[SUMMARIES]

General Rule: Dividend income paid by Singapore-resident companies is tax-exempt for shareholders under the One-Tier System.

Foreign Dividends: Foreign-sourced dividends remitted to Singapore are taxable unless they meet the three conditions of the Foreign-Sourced Income Exemption (FSIE) scheme.

Compliance: Even tax-exempt dividends must be declared in Form C or Form C-S for administrative purposes.

No Withholding Tax: Singapore does not levy withholding tax on dividend payments to non-residents.

Exceptions: Dividends from co-operatives or certain REIT distributions may be subject to different tax treatments.

[/SUMMARIES]

Business owners often ask Koobiz: “Is dividend income taxable in Singapore?” The short answer is generally No, due to Singapore’s One-Tier Corporate Tax System, under which dividends paid by Singapore companies are generally tax-exempt in the hands of shareholders. That said, not all dividends are treated equally. While locally sourced dividends enjoy automatic exemption, foreign-sourced dividends are subject to specific remittance and exemption rules. This guide breaks down how dividend taxation works in practice, outlines the FSIE exemption framework, and highlights the key compliance steps your company must follow to remain fully aligned with IRAS requirements.

Is Dividend Income Taxable in Singapore for Companies?

No. Generally, dividend income is tax-exempt for companies in Singapore, provided it is paid by a local tax-resident company under the One-Tier Corporate Tax System.

Key details:

- Final Tax: The tax paid by the paying company on its profits is considered the final tax.

- No Double Taxation: Shareholders (companies) are exempt from paying further tax on the dividends received.

- Universal Application: This exemption applies to all shareholders, regardless of whether they are Singapore tax residents or non-residents.

- Exception: This rule applies to local dividends. Foreign-sourced dividends remitted to Singapore may be taxable unless specific exemptions (FSIE) apply.

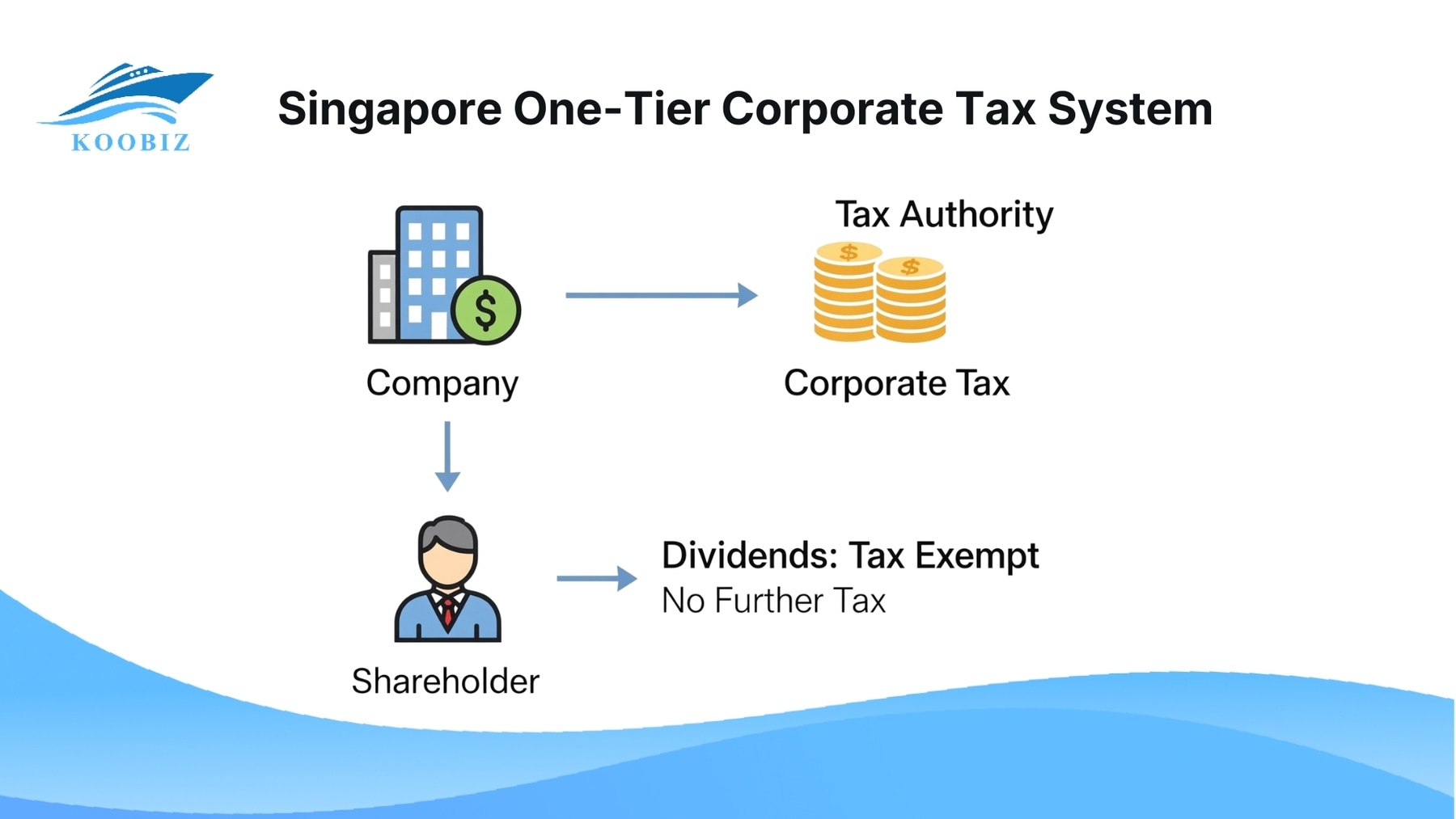

What is the One-Tier Corporate Tax System?

Since January 1, 2003, Singapore has utilized the One-Tier Corporate Tax System. Under this regime, the tax payable on a company’s chargeable income (currently capped at 17%) is the final tax.

As a result, dividends distributed to shareholders are not taxed again, significantly simplifying compliance and lowering overall administrative burdens.

Core Attributes of the One-Tier System:

- Final Tax: Corporate tax paid by the company is final; no further tax is levied on the distribution.

- No Tax Credits: Shareholders do not claim tax credits attached to dividends.

- Unlimited Distribution: Companies can pay dividends out of all accounting profits.

Tax Treatment of Local vs. Foreign-Sourced Dividends

The tax treatment differs significantly depending on the source of the dividend. Local dividends are automatically exempt, whereas foreign dividends require specific conditions to be met.

Quick Comparison: Local vs. Foreign Dividends

| Feature | Local Dividends | Foreign-Sourced Dividends |

|---|---|---|

| Source | Paid by a Singapore Tax Resident Company | Paid by a Non-Singapore Resident Company |

| Tax Status | Tax-Exempt | Prima facie Taxable (when remitted to Singapore) |

| Key Condition | None (Automatic under One-Tier System) | Must meet FSIE conditions (see below) to be exempt |

| Double Taxation | Avoided via One-Tier System | Avoided via FSIE or Unilateral Tax Credit (UTC) |

To prevent double taxation on foreign income, companies must utilize the Foreign-Sourced Income Exemption (FSIE) scheme.

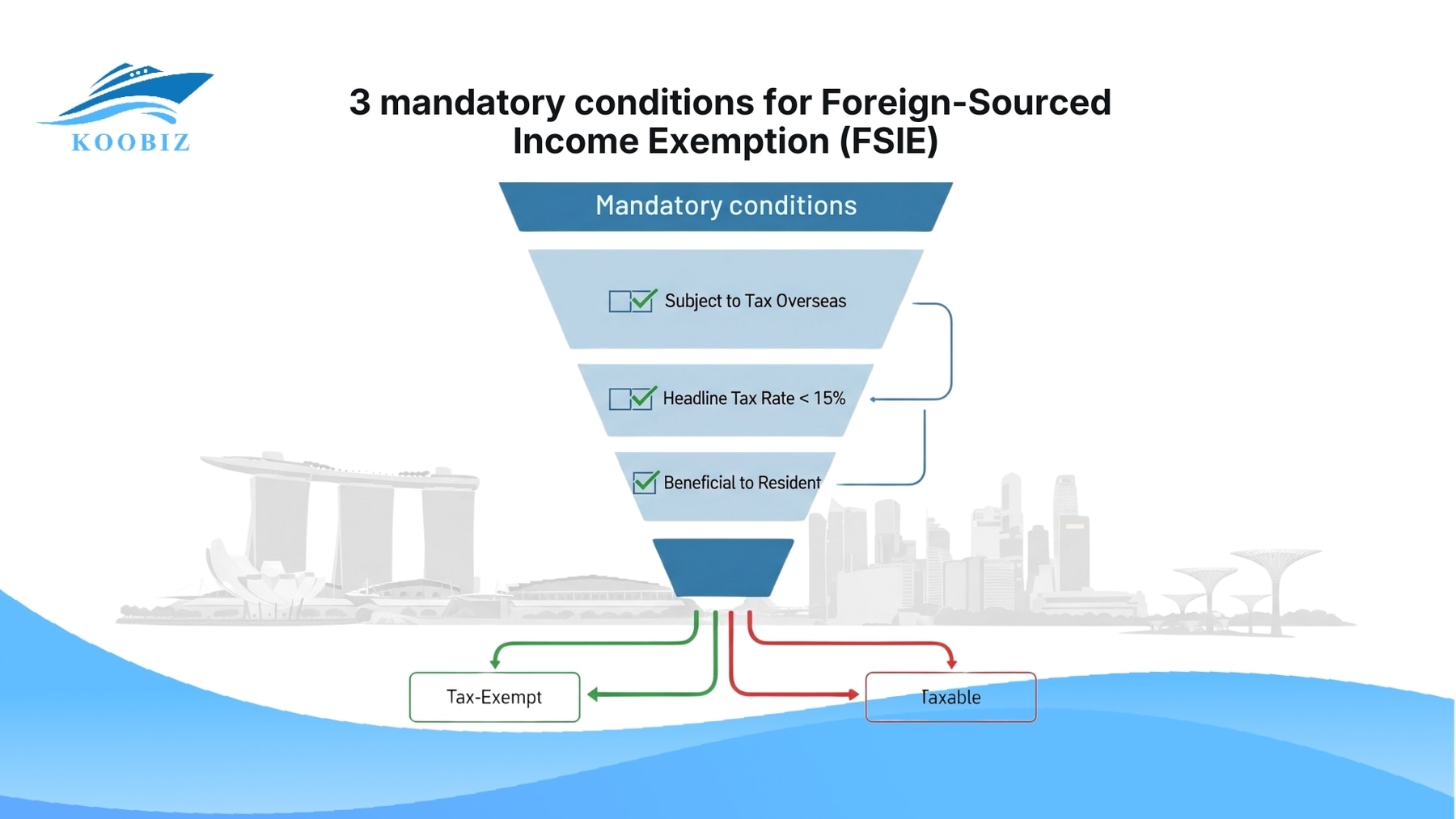

Requirements for Foreign-Sourced Income Exemption (FSIE)

To qualify for tax exemption under Section 13(8) of the Income Tax Act, foreign-sourced dividends must meet three mandatory conditions. If even one condition is missing, the dividend is taxable upon remittance.

The FSIE Checklist:

“Subject to Tax” Condition

The foreign-sourced dividend must have been taxed in the overseas jurisdiction. This can take the form of corporate income tax imposed on the underlying profits or withholding tax levied on the dividend distribution itself.

Note: If tax was not paid due to a substantive business incentive in the foreign country, you may apply to IRAS for a waiver.

“Headline Tax Rate” Condition

The country from which the dividend originates must have a headline (statutory) corporate income tax rate of at least 15% at the point the income is received in Singapore.

Clarification: This refers to the statutory tax rate, not the effective rate actually paid.

“Beneficial to Resident” Condition

The Comptroller of Income Tax must be satisfied that granting the exemption is beneficial to the Singapore tax resident company.

Context: Exemption is generally beneficial unless the company is in a loss position and prefers to pay tax to utilize foreign tax credits.

Case Studies: Applying the Rules in Practice

Visualizing these rules helps clarify the distinction between taxable and tax-exempt scenarios. Here are three typical examples for Koobiz Holdings Pte Ltd (a Singapore tax resident company).

Scenario A: Local Dividend (Tax-Exempt)

- Source: Koobiz Holdings receives dividends from a local subsidiary, SingTech Pte Ltd.

- Outcome: Not Taxable.

- Reason: Under the One-Tier System, dividends from Singapore resident companies are strictly tax-exempt.

Scenario B: Qualified Foreign Dividend (Tax-Exempt)

- Source: Dividends received from a subsidiary in Japan (Headline Tax Rate ~23%). The Japanese subsidiary paid corporate tax on its earnings.

- Outcome: Not Taxable.

- Reason: It meets FSIE conditions:

- Subject to tax in Japan? Yes.

- Headline rate ≥ 15%? Yes (23%).

- Beneficial to Singapore resident? Yes.

Scenario C: Non-Qualified Foreign Dividend (Taxable)

- Source: Dividends received from a subsidiary in the Cayman Islands (Headline Tax Rate 0%).

- Outcome: Taxable at 17%.

- Reason: It fails FSIE conditions. The headline tax rate is below 15%, and no foreign tax was paid. Koobiz Holdings must declare this as taxable income in Form C-S.

While local dividends are fully exempt and foreign-sourced dividends may qualify for exemption under the FSIE regime, real-world cases are often less straightforward. In practice, Koobiz advisors frequently deal with situations where the usual rules break down due to jurisdictional nuances, incentive regimes, or structural complexities. The next section therefore explores key exceptions, proper reporting treatment, and lesser-known attributes within Singapore’s tax framework that businesses should be aware of.

Exceptions: When is Dividend Income Taxable?

While exemption is the norm, business owners must be aware of specific scenarios where tax liability arises.

Alert: 3 Scenarios Where Dividends Are Taxable

1. Dividends from Co-operatives:

Co-operatives often receive entity-level tax concessions, so their dividends do not fall under the One-Tier system and are generally taxable for the shareholder.

2. Foreign Dividends Failing FSIE:

If dividends come from a jurisdiction with a headline tax rate below 15% (e.g., certain tax havens) or where no tax was paid, they are fully taxable. In this case, claim Unilateral Tax Credit (UTC) to mitigate double tax.

3. Certain REIT Distributions:

Although many REIT distributions are exempt for individual investors, distributions derived from taxable income are usually taxable for corporate unitholders unless specific tax transparency treatment applies. For foreign investors, such distributions may also be subject to a final withholding tax, commonly at a rate of around 10%.

How to Report Dividend Income in Tax Returns (Form C/C-S)

Even though dividend income is often tax-exempt, it must be reported in your annual tax return for reconciliation purposes.

Step-by-Step Reporting Guide:

Step 1: Identify

Separate “Singapore Dividends” from “Foreign Dividends.”

Step 2: Verify

Confirm local dividends are One-Tier and foreign dividends meet FSIE.

Step 3: File

Form C-S / C-S (Lite): Enter the total amount in the “Tax-Exempt Income” declaration section.

Form C: List dividends under “Non-Taxable/Exempt Income” in your tax computation to deduct them from net profit.

Step 4: Retain

Keep dividend vouchers and proof of foreign tax paid for 5 years.

💡 Koobiz Pro Tip: Accurately categorizing this income prevents unnecessary queries from IRAS. Ensure your financial statements clearly distinguish between “tax-exempt dividends” and other income sources before filing.

Withholding Tax on Dividends: Does it Apply?

No. Singapore does not impose withholding tax on dividends paid to non-resident shareholders.

This zero-tax policy significantly boosts ROI for international investors compared to other jurisdictions.

Global Comparison:

- 🇸🇬 Singapore: 0%

- 🇺🇸 USA: 30% (Standard rate)

- 🇮🇩 Indonesia: 20% (Standard rate)

This eliminates complex treaty relief applications for dividends, ensuring smooth cross-border cash flows.

Frequently Asked Questions (FAQs)

1. Are dividends from US stocks taxable in Singapore?

Generally, yes, if the income is remitted to Singapore. However, you can often claim a foreign tax credit for the 30% withholding tax paid to the IRS. For Singapore companies, if the US corporate tax rate (federal + state) meets the 15% headline tax condition and the “subject to tax” rule is met, the dividend might qualify for exemption under FSIE, though US LLCs and C-Corps have different nuances.

2. Can my company declare dividends if we made a loss this year?

No. Under Section 403 of the Companies Act, dividends can only be paid out of available profits. Paying dividends when a company is insolvent or has no retained earnings is an offence and can lead to personal liability for directors.

3. Are dividends received by individuals taxable in Singapore?

For individuals, dividends paid by Singapore-resident companies are strictly tax-exempt. Foreign dividends received by resident individuals in Singapore are also generally tax-exempt, unless they are received through a partnership in Singapore.

4. Does the “Zero Withholding Tax” apply to foreign shareholders?

Yes. Singapore operates a zero-withholding-tax policy on dividends. Regardless of whether the shareholder is a foreign company, an overseas individual, or a trust based in another jurisdiction, dividends declared by a Singapore company are paid out in full, with no tax withheld at source.

Conclusion

Overall, Singapore offers one of the most business-friendly dividend tax frameworks globally. Dividends from Singapore-resident companies are fully tax-exempt under the One-Tier Corporate Tax System, while foreign-sourced dividends can often be brought into Singapore tax-free if they qualify under the FSIE rules. However, the nuances of compliance—reporting correctly on Form C-S and ensuring foreign dividends meet the 15% headline tax rate test—require diligence.

At Koobiz, we specialize in helping businesses navigate the Singapore corporate landscape. Whether you need assistance with incorporating a Singapore company, opening a corporate bank account, or managing your tax and accounting compliance, our team of experts is ready to assist. We ensure your financial structures are optimized so you can focus on growth while we handle the regulatory complexities.

Visit Koobiz.com today to schedule a consultation regarding your dividend tax planning.

Leave a Reply