[SUMMARIES]

Universal Coverage: The Act covers all employees (local and foreign) under a contract of service, regardless of whether they are full-time, part-time, or temporary.

Key Exclusions: Seafarers, domestic workers, and civil servants are explicitly excluded and governed by separate regulations.

The PME Distinction: Managers and Executives are covered for core provisions (like dismissal) but are excluded from Part IV (hours and overtime) if they earn over $4,500.

Salary Thresholds: Part IV protection applies strictly to workmen earning up to $4,500 and non-workmen earning up to $2,600.

Contract Type Matters: Only a “Contract of Service” qualifies for protection; a “Contract for Service” (Freelancers) does not.

[/SUMMARIES]

Understanding the scope of Singapore’s Employment Act is essential, but often misunderstood.. At Koobiz, where we support businesses with Singapore incorporation and ongoing compliance, we simplify these legal boundaries for employers and founders. This guide definitively answers who is covered under the Employment Act versus excluded, clarifying salary thresholds for PMEs and Workmen to help you navigate rights and obligations with confidence.

What is the Singapore Employment Act?

The Singapore Employment Act (Chapter 91) is the country’s primary labour law, setting out the minimum terms and conditions for anyone employed under a contract of service. It functions as a legal safety net, ensuring that no employment agreement can provide terms that are less favourable than those prescribed by the Ministry of Manpower (MOM).

Key Provisions of the Act:

- Minimum Standards: Establishes the baseline for working hours, overtime, and leave entitlements.

- Contract Validity: Any contract term less favorable than the Act is legally null and void.

- Scope: Covers rights regarding public holidays, sick leave, maternity protection, and termination notice.

- Purpose: Designed to prevent exploitation and maintain industrial harmony between employers and employees.

For businesses incorporating in Singapore through Koobiz, aligning internal HR policies with these definitions is the first step toward compliance.

Who is Covered Under the Employment Act?

The Employment Act generally covers every employee engaged under a contract of service with an employer, including both local Singaporeans and foreign employees. Specifically, this grouping encompasses the following categories, provided they do not fall into specific exclusion groups:

- Full-time Employees: Permanent staff working standard hours.

- Part-time Employees: Staff working less than 35 hours a week.

- Temporary Employees: Staff hired for a short-term period.

- Contract Employees: Staff engaged for a specific project or fixed term.

Over the years, the Ministry of Manpower has expanded the Act’s scope to protect most of the workforce. While high-income earners were once excluded, recent amendments have removed these limits. Today, anyone in a genuine employer–employee relationship,defined by control, payment, and mutual obligations, is covered by the Act’s core provisions.

These core protections include timely salary payment, safeguards against wrongful dismissal, and statutory leave entitlements. As a result, the Employment Act now applies to the vast majority of private-sector employees in Singapore, regardless of working hours or employment arrangement.

Who is Excluded from the Employment Act?

Three specific groups are explicitly excluded from the Employment Act. These exclusions exist because these roles are governed by their own specific legislative acts or the private nature of the employment makes the general Act unsuitable:

- Seafarers: They are covered under the Merchant Shipping (Maritime Labour Convention) Act, which is specifically tailored to the unique nature of maritime work and international standards.

- Domestic Workers: They are excluded because working in a private household makes regulating specific hours of work (a key component of the Employment Act) practically difficult. Instead, they are covered under the Employment of Foreign Manpower Act.

- Statutory Board Employees & Civil Servants: Their terms of employment are guided by the Public Service Division, which offers its own comprehensive set of benefits and regulations distinct from the private sector.

Are Managers and Executives (PMEs) Covered?

Yes, all Managers and Executives (PMEs) are covered by the Employment Act, but their coverage is limited to “Core Provisions.” They are explicitly excluded from Part IV provisions (working hours and overtime), regardless of their salary level.

It is helpful to view PME coverage as having two distinct layers:

- Core Protections (YES): Since April 2019, all PMEs are covered for core rights. This includes protection against wrongful dismissal, timely payment of salary, paid public holidays, paid sick leave, and maternity/childcare leave.

- Part IV Protections (NO): PMEs are not entitled to overtime pay, statutory rest days, or regulated hours of work. The law assumes that PME roles are “outcome-based” rather than “time-based,” meaning they are paid for the responsibilities they hold rather than the specific hours they clock.

Who qualifies as a PME? A PME is an employee with executive or supervisory functions. This typically includes those with authority over hiring, discipline, termination, and performance reviews, as well as professionals with specialized tertiary education (e.g., lawyers, accountants, doctors).

Important Note on Public Holidays: All PMEs are entitled to paid public holidays. If required to work on a public holiday, they must receive either an extra day’s salary or a replacement day off, regardless of income level.

Understanding Part IV Coverage: Salary Thresholds

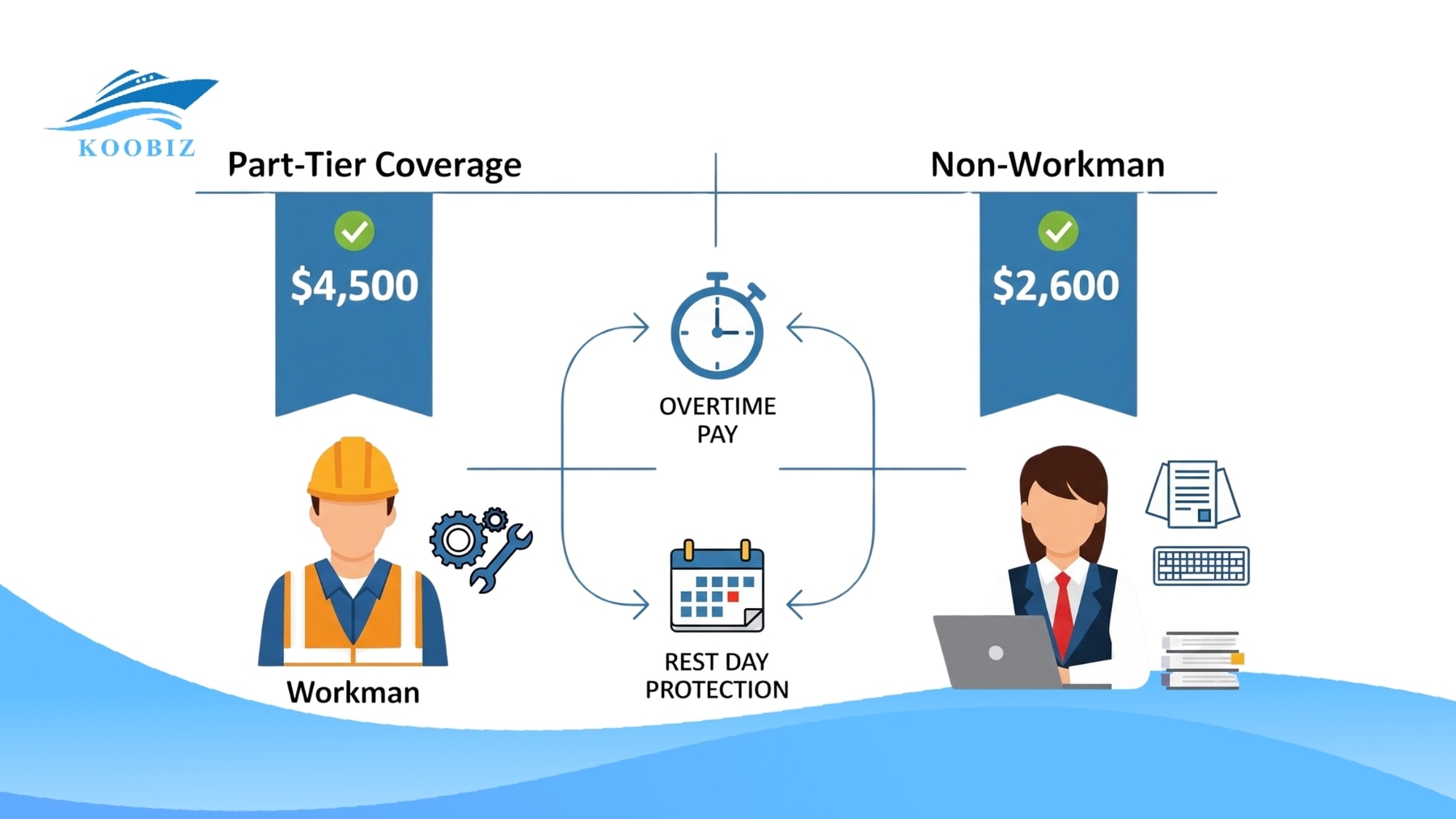

Part IV protection depends on salary tiers: Workmen earning up to $4,500 and Non-workmen earning up to $2,600 are eligible for overtime and rest day protections. In contrast to the general provisions that apply to everyone, Part IV is a specific subset of the Act designed to protect vulnerable employees from excessive working hours.

This comparison of salary thresholds creates a two-tier system within the workforce. If an employee falls under Part IV, they are legally entitled to 1.5 times their hourly basic rate of pay for overtime work and one rest day per week. Employers cannot ask them to work more than 12 hours a day or 72 hours of overtime a month without a specific exemption. Koobiz often advises clients on structuring salary packages to clearly define who falls into these categories to avoid future disputes.

Who qualifies as a ‘Workman’?

A Workman is a distinct category under the Employment Act, referring to employees whose roles are primarily physical in nature. This includes artisans, apprentices, and individuals engaged in operating vehicles for transport. The classification is based on the substance of the work performed, not the job title on paper.

Specifically, “manual labor” implies that the employee spends more than 50% of their time performing physical tasks. This includes roles like cleaners, construction workers, bus drivers, and machine operators. For these employees, the salary threshold for Part IV coverage is significantly higher ($4,500) than for non-workmen, reflecting the physical toll of their work and the necessity for strict regulation of their rest periods.

Coverage for ‘Non-Workmen’

Non-workmen are employees under a contract of service who do not fit the definition of a workman, typically performing white-collar or administrative roles. However, unlike workmen, non-workmen are only covered under Part IV if their basic monthly salary is $2,600 or less.

To illustrate, a junior administrative assistant earning $2,500 would be entitled to overtime pay and rest day protections. However, a senior administrator earning $2,800 would conceptually “graduate” out of Part IV protection, even though they are not a Manager or Executive. They would still be covered by the core provisions of the Act (sick leave, dismissal protection) but would no longer be legally entitled to overtime pay under the statutory law.

Practical Examples: Coverage Scenarios

To bring these rules to life, let’s look at three common employment scenarios. These examples illustrate how job scope and salary interact to determine specific rights regarding overtime and working hours.

Scenario A: The Marketing Manager (PME)

Profile: Sarah is a Marketing Manager earning $5,000/month. She often works late to meet campaign deadlines.

- Coverage Status: She is covered under the Core Provisions (sick leave, dismissal protection) but excluded from Part IV.

- Implication: Her employer is not legally required to pay her overtime for late nights. However, she is protected by the Act if she is fired without due cause or if her salary is withheld.

Scenario B: The Administrative Assistant (Non-Workman)

Profile: John is an Admin Assistant earning $2,500/month. His boss asks him to stay back on Saturdays to file paperwork.

- Coverage Status: He is a Non-Workman earning below the $2,600 threshold. He is fully covered, including Part IV provisions.

- Implication: John is legally entitled to 1.5x overtime pay for work beyond 44 hours a week or for work done on his rest day. If his salary were $2,800, he would lose this overtime entitlement.

Scenario C: The Site Supervisor (Workman)

Profile: Ali is a Construction Site Supervisor earning $4,000/month. His role involves manual supervision and operation of machinery (more than 50% of his time).

- Coverage Status: He is classified as a Workman. Since he earns below the $4,500 threshold for workmen, he is fully covered, including Part IV.

- Implication: Despite his relatively high salary compared to John (Scenario B), Ali’s manual job scope grants him strict overtime rights that Sarah (the Manager) does not have.

Contract of Service vs Contract for Service

Employees work under a Contract of Service (covered), while freelancers and independent contractors work under a Contract for Service (excluded). This distinction is the legal boundary that separates an employee entitled to CPF and statutory benefits from a self-employed individual who is not.

To clearly visualize the differences, refer to the comparison table below based on MOM’s “Control” and “Economic Reality” tests:

| Key Factor | Contract of Service (Employee) | Contract for Service (Freelancer) |

|---|---|---|

| Coverage | Covered under Employment Act | Excluded from Employment Act |

| Control | Employer decides working hours and how work is done | You decide your own schedule and methods of work |

| Equipment | Employer provides tools and equipment | You provide your own tools and equipment |

| Financial Risk | Employer bears the business risk | You bear the profit and loss risk |

| Subcontracting | You cannot subcontract your duties | You can often hire others to do the work |

| Payment | Paid a fixed salary for time/role | Paid a fee for specific results/projects |

At Koobiz, we emphasize that simply labeling a contract as “freelance” does not make it so; if the reality of the work mimics the “Contract of Service” column, the courts may deem it as such, making the employer liable for missing benefits.

Special Coverage Scenarios

Interns and probationers fall into unique categories depending on the nature of their contract and the educational institution involved. While they are often viewed as temporary or learning roles, the law applies specific tests to determine their coverage.

Are Interns Covered?

Interns are generally not covered by the Employment Act if the internship is part of a compulsory academic requirement from a recognized educational institution. In this specific grouping, the primary objective is education rather than employment.

However, if the internship is voluntary, from a non-recognized school, or continues after graduation, it is likely treated as a Contract of Service. In such cases, the “intern” is regarded as an employee and entitled to statutory benefits like annual and sick leave. Simply calling a role an “internship” does not remove legal obligations.

Are Employees on Probation Covered?

Yes, employees on probation are covered under the Employment Act from their very first day of employment. There is a common misconception that statutory rights only kick in after confirmation, but the law makes no distinction between “probationary” and “confirmed” staff regarding core coverage.

Specifically, while they are covered, eligibility for certain benefits has a vesting period. For example, paid annual leave and paid sick leave entitlements typically require the employee to have served for at least 3 months. However, protection against unauthorized salary deductions, payment timeliness, and public holiday pay applies immediately. If an employer wishes to terminate a probationer, they must still follow the notice period agreed upon in the contract or the minimums set by the Act.

About Koobiz

Navigating Singapore’s employment laws is only one dimension of running a successful business. Koobiz is your trusted partner for entering and operating in the Singapore market. We provide comprehensive Corporate Services, including Singapore Company Incorporation, Corporate Secretary services, and professional assistance with opening corporate bank accounts in Singapore.

Beyond incorporation, our team of experts manages your Tax, Accounting, and Audit compliance, ensuring your business operations remain legally sound and financially optimized. Whether you are a foreign entrepreneur establishing an Asian headquarters or a local startup seeking dependable compliance support, Koobiz delivers tailored solutions that streamline administrative burdens and reduce regulatory risk, so you can focus fully on scaling and growing your business in Singapore with confidence.

Visit us at Koobiz.com to learn more about how we can support your business journey in Singapore.

Leave a Reply