[SUMMARIES]

Best for Local SMEs: OCBC Business Growth Account offers the most balanced features with instant setup for eligible local companies.

Best for Digital Startups: Aspire serves as an all-in-one financial operating system, ideal for companies needing speed and integrated corporate cards.

Best for Global Trade: Wise Business and Airwallex provide superior exchange rates (mid-market) compared to traditional banks.

Best Licensed Digital Bank: ANEXT Bank offers a middle ground with digital-first speed and SDIC insurance protection.

Key Decision Factor: Choose traditional banks (DBS, UOB) for safety and cash facilities, or fintechs for lower fees and ease of use.

Koobiz Tip: Foreign owners can open accounts remotely with fintechs, but traditional banks may require a physical presence or specific nominee director arrangements.

[/SUMMARIES]

Choosing a financial partner goes far beyond simply holding funds – it’s about managing cash flow efficiently, keeping operating costs low, and gaining access to the right business tools. In Singapore’s competitive 2025 landscape, business owners must weigh the reliability of traditional local banks against the flexibility of modern fintech platforms. Whether your focus is on lower fees, multi-currency support, or smooth Xero integration, this guide breaks down the leading options to help you decide with confidence. As a corporate services provider, Koobiz has guided hundreds of local and foreign founders through this exact decision as part of their company incorporation journey.

Quick verdict: Top business accounts by category

In Singapore’s 2025 landscape, a few clear leaders stand out – Aspire, OCBC, Wise, and DBS – each excelling in a different business use case. Before diving into the details, we’ve grouped these options by the practical needs of modern companies, because not all business accounts serve the same purpose. A high-transaction trading firm, for example, requires very different features from a lean, digital-first consultancy.

1. Best for New Startups & Digital Nomads: Aspire

Aspire isn’t a traditional bank but rather a financial operating system. It leads this category thanks to its smooth incorporation process, zero minimum balance requirements, and an interface designed specifically for digital-first founders.

2. Best for Established SMEs: OCBC

The OCBC Business Growth Account continues to be the benchmark for Singapore-registered companies seeking a full-service bank account, without the steep initial deposit thresholds that were once the norm.

3. Best for Global Trade & E-commerce: Wise Business / Airwallex

If your business pays suppliers in China or serves clients in the US, traditional bank FX spreads can quickly erode your margins. Platforms like Wise and Airwallex use mid-market exchange rates, helping you save up to 3% on each transaction.

4. Best for Cash- Heavy Businesses: DBS / UOB

For retail or F&B businesses that regularly deal with physical cash, the wide network of ATMs and cash deposit machines offered by DBS and UOB clearly sets them apart as the leading choice.

Best Traditional Business Bank Accounts: The “Big Three” Reviewed

There are three major local banks in Singapore:DBS, OCBC, and UOB that offer the highest level of security, regulatory protection, and comprehensive lending facilities.

Despite the rapid growth of fintech platforms, these “Big Three” banks remain the most trusted options for safeguarding corporate funds, backed by strong balance sheets and full MAS regulation. At Koobiz, we typically advise clients to use fintech solutions for day-to-day transactions while maintaining a traditional bank account for long-term reserves and added credibility.

OCBC Business Growth Account

The OCBC Business Growth Account is a go-to option for SMEs as it removes many of the traditional entry hurdles of corporate banking. Eligible Singapore-registered companies – usually those with only local directors and shareholders – can benefit from instant online account opening.

- Key feature: Low initial deposit of just SGD 500, often waived for the first six months under promotional offers.

- Fees: No monthly fee initially, with a standard charge of around SGD 10 per month if requirements are not met thereafter.

- Best for: Newly incorporated companies with local directors seeking a fast, reputable banking solution.

DBS Business Multi-Currency Account

Previously branded as the Digital Account, the DBS Business Multi-Currency Account stands out for its advanced digital integration through the DBS IDEAL platform. As Southeast Asia’s largest bank, DBS also offers exceptional network reliability and strong ecosystem connections.

- Key feature: The IDEAL mobile app is highly robust, enabling biometric authorization for transactions.

- Fees: Generally subject to an annual fee, with tiered pricing options available.

- Best for: Companies looking to automate back-office operations and connect banking data directly to ERP systems via APIs.

UOB eBusiness Account

The UOB eBusiness Account is built to keep transaction costs low, making it a compelling option for businesses that process a high volume of local payments. Beyond cost efficiency, UOB’s strong footprint across ASEAN is a major advantage for companies expanding into markets like Malaysia, Thailand, or Vietnam.

- Key feature: Generous free FAST/GIRO transaction limits designed for day-to-day operational efficiency.

- Fees: A competitive fee structure that offers rebates as transaction volumes increase.

- Best for: Trade and manufacturing businesses that rely on frequent local transfers and dependable regional banking connectivity.

Best Digital & Fintech Business Accounts for Startups

A new wave of challengers – Aspire, Wise, Airwallex, and licensed digital bank ANEXT – has reshaped business banking by cutting out paperwork and significantly reducing FX costs. Built with a digital-first approach, these platforms offer fully online account opening that can take just days, or even hours. For this reason, Koobiz frequently helps foreign founders set up these accounts as their main operational solution while their traditional bank applications are still in progress.

Aspire Business Account

Aspire positions itself as a full finance operating system rather than just a bank account, combining banking, expense management, and invoicing in one platform. What sets it apart is the issuance of corporate cards that offer cashback on digital advertising spend, such as Facebook or Google Ads.

- Pros: No minimum balance requirements, free local transfers, and built-in corporate card controls.

- Cons: Not a licensed bank — funds are held in safeguarded trust accounts and are not SDIC insured, and chequebooks are not available.

- Ideal user: Tech startups and digital agencies with significant online advertising spend.

Wise Business

Wise Business is the undisputed leader for international transfers, offering the mid-market exchange rate without hidden markups.

For companies with remote teams or overseas suppliers, Wise serves as a multi-currency wallet that holds 50+ currencies simultaneously.

- Pros: Transparent fees (usually 0.5% – 1%), local account details for receiving USD, GBP, EUR, and AUD like a local.

- Cons: Does not offer business loans or credit facilities.

- Ideal User: Freelancers, exporters, and companies with a distributed global workforce.

ANEXT Bank (Licensed Digital Bank)

Unlike Aspire or Wise, ANEXT is a fully licensed digital bank regulated by MAS, meaning it offers deposit insurance.

It bridges the gap between fintech speed and bank-grade security.

- Pros: SDIC insured up to SGD 100k, remote opening for foreigners, no minimum balance.

- Cons: Newer player with fewer integrated software features compared to Aspire.

- Ideal User: SMEs who want the safety of a licensed bank but the ease of a digital interface.

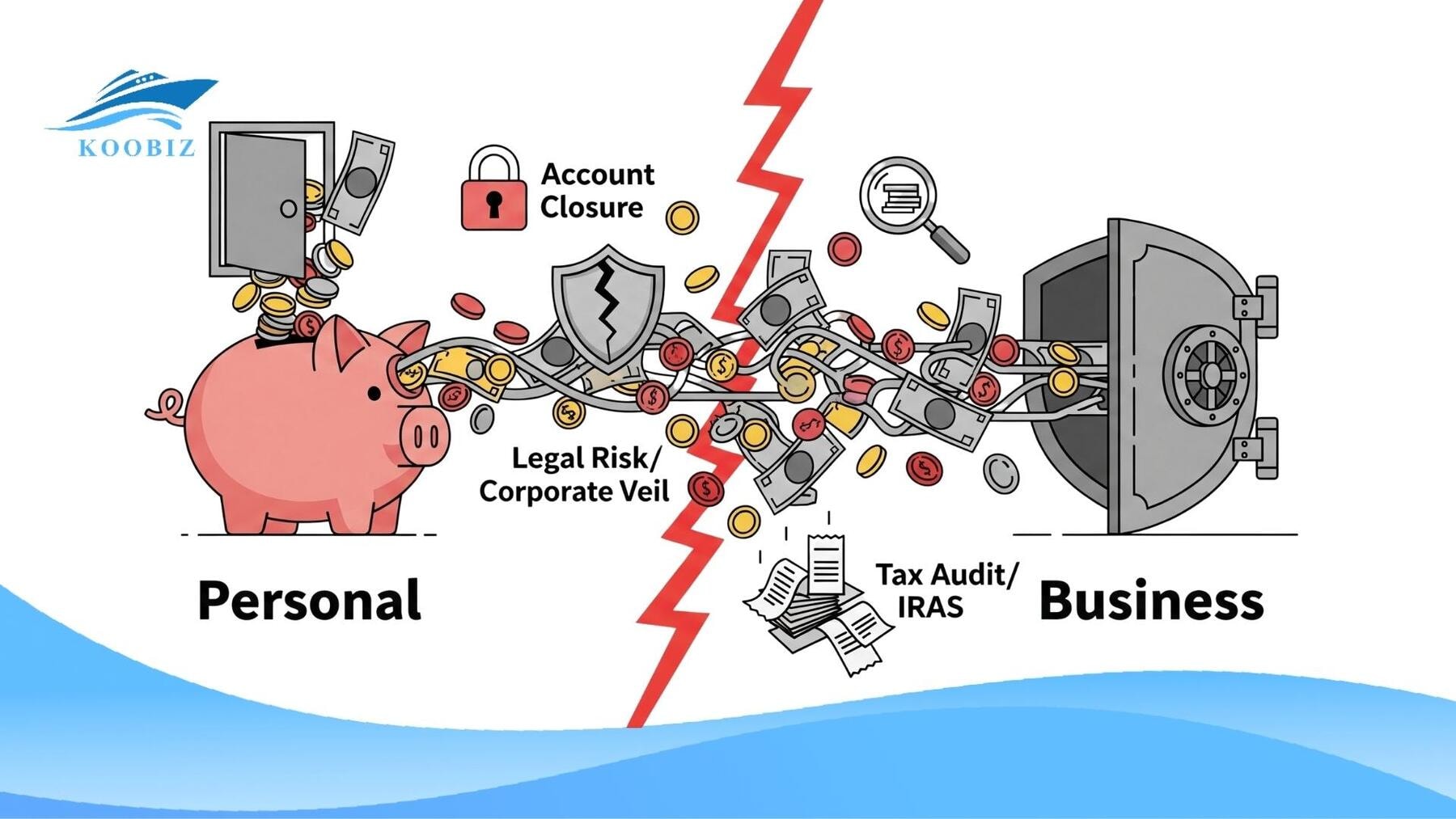

Traditional Banks vs. Digital Banks: Which Should You Choose?

To help you decide between the stability of a traditional bank and the speed of a digital challenger, we have compared them side-by-side based on the factors that matter most to Singapore business owners.

| Feature | Traditional Banks (DBS, UOB, OCBC) | Digital Banks/Fintechs (Aspire, Wise, ANEXT) | Winner |

|---|---|---|---|

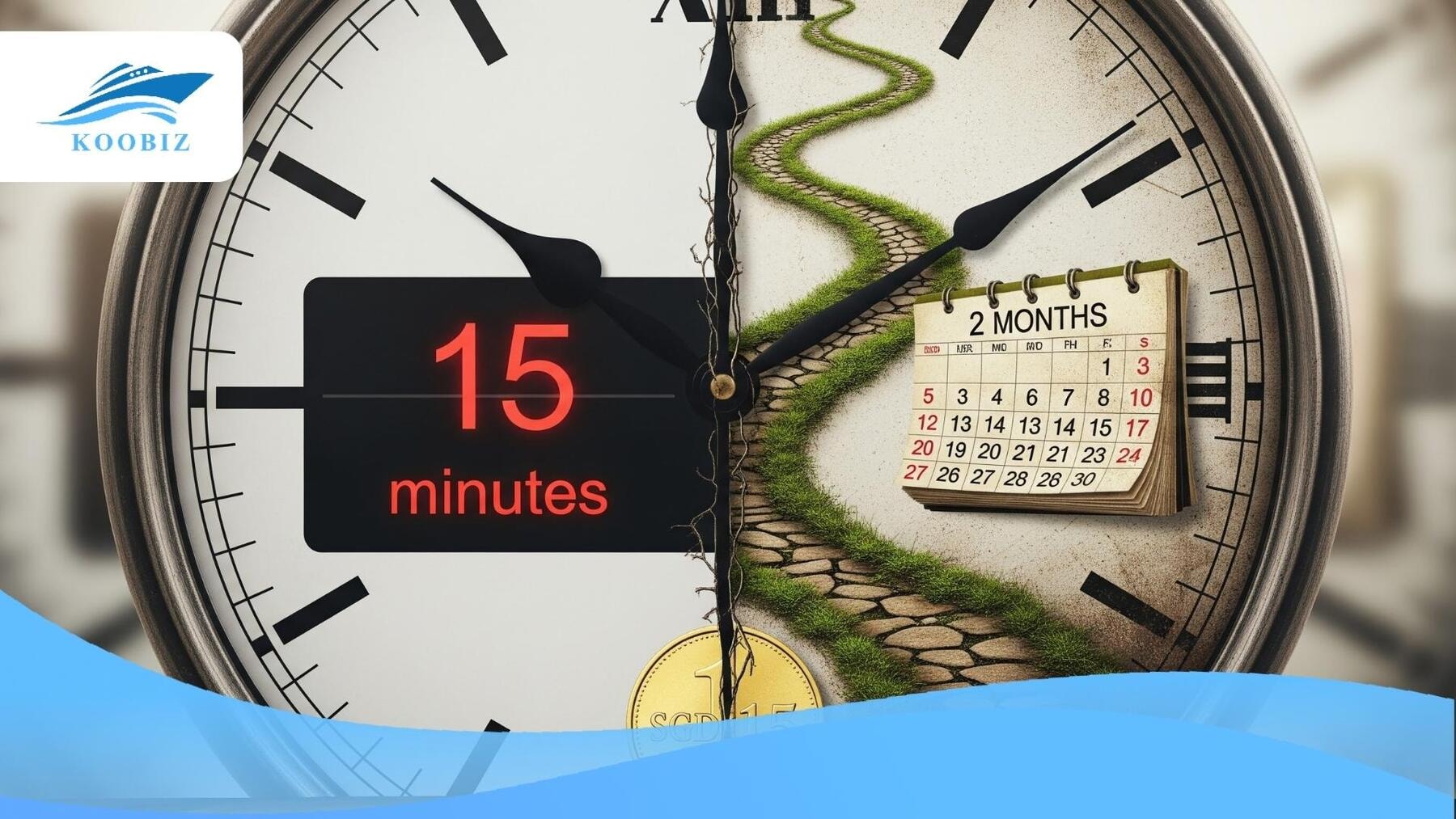

| Account Opening | Slower (1-4 weeks, often requires physical presence/interview) | Instant (1-3 days, 100% online verification) | Digital Banks |

| Minimum Balance | High (SGD 5,000 – 10,000 typically required to waive fees) | None ($0 minimum balance required) | Digital Banks |

| Fees & FX Rates | Higher (Admin fees + FX markup of 1-3%) | Lowest (Transparent fees + Mid-market rates) | Digital Banks |

| Safety & Insurance | High (Fully MAS licensed & SDIC insured up to SGD 100k) | Varied (ANEXT is SDIC insured; others safeguard funds but lack SDIC) | Traditional Banks / ANEXT |

| Product Range | Complete (Cheques, Business Loans, Gov Grants, Cash Deposit) | Limited (Transfers, Cards; ANEXT offers loans) | Traditional Banks |

| Integration | Basic (Direct feeds often cost extra or require forms) | Seamless (Native integration with Xero, Slack, Google Pay) | Digital Banks |

The Koobiz Recommendation:

You often do not have to choose just one. At Koobiz, we advise a hybrid approach: open a traditional account (like OCBC) for your main capital reserves and business loans, and open a fintech account (like Aspire or Wise) for daily operational expenses and foreign transactions to save on fees.

Critical Fee Comparison: Minimum Balance & Transaction Costs

The biggest cost drains for small businesses are usually fall-below fees for not maintaining the required balance and charges on outgoing transactions. These are often overlooked by new founders, yet they can quietly add up to hundreds of dollars in avoidable costs each year.

- Minimum Balance & Fall-below Fees:

- Traditional Banks: Typically require a minimum daily average balance ranging from SGD 5,000 to SGD 10,000. If you fall below this, you are charged ~SGD 35/month. However, starter accounts (like OCBC Business Growth) waive this for the first 6 months.

- Fintechs/Digital Banks: Aspire, Airwallex, and ANEXT generally have $0 minimum balance requirements and no fall-below fees, making them risk-free for early-stage startups.

- Transaction Costs:

- Local Transfers (FAST): Most digital accounts offer these for free. Traditional banks may charge small fees after a certain number of free transactions.

- International Transfers: This is the biggest differentiator. Traditional banks often charge a cable fee (SGD 20-30) plus an FX markup (1-3%). Fintechs usually charge no cable fee and a much lower markup (0.4-1%).

Understanding Hidden Costs and Banking Limitations

Hidden banking costs are the charges rarely highlighted in brochures, including early account closure penalties, foreign transaction admin fees, and cheque processing charges. Understanding these finer details in banking terms is essential to avoid unexpected deductions from your company funds, as banks often generate revenue well beyond the headline monthly fees through these operational charges.

Are Multi-Currency Accounts Worth the Conversion Fee?

Yes, multi-currency accounts are absolutely worth the conversion fee if your business handles more than SGD 5,000/month in foreign transactions.

Specifically, using a single-currency (SGD) account for foreign trade forces a double conversion (Foreign Currency -> SGD -> Foreign Currency) every time you pay and receive, leading to losses of 3-5% on the spread.

- Detail: A multi-currency account (like DBS Business Multi-Currency or Wise) allows you to hold USD or EUR directly. You can receive payment in USD, hold it, and pay a US supplier later without ever converting to SGD.

- Evidence: For a business with $100,000 annual foreign turnover, avoiding a 2% spread saves $2,000 in pure profit.

Can You Open a Business Account Online Without Visiting Singapore?

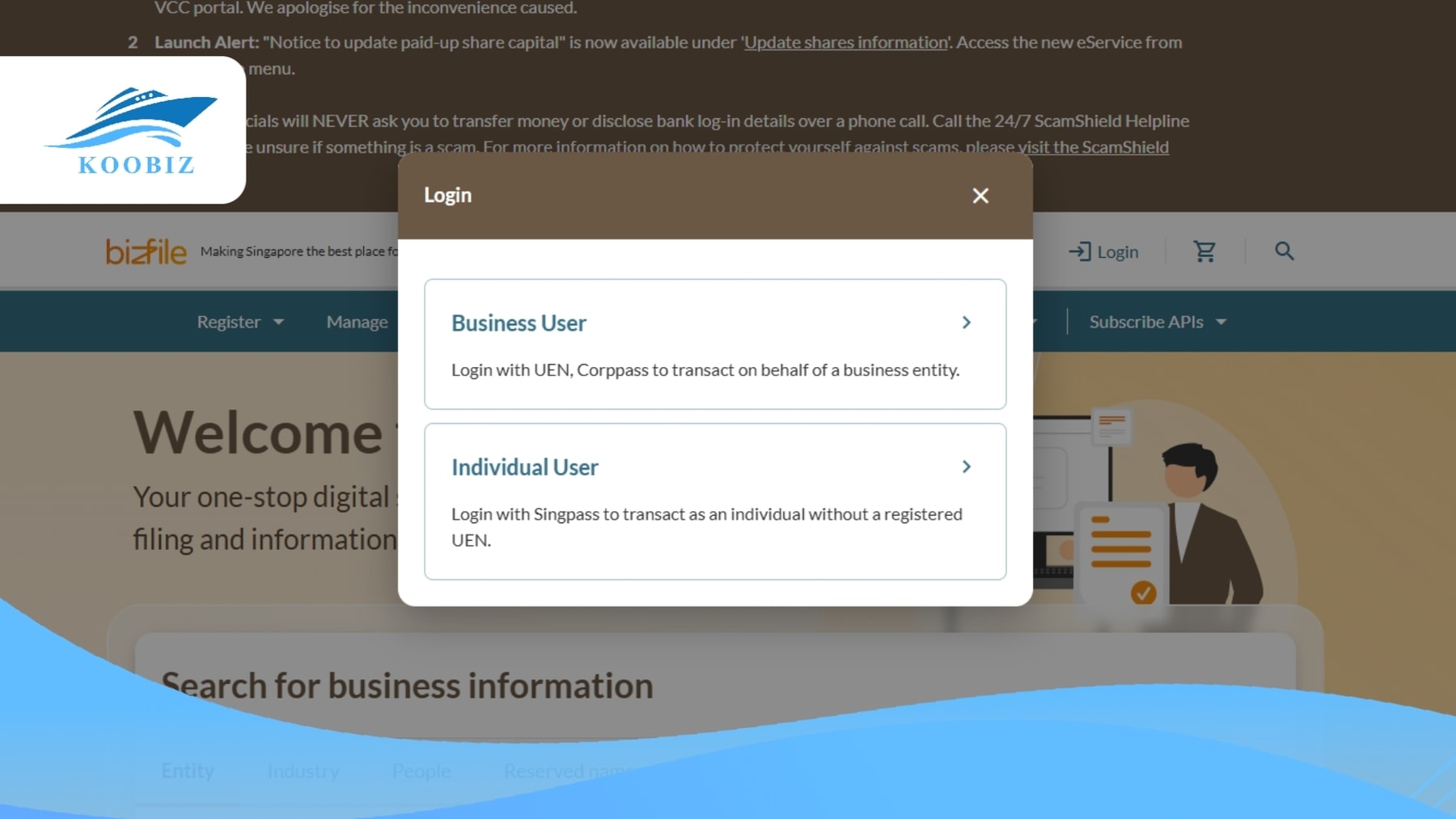

Yes, for fintech accounts like Aspire and Wise; however, for traditional banks, it depends heavily on the bank’s policy and the nationality of the directors.

While the “Big Three” have introduced remote opening capabilities, they often require a video interview or the physical presence of the authorized signatory, especially for foreign-owned companies.

- The Nuance: Fintechs use e-KYC (electronic Know Your Customer) technology to verify passports and proof of address remotely. Traditional banks are stricter due to anti-money laundering (AML) regulations.

- Koobiz Solution: For our foreign clients, we often facilitate the necessary resolutions and act as the local liaison to smooth out the remote opening process where possible.

What Happens if Your Business Account Application is Rejected?

If your application is declined, the first step is to pinpoint the underlying red flag – most commonly an unclear business plan, a high-risk industry classification, or a complex ownership structure. Singapore banks are highly risk-averse, but a rejection is not final; it simply means you need to adjust your approach.

- Step 1: Reassess your stated business activities and SSIC code to ensure they accurately reflect how you operate.

- Step 2: Apply to a fintech platform such as Aspire or Wise right away to keep your business running, as their risk framework differs from traditional banks.

- Step 3: Engage a corporate services provider. At Koobiz, we help refine your application by clearly presenting your source of funds and business model in a way that meets bank compliance expectations.

FAQ: Frequently Asked Questions

Which bank is best for foreigners opening a company in Singapore?

Fintechs like Aspire and Wise are the easiest for foreigners as they support 100% remote opening. For traditional banks, OCBC and DBS are popular but may require a nominee director or a visit to Singapore.

Is my money safe with fintechs like Aspire?

Aspire safeguards funds in a dedicated trust account with a Tier-1 bank (like DBS), so your money is kept separate from their company funds. However, unlike traditional banks and ANEXT, these funds are not insured by SDIC.

What is the minimum balance for a business account in Singapore?

It varies. Digital banks usually have $0 minimum balance. Traditional banks like DBS and UOB typically require SGD 5,000 to SGD 10,000, though initial waivers are often available for startups.

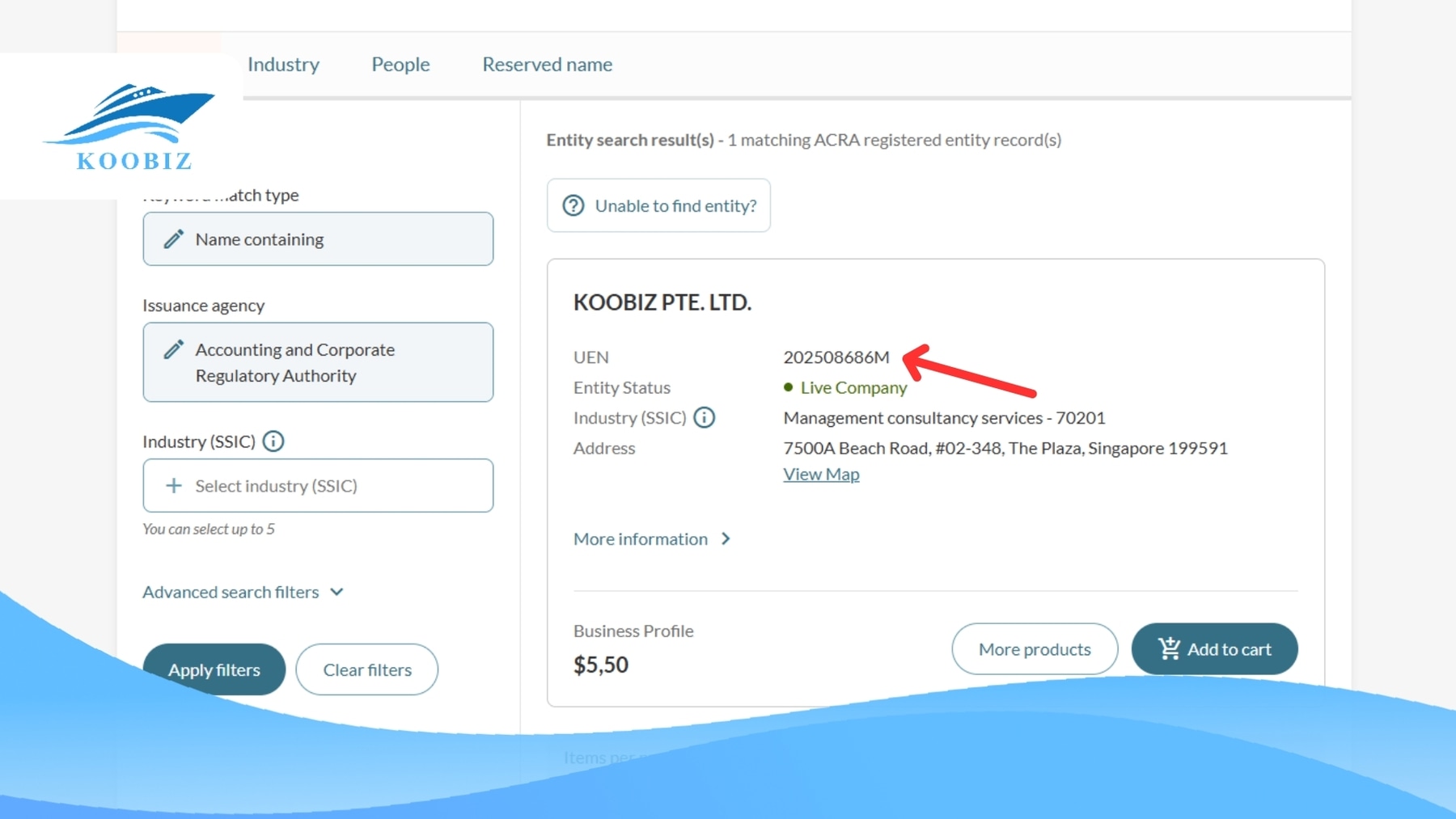

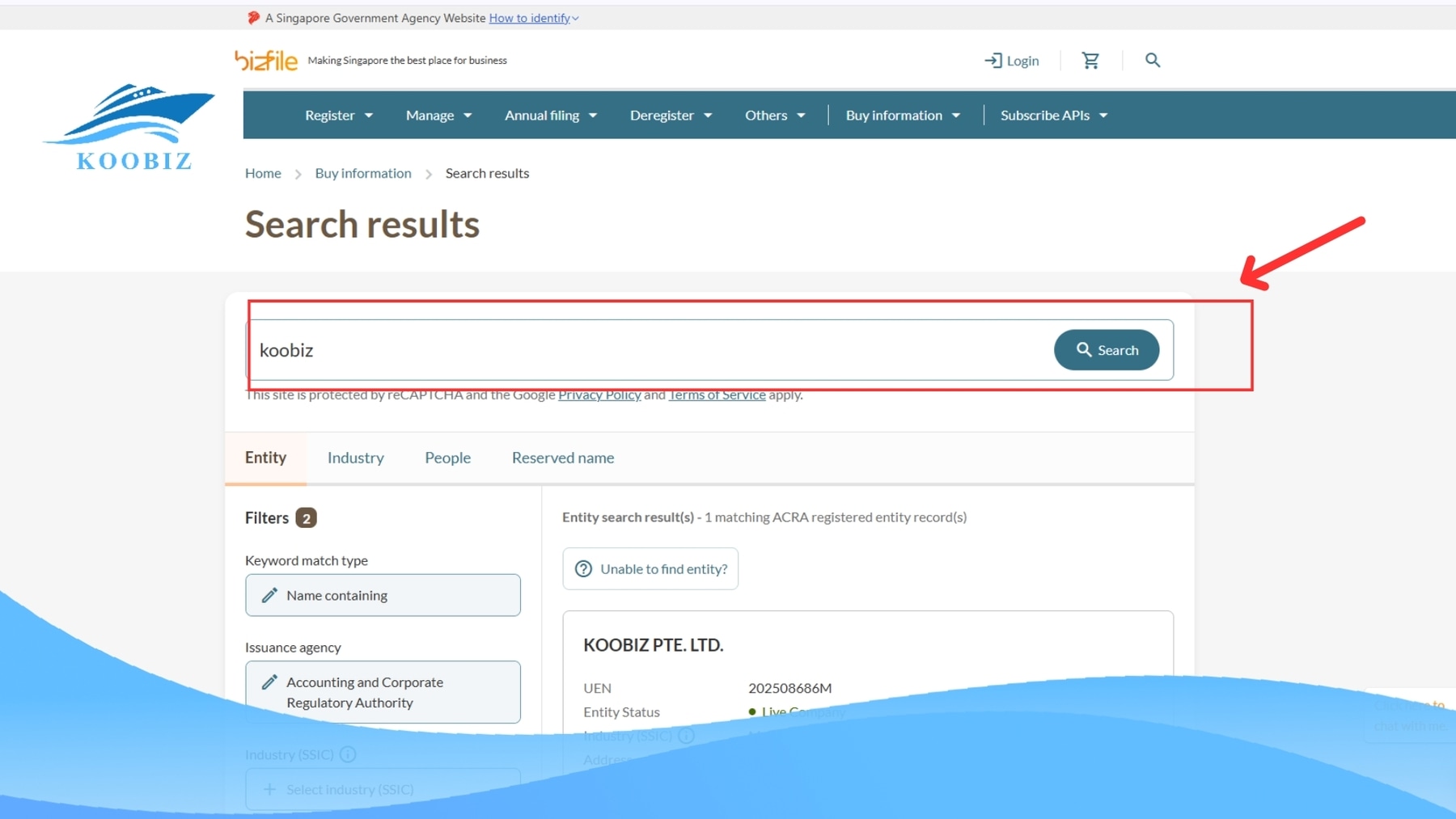

About Koobiz

Navigating the banking landscape in Singapore can be complex, especially with the strict compliance requirements of 2025. Koobiz is your trusted partner for Singapore corporate services.

We specialize in:

- Company Incorporation: Setting up your Pte Ltd correctly from day one.

- Bank Account Opening Support: Advising on the best bank for your needs and assisting with the document preparation to maximize approval chances.

- Compliance & Accounting: Handling your annual filing, tax, and bookkeeping so you can focus on growth.

Ready to launch your business in Singapore? [Visit Koobiz.com today for a free consultation].