[SUMMARIES]

Mandatory Estimate: ECI stands for Estimated Chargeable Income, a preliminary report of a company’s taxable profit required by IRAS within 3 months of the financial year-end.

Waiver Eligibility: Companies are exempt from filing if their annual revenue is S$5 million or less AND their ECI is NIL.

Cash Flow Benefit: Early e-filers can access up to 10 interest-free GIRO installments to settle their tax liabilities.

Contextual Variety: While primarily a tax term in Singapore, ECI also refers to Early Childhood Intervention in healthcare and Electronic Commerce Indicators in digital payments.

[/SUMMARIES]

Understanding ECI is essential for staying compliant with Singapore tax regulations. At Koobiz, we support SMEs in navigating IRAS requirements accurately, helping them stay compliant and avoid unnecessary penalties. This article breaks down what ECI means for tax purposes, who is required to file, and how early submission can improve cash flow. To avoid confusion, we also clarify how tax ECI differs from other common uses of the term, such as Early Childhood Intervention and Electronic Commerce Indicators.

What is Estimated Chargeable Income (ECI)?

Estimated Chargeable Income (ECI) is essentially an early snapshot of a company’s taxable income for a particular Year of Assessment (YA) that must be submitted to IRAS. In simple terms, it reflects the company’s taxable profit—after deducting allowable expenses—before the final corporate tax return (Form C-S, Form C-S (Lite), or Form C) is filed.

The purpose of this requirement is to give the Singapore authorities an early view of a company’s earnings. At Koobiz, our experts often stress that although ECI is only an estimate, it should be prepared using the most up-to-date and accurate management accounts available, so as to minimize discrepancies when the final tax assessment is completed.

Why IRAS Mandates ECI Filing for Singapore Companies

The main purpose of mandatory ECI filing is to support efficient tax collection and give the authorities a timely picture of the overall economic performance across different industries. By asking companies to submit an estimate of their earnings within a short timeframe, IRAS is better able to forecast tax revenue and offer installment payment arrangements that help ease short-term cash flow pressure for businesses.

Beyond revenue planning, this requirement also encourages companies to keep their management accounts up to date throughout the year. In practice, jurisdictions that adopt early income estimation systems tend to achieve higher levels of on-time tax compliance, and IRAS leverages this information to monitor and analyse sector-specific economic trends.

ECI vs. Actual Taxable Income: Key Differences

It is important to clearly differentiate ECI from the actual taxable income declared later in the year. ECI is a forward-looking estimate prepared using provisional figures, while actual taxable income is backward-looking and only finalised after the financial year has been fully closed and, where applicable, audited.

| Feature | ECI (Estimated Chargeable Income) | Actual Taxable Income |

|---|---|---|

| Basis | Forward-looking estimate (provisional figures) | Backward-looking final figure (audited/finalized) |

| Deadline | Within 3 months of Financial Year End (FYE) | By Nov 30th of the Assessment Year |

| Form Type | ECI Filing | Form C-S, Form C-S (Lite), or Form C |

| Adjustment | Subject to revision if actuals differ | Final declaration (unless amended later) |

If there is any variance between the ECI submitted and the figures in the final tax return, IRAS will address this through the Notice of Assessment (NOA). Where the ECI exceeds the final taxable income, the excess tax paid will be refunded; conversely, if the ECI is lower, the company will be required to make an additional tax payment.

Which company types need to file ECI?

In general, all companies in Singapore – including newly incorporated startups and foreign entities with income sourced locally are required to file Estimated Chargeable Income (ECI), unless they qualify for specific administrative concessions set out by IRAS. The obligation is firm: eligible companies must submit an ECI return, even if it is a “NIL” return, unless they fully meet the prescribed revenue and income thresholds for a waiver.

The S$5 million revenue waiver Criteria

Under the current framework, a company is exempt from filing ECI for a specific Year of Assessment only when both of the following conditions are met. You can view this as a straightforward checklist:

- Condition 1: Annual revenue does not exceed S$5 million; and

- Condition 2: The ECI is strictly NIL (S$0).

Only when both conditions are satisfied can the ECI filing be waived.

It is a common misconception that making no profit automatically removes the filing obligation. For example, a company with S$6 million in revenue but a loss of S$500,000 is still required to submit a “NIL” ECI.

Specific Entities Not Required to File ECI

Beyond the revenue-based waiver, certain entities are granted administrative concessions by IRAS. These include:

- Foreign Ship Owners/Charterers: Specifically those who have submitted a “Shipping Return.”

- Designated Unit Trusts: Entities that meet specific tax transparency requirements.

- Real Estate Investment Trusts (REITs): Provided they meet the distribution conditions for tax transparency.

How to calculate and file your ECI in 2026

There are three main ways to determine your ECI: preparing it based on management accounts, using accounting software that integrates with IRAS, or engaging a professional advisor. For most SMEs, this typically involves a structured review of the Profit and Loss statement, with adjustments made for expenses that are not tax-deductible.

Digital Tax Filing Tools

IRAS continues to enhance the digital filing experience to improve accuracy and convenience.

- Seamless Integration: Many approved accounting software platforms now allow you to transmit ECI data directly to IRAS, reducing manual entry errors.

- Pre-Filling: The myTax Portal may pre-fill certain data fields based on prior records or other government sources to streamline the submission process.

- Digital Reminders: Companies subscribed to digital notices receive timely SMS or email alerts when their filing window opens, ensuring deadlines are not missed.

Seamless E-Filing: A Step-by-Step Walkthrough

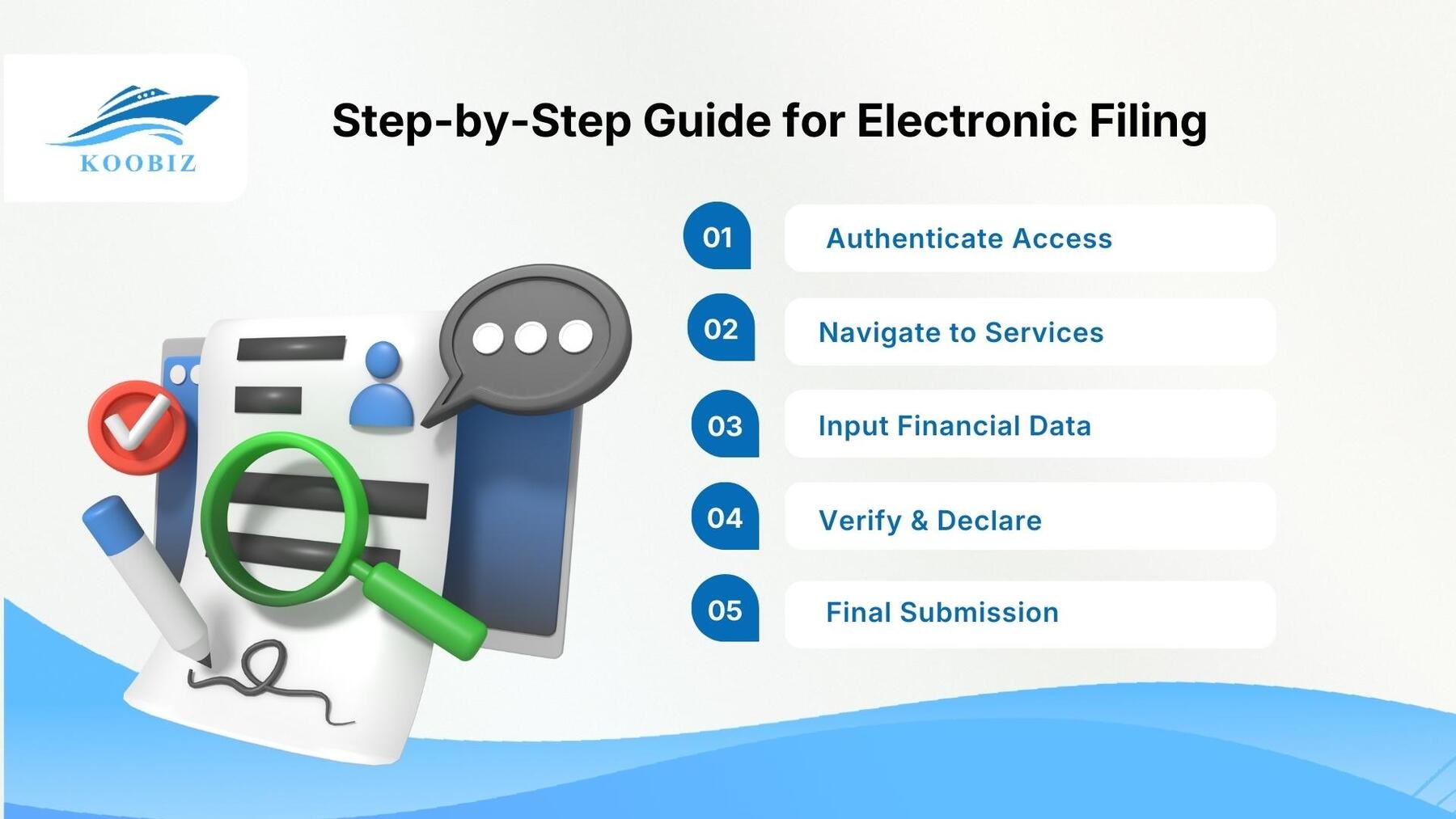

Navigating the IRAS system is efficient when you know the correct path. Follow this streamlined guide to ensure your ECI is filed correctly via the myTax Portal.

Before You Start:

- Ensure you have your Singpass ready.

- Verify your Corppass is authorized as an “Approver” or “Preparer” for Corporate Tax.

- Have your Management Accounts (Revenue & Expense figures) on hand.

Step 1: Authenticate Access

Begin by securely logging into the myTax Portal using your corporate Singpass.

Step 2: Navigate to Services

Once on the dashboard, locate the menu bar. Select “Corporate Tax” and subsequently click on “File ECI” from the drop-down options to initiate the return.

Step 3: Input Financial Data

Proceed to enter your company’s Gross Revenue and the Estimated Chargeable Income figures derived from your management accounts.

- Guidance: If your revenue varies significantly from the previous year, be prepared to provide a brief explanation in the optional remarks field.

Step 4: Verify & Declare

Review the auto-populated details carefully. Confirm your eligibility for any tax exemptions, such as the Tax Exemption Scheme for New Start-Up Companies, and declare that the information provided is accurate.

Step 5: Final Submission

Click the “Submit” button to finalize the process.

- Crucial Step: Wait for the confirmation screen and download the Acknowledgment Page immediately. This document serves as your official proof of timely submission.

Benefits of Early ECI Filing: Installment Plans

Filing ECI early offers a clear cash flow advantage. To encourage timely submission, IRAS provides a tiered instalment payment scheme – the sooner you file after your Financial Year End (FYE), the greater the number of instalments you may qualify for.

10-Month vs. 6-Month GIRO Installment Tables

The number of installments is determined by the date of filing.

| Filing Date (After FYE) | Number of Installments (GIRO) |

|---|---|

| Within 1 Month | 10 Installments |

| Within 2 Months | 8 Installments |

| Within 3 Months | 6 Installments |

| After 3 Months | 0 (Full payment required) |

Alternative Meanings of ECI: Healthcare, Fintech, and Economics

The term “ECI” is frequently used in other high-impact industries.

Early Childhood Intervention (ECI) in Singapore

In the healthcare context, ECI stands for Early Childhood Intervention, which focuses on providing specialised support to children with developmental delays. In Singapore, the government, through ECDA, continues to support programmes such as EIPIC (Early Intervention Programme for Infants & Children), enabling children with developmental needs to learn and develop alongside their peers.

Electronic Commerce Indicator (ECI) for Online Payments

In fintech, ECI stands for Electronic Commerce Indicator, a value used in 3D Secure transactions to indicate the level of security used.

- ECI 05: Fully Authenticated Transaction.

- ECI 06: Attempted Authentication (Issuer not participating).

- ECI 07: Non-Authenticated Transaction (Standard SSL).

Note: Transactions flagged as ECI 07 (non-authenticated) typically carry a higher risk of fraud and liability chargebacks for merchants.

The Economic Complexity Index (ECI)

In macroeconomics, the Economic Complexity Index measures a country’s industrial “sophistication” and knowledge intensity. Singapore consistently ranks highly on this index due to its diverse and complex export capabilities. Researchers are also increasingly discussing “Green ECI” as a measure of a country’s ability to export green technologies.

About Koobiz Services

Navigating the complexities of what is ECI doesn’t have to be a solo journey. Koobiz (koobiz.com) is a premier professional services provider.

- Company Formation: Seamlessly register your Singapore company.

- Tax & Accounting: We handle your ECI and Form C-S/C filings with 100% accuracy.

- Banking: Expert advisory on corporate account openings.

Frequently Asked Questions

1. What happens if I miss the 3-month ECI filing deadline?

IRAS may issue a “Notice of Assessment” based on their estimation. You lose GIRO installment privileges and may face late filing penalties.

2. Can I change my ECI after I have filed it?

Yes, you can submit a revised ECI via the myTax Portal.

3. Does a dormant company need to file ECI?

Only if they haven’t applied for a “Waiver of Income Tax Return Submission.”

4. Is revenue for ECI the same as Net Profit?

No. Revenue is the gross income from sales; ECI is the estimated taxable profit after allowable expenses.

5. Is the CIT rebate included in my ECI calculation?

No. File based on your gross tax liability. IRAS will automatically compute and apply any applicable Corporate Income Tax (CIT) rebate (e.g., for YA 2025) in the final tax bill.

Leave a Reply