[SUMMARIES]

Mandatory Electronic Filing: All GST returns (Form F5) must be filed electronically via the IRAS myTax Portal, typically on a quarterly basis.

Net GST Calculation: Your payment or refund depends on the difference between Output Tax (collected from customers) and Input Tax (paid on business purchases).

Strict Deadlines: Filings are due one month after the end of your prescribed accounting period; late filings incur an immediate $200 penalty plus $200 per outstanding month.

Claiming Input Tax: Valid tax invoices addressed to your company are required; expenses must be business-related and not explicitly disallowed (e.g., private car usage).

Error Correction: Errors with a Net GST difference of ≤ S$3,000 can be adjusted in the next return; larger errors require a Form F7.

2026 Updates: Form F5 now includes boxes for Reverse Charge on Low-Value Goods and Remote Services.

[/SUMMARIES]

Managing tax compliance is a priority for every Singapore business for any registered company, and knowing how to accurately file your Singapore GST return is essential. For both new startups and established SMEs, understanding the nuances of Form F5 and maximizing your Input Tax Claims can significantly impact your cash flow and compliance standing. At Koobiz, we understand that tax season can be stressful, which is why we have compiled this comprehensive guide. This article will walk you through the essential steps of filing, clarify the definition of output versus input tax, and explore the crucial conditions for claiming refunds, ensuring your business remains compliant with IRAS regulations while optimizing its tax position.

Disclaimer: Information is accurate as of January 2026. Please verify the latest updates on the IRAS website.

What is the Singapore GST Return (Form F5)?

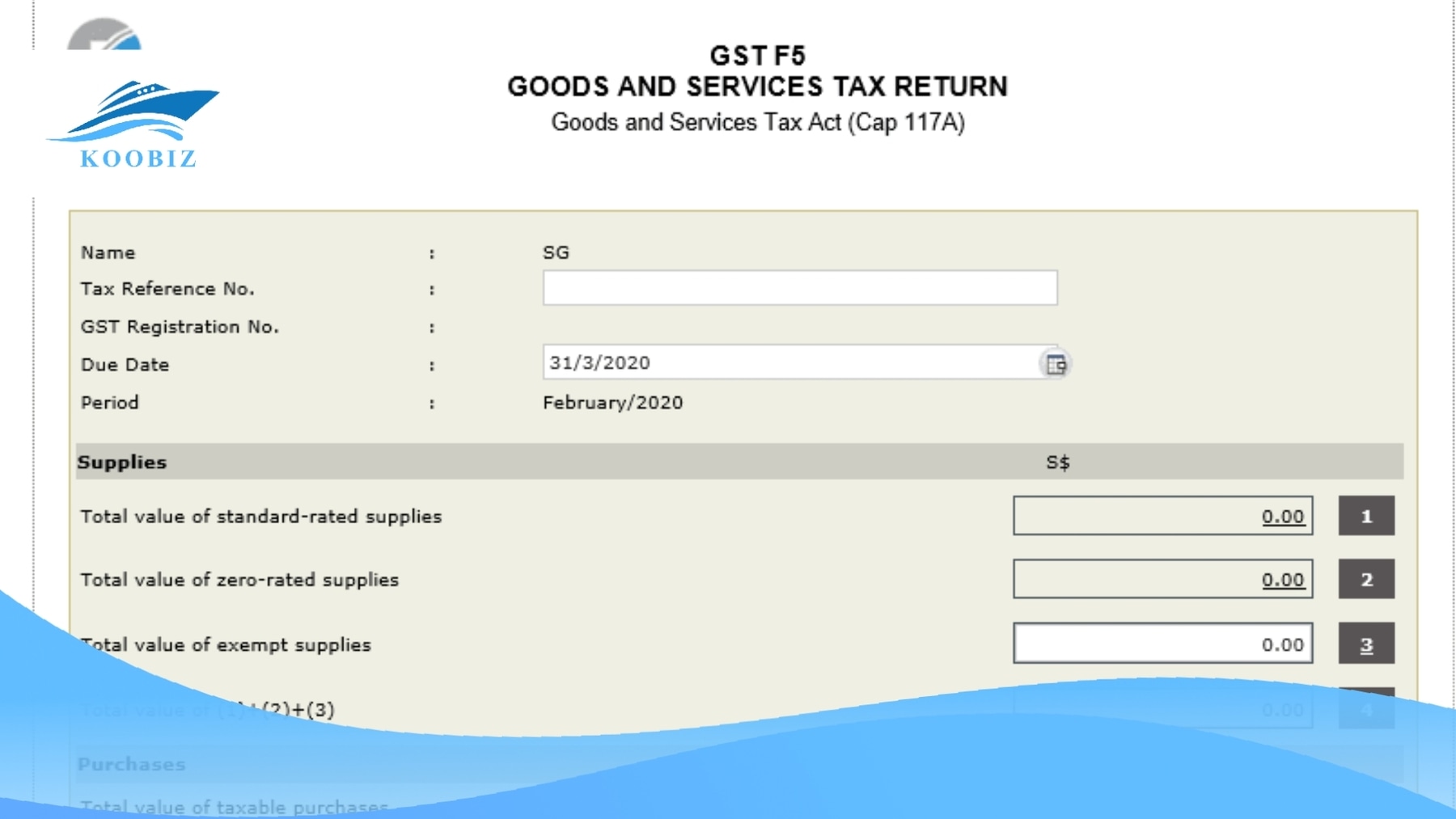

The Singapore GST Return, officially known as Form F5, is the mandatory electronic filing used by GST-registered businesses to report their GST transactions to the Inland Revenue Authority of Singapore (IRAS). Below are the key features of Form F5 that every GST-registered business should understand:

- Electronic Filing: Form F5 must be submitted electronically through the IRAS myTax Portal; paper submissions are not accepted.

- Summary Declaration: The return consolidates GST collected from customers (output tax) and GST paid to suppliers (input tax) for the relevant accounting period.

- Net Calculation: Based on the figures reported, Form F5 determines whether the business must pay GST to IRAS or is entitled to a GST refund.

- Periodic Filing: Unlike corporate income tax, GST returns are filed on a recurring basis, most commonly on a quarterly schedule.

- Authentication: Submission of Form F5 requires Singpass access with the appropriate Preparer or Approver role assigned.

For businesses, this document is the “source of truth” regarding their indirect tax liability. Accuracy in Form F5 is essential, as incorrect or inconsistent filings may trigger IRAS reviews, audits, or penalties.

Who Must File a GST Return in Singapore?

In Singapore, businesses required to file a GST return generally fall into two categories: those compulsorily registered for GST and those voluntarily registered with IRAS. If your business belongs to either category, the filing of Form F5 is mandatory and required by law, regardless of whether the business records a profit or a loss for the period.

Detailed breakdown of these categories includes:

- Compulsory Registrants: These are businesses whose taxable turnover exceeds S$1 million at the end of the calendar year (Retrospective View) or is expected to exceed S$1 million in the next 12 months (Prospective View). Once GST registration is effective, the business is required to file Form F5 for each assigned accounting period without exception.

- Voluntary Registrants: These are businesses that elect to register for GST, often to recover input tax incurred on significant startup or operating costs, despite having annual turnover below S$1 million. Once approved by IRAS, they are bound by the same filing rules as compulsory registrants and usually must remain registered for at least two years.

When is the GST Return Deadline?

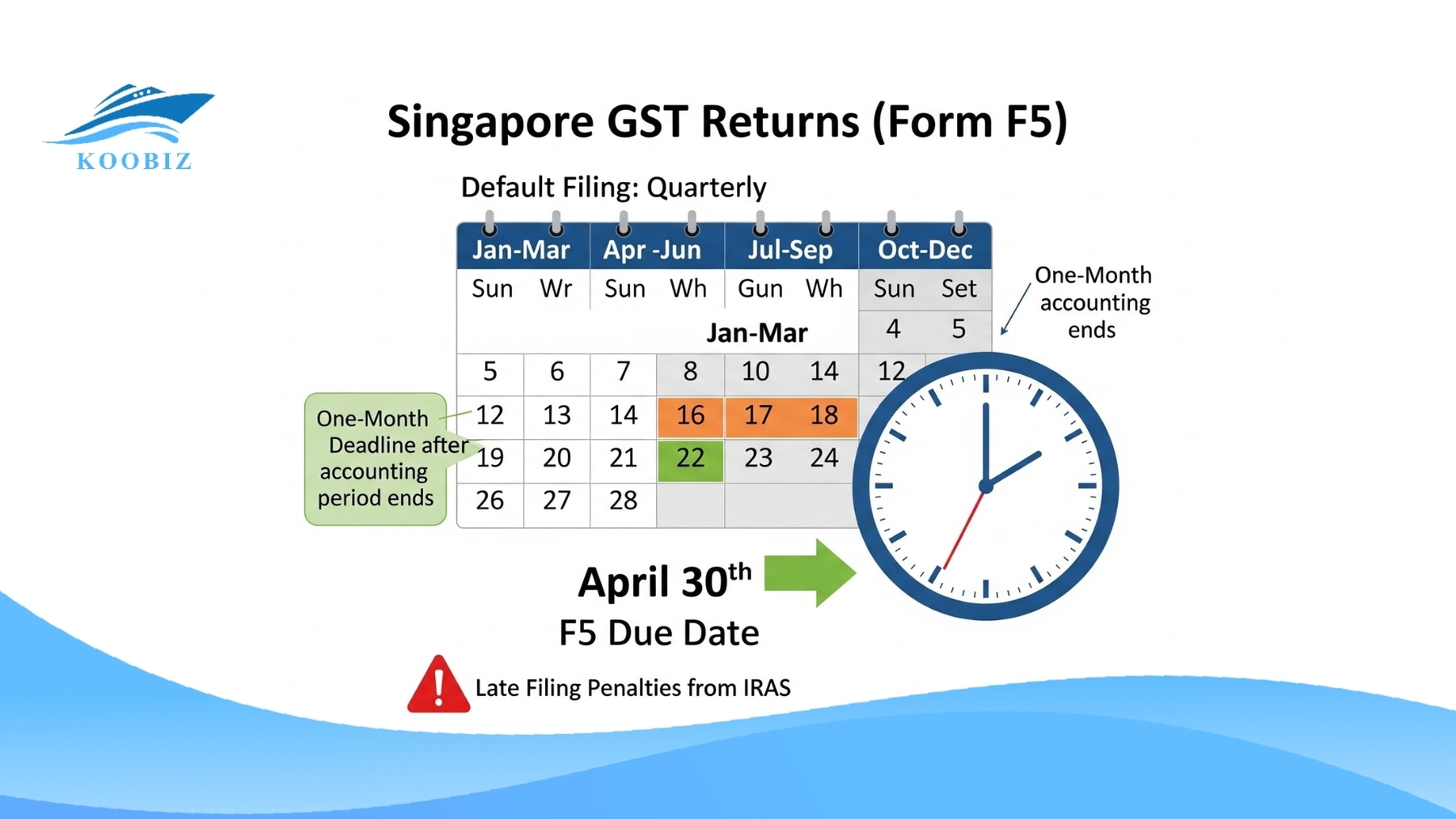

GST returns in Singapore are subject to strict statutory deadlines and must generally be filed within one month after the end of the prescribed accounting period. For most GST-registered businesses, the standard filing frequency is quarterly, although some businesses may opt for or be assigned a monthly filing cycle by IRAS.

Here is how the timeline works structurally:

- Quarterly Filing: This is the default frequency. If your accounting period covers January to March, your Form F5 and the corresponding payment are due by April 30th.

- Monthly Filing: This filing frequency typically applies to exporters or businesses that regularly receive GST refunds to support cash flow. If the accounting period is January, the Form F5 deadline falls at the end of February.

- GIRO Deadlines: Although the GST filing deadline remains the end of the following month, businesses enrolled in GIRO enjoy a later payment deduction date, usually on the 15th of the month following the filing deadline, which provides a modest cash flow benefit.

Failure to meet these dates triggers immediate compliance actions from IRAS. Accordingly, it is essential for businesses to closely monitor their assigned accounting period end dates to ensure timely GST compliance.

How to File GST Return in Singapore: Step-by-Step Guide

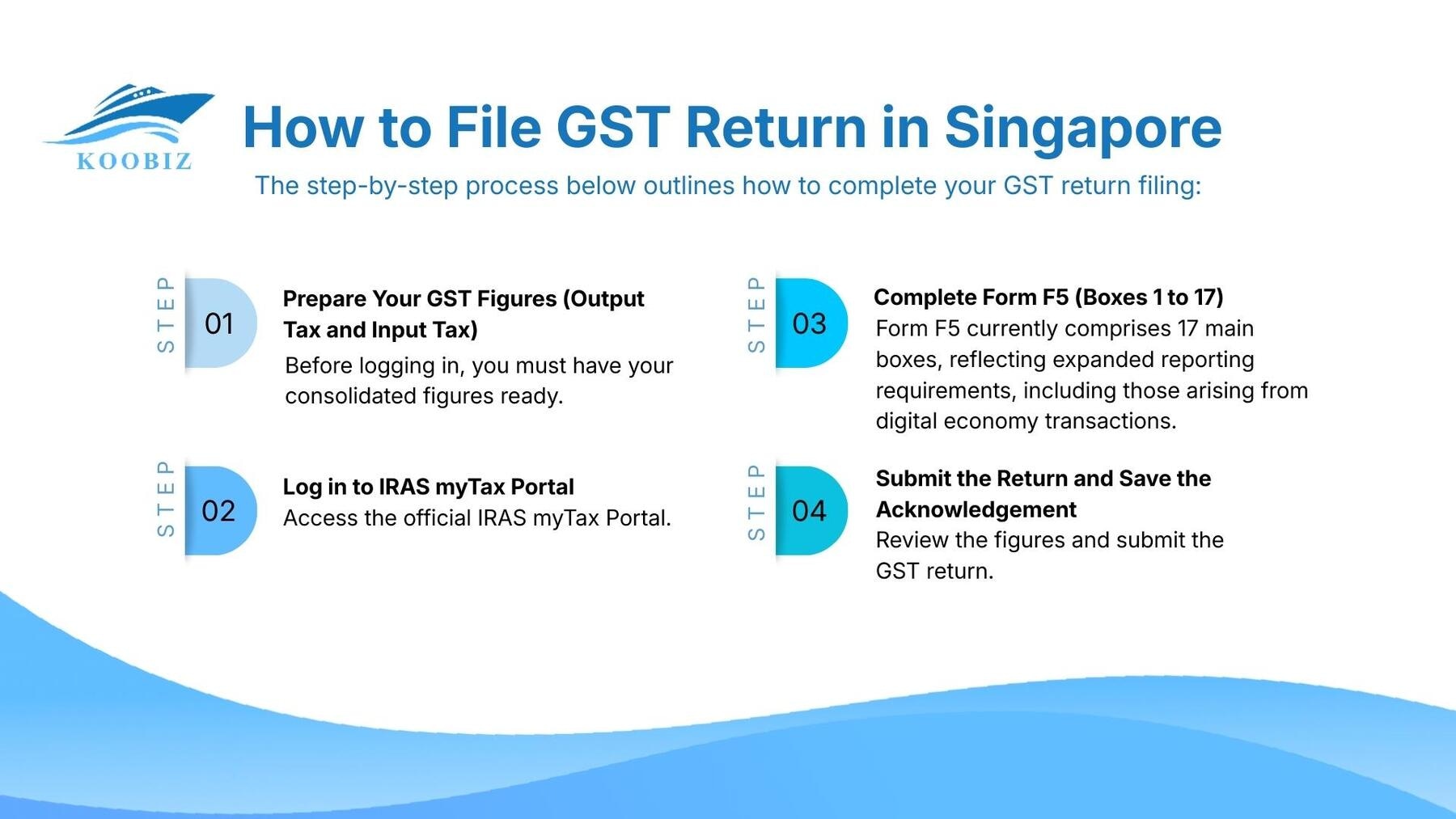

Filing a GST return in Singapore follows a standardized digital process on the IRAS myTax Portal and requires Singpass authentication together with accurate data entry. The process is designed to allow businesses to meet their GST compliance obligations efficiently, provided that their accounting records are properly maintained. The step-by-step process below outlines how to complete your GST return filing:

Step 1: Prepare Your GST Figures (Output Tax and Input Tax)

Before logging in, you must have your consolidated figures ready. The difference between what you collect and what you pay determines your liability.

- Output Tax: This refers to the 9% GST charged on taxable supplies made to customers. This GST is collected on behalf of IRAS and does not form part of business income.

- Input Tax: This is the GST paid on business-related purchases such as rent, utilities, and inventory, which may be claimed to offset output tax, subject to IRAS rules.

Ensuring these figures are backed by valid tax invoices and proper listing is the foundation of a correct return. In practice, many businesses reconcile these figures before logging into the portal to avoid delays or session timeouts during submission.

Step 2: Log in to IRAS myTax Portal

- Access the official IRAS myTax Portal.

- Log in using your Singpass (ensure you are authorized as an “Approver” or “Preparer” in CorpPass).

- From the main menu, select “GST” and then choose “File GST Return / Edit Past Return.”

- The system will display the relevant Form F5 for the current filing period.

Step 3: Complete Form F5 (Boxes 1 to 17)

Form F5 currently comprises 17 main boxes, reflecting expanded reporting requirements, including those arising from digital economy transactions. Accurate completion of these boxes is a key compliance requirement.The table below summarises the purpose of each box and the information to be reported.

| Box No. | Description | What to Enter |

|---|---|---|

| 1 | Total Value of Standard-rated Supplies | Value of standard-rated supplies subject to 9% GST, including applicable reverse charge supplies. |

| 2 | Total Value of Zero-rated Supplies | Value of exported goods and international services (0%). |

| 3 | Total Value of Exempt Supplies | Value of financial services, residential property sales/rentals. |

| 4 | Total Value of Supplies | Automatically calculated (Sum of Boxes 1, 2, and 3). |

| 5 | Total Value of Taxable Purchases | Value of taxable purchases supported by valid tax invoices, including purchases subject to reverse charge. |

| 6 | Output Tax Due | GST collected on sales + GST accounted for under Reverse Charge. |

| 7 | Input Tax and Refunds Claimed | Input tax claimed, including GST paid to suppliers and GST claimable under reverse charge, subject to IRAS conditions. |

| 8 | Net GST to be Paid/Claimed | Automatically calculated (Box 6 – Box 7). |

| 9-12 | Special Scheme/Refunds | Boxes relating to special GST schemes and refunds, such as the Major Exporter Scheme (MES) and Tourist Refund Scheme, where applicable. |

| 13 | Revenue from Remote Services | For Overseas Vendors: Value of digital services supplied. |

| 14 | Imported Services & Low-Value Goods | Reverse Charge: Declare value of imported services and low-value goods (LVG) subject to RC. |

| 15-17 | Electronic Marketplace | Marketplace Operators: Declaration for supplying/redelivering low-value goods. |

Note: Boxes 18-21 may appear for businesses approved under the Import GST Deferment Scheme (IGDS).

Step 4: Submit the Return and Save the Acknowledgement

- Review all entered figures against your source documents.

- Submit the GST return once all figures have been reviewed and confirmed.

Important: Once verified and submitted, proceed to the acknowledgement page. Koobiz advises saving a PDF copy of this acknowledgement immediately for your audit trail.

What are the Conditions for Claiming Input Tax?

Input tax may be claimed, provided that the expenses are incurred strictly for business purposes and are supported by valid tax invoices issued to the company. The input tax credit mechanism prevents the cascading of GST; however, IRAS applies strict conditions on which expenses qualify for input tax claims.

To be eligible for an input tax claim, all of the following conditions must be met:

- You must be GST-registered at the time the tax was incurred.

- The goods or services must have been supplied directly to the GST-registered business and not to a third party.

- The goods or services are used for the purpose of your business.

- The business must hold a valid tax invoice or simplified tax invoice at the time the input tax is claimed.

Common Disallowed Input Tax Expenses

Certain categories of expenses are specifically blocked from input tax claims under GST regulations. Even where such expenses are incurred for business-related purposes, GST claims are disallowed to prevent misuse.

- Private Passenger Cars: GST incurred on the purchase, repair, or rental of private cars (S-plated) is disallowed, even if used for client meetings.

- Medical and Accident Insurance: Expenses relating to medical and accident insurance for staff are generally disallowed, unless the insurance is compulsory under WICA or a collective agreement.

- Club Subscription Fees: Entrance and subscription fees to recreation clubs are blocked.

- Family Benefits: Benefits provided to the family members of employees are not eligible for input tax claims.

Can You Claim Input Tax Without a Tax Invoice?

A valid tax invoice is mandatory evidence required under GST legislation to support any input tax claim. A receipt or a credit card slip is often insufficient if it does not contain the supplier’s GST registration number, the tax amount, and the breakdown of the supply.

For amounts not exceeding S$1,000, a simplified tax invoice is acceptable. For amounts exceeding S$1,000, a full tax invoice stating the company’s name and address is required. If an original tax invoice is lost, a certified true copy must be obtained from the supplier before the input tax is claimed in Form F5.

How to Calculate Net GST Payable or Refundable in Singapore?

Net GST is calculated by subtracting total input tax claimed (Box 7) from total output tax due (Box 6). This calculation determines whether GST is payable to IRAS or refundable to the business.

- Net GST Payable: If Box 6 > Box 7, you owe IRAS the difference. Any GST payable must be settled by the filing deadline using approved payment methods such as GIRO, PayNow Corporate, or AXS.

- Net GST Refundable: If Box 7 > Box 6, IRAS owes you money. This situation commonly arises for exporters who make zero-rated supplies but incur GST on local purchases. Refunds are usually credited directly into your bank account, provided you have no other outstanding tax liabilities.

With the standard filing process covered, it is crucial to understand that not all business models fit the generic mold. GST reporting may become more complex as businesses expand or engage in cross-border transactions.

Special GST Schemes and Complex Filing Scenarios

Special GST schemes, such as the Major Exporter Scheme (MES) and the Reverse Charge mechanism, modify standard GST reporting to support cash flow management and maintain tax neutrality.

How to File Under the Major Exporter Scheme (MES) in Singapore?

The Major Exporter Scheme (MES) suspends the payment of GST at the point of importation to improve cash flow.

- Do not claim input tax on such imports, as GST was not paid at the point of importation.

- Declare the value of imported goods under MES in Box 9 of Form F5.This confirms the goods have entered the GST chain without immediate tax payment.

What is the Reverse Charge Mechanism in Singapore?

The reverse charge mechanism applies to imported services and low-value goods (LVG) to ensure tax parity between local and overseas suppliers.This applies to businesses not entitled to full input tax credit (e.g., banks, developers, charities) or those exceeding import thresholds.

- Scope: Imported services and imported low-value goods (not exceeding S$400 per item and delivered via air or post).

- Filing: The business accounts for GST as both supplier and customer by reporting the value of the supply in Box 1 and Box 14 of Form F5, while claiming the corresponding input tax in Box 7, subject to eligibility.

Handling Pre-registration Input Tax Claims in Singapore

Newly GST-registered businesses may recover GST incurred on pre-registration setup costs, subject to specific consumption and eligibility rules imposed by IRAS.

- Goods: Claimable only if the goods are held by the business at the effective date of GST registration. Goods acquired more than six months before registration must not have been consumed or supplied prior to the effective registration date.

- Services: Claimable if incurred up to 6 months prior to registration (e.g., rental, legal fees).

In practice, businesses are required to prepare a pre-registration GST checklist and supporting apportionment calculations to substantiate such claims.

Managing GST Errors and Compliance Issues in Singapore

GST compliance requires distinguishing between minor administrative errors that may be adjusted in a subsequent return and material errors that require formal disclosure to IRAS.

Form F5 vs. Form F7: How to Correct Mistakes in Your Return

Form F7 is the prescribed mechanism for correcting errors in a previously filed GST return, effectively amending the original Form F5.

- Administrative Concession (Revised): Under the administrative concession, errors may be adjusted in the next GST return only if the net GST difference does not exceed S$3,000, regardless of the total value of supplies. The 5% rule applies only to non-GST errors.

- Mandatory F7: Any error exceeding the S$3,000 net GST threshold must be corrected immediately via Form F7.

- Tip: The GST F7 Calculator available on the IRAS website may be used to assess eligibility for the administrative concession.

What Happens If You File Late? (Penalties & Composition Fines)

Late GST compliance results in a cumulative penalty regime that escalates over time.

- Late Submission Fee: An immediate S$200 penalty is imposed once the deadline passes. An additional S$200 is added for every completed month the return remains outstanding, capped at S$10,000.

- Late Payment Penalty: A 5% penalty is imposed immediately on unpaid GST. If the tax remains unpaid after 60 days, an additional 2% penalty is charged for each completed month, capped at 50% of the unpaid tax.

How to File a Nil GST Return in Singapore

Even where no GST transactions occurred, a nil return must still be filed to avoid late filing penalties.

- Log in to myTax Portal.

- Select the ‘Nil Return’ option.

- Declare zero supplies and zero claims, then submit the return.

Frequently Asked Questions (FAQ)

1. Can I ask for an extension to file my GST return?

A one-time extension of up to 14 days may be requested via the myTax Portal. Approval is discretionary and depends on the business’s compliance history.

2. What are “Low-Value Goods” in the context of GST?

These are goods valued at S$400 or below, imported via air or post, which are non-dutiable. As of 2023, GST applies to these goods via the Reverse Charge mechanism or Overseas Vendor Registration regime.

3. Do I need to keep physical copies of my invoices?

| IRAS accepts digital copies of tax invoices and simplified tax invoices, provided they are legible and can be retrieved upon request for a minimum period of five years. |

|---|

Managing Singapore’s GST obligations requires careful compliance with statutory rules and filing requirements.From determining your filing liability to maximizing your input tax claims and avoiding the pitfalls of late submission, every step in the File GST Return Singapore process impacts your business’s bottom line.

Koobiz specializes in simplifying these corporate complexities for you. Whether you need assistance with company incorporation in Singapore, opening a corporate bank account, or managing your ongoing tax, accounting, and audit obligations, our team of experts is ready to assist. We ensure that your GST returns are filed accurately and on time, allowing you to focus on growing your business.

Visit us at koobiz.com to learn more about how we can support your business journey in Singapore.

Leave a Reply