[SUMMARIES]

Tax Residency Rule: Your tax status depends on how long you are in Singapore. You are generally considered a tax resident if you stay or work for 183 days or more in a calendar year.

Rate Distinction: Tax residents pay progressive rates starting from 0%. Non-residents typically pay a flat 15% rate on employment income (or the progressive rate, whichever is higher). .

Tax Reliefs: Only tax residents can claim personal tax reliefs to reduce their taxable income.

Mandatory Clearance: When leaving your job or Singapore for an extended period, your employer must complete a Tax Clearance process.

[/SUMMARIES]

Figuring out your correct Singapore income tax rate as a foreigner depends completely on your residency status, primarily determined by the “183-day rule.” This guide will help you understand the different tax brackets, available reliefs, and essential procedures.

At Koobiz, we simplify this calculation for you. This guide compares resident vs. non-resident rates, explains the 2025 tax brackets, and outlines essential reliefs and tax clearance procedures to ensure you pay exactly what you owe.

Understanding Singapore Tax Residency Rules

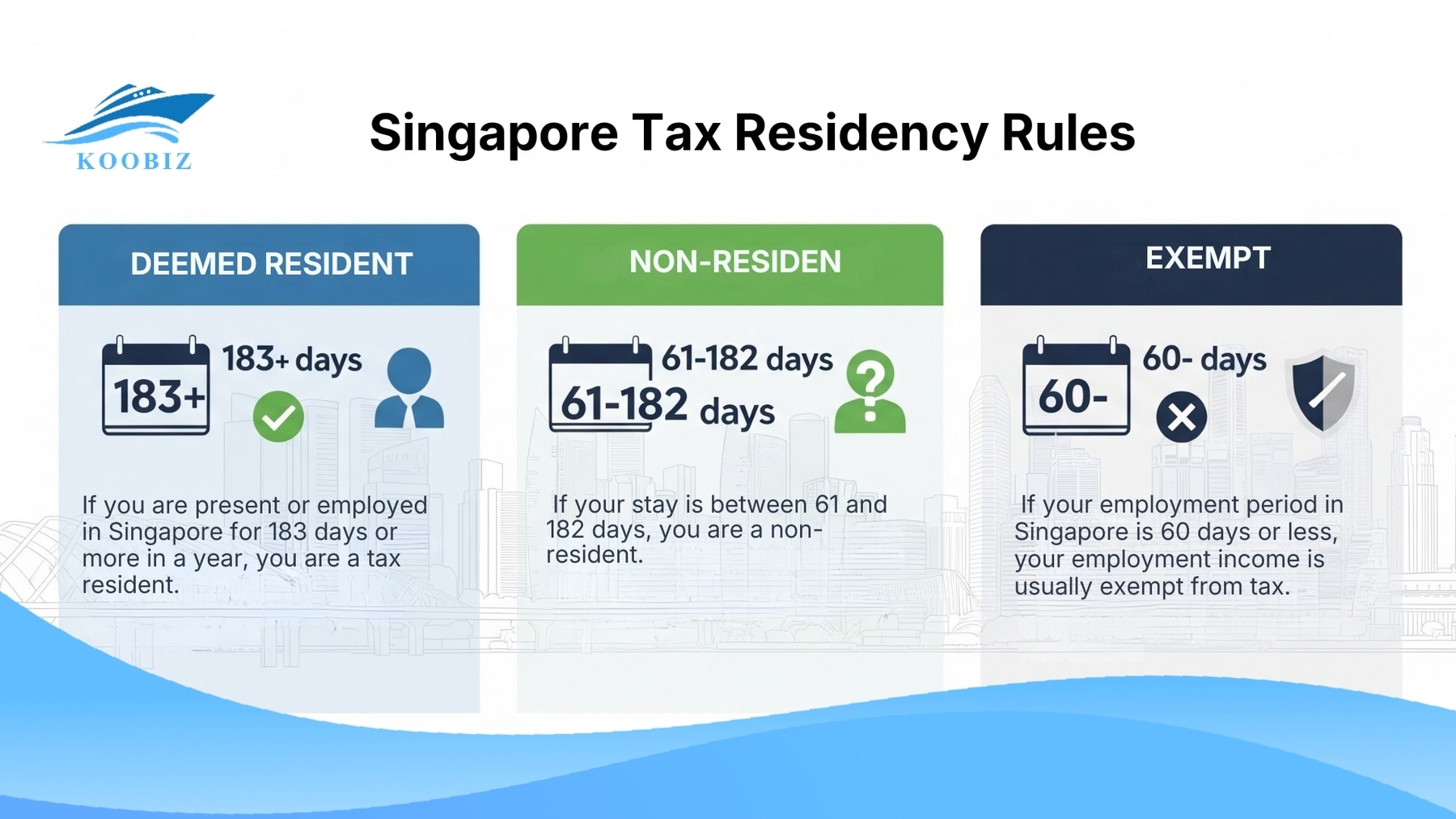

Your tax residency is based on your physical presence in Singapore during the year (January 1 to December 31), not your citizenship or type of work pass. The rules are straightforward:

- Deemed Resident (183 Days or more): If you are present or employed in Singapore for 183 days or more in a year, you are a tax resident. You will benefit from progressive tax rates and can claim tax reliefs. .

- Non-Residen(61 to 182 Days): If your stay is between 61 and 182 days, you are a non-resident. Your employment income will be taxed at a higher flat rate or the progressive rate (whichever results in more tax), and you cannot claim personal reliefs.

- Exempt (60 Days or less): If your employment period in Singapore is 60 days or less, your employment income is usually exempt from tax. This does not apply to company directors or public entertainers.

Special Administrative Concessions for Residency

Even if you don’t meet the 183-day rule in a single year, you might still be considered a tax resident under special IRAS rules if your employment stretches continuously across two or three calendar years.

- Two-Year Administrative Concession: If you reside or are employed in Singapore for a continuous stretch of at least 183 days that spans two calendar years, you are considered a tax resident for both years.

- Three-Year Administrative Concession: If you reside or work in Singapore for three consecutive years without breaks, you will be considered a tax resident for each of the three years, even if your days in the first or third year are fewer than 183.

After you’ve set out your timeline, the next step is to see how these statuses convert into the actual tax rates expressed as percentages.

Resident vs. Non-Resident Tax Rates: What is the Difference?

Residents enjoy a progressive tax schedule from 0% up to 24%, while non-residents are taxed at a flat rate of either 15% or 24%. When comparing these approaches, it becomes evident why attaining tax residency can be financially beneficial for foreigners earning a moderate income. The table below highlights the main distinctions:

| Feature | Tax Residents | Non-Residents |

|---|---|---|

| Tax Rates | Progressive Rates (0% to 24%) | Flat rate of 15% OR Progressive Resident Rates (whichever is higher) for employment income. |

| Tax-Free Income | First $20,000 is tax-free. | None (taxed from the first dollar). |

| Personal Reliefs | Eligible for reliefs (e.g., Earned Income, Spouse Relief). | Not eligible for personal tax reliefs. |

| Director’s Fees | Taxed as regular employment income. | Flat rate of 24% (from YA 2024). |

This distinction creates a “tipping point” where being a non-resident becomes significantly more expensive. Koobiz often advises clients to carefully plan their entry and exit dates to maximize their days in Singapore if they are on the borderline of the 183-day threshold.

Singapore Income Tax Calculator 2025: The Progressive Tax Brackets

The Singapore tax structure is progressive, so higher earners pay a larger share of tax. Below is the full tax table applicable for the Year of Assessment (YA) 2024 onwards (for income earned in 2023 and subsequent years).

To accurately calculate Singapore income tax for residents, apply your Net Chargeable Income (Total Income minus Expenses and Reliefs) to these brackets.

| Chargeable Income | Tax Rate (%) | Gross Tax Payable on Bracket |

|---|---|---|

| First $20,000 | 0% | $0 |

| Next $10,000 | 2% | $200 |

| Next $10,000 | 3.5% | $350 |

| Next $40,000 | 7% | $2,800 |

| Next $40,000 | 11.5% | $4,600 |

| Next $40,000 | 15% | $6,000 |

| Next $40,000 | 18% | $7,200 |

| Next $40,000 | 19% | $7,600 |

| Next $40,000 | 19.5% | $7,800 |

| Next $40,000 | 20% | $8,000 |

| Next $180,000 | 22% | $39,600 |

| Next $500,000 | 23% | $115,000 |

| Above $1,000,000 | 24% | – |

Example Calculation:

If a foreign professional classified as a Resident earns $120,000 per year:

- On the first $80,000: Tax is $3,350 (Cumulative of the first 4 brackets).

- On the remaining $40,000 (at 11.5%): Tax is $4,600.

- Total Tax Payable: $7,950 (Effective rate of approx 6.6%).

This comparatively low effective rate helps explain why Singapore remains a popular destination for global talent. Note that the calculation would change if residency criteria are not met.

How to Calculate Tax for Non-Resident Professionals?

For non-residents on employment, the calculation is a two-step comparison:

Step 1: Calculate Flat Rate Tax

Apply a flat 15% rate to your total employment income.

Step 2: Calculate Progressive Rate Tax

Apply Singapore’s resident progressive tax rates (as shown in the table) to the same total income.

Note: Non-residents generally cannot claim personal reliefs, so the taxable amount is not reduced by reliefs as it would be for residents.

Step 3: Compare and Pay

Compare the results from Step 1 and Step 2.

Your final tax liability is whichever amount is higher.

Important note:

The 15% concession in Step 1 applies specifically to employment income. Other income sources, such as Director’s Fees, are taxed differently (typically at a flat 24% from YA 2024).

Case Studies: Real-World Tax Scenarios

To help you understand how these rules apply in real life, let’s look at three common scenarios for foreigners working in Singapore.

Scenario A: The “Full-Year” Resident (Standard Professional)

Profile: Sarah, a Marketing Director from the UK.

Duration: Lived in Singapore for 365 days in 2024.

Annual Income: $150,000.

Status: Tax Resident (Stayed > 183 days).

- Calculation Method: Progressive Resident Rates.

- Step 1: First $120,000 is taxed at approx $7,950 (cumulative).

- Step 2: Remaining $30,000 is taxed at 15% = $4,500.

- Total Tax: $7,950 + $4,500 = $12,450.

- Note: Sarah can further reduce this amount by claiming personal reliefs.

Scenario B: The Short-Term Consultant (Non-Resident)

Profile: Mark, an IT Consultant from Australia.

Duration: Worked in Singapore for 3 months (90 days) on a short-term contract.

Total Income earned in SG: $30,000.

Status: Non-Resident (Stayed 61–182 days).

- Calculation Method: “Higher of the two” (Flat 15% vs. Progressive).

- Option 1 (Flat 15%): $30,000 × 15% = $4,500.

- Option 2 (Progressive): First $20k is $0; Next $10k @ 2% = $200.

- Result: Mark pays the higher amount: $4,500.

- Analysis: Because Mark is a non-resident, he pays significantly more ($4,500) than if he were a resident earning the same amount ($200).

Scenario C: The Business Traveler (Tax Exempt)

Profile: James, a Regional Manager based in Hong Kong.

Duration: Traveled to Singapore for various business meetings totaling 45 days in the year.

Income Attributable to SG: $15,000.

Status: Exempt (Stayed ≤ 60 days).

- Calculation Method: Short-term employment exemption.

- Total Tax: $0.

- Condition: This exemption applies because James is not a company director or public entertainer, and his presence in Singapore was 60 days or less.

What Tax Reliefs and Deductions are Available for Foreigners?

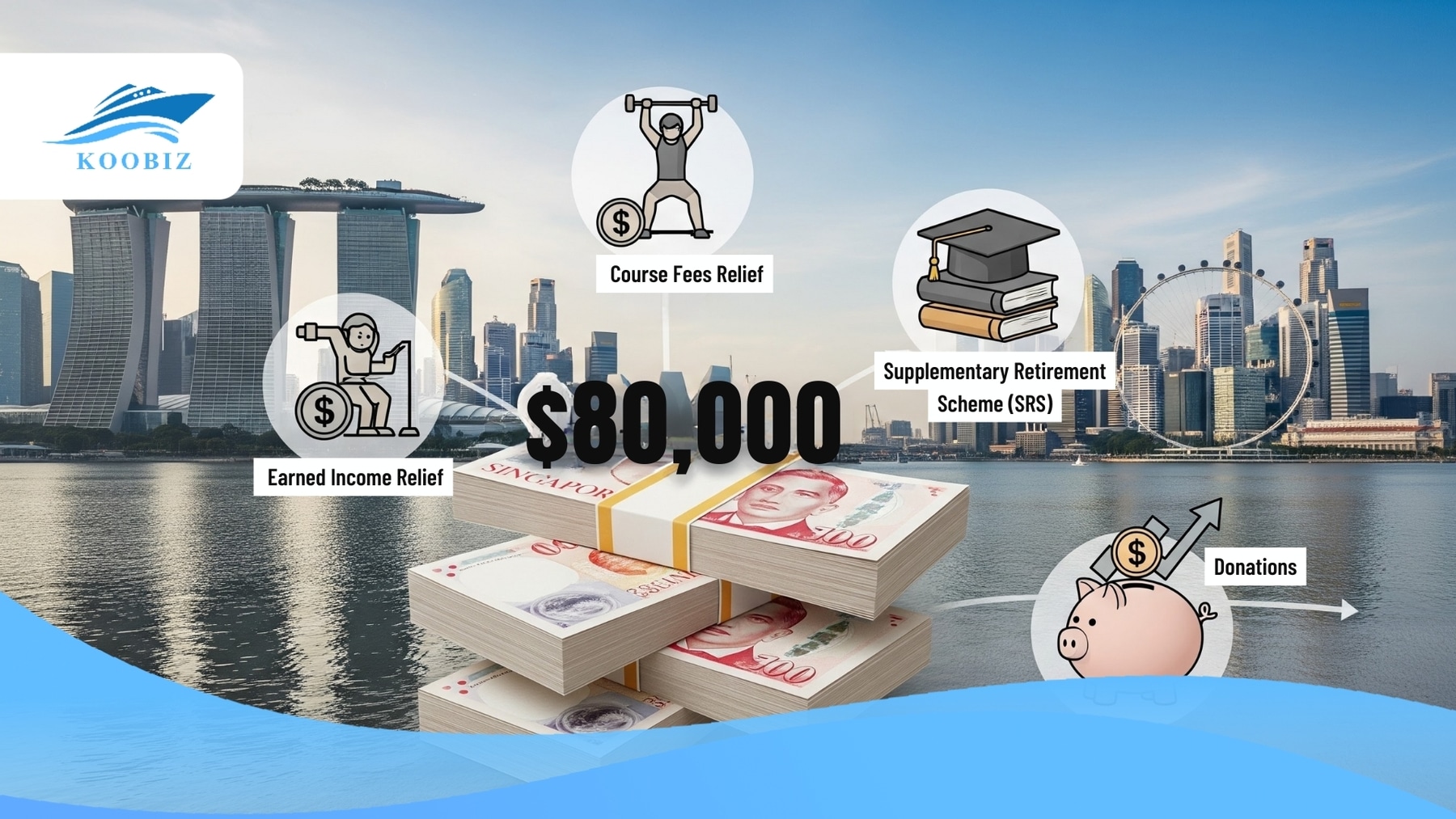

Tax reliefs are mainly available to tax residents, offering a great way to lower your Singapore income tax. The total reliefs you can claim are capped at $80,000 per year.

Unlike citizens and PRs, foreigners qualify for fewer deductions. However, key reliefs include:

1. Earned Income Relief:

Tax residents automatically qualify for this based on age.

- Below 55: $1,000

- 55 to 59: $6,000

- 60 and above: $8,000

2. Course Fees Relief:

For relevant courses (up to $5,500, but check for future changes).

3. Supplementary Retirement Scheme (SRS):

This is the most powerful tax planning tool for foreign residents. Since foreigners do not contribute to the Central Provident Fund (CPF), they can voluntarily contribute to the SRS.

- Benefit: Every dollar contributed is tax-deductible.

- Cap: Foreigners can contribute up to $35,700 per year.

- Strategy: By contributing to SRS, you effectively lower your chargeable income, potentially dropping you into a lower tax bracket.

4. Donations:

Donations to approved charities are 250% tax-deductible.

Koobiz recommends that high-earning foreign residents consider SRS contributions before the end of the year to optimize their tax bill. Conversely, Non-Residents are generally not eligible for any personal tax reliefs, meaning their taxable income is usually their gross income.

We have covered how to calculate the tax and reduce it. Now, we must address the critical compliance procedures when leaving a job and special taxation schemes.

Tax Clearance and Special Schemes for Foreign Employees

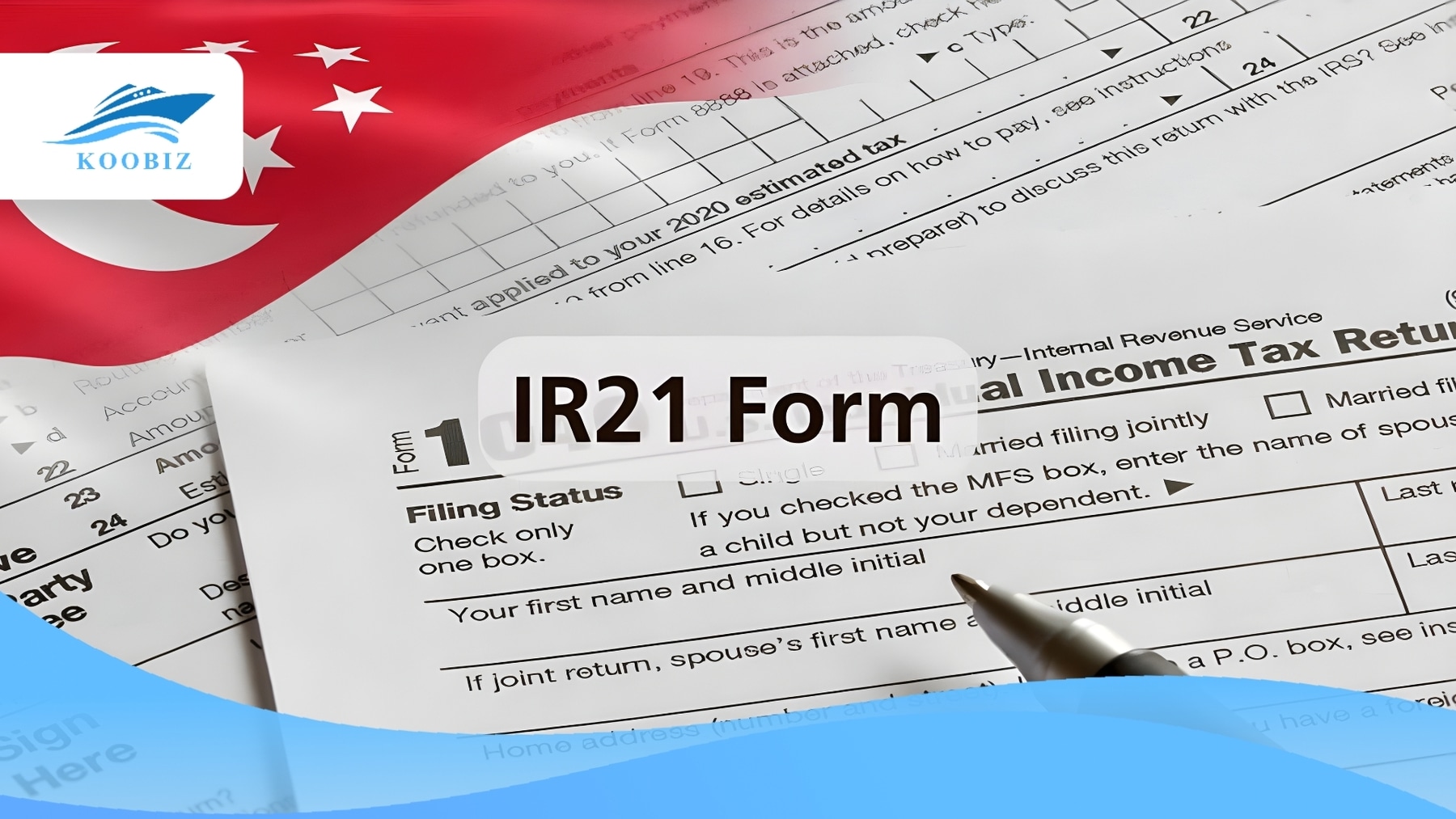

This category includes mandatory procedures like Tax Clearance (Form IR21) and special schemes like the DTA and NOR.

Beyond the basic calculation, the lifecycle of a foreign employee in Singapore involves specific regulatory hurdles. The most critical of these occurs at the end of your employment.

Tax Clearance is a mandatory process where employers must notify IRAS at least one month before a non-Singapore citizen employee ceases employment or leaves Singapore for more than three months.

This is a strict compliance requirement. When you resign or are terminated, your employer is required to withhold all monies (salary, bonus, overtime pay) due to you. They must then file Form IR21.

- Process: The employer files the form. IRAS processes it (usually within 21 days, or immediately for e-filing).

- Outcome: IRAS issues a Tax Clearance Directive. The employer pays your tax liability from the withheld money and releases the remaining balance to you.

- Note: If the withheld amount is insufficient, you must pay the difference to IRAS immediately.

How Does the Double Taxation Agreement (DTA) Affect You?

Singapore has treaties with over 80 countries to prevent you from being taxed twice on the same income. If you are a tax resident of a treaty country, you may claim relief in your home country for tax paid in Singapore.

- Tax Credit: You may claim a tax credit in your home country for the tax paid in Singapore.

- Exemption: In some specific short-term assignment cases (often under 183 days), you might be exempt from Singapore tax entirely if your salary is paid by a foreign entity and not charged to a Singapore permanent establishment.

Are Director’s Fees Taxed Differently?

Yes, Director’s Fees for non-resident directors are subject to a final withholding tax rate, typically 24%.

Unlike employment income which might enjoy the 15% concession, remuneration for a role as a Board Director (where you do not perform daily executive functions) is taxed strictly. The company paying the fee must withhold this tax before paying the director.

What are the Penalties for Non-Compliance?

Failing to comply with tax obligations can result in severe penalties, including heavy fines and legal consequences for both employee and employer.Penalties for tax evasion or negligence can include fines of up to 400% of the tax undercharged, jail terms, and the freezing of bank accounts.

Singapore takes tax compliance very seriously. Common offenses include:

- Failure to file a tax return.

- Incorrect return without reasonable excuse.

Failure by the employer to file Form IR21 (Employers can be fined up to $1,000 and liable for the tax meant to be withheld).Failing to comply with tax obligations can result in severe penalties, including heavy fines and legal consequences for both employee and employer.

At Koobiz, we ensure our clients’ tax filings are accurate and timely to avoid these severe repercussions.

About Koobiz

Koobiz is your trusted partner for business and financial services in Singapore. We specialize in helping international entrepreneurs and professionals navigate the complexities of the Singaporean financial landscape.

- Company Incorporation: Seamless setup of your Singapore entity.

- Corporate Secretary: Full compliance with ACRA regulations.

- Tax & Accounting: From personal income tax filing for foreigners to corporate tax planning and auditing.

- Bank Account Opening: Expert consultancy to help you secure business banking facilities in Singapore.

If you are unsure about your residency status or need assistance with Form IR21, contact Koobiz today for professional guidance.

- Website: koobiz.com

Disclaimer: The information provided in this article is for general guidance only and does not constitute professional tax advice. Tax laws are subject to change, and individual circumstances vary. Readers are advised to consult with IRAS or a qualified tax advisor for personalized assistance. For the most up-to-date information, please visit the official IRAS Website.

Leave a Reply