[SUMMARIES]

Mandatory vs. Optional: Deregistration is compulsory if your business stops operating or is transferred. It is voluntary if your taxable turnover falls below S$1 million.

The Process: All applications must be submitted online through the myTax Portal; paper forms are generally not accepted.

Form F8: Once approved, you must file the final GST return (Form F8) within one month from the end of the prescribed accounting period.

Deemed Supply: GST may be payable on business assets held on your last day of registration if the total GST exceeds S$10,000.

[/SUMMARIES]

Knowing how to deregister GST in Singapore is a critical compliance step for businesses facing operational changes like downsizing, restructuring, or ceasing operations. The process involves more than just a simple cancellation; you must determine if you qualify for Compulsory or Voluntary deregistration, settle liabilities, and file the final Form F8. At Koobiz,we guide clients through every stage of this IRAS process,from assessing eligibility to managing deemed supply risks, so you can exit the GST system smoothly, avoid penalties, and close this chapter with confidence.

Is GST Deregistration Mandatory or Optional for Your Business?

It depends. GST deregistration is mandatory if your business ceases operations, but it is optional if your business continues with a turnover below S$1 million.

To help you quickly determine your obligations, here are the key points regarding your status:

- Compulsory Triggers: You have no choice but to cancel if you stop making taxable supplies (e.g., closing down, selling the business, or changing entity type).

- Strict Deadline: For compulsory cases, you must apply within 30 days. Failure to do so is an offense under IRAS regulations.

- Voluntary Option: If your business is active but sales have dropped below S$1 million, you can choose to deregister to save on administrative compliance costs.

- The Trade-off: Deregistering voluntarily means you lose the ability to claim Input Tax refunds on expenses.

Koobiz advises reviewing your projected turnover for the next 12 months carefully before opting for voluntary deregistration, as re-registering shortly after can be costly and disruptive.

Compulsory vs. Voluntary Cancellation: Criteria and Eligibility

Compulsory cancellation applies when a business ceases to exist or make supplies, whereas voluntary cancellation is available for active businesses whose turnover falls below the S$1 million threshold.

Although both routes result in the same outcome, the end of GST filing obligations, the conditions for eligibility and the lock-in periods are very different. The comparison table below highlights these key distinctions to help you determine which category your business falls under.

| Feature | Compulsory Cancellation | Voluntary Cancellation |

|---|---|---|

| Who is it for? | Businesses that have stopped operations or changed ownership structure. | Active businesses with reduced revenue (Turnover < S$1 million). |

| Trigger Scenarios | 1. Cessation of Business: Stopped making taxable supplies.

2. Transfer of Business: Business sold or transferred (e.g., Sole Prop to Pte Ltd). 3. Change in Constitution: Partnership dissolution or formation changes. |

1. Revenue Drop: Annual taxable turnover is projected to be less than S$1 million in the next 12 months.

2. Commercial Reasons: Reducing administrative compliance costs. |

| Application Deadline | Strict. Must apply within 30 days of the triggering event. | Flexible. Can apply anytime once eligibility criteria are met. |

| Key Restrictions | None. Immediate cancellation required. | 2-Year Lock-in: If you originally registered voluntarily, you must remain registered for at least 2 years before cancelling. |

| Financial Consequence | Penalties apply for late notification. | You lose the ability to claim Input Tax on business expenses (e.g., rental, utilities). |

Koobiz frequently assists clients with a practical cost-benefit analysis. If most of your customers are GST-registered, they can reclaim the GST you charge. By deregistering voluntarily, you may offer lower prices, but you will lose the ability to recover GST paid on your operating costs and expenses.

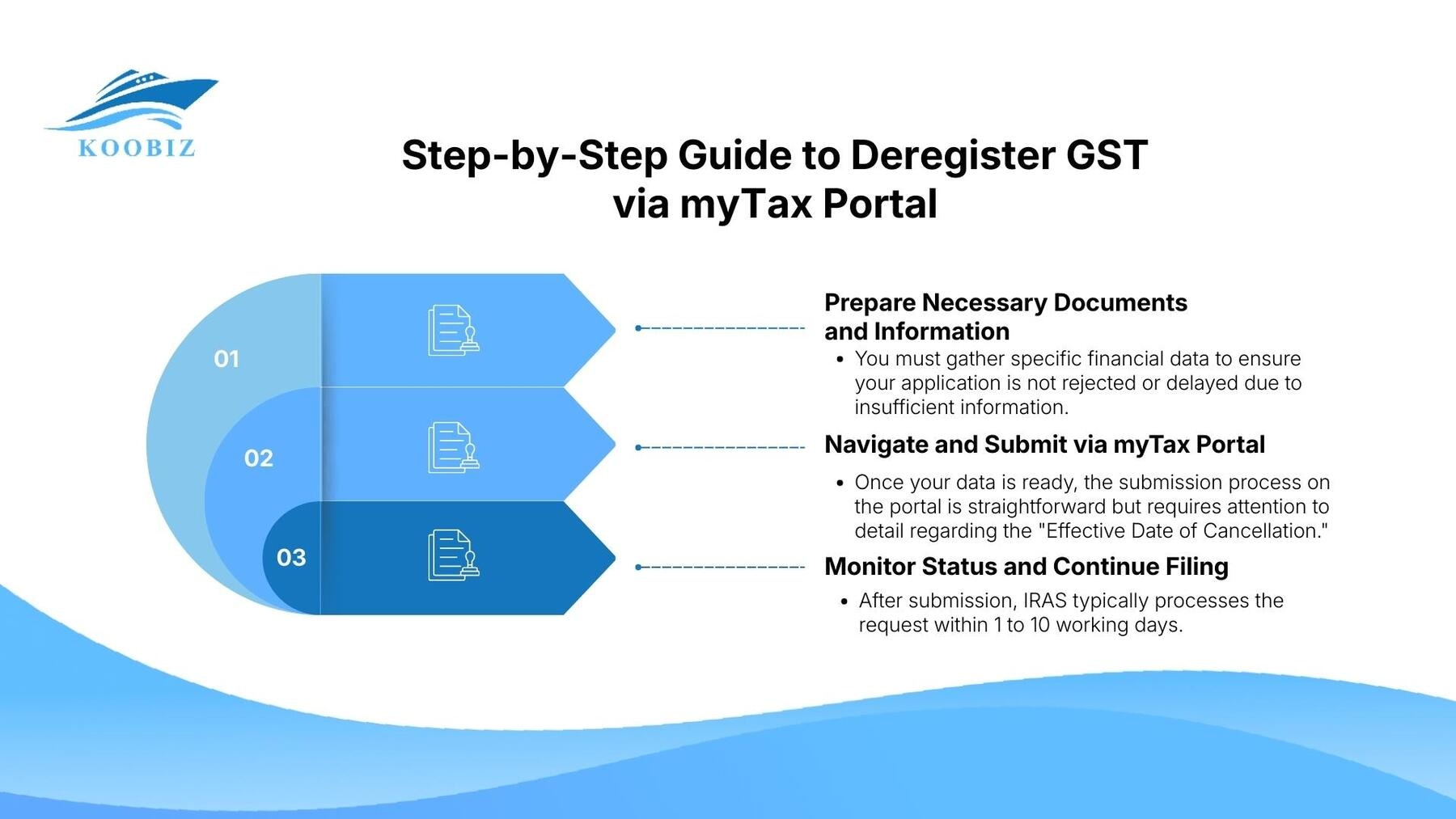

Step-by-Step Guide to Deregister GST via myTax Portal

The method for deregistering GST involves a digital application via the myTax Portal, consisting of identifying the effective date, submitting relevant turnover data, and receiving an official notification.

Paper forms are no longer accepted—IRAS now processes all cancellation requests digitally for speed and audit clarity. Follow this simple three-step approach to ensure your submission is accurate and approved without delays.

Step 1: Prepare Necessary Documents and Information

Before logging into the portal, you must gather specific financial data to ensure your application is not rejected or delayed due to insufficient information.

To start, ensure you have the following readily available:

- Singpass (Corppass) Access: Ensure you are authorized to access the “GST” e-Services for your company.

- Date of Cessation/Change: The exact date your business stopped making supplies or when turnover dropped.

- Turnover Figures: The value of taxable supplies for the past 12 months and the projected value for the next 12 months.

- Asset Details: A list of business assets held, including their market value, as this impacts your final tax liability.

Having this data structured—a service Koobiz provides for our accounting clients—streamlines the actual submission process significantly.

Step 2: Navigate and Submit via myTax Portal

Once your data is ready, the submission process on the portal is straightforward but requires attention to detail regarding the “Effective Date of Cancellation.”

Follow these specific actions:

- Log in: Go to myTax Portal and log in using your Singpass.

- Navigate: Select GST > Apply for Cancellation of GST from the main menu.

- Select Reason: Fill in the correspondence details and select the reason for cancellation (Voluntary or Compulsory).

- Input Data: Enter the requested financial figures and asset details prepared in Step 1.

- Submit: Review the declaration carefully and click submit.

Step 3: Monitor Status and Continue Filing

After submission, IRAS typically processes the request within 1 to 10 working days. You will receive a notification letter and, if registered for e-Notifications, an SMS or email. It is vital to continue filing your regular GST returns until you receive the official approval letter stating your last day of registration.

Understanding Your Final GST Return (Form F8) Obligations

Form F8 is the final GST return that covers the period from your last regular return up to your effective date of deregistration.

This is not merely another routine submission; it serves as the formal “tax clearance” document where all remaining GST matters are finalized.

What is Form F8 and When is it Due?

Upon approval of your cancellation, IRAS will issue a specifically designated return called Form F8. This form is critical because it acts as the closing ledger for your GST account.

- Filing Deadline: Unlike standard returns which are due one month after the accounting period, the Form F8 is strictly due one month after the end of the prescribed final accounting period mentioned in the approval letter.

- Content: It must include the total value of supplies made up to the last day of registration.

- Outstanding Liabilities: You must account for output tax on all taxable supplies made before the cancellation date, even if you haven’t issued the invoice or received payment yet.

Many businesses wrongly believe that submitting a deregistration application allows them to stop filing immediately. This is incorrect. Koobiz consistently reminds clients that all compliance duties remain fully in effect until the final Form F8 is lodged and any GST due is paid.

Beyond the mechanics of filing, it is equally important to understand the financial consequences of leaving the GST system. The most technically challenging element of this stage is how IRAS treats the business assets you still hold—a concept referred to as Deemed Supply.

Handling Business Assets and ‘Deemed Supply’ Upon Deregistration

Deemed Supply is a provision where assets held by a business upon deregistration are treated as if they were sold, requiring the business to account for output tax on their Open Market Value.

This rule ensures that businesses do not gain an unfair tax advantage by claiming input tax on assets (like machinery, vehicles, or inventory) and then deregistering to use them tax-free. If you have claimed input tax on these items, IRAS essentially “claws back” that benefit upon your exit.

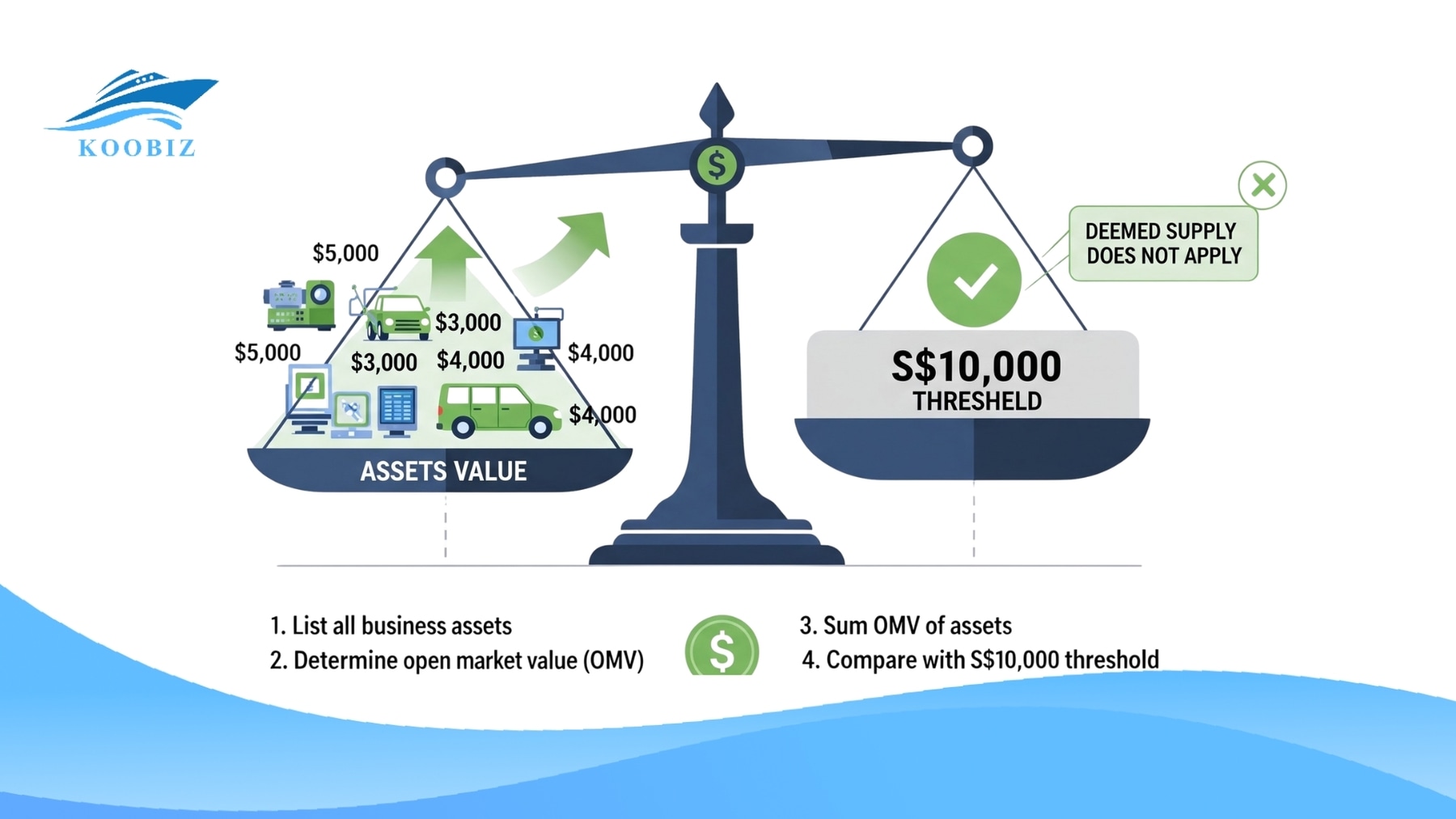

How to Calculate Output Tax on Remaining Assets

To determine if you owe money under this rule, you must assess the value of all your taxable assets on the last day of registration.

The calculation follows a specific threshold:

- The S$10,000 Threshold: You need to calculate the GST chargeable on the Open Market Value (OMV) of all your assets. If the total GST amount is more than S$10,000, you must account for this tax in your Form F8.

- Exemption: If the total GST amount calculated is S$10,000 or less, you do not need to account for output tax. This is a relief provided to small businesses to reduce the burden of deregistration.

- Input Tax Condition: Deemed supply only applies to assets where input tax was previously claimed (or could have been claimed). If you bought an asset from a non-GST registered supplier and never claimed input tax, it is excluded from this calculation.

Koobiz accountants often assist in valuing inventory and fixed assets to determine if clients cross this S$10,000 threshold, ensuring accurate reporting in the Form F8.

Exceptions for Transfer of Business as a Going Concern (TOGC)

There is, however, an important exception to the Deemed Supply rule, when a business is not shutting down, but being transferred to a new owner.

If your business is transferred as a Going Concern (TOGC) to another GST-registered person (or a person who becomes registered immediately), the assets transferred are excluded from the deemed supply calculation.

- Condition: The business must be capable of separate operation, and the assets must be used by the transferee to carry on the same kind of business.

- Benefit: This relieves the cash flow burden of paying GST on the transfer of the entire business assets.

Under IRAS’s TOGC guidelines, this relief is only available if the proper documentation and notifications are in place. Meeting these requirements ensures the transferor is not required to account for unnecessary output tax on the business transfer.

Real-World Scenarios: GST Deregistration in Action

To show how these rules work in practice, here are three common situations faced by Singapore businesses. These examples highlight the key decisions and financial implications involved.

Disclaimer: The following are illustrative examples only. Please consult IRAS or a qualified tax professional for advice specific to your business.

Scenario 1: The Retail Closure (Compulsory Cancellation)

- Situation: “FashionSg Pte Ltd” decides to close its physical outlet and cease business operations entirely on 31 March 2026 due to rising rental costs.

- Action: The director is legally required to submit the cancellation application via myTax Portal by 30 April 2026 (within 30 days of cessation).

- Outcome: IRAS approves the cancellation effective 31 March 2026. The company must file its final Form F8 for the period from 1 January to 31 March 2026. It must also account for GST on any unsold inventory held as of 31 March 2026 if the total GST exceeds S$10,000.

Scenario 2: The Consultant’s Pivot (Voluntary Cancellation)

- Situation: “TechSolve,” a consultancy firm, registered for GST voluntarily in January 2024. By June 2026, their annual turnover has stabilized at S$600,000 as they downsize their client base.

- Action: Since they have fulfilled the 2-year lock-in period (Jan 2024 – Jan 2026), they are eligible to deregister.

- Decision: TechSolve performs a cost-benefit analysis. They realize they have minimal taxable expenses (no office rental, few subscriptions) and their clients are mostly non-GST registered. Deregistering will lower their administrative burden without significantly impacting their costs. They proceed to apply.

Scenario 3: The Asset Trap (Deemed Supply Calculation)

- Situation: A logistics company is deregistering. On their last day of registration, they still own a delivery van (Open Market Value: S$80,000) and warehouse equipment (Open Market Value: S$40,000). Both items were claimed for input tax previously.

- Calculation:

- Total Value of Assets = S$120,000

- GST at 9% = S$10,800

- Result: Since the calculated GST (S$10,800) is **more than S$10,000**, the company must account for this full amount in their final Form F8 and pay it to IRAS.

- Contrast: If the total GST amount had been S$9,000, the company would not need to pay any output tax on these assets.

Special Circumstances for GST Cancellation

There are several unique scenarios, such as the death of a sole proprietor or corporate insolvency, that trigger specific deregistration protocols outside the standard process.

While these are considered “rare attributes” within GST administration, they are crucial for executors, liquidators, and legal representatives managing the business’s affairs.

Deregistration due to Sole Proprietor’s Death or Incapacity

When a sole proprietor passes away, the GST registration does not end automatically if the business continues under an executor or administrator.

- The Process: The personal representative (executor or administrator) must inform IRAS. If they continue to run the business to wind it up or sell it, they are liable for the GST registration during that interim period.

- Finalization: Eventually, when the business assets are distributed or the business ceases, the representative must file for cancellation.

Cancellation during Liquidation or Receivership

For companies entering liquidation (winding up) or receivership, the responsibility for GST compliance shifts to the appointed liquidator or receiver.

- Liquidator’s Role: The liquidator is responsible for filing the Form F8 and settling GST liabilities from the realized assets.

- Priority of Debt: GST liabilities are often considered preferential debts in insolvency proceedings.

- Koobiz advises that in such complex scenarios, professional tax advice is mandatory to ensure the liquidator does not incur personal liability for non-compliance.

Consequences of Failing to Deregister on Time

Yes, there are significant legal and financial penalties for failing to notify IRAS of a cessation of business or failing to submit the final Form F8 on time.

IRAS takes non-compliance seriously to maintain the integrity of the tax system.

- Late Notification: Failing to apply for cancellation within 30 days of ceasing business is an offence.

- Late Filing of Form F8: Similar to regular returns, late filing attracts a penalty of S$200 per month for every month the return remains outstanding (capped at S$10,000).

- General Penalties: In severe cases of negligence or evasion, prosecution may occur, leading to fines up to S$5,000 and possible imprisonment.

Conversely, timely deregistration ensures a clean slate. It allows the business owners to close the entity legally or pivot to a new venture without the baggage of unresolved tax debts.

Conclusion

GST deregistration in Singapore is not a simple administrative click. From identifying whether cancellation is voluntary or compulsory, to handling Deemed Supply and completing the final Form F8, each stage requires precision. Whether you are winding down operations or restructuring for the future, compliance is essential to avoid penalties and achieve peace of mind.

At Koobiz, we specialize in supporting businesses through every stage of their lifecycle in Singapore. From company incorporation and opening bank accounts to tax planning and GST deregistration, our team of experts ensures your administrative burden is minimized. If you are unsure about your eligibility for cancellation or need assistance calculating your final tax liabilities, Koobiz is here to guide you through a seamless exit from the GST system.

Visit Koobiz.com today for professional consultation on your Singapore business needs.

Leave a Reply