[SUMMARIES]

DRC & FWL Defined: The Dependency Ratio Ceiling (DRC) sets the maximum number of foreign workers you may employ, while the Foreign Worker Levy (FWL) is a monthly levy payable based on worker skill tiers.

Local Qualifying Salary (LQS): Quota calculations depend on your LQS count. Only Singapore Citizens and PRs earning at or above the prescribed LQS threshold contribute to foreign worker quota.

Sector Variations: Quota limits have tightened significantly for 2026, particularly in the Marine Shipyard sector (now 1:3 ratio) and Construction/Process sectors (1:5 ratio).

Cost Optimization: Upgrading workers to “Higher-Skilled” (R1) status can significantly reduce your monthly levy bill.

Compliance Key: Exceeding quota limits or misrepresenting local workforce figures exposes employers to significant MOM penalties

[/SUMMARIES]

Compliance with Ministry of Manpower (MOM) regulations is a core operational requirement for employers in Singapore. As 2026 approaches, understanding the relationship between your Foreign Worker Quota (DRC) and Foreign Worker Levy (FWL) is vital for compliance and cost control. Koobiz assists employers with interpreting MOM manpower rules and applying them correctly in day-to-day workforce planning. This guide provides a clear roadmap to determine your hiring limits, understand levy costs, and optimize your workforce strategy.

What is the Foreign Worker Quota (DRC) and Levy?

The Foreign Worker Levy (FWL) is a mandatory monthly levy payable to the government for each foreign employee you are legally allowed to hire based on your total workforce size. The Foreign Worker Levy (FWL) is the monthly “tax” or pricing mechanism you must pay to the government for each foreign employee.

In practice, the system operates as a two-step manpower control mechanism:

- Quota (DRC): Determines whether you are permitted to hire foreign workers.

- Levy (FWL): Determines the monthly cost of employing foreign workers.It is a tiered pricing system—hiring more foreigners generally costs more per head.

Key Concepts at a Glance:

- Purpose: To protect the local Singaporean core workforce while allowing controlled access to foreign manpower.

- Floating Ratio: The quota is not fixed. Any reduction in eligible local headcount results in an immediate reduction in allowable foreign workers.

- Tiered Cost: Levy rates are progressive and increase as quota utilisation rises.

- Liability: Levy charges commence from the date a Work Permit or S Pass is issued

Prerequisites to Calculate Your Quota: The Local Qualifying Salary (LQS)

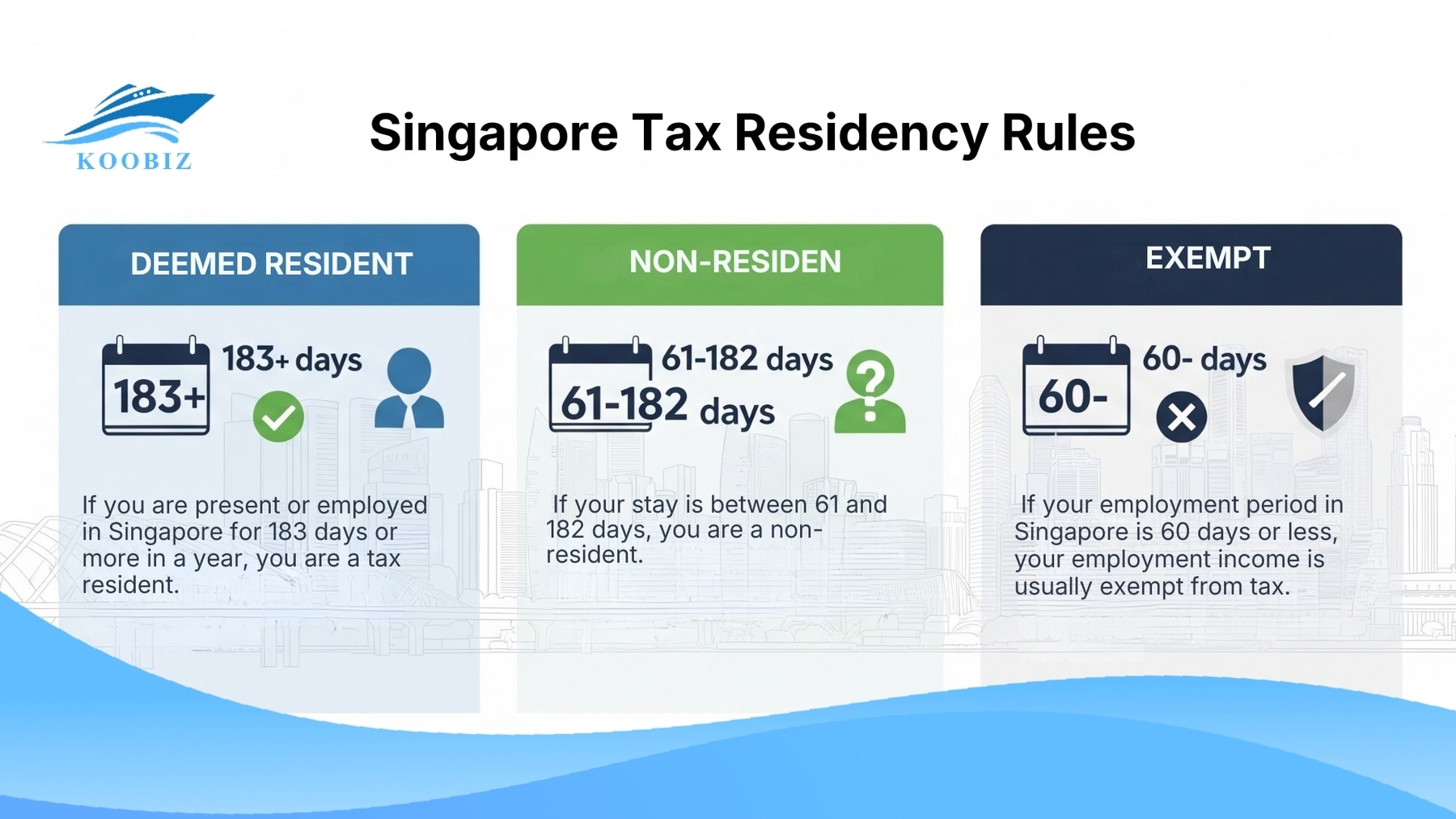

Not every Singapore Citizen or Permanent Resident automatically counts toward your quota entitlement; they must meet the Local Qualifying Salary (LQS) threshold to be considered valid “local headcount” for quota calculation. This is one of the most common compliance misunderstandings among employers—assuming that hiring a part-time intern or low-wage local employee automatically generates foreign worker quota.

To count as a local employee for the purpose of generating foreign worker quota, a Singapore Citizen or Permanent Resident (PR) earns a gross monthly salary that meets the prevailing LQS criteria set by MOM.

- Full LQS Count (1.0): A local worker counts as one headcount if they earn at least the full LQS threshold (e.g., SGD 1,600+).

- Partial LQS Count (0.5): A local worker counts as half a headcount if they earn at least half the LQS threshold but below the full amount (e.g., SGD 800 to SGD 1,599).

Accordingly, employers should first audit their local payroll before attempting any quota calculation. If the allowable foreign worker quota may effectively be zero, regardless of the total number of local employees on record.

How to Calculate Foreign Worker Quota by Sector (2026 Limits)

There are five distinct business sectors in Singapore—Services, Manufacturing, Construction, Marine Shipyard, and Process—each with its own Dependency Ratio Ceiling (DRC) and applicable sub-quota limits for 2026. This sector-based segmentation is critical, as MOM applies stricter quotas to less labour-intensive sectors (like Services) while allowing more leeway in sectors locals avoid (like Construction), with recent policy updates further tightening these ratios across multiple sectors.

Below, we break down the calculation logic for the primary sectors based on 2026 regulations.

| Sector | Total Foreign Worker Quota (DRC) | S Pass Sub-Quota | Work Permit Quota |

|---|---|---|---|

| Services | 35% | 10% | Up to 35% of total workforce (inclusive of S Pass holders) |

| Manufacturing | 60% | 15% | Up to 60% of total workforce (inclusive of S Pass holders) |

| Construction | 83.3% (Ratio 1:5) | 15% | Maximum ratio of 1 local to 5 foreign workers |

| Process | 83.3% (Ratio 1:5) | 15% | Maximum ratio of 1 local to 5 foreign workers |

| Marine Shipyard | 75% (Ratio 1:3) | 15% | Maximum ratio of 1 local to 3 foreign workers |

Real-World Calculation Example (Services Sector)

Scenario: A Restaurant (Services Sector) wants to hire foreign staff. They have 10 Full-Time Locals earning above $1,600 (LQS).

- Calculate total allowable workforce: 10 locals ÷ (1 − 35% DRC) ≈ 15 total employees.

- Max Foreigners Allowed: 15 Total – 10 Locals = 5 Foreigners.

- Check S Pass sub-quota limit:10 Locals ÷ (1 – 10% Sub-Quota) ≈ 11 Total. Max S Pass = 11 – 10 = 1 S Pass.

- Result: The restaurant may hire up to 1 S Pass holder and 4 Work Permit holders.

Real-World Calculation Example (Construction Sector – 2026 Limits)

Scenario: A Construction Firm has 10 Full-Time Locals earning above $1,600 (LQS).

- Calculate using the statutory ratio (1:5):10 Locals × 5 = 50 Work Permit Holders.

- Result: Unlike the Services sector, which applies a percentage-based DRC formula, the Construction sector allows a direct multiplier. However, the S Pass sub-quota of 15% of the total workforce continues to apply

Important Note: The above formulas are simplified for illustration purposes only. Always use the official MOM calculator for final approval.

Services Sector Quota Calculation

The Services sector is subject to the tightest Dependency Ratio Ceiling (DRC) as MOM policy prioritizes automation and productivity gains and reduces reliance on lower-skilled foreign labour in retail, F&B, and hospitality. If your company employs 10 workers in total and the DRC is 35%, the maximum allowable foreign workforce is 3.5 (rounded down to 3).

Manufacturing Sector Quota Calculation

The Manufacturing sector is permitted a higher Dependency Ratio Ceiling (DRC) to support industrial output, although this ratio is being progressively tightened to encourage “Industry 4.0” adoption. The S Pass sub-quota is capped at 15% to ensure firms prioritize local PMETs.

Construction, Marine Shipyard, and Process Sectors

These sectors have experienced significant quota tightening in recent policy cycles.

- Construction & Process: The statutory ratio is now capped at 1 local employee to 5 foreign workers (down from previous highs of 1:7).

- Marine Shipyard: With effect from 1 January 2026, the ratio has reduced to 1 Local : 3 Foreigners (down from 1:3.5).

- Man-Year Entitlement (MYE) Phase-Out: The Man-Year Entitlement (MYE) framework was fully phased out by December 31, 2024. All new levies are now standardized under the new framework, removing the distinction between “MYE” and “Non-MYE” rates.

Foreign Worker Levy (FWL) Rates and Tiers 2026

Basic Tier levies offer the most cost-effective rates for compliant companies, whereas Tier 2 and Tier 3 impose significantly higher punitive costs for exceeding specific sub-quota thresholds. Once your allowable foreign headcount is determined, you must calculate the monthly cost. The levy framework is designed as a pricing mechanism: the more you rely on foreign labor, the more you pay.

S Pass Levy Rates (Standardized 2026)

With effect from September 2025,, the S Pass levy structure has been simplified to harmonize costs.

| Pass Type | Tier | Monthly Levy Rate (SGD) |

|---|---|---|

| S Pass | Standardized | $650 (All Sectors) |

Work Permit Levy Rates (R1 vs. R2)

For Work Permit holders, the levy depends on the worker’s qualifications (R1 Higher-Skilled vs. R2 Basic-Skilled) and the applicable sector-based tier system.

| Sector | Skill Level | Monthly Levy Range (Approx.) |

|---|---|---|

| Services | Basic (R2) | $450 – $800 (Tier 3 is highest) |

| Higher (R1) | $300 | |

| Construction | Basic (R2) | $700 – $900 (NTS vs M’sia/NAS) |

| Higher (R1) | $300 – $500 | |

| Manufacturing | Basic (R2) | $370 – $650 (Tier 3 is highest) |

| Higher (R1) | $250 – $550 | |

| Marine Shipyard | Basic (R2) | $400 – $500 |

| Higher (R1) | $300 – $350 |

- Higher-Skilled (R1): These workers have specific certificates (like SEC-K) or years of experience and earn a higher salary. They attract a lower levy to encourage productivity.

- Basic-Skilled (R2): These are workers without specific certifications. They attract the highest levy rates to discourage cheap, low-skilled labor.

Strategies to Lower Your Foreign Worker Levy Bill

Strategic workforce planning enables employers to lawfully reduce their monthly Foreign Worker Levy (FWL) liability by upgrading worker skill levels and utilizing specific MOM waiver schemes. For many SMEs that Koobiz advises, optimizing the levy bill can result in annual savings of several thousand dollars, with a direct and measurable impact on operating margins.

Follow these steps to proactively minimize your foreign worker costs:

Step 1: Audit Your Workforce Tiers

Review your current foreign workforce profile. Identify employees classified under the Basic-Skilled (R2) tier. These workers attract significantly higher levy rates (for example, approximately SGD 350–500 more per worker in Construction/Marine sectors) compared to their Higher-Skilled counterparts.

Step 2: Upgrade R2 Workers to “Higher-Skilled” (R1) Status

Upgrading a worker from R2 to R1 is the most sustainable cost-optimisation strategy

- Salary-Based Upgrade (Market-Based Pathway): In sectors like Construction, Marine, and Process, R2 workers earning a fixed monthly salary of at least SGD 1,600 may qualify for R1 classification (Direct R1 Pathway).

- Via Training: Send workers for recognized training, such as CoreTrade (Construction) r Workforce Skills Qualifications (WSQ) schemes (Process/Services).

- Via Experience: Workers with 4+ years of experience in Singapore generally qualify for simplified upgrade pathways (e.g., Multi-Skilling Scheme).

Step 3: Leverage Levy Waivers for Non-Active Periods

Employers are not required to pay levies due to specific valid reasons.

- Overseas Leave: If the worker is out of Singapore for a minimum of seven consecutive days (capped at 60 days per calendar year).

- Medical Leave: Hospitalisation leave certified by a Singapore-registered medical practitioner (capped at 60 days/calendar year).

- Police/Embassy Custody: If the worker is unable to work due to investigations or custody.

Step 4: File Waiver Applications on Time

Levy waivers are not granted automatically.

- Application Deadline: You must submit the waiver application within one year of the levy bill month (e.g., for a Jan 2026 bill, apply by Jan 2027).

- Action: Log in to MOM’s Check and pay foreign worker levy e-Service.

- Supporting Documents: Maintain valid proofs like boarding passes, passport stamps, and medical certificates for audit purposes.

Advanced Quota Rules for Specific Scenarios

Certain niche scenarios require advanced regulatory understanding to avoid compliance pitfalls. These represent ‘rare attributes’” of the quota system that usually apply to larger entities or complex restructuring cases.

Quota Transfer and Voided Quotas

What happens when a business undergoes a merger, acquisition, or restructuring?Quota eligibility is tied to the Unique Entity Number (UEN).

- Transfer: Foreign worker quota cannot generally be ‘transferred’ from Company A to Company B unless there is a formal business transfer (novation of contracts and transfer of local employees).

- Voiding: If your local employees resign, your quota drops immediately. If you have excess foreigners, you have a grace period to replace the locals or you must cancel the excess Work Permits.

Penalties for Exceeding Quota or Evading Levy

Yes, exceeding your quota or attempting to evade levy payments results in severe penalties, including hefty fines and a long-term or permanent debarment from hiring foreign workers. MOM takes a very strict stance on “Phantom Workers”—the practice of listing locals on the payroll who do not actually work there, simply to inflate the quota.

- Financial Penalties: Fines may reach up to SGD 30,000 per charge or up to 2 years imprisonment.

- Debarment: The company and its directors may be debarred from applying for work passes, effectively shutting down operations that rely on foreign staff.

- Back-payment: You will be forced to back-pay any underpaid levies with interest.

According to MOM enforcement data, hundreds of employers are prosecuted annually for false declarations regarding local workforce numbers.

Conclusion

Calculating your Singapore Foreign Worker Quota and Levy for 2026 requires more than just a calculator; it requires a strategic approach to local hiring, sector classification, and continuous monitoring of MOM’s changing policies. From ensuring your locals meet the LQS to optimizing your levy tiers via R1 upgrades, every decision has a direct impact on manpower costs and compliance risk.

At Koobiz, we specialize in helping international businesses navigate Singapore’s regulatory landscape. Whether you need assistance with company incorporation in Singapore, opening a corporate bank account, or managing your tax and accounting to ensure your LQS declarations are accurate, our team is ready to support you. Don’t let compliance complexities stall your business growth.

Visit Koobiz.com today to consult with our experts on your manpower strategy.