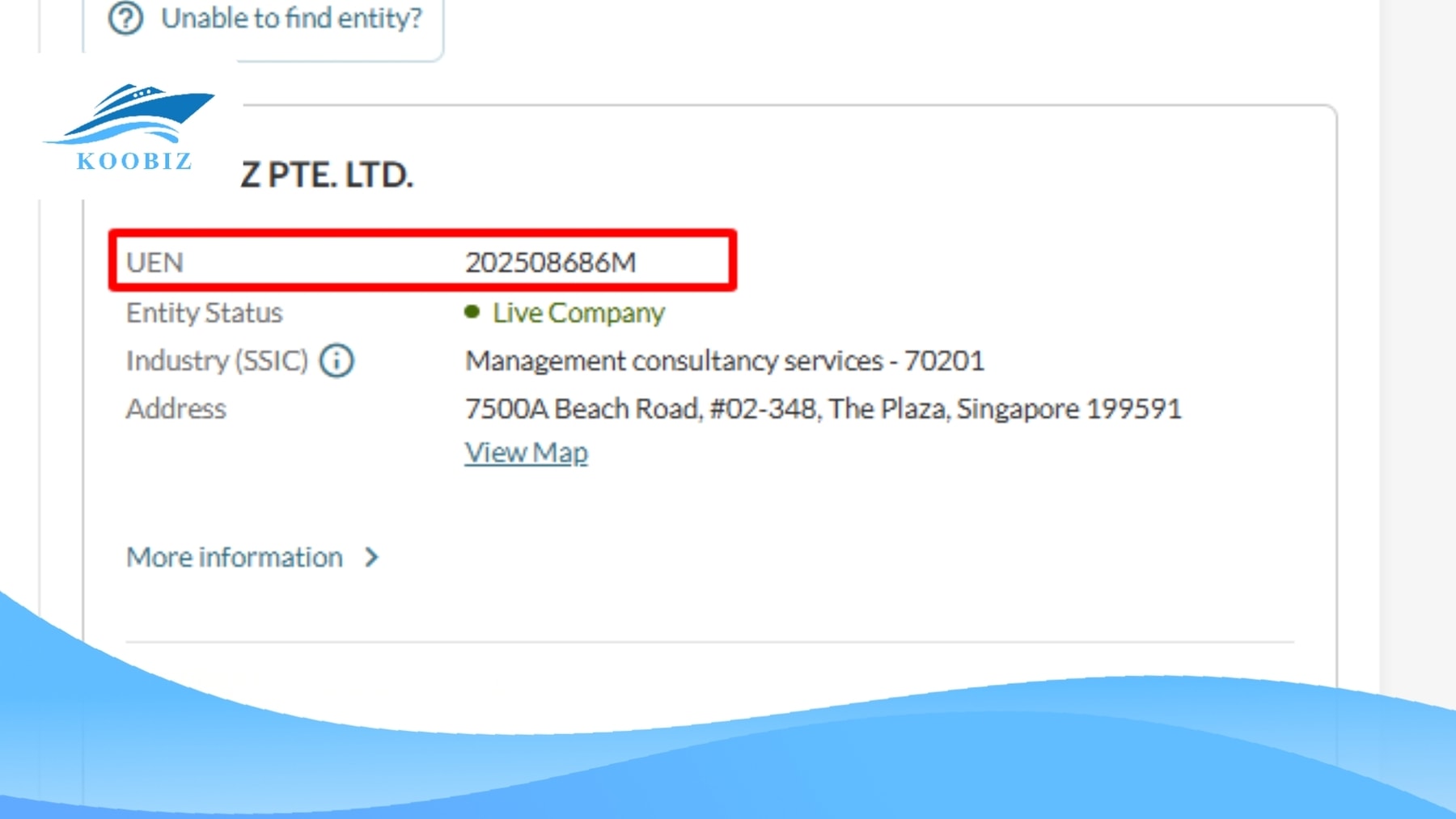

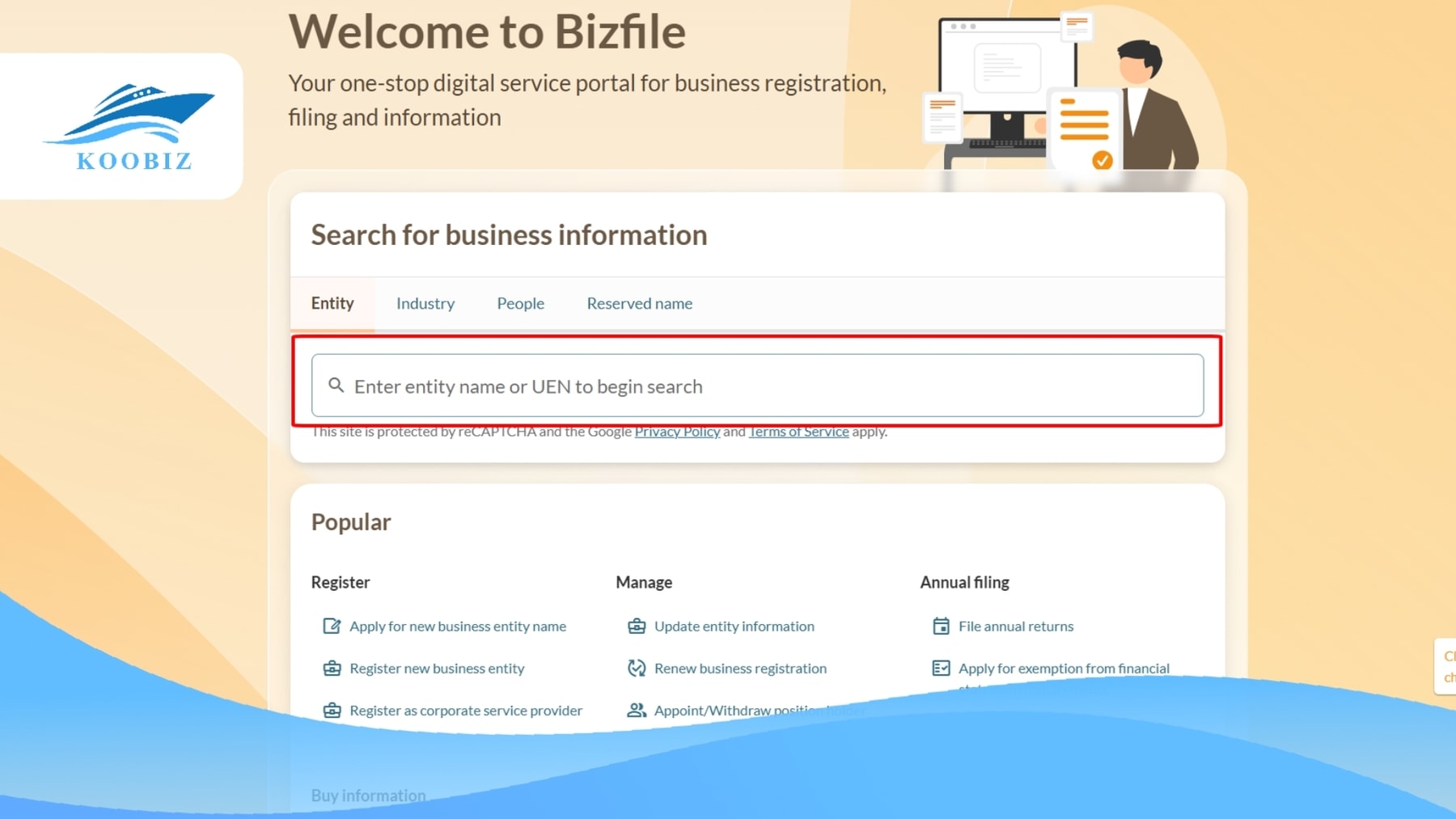

Step 1: Access the BizFile+ Search Portal

To begin, visit the official BizFile+ website. Use the “Search” function and enter either the Company Name or the UEN.

- Search by Name: Useful if you don’t have the UEN.

- Search by UEN: The most accurate method, especially when dealing with similar company names.

Step 2: Selecting the Correct Product Type

Once the entity is found, you must choose what to purchase. The most common choice is the “Business Profile (Standard),” but there are other options like financial statements.

- Standard Business Profile: Most commonly used for due diligence and verification.

- Business Profile with Certificate of Production: Typically required for official submissions to government agencies or legal purposes.

Step 3: Complete Payment Securely

Payment is processed through ACRA’s secure payment gateway. The standard Business Profile generally costs around S$5.50.

- Credit Cards: Visa and Mastercard are widely accepted.

- PayNow: Convenient for those with Singaporean bank accounts.

Step 4: Receive and Verify the PDF via Email

Once payment is successful, ACRA will email a download link to the provided address. This link is usually valid for up to 7 days.

- Download: Save the PDF immediately.

- Verify: Use the embedded QR code or link to authenticate the document via ACRA’s trustBar system.

ACRA’s digital infrastructure ensures that the vast majority of corporate document requests are fulfilled instantly, allowing you to receive your official files within minutes of payment.

Comparing Basic UEN Search vs. Certified Extracts

Choosing the right document depends entirely on your end goal. For daily operations, a standard profile is usually sufficient; however, for complex legal disputes or formal administrative requirements, a certified extract is mandatory.

The table below highlights the key distinctions between a basic UEN search and a certified extract, helping you determine which option best suits your specific requirements when working with Koobiz.

| Feature | Basic UEN Search | Business Profile (Standard) | Certified Extract |

|---|---|---|---|

| Primary Purpose | Quick identification | General due diligence & KYC | Legal & official submissions |

| Information Depth | Basic (Name, UEN, Status) | Comprehensive (Directors, Capital) | Deep (Historical changes) |

| Legal Weight | Informational only | Standard operational document | Admissible in a court of law |

| Authentication | Web View only | QR Code protected | Signed by Assistant Registrar |

| Cost* | Free | S$5.50 | Starting from S$16.50 (e.g., with Certificate of Production) |

*Costs as of December 2025; subject to GST and ACRA updates.

Legal Weight and Evidentiary Value

Certified extracts are signed by the Assistant Registrar of ACRA, making them admissible as evidence in a court of law. A standard PDF download does not carry this same weight without a specific certificate.

Cost Structure and Information Scope

While a basic UEN check is free via the directory, a full certified extract can cost significantly more depending on the depth of information required (e.g., historical extracts).

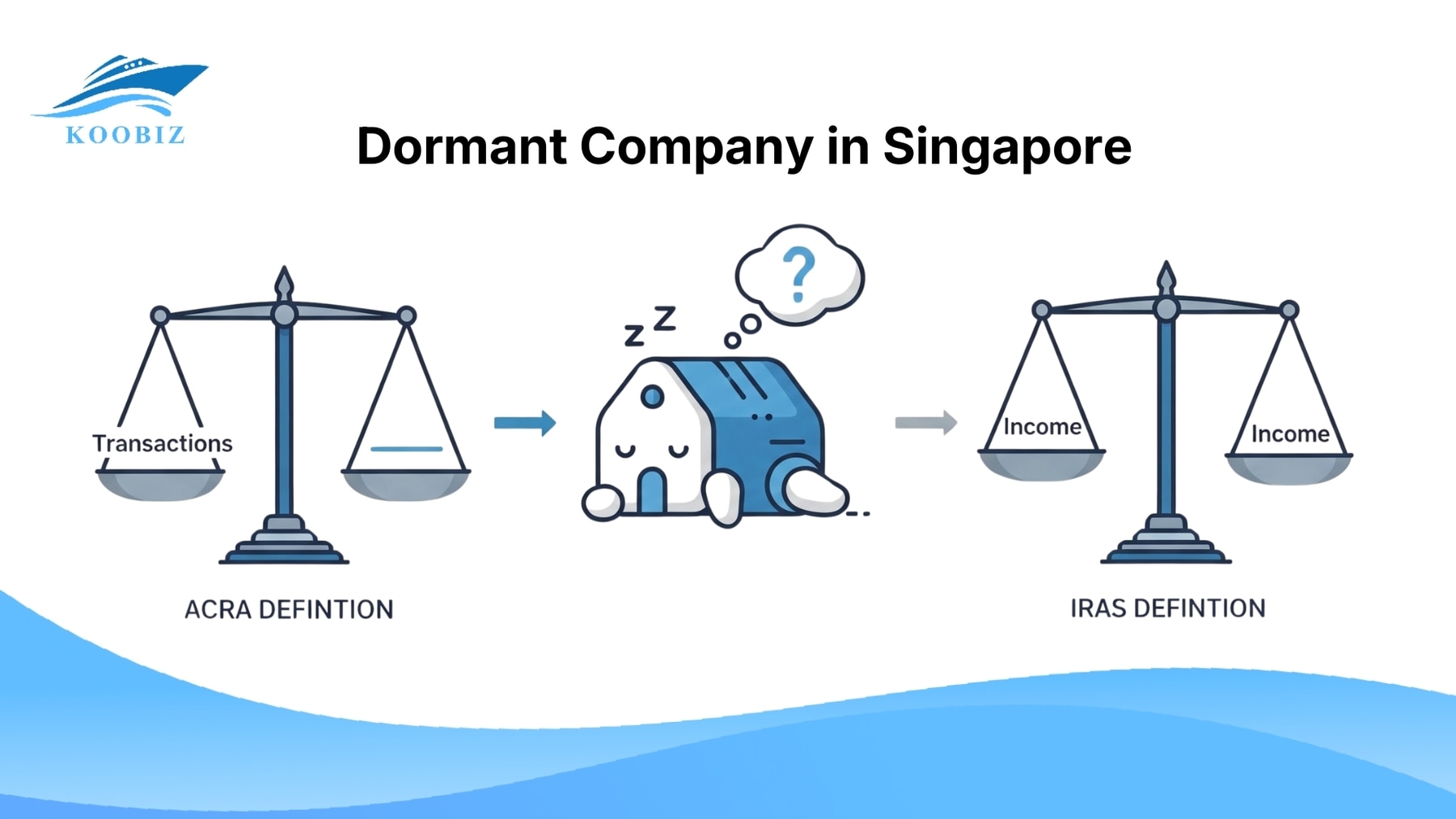

Identifying Non-Active Entities: Struck Off vs. Dissolved Status

Understanding non-active statuses is a critical due diligence skill involving the differentiation between administrative removal (Struck Off) and formal liquidation (Dissolved).

When a company search shows a status other than “Live”, it signals that the entity has lost its normal legal standing. Such statuses indicate that the company is no longer operating as a valid commercial counterpart. Koobiz often helps clients investigate these statuses to ensure they aren’t entering contracts with defunct entities.

What Does it Mean if a Company is “Struck Off”?

“Struck Off” is an administrative action where ACRA removes a company from the register, most commonly due to prolonged non-compliance (e.g. failure to file Annual Returns) or confirmation that the company has ceased business activities..

- Implication: The company no longer has the power to trade or own property.

- Reversibility: It is possible to restore a struck-off company via a court order, typically within 6 years of the striking off date.

How to Retrieve Records for Liquidated or Dissolved Businesses

“Dissolved” is the final stage of a company’s life cycle, usually following a formal liquidation process (winding up).

- Rare Attribute: Retrieving records for dissolved companies often requires searching the historical archives, as they may not appear in the primary “Live” search results.

The Role of the Authenticity QR Code on Official ACRA Downloads

In 2024, ACRA enhanced security by adding a Unique QR Code to every downloaded Business Profile. This unique attribute allows any third party to scan the document and verify its authenticity directly against ACRA’s database, preventing the use of forged PDF documents in bank account applications.

When to Use a Business Profile vs. a Certificate of Good Standing

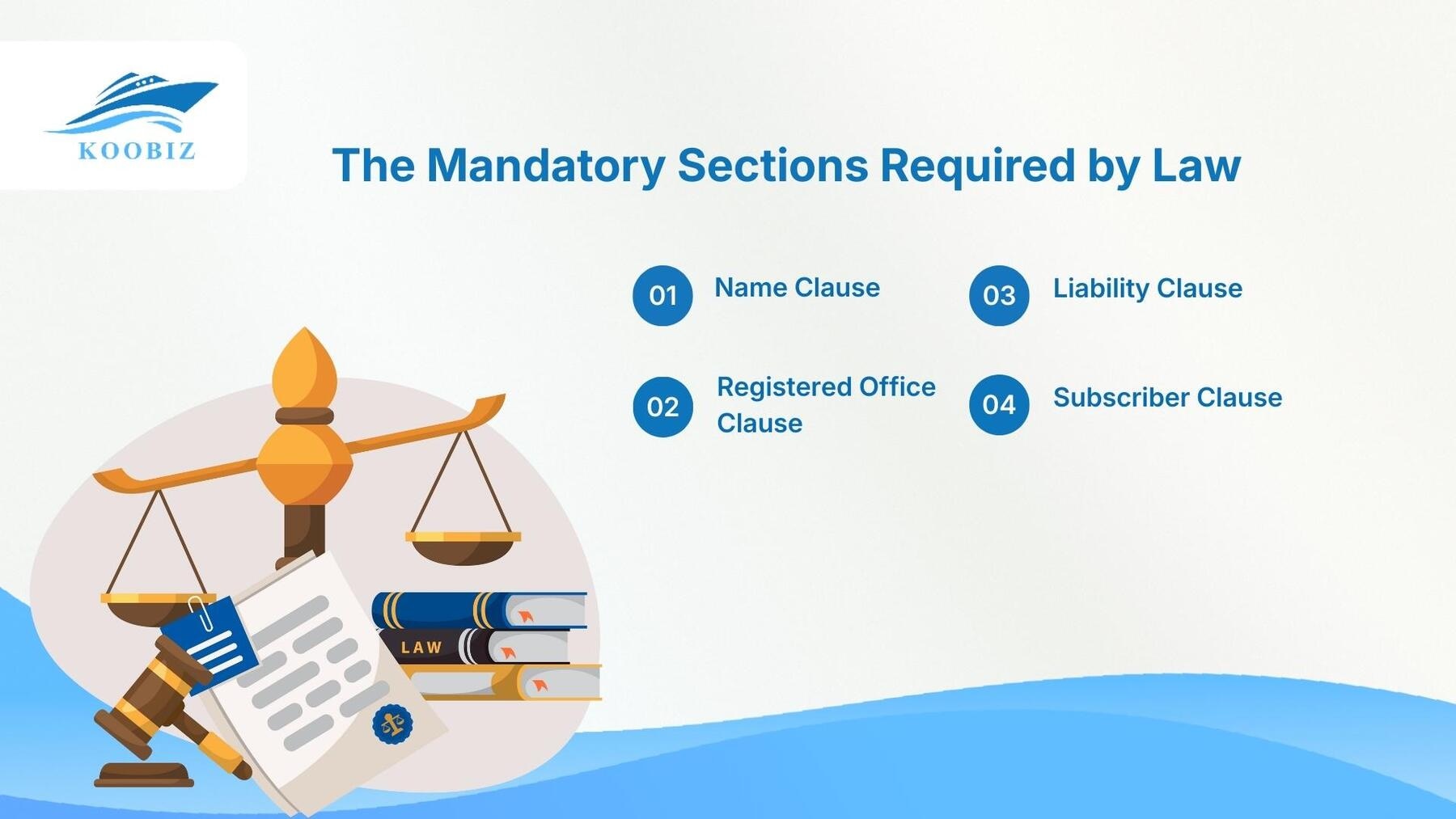

These two documents serve different compliance objectives and are not interchangeable.

A Business Profile provides factual information about the company’s structure, officers, and registration details at a specific point in time.

A Certificate of Good Standing (CGS), on the other hand, is a formal certification issued by ACRA confirming that the company is active (“Live”) and fully compliant with all statutory filing obligations.

Typical Use Cases for CGS:

- Cross-border transactions and overseas business registrations

- Foreign bank account openings

- Work visa or regulatory applications for directors in other jurisdictions

Because of its legal weight, the CGS is generally requested only in international or high-level regulatory contexts, rather than for routine domestic operations.

Can You Search for Sole Proprietorships and Partnerships?

Yes, ACRA search is not limited to Private Limited companies. You can also search for:

- Sole Proprietorships: Businesses owned by one person.

- Partnerships: Entities with two or more partners.

- LLPs: Limited Liability Partnerships.

Each of these entity types will have a different UEN format and different levels of disclosure in their Business Profiles.

About Koobiz

Koobiz is your premier partner for navigating the complex regulatory environment of Singapore. We specialize in providing high-end corporate services designed to help global entrepreneurs thrive in Asia’s most dynamic business hub.

Our core services include:

- Singapore Company Incorporation: Fast, reliable, and compliant setup.

- Bank Account Opening Assistance: Leveraging our network of local and international banks.

- Tax and Accounting Services: Ensuring your business meets all IRAS and ACRA requirements.

- Audit and Compliance: Maintaining your “Good Standing” status with the Singapore government.

Visit us at koobiz.com to start your Singapore business journey today.

Disclaimer: This information is based on ACRA guidelines as of December 2025. Always verify on the official BizFile+ portal for the latest details.